Bequest in Trust for the Care and Maintenance of Pet (Short Form

Description Trust Bequest Care Form Template

How to fill out Trust Bequest Care Maintenance Complete?

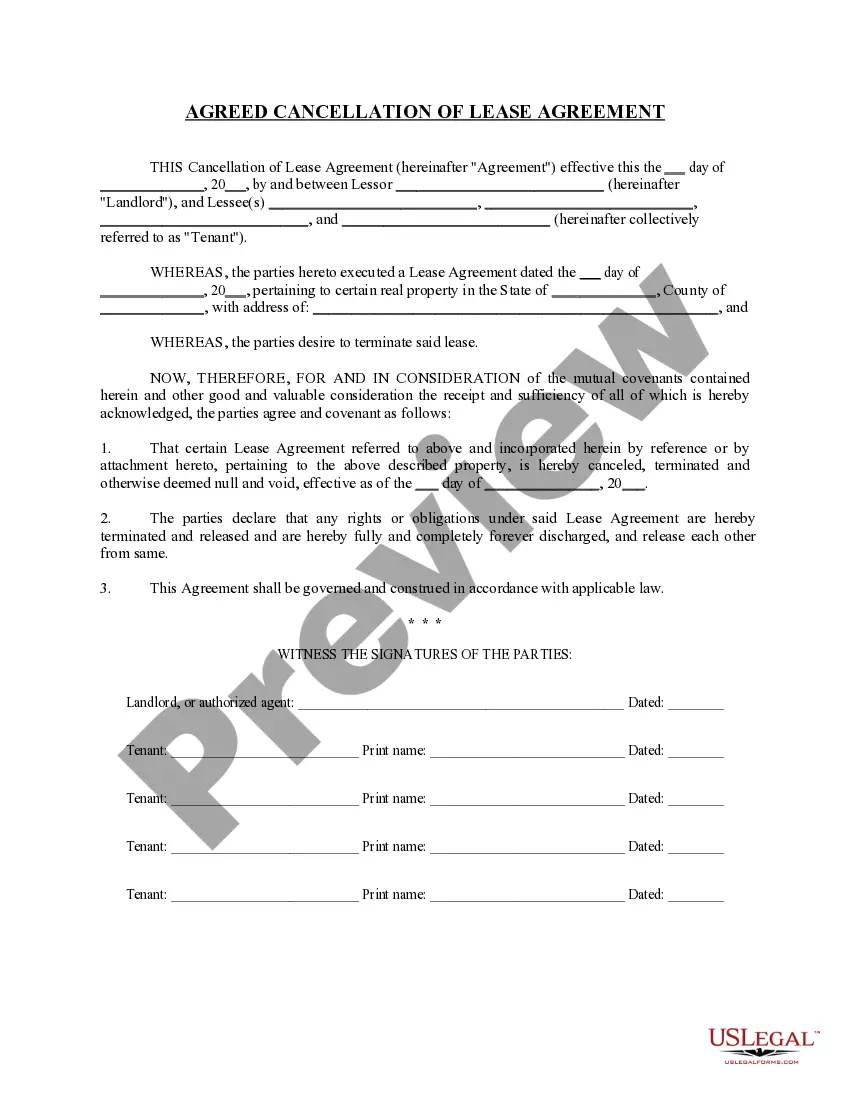

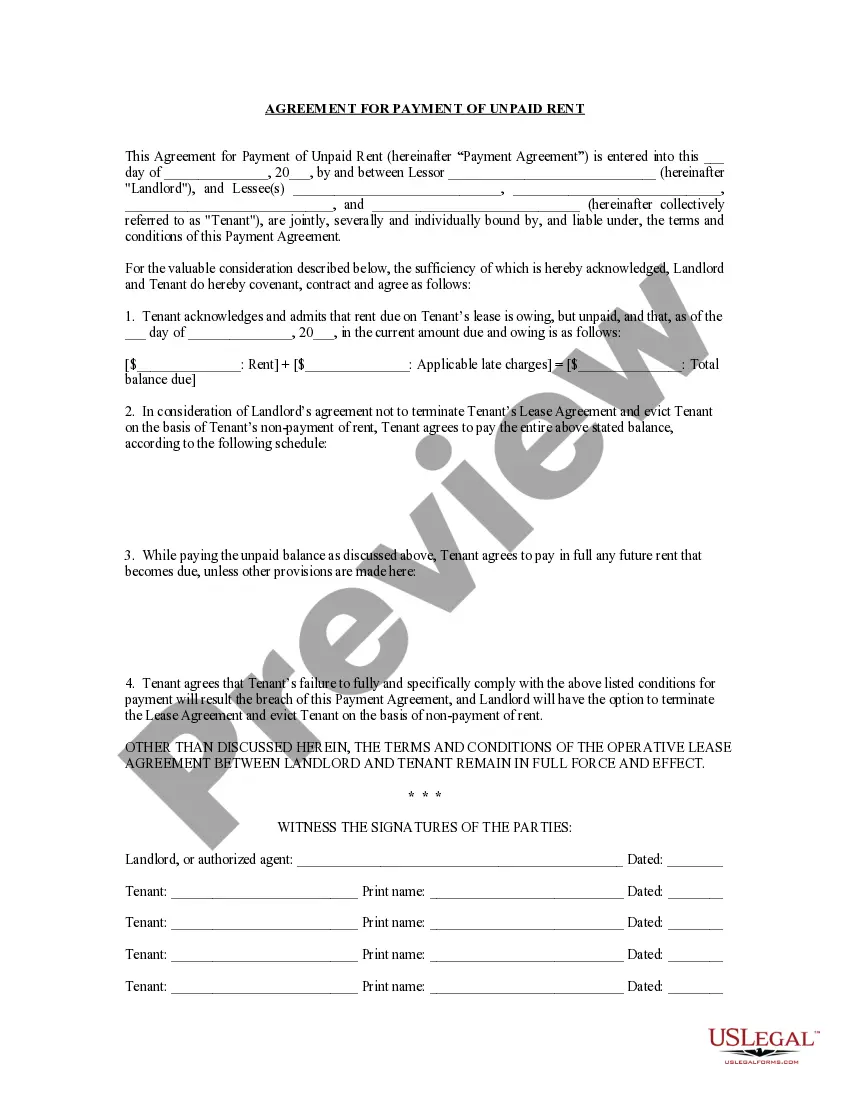

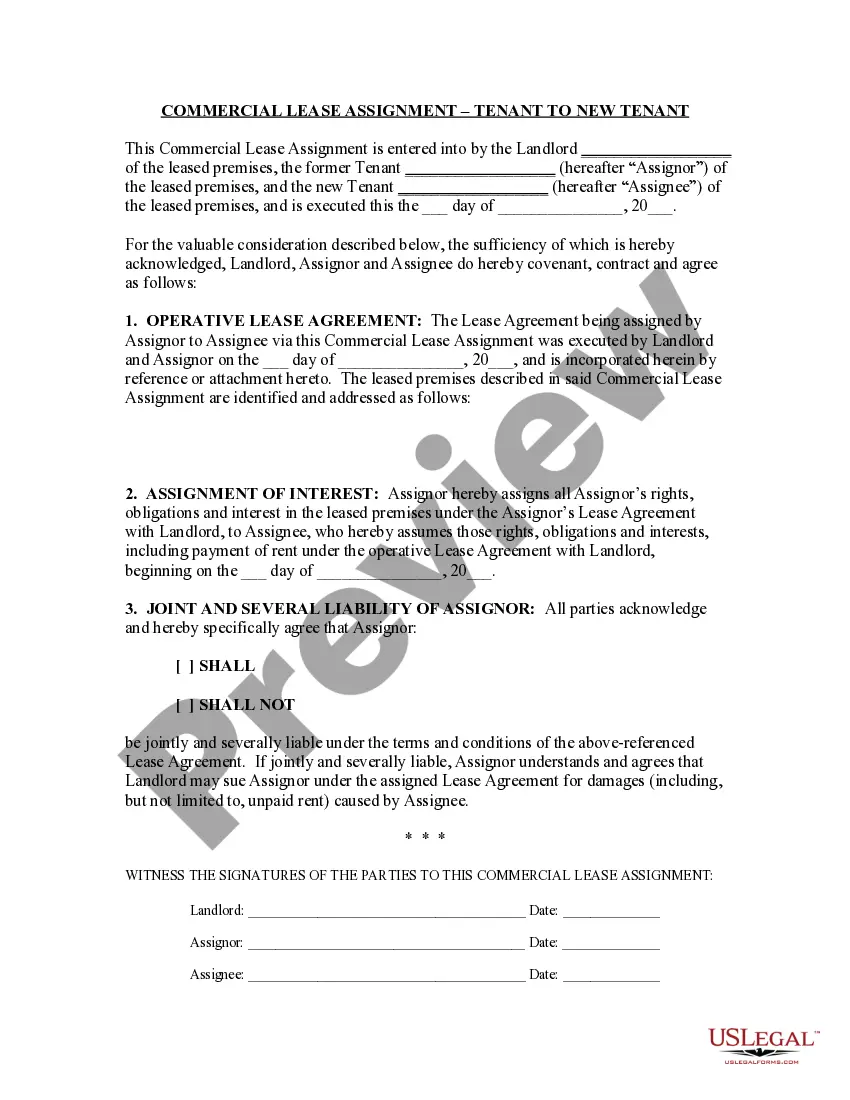

Aren't you tired of choosing from hundreds of samples every time you need to create a Pet Trust - Bequest in Trust for the Care and Maintenance of Pet - Bypass - Short Form? US Legal Forms eliminates the wasted time an incredible number of American people spend searching the internet for appropriate tax and legal forms. Our professional team of attorneys is constantly updating the state-specific Forms catalogue, so that it always has the right documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription need to complete quick and easy actions before being able to get access to their Pet Trust - Bequest in Trust for the Care and Maintenance of Pet - Bypass - Short Form:

- Use the Preview function and read the form description (if available) to make certain that it is the right document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate example for the state and situation.

- Utilize the Search field at the top of the web page if you have to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your file in a needed format to complete, create a hard copy, and sign the document.

As soon as you have followed the step-by-step guidelines above, you'll always have the capacity to sign in and download whatever document you need for whatever state you want it in. With US Legal Forms, completing Pet Trust - Bequest in Trust for the Care and Maintenance of Pet - Bypass - Short Form samples or any other official paperwork is simple. Begin now, and don't forget to look at the examples with accredited attorneys!

Pet Trust Care Sample Form popularity

Pet Trust Bequest Fill Other Form Names

Bequest Care Maintenance Purchase FAQ

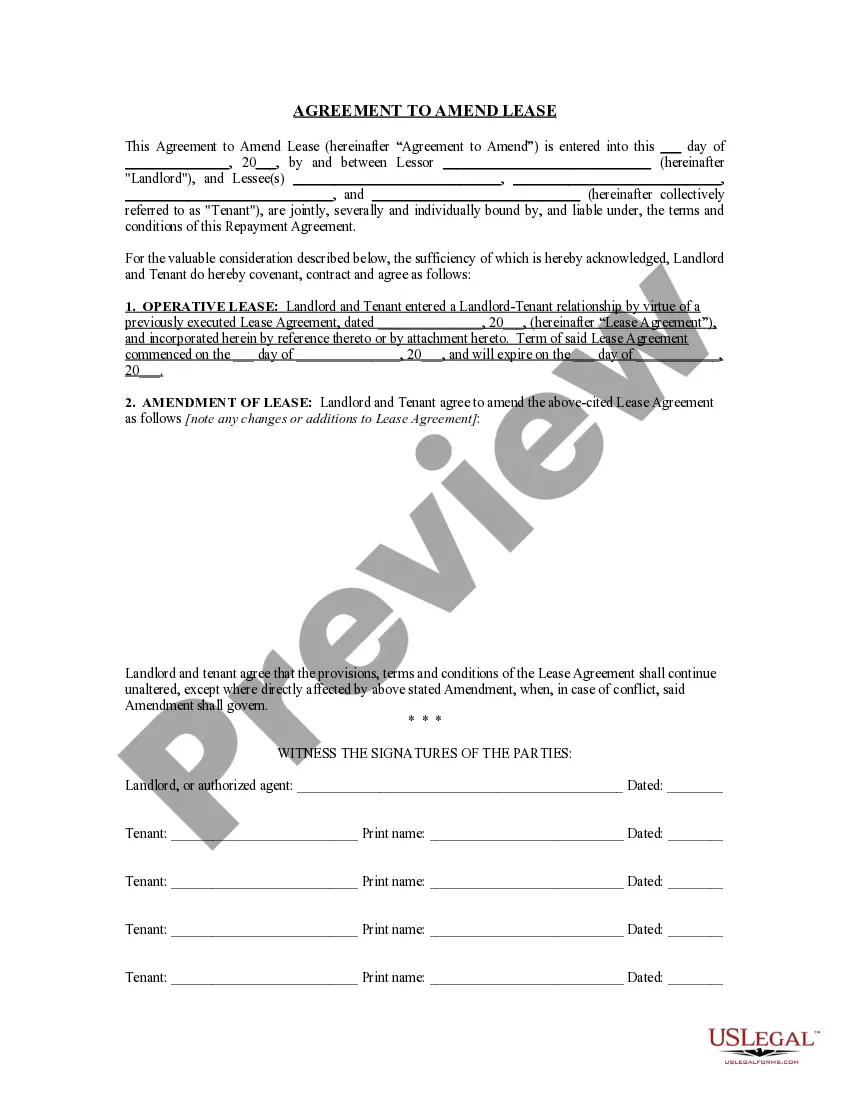

I will just name my pet as a beneficiary to get around these restrictions. Well, you would be wrong if you did that, because just as your animal is not able to own property, they are not able to be a beneficiary in a trust, will, or any other testamentary instrument.

A Pet Protection Agreement(R) is a document that lets you decide who will take care of your pets and how they will be cared for. Most importantly, a Pet Protection Agreement(R) allows you to name a Pet Guardian, which is the person who will be responsible for taking care of your pet(s) in case something happens to you.

Your life insurance beneficiary can be a family member, a business partner, a charitable organization, a legal entity like a trust, or your estate. You cannot name a pet as a life insurance beneficiary, and you should avoid naming a minor child, too.

A beneficiary of trust is the individual or group of individuals for whom a trust is created. The trust creator or grantor designates beneficiaries and a trustee, who has a fiduciary duty to manage trust assets in the best interests of beneficiaries as outlined in the trust agreement.

The surest and simplest way to provide care for your pet after you die is to leave your pet (and some money) through a provision in your will or living trust. If you do this, the person you name will become the owner of your pet and will receive outright any money you leave to him or her for your pet's care.

You cannot name a pet as a life insurance beneficiary, and you should avoid naming a minor child, too.

Can You Leave Money for Pets? You cannot leave money or other kinds of property to your pet. The law says animals are property, and one piece of property cannot own another piece of property. However, you can plan to make sure that your pet has a good life after you die.

A pet trust is a legally sanctioned arrangement providing for the care and maintenance of one or more companion animals in the event of a grantor's disability or death.Typically, a trustee will hold property (cash, for example) in trust for the benefit of the grantor's pets.