No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Rejection of Claim and Report of Experience with Debtor

Description Claim With Debtor

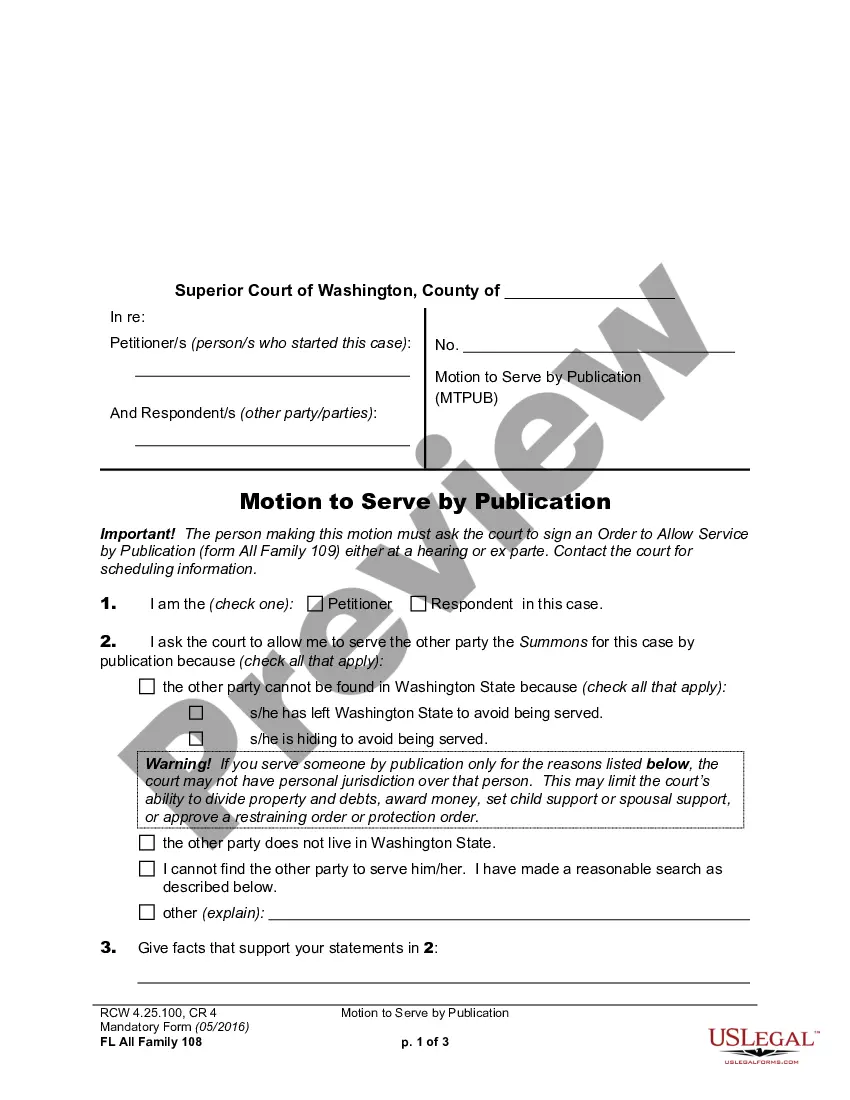

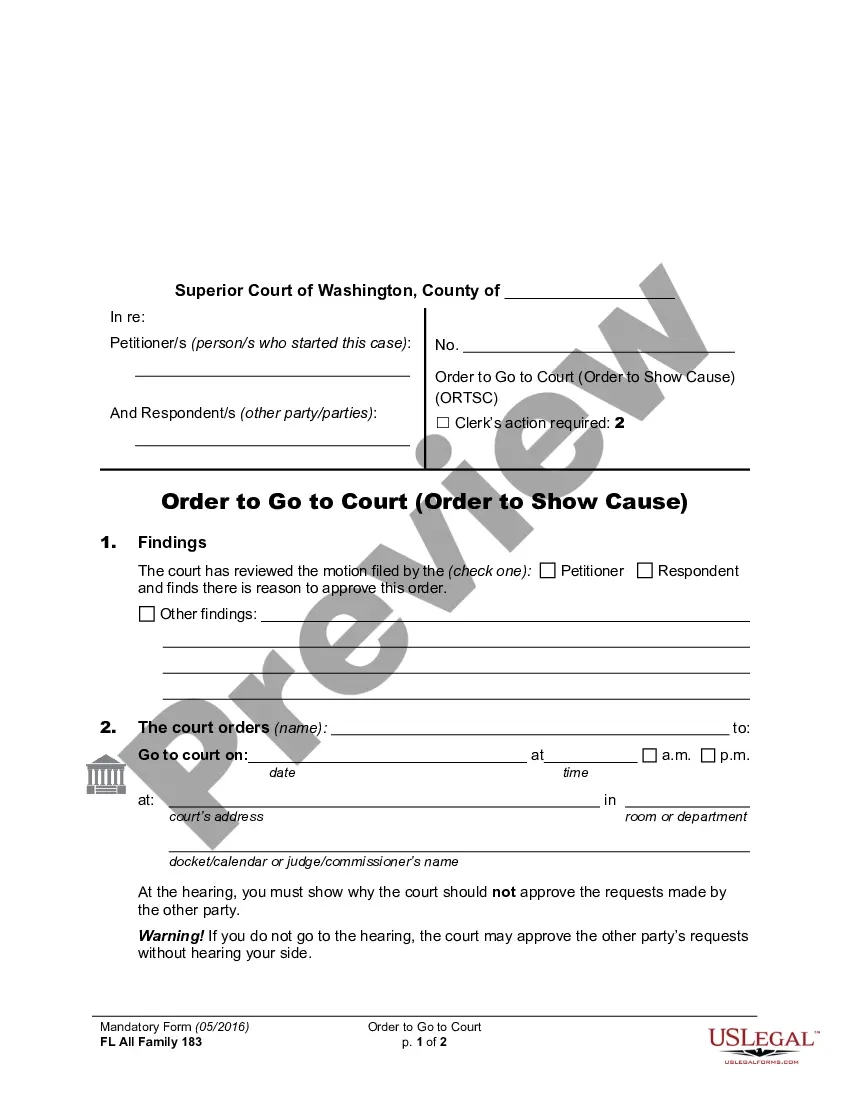

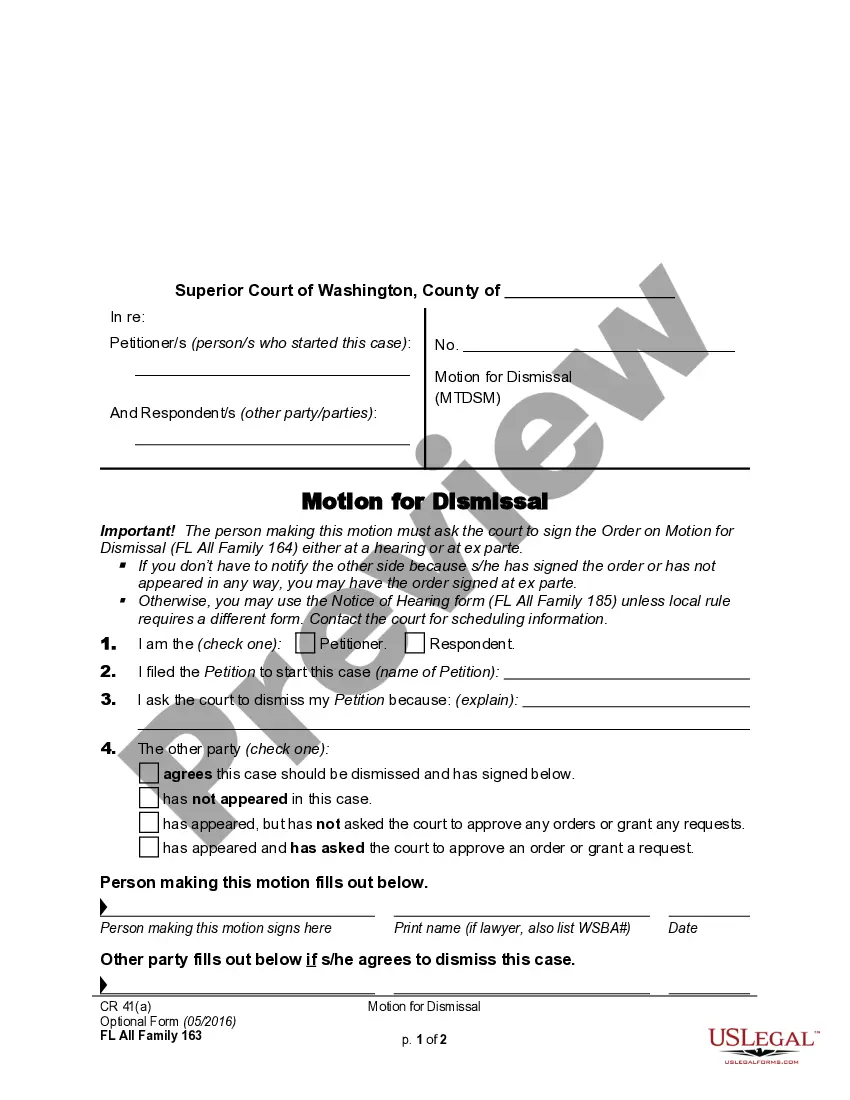

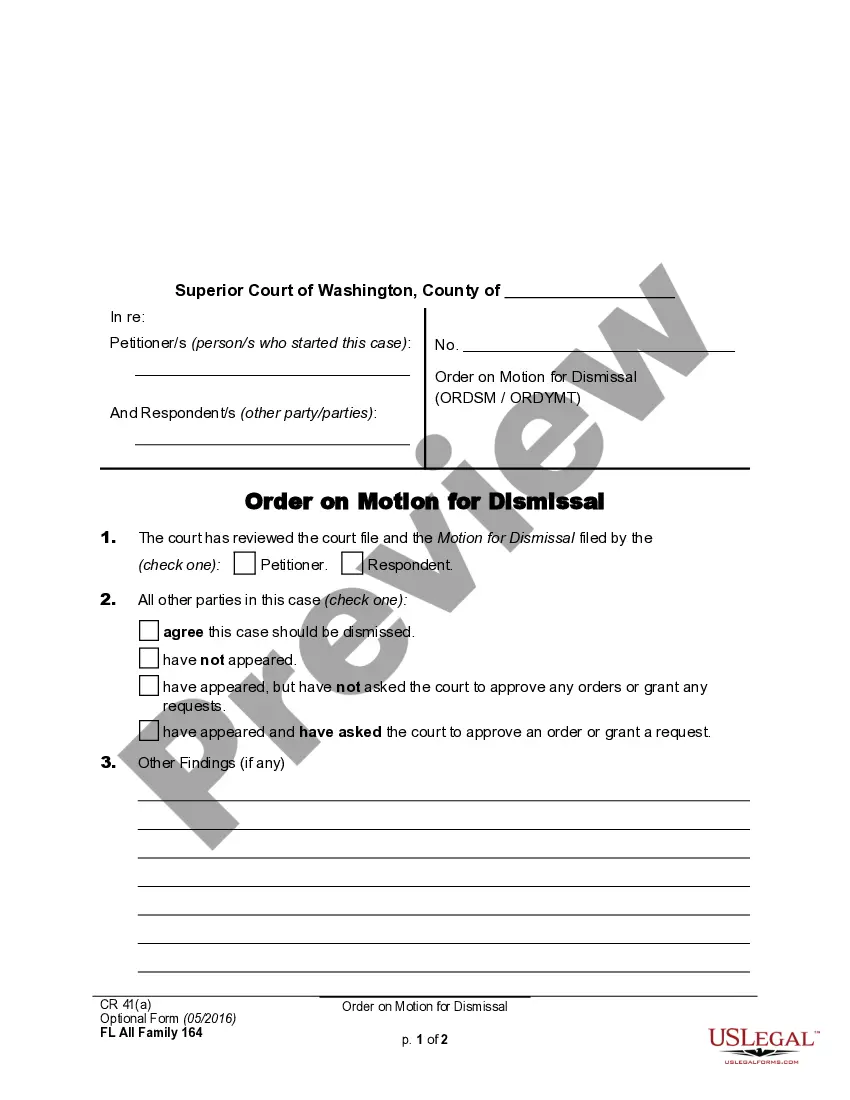

How to fill out Rejection Of Claim And Report Of Experience With Debtor?

Aren't you tired of choosing from numerous templates every time you want to create a Rejection of Claim and Report of Experience with Debtor? US Legal Forms eliminates the lost time millions of American people spend browsing the internet for perfect tax and legal forms. Our expert team of lawyers is constantly upgrading the state-specific Templates collection, to ensure that it always provides the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have an active subscription should complete a few simple actions before having the ability to download their Rejection of Claim and Report of Experience with Debtor:

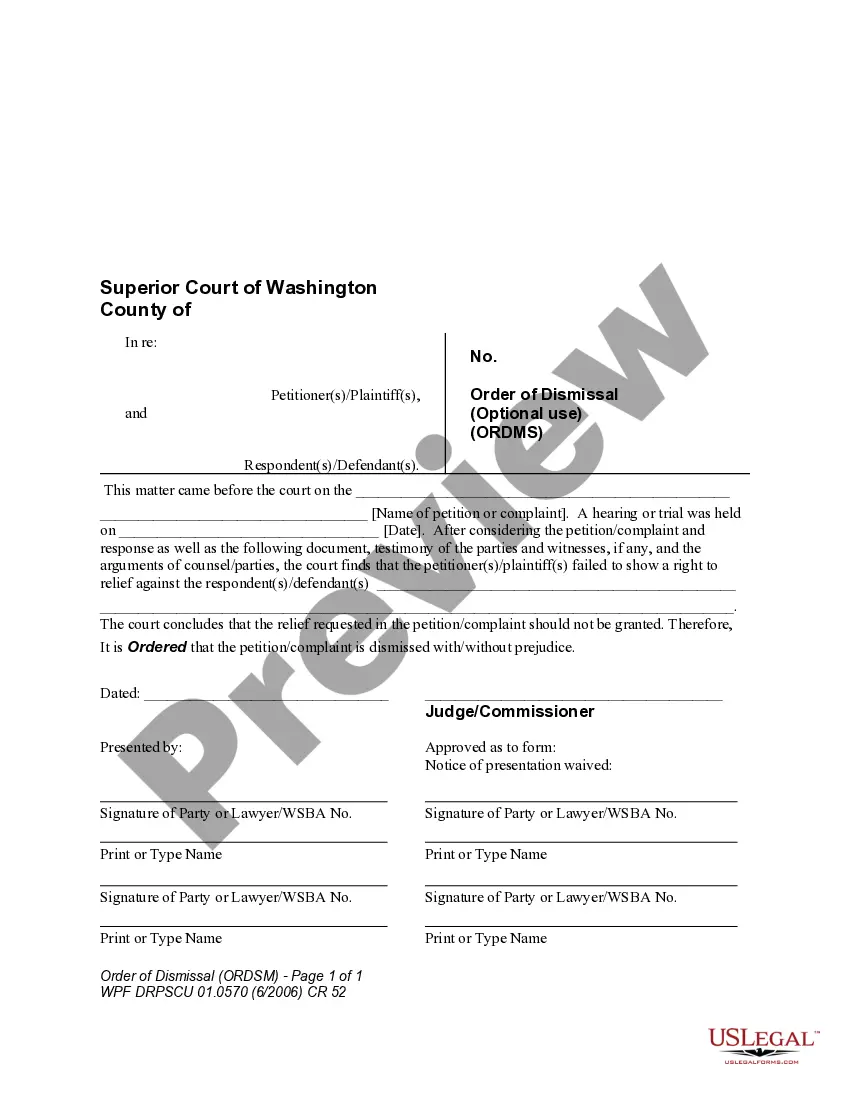

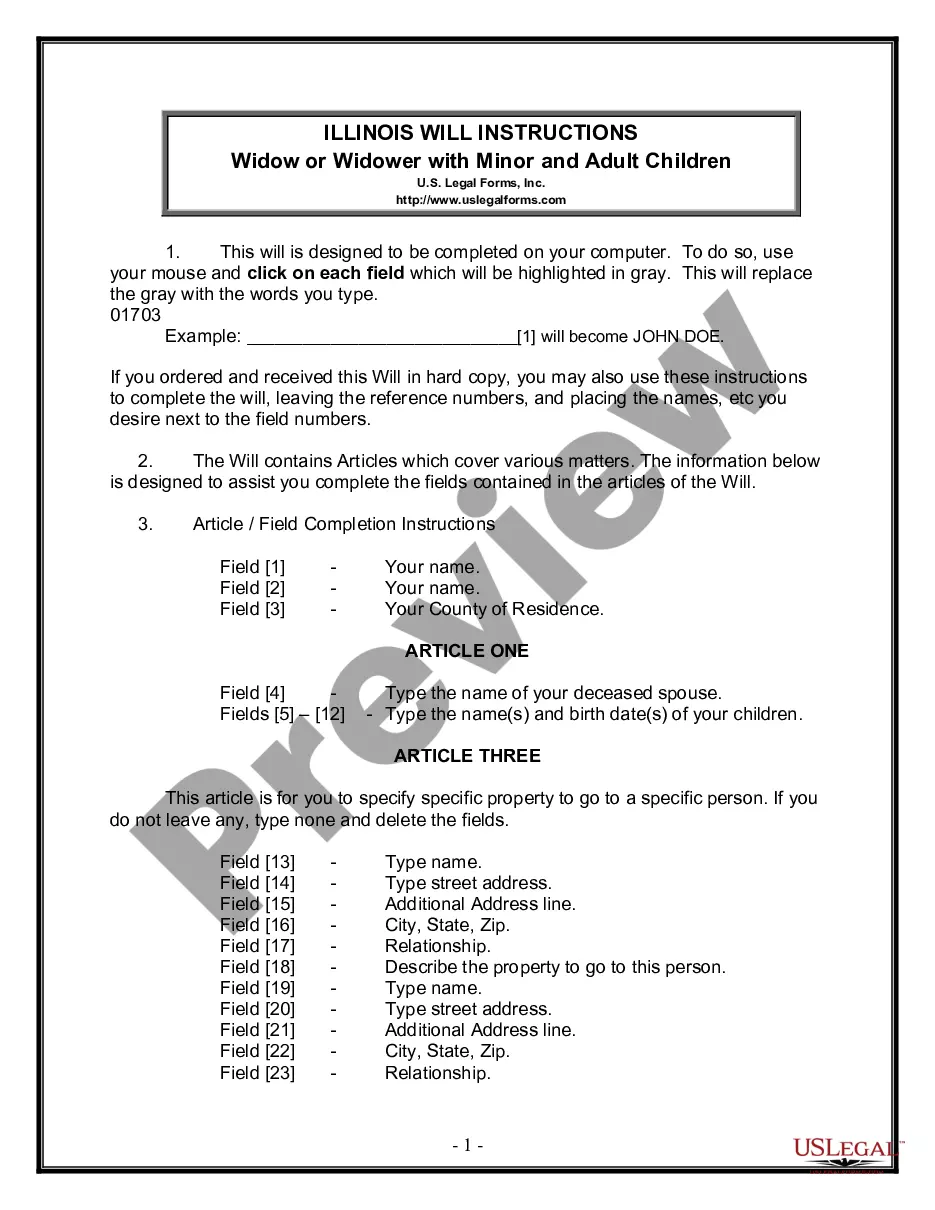

- Utilize the Preview function and read the form description (if available) to ensure that it’s the proper document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate sample for your state and situation.

- Make use of the Search field at the top of the web page if you want to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your sample in a convenient format to complete, create a hard copy, and sign the document.

After you have followed the step-by-step guidelines above, you'll always be capable of sign in and download whatever file you need for whatever state you need it in. With US Legal Forms, finishing Rejection of Claim and Report of Experience with Debtor templates or other official documents is simple. Begin now, and don't forget to look at the samples with certified attorneys!

With Debtor Fill Form popularity

With Debtor Statement Other Form Names

Rejection Claim Document FAQ

If one creditor fails to file a timely proof of claim, the amount the debtor must pay is reduced dollar-for-dollar. Not having to pay that debt can result in a lower monthly plan payment, a shorter plan, or both.

Under the bankruptcy procedural rules, and except as otherwise provided under those rules, an unsecured creditor must file a proof of claim in order for the unsecured creditor's claim to be allowed.

A proof of claim filed by a creditor supersedes a claim filed by the debtor or trustee only if it is timely filed within the 90 days allowed under Rule 3002(c).Under that provision, the debtor or trustee may file proof of a claim if the creditor fails to do so in a timely fashion.

Why Would a Creditor Not File a Proof of Claim?A creditor might not file a proof of claim in your bankruptcy if: you have a no-asset Chapter 7 bankruptcy (meaning you don't have any property the bankruptcy trustee can distribute to your creditors, so they won't get paid) you owe the creditor a very small sum, or.

Chapter 11 creditors are not required to file a Proof of Claim because the debtor is required to file a Schedule of Assets and Liabilities.If it is not filed, the Bankruptcy Court will consider the customer's Schedule of Liabilities as accurate and make any distributions accordingly.

In Chapter 7, a creditor can file a late claim and the result is the claim is subordinated to timely filed claims. 11 U.S.C. §726(a)(3).at 1193 (However, a secured creditor, who does not wish to participate in a Chapter 13 plan or who fails to file a timely proof of claim, does not forfeit its lien.)