Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information.

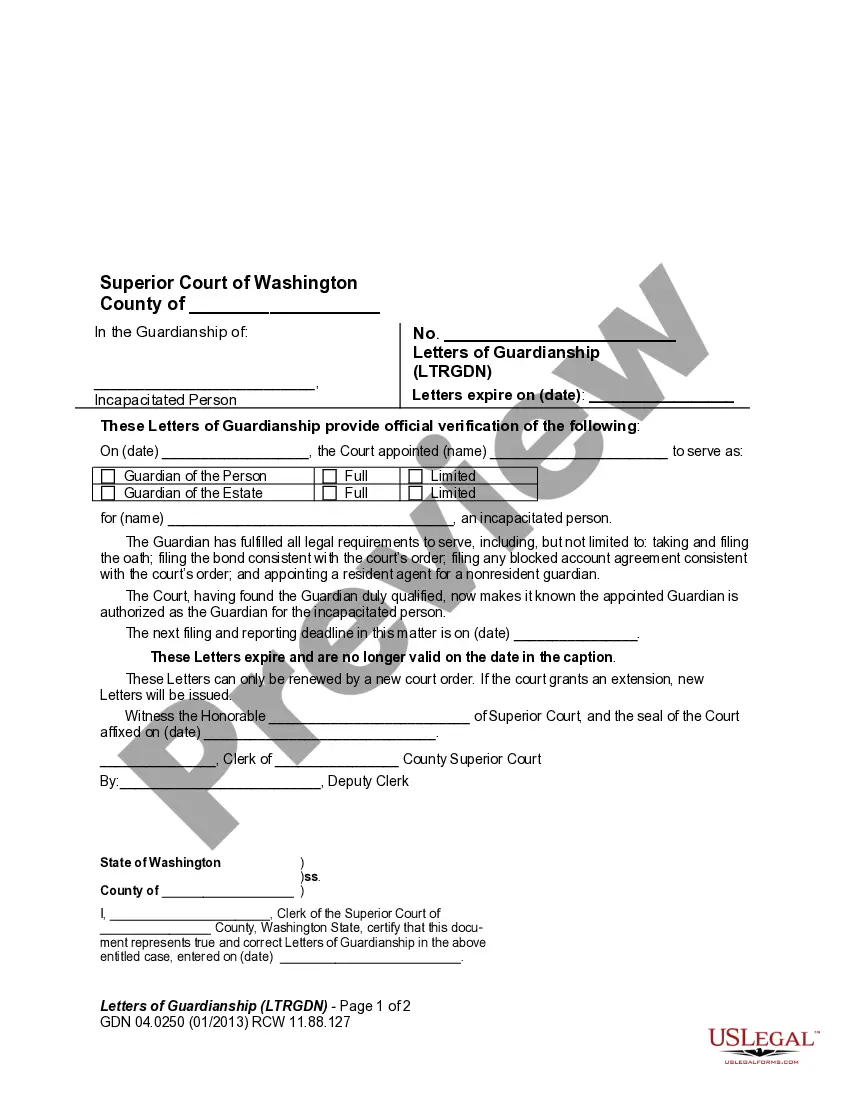

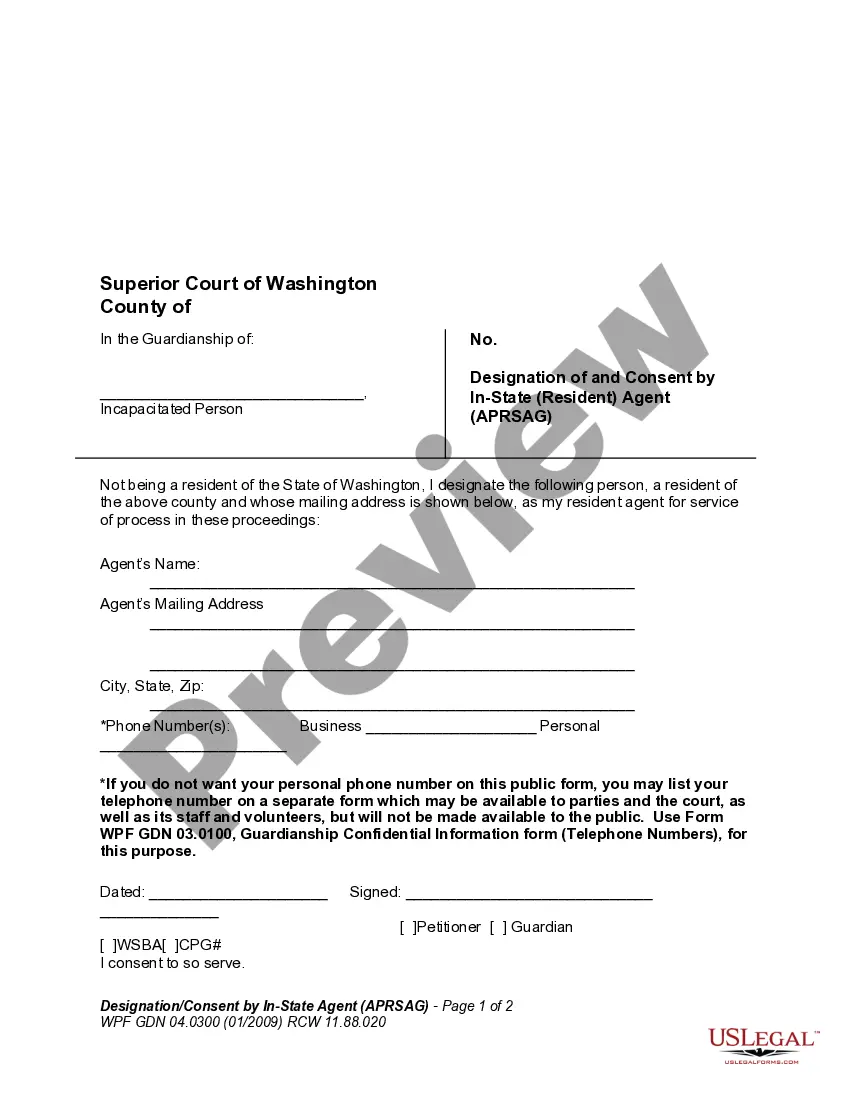

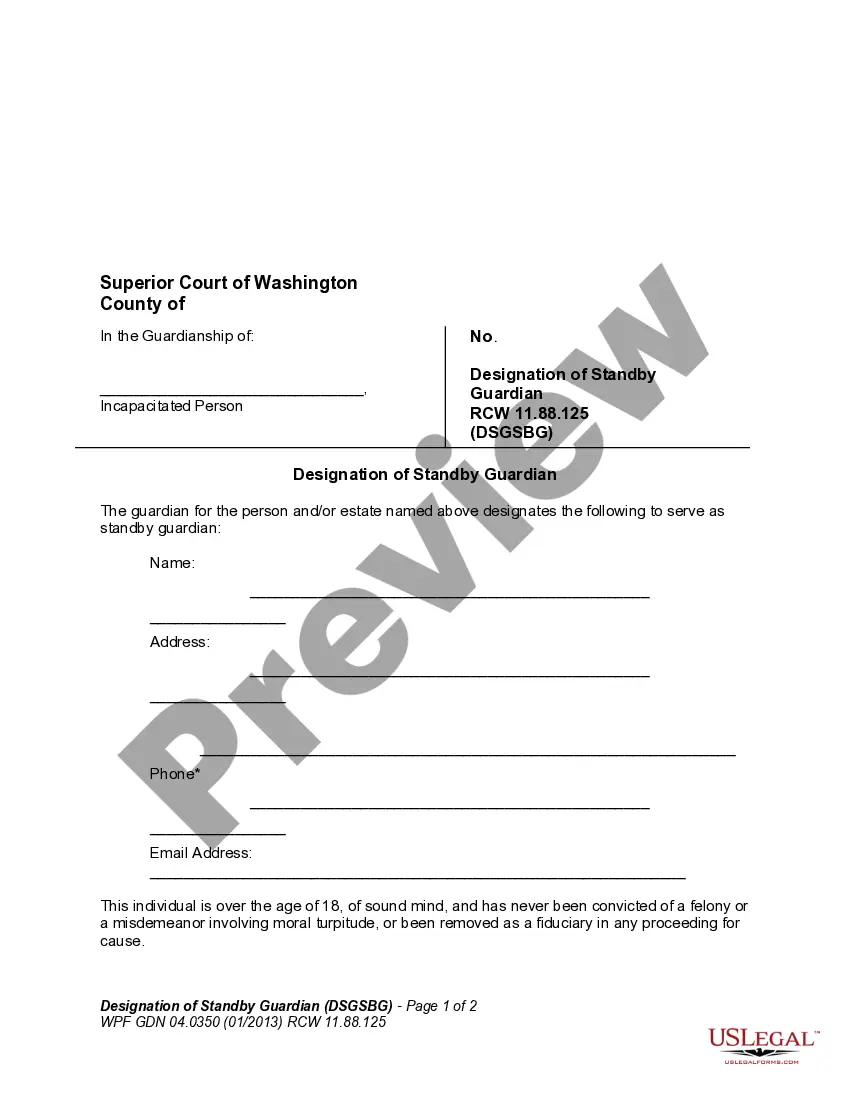

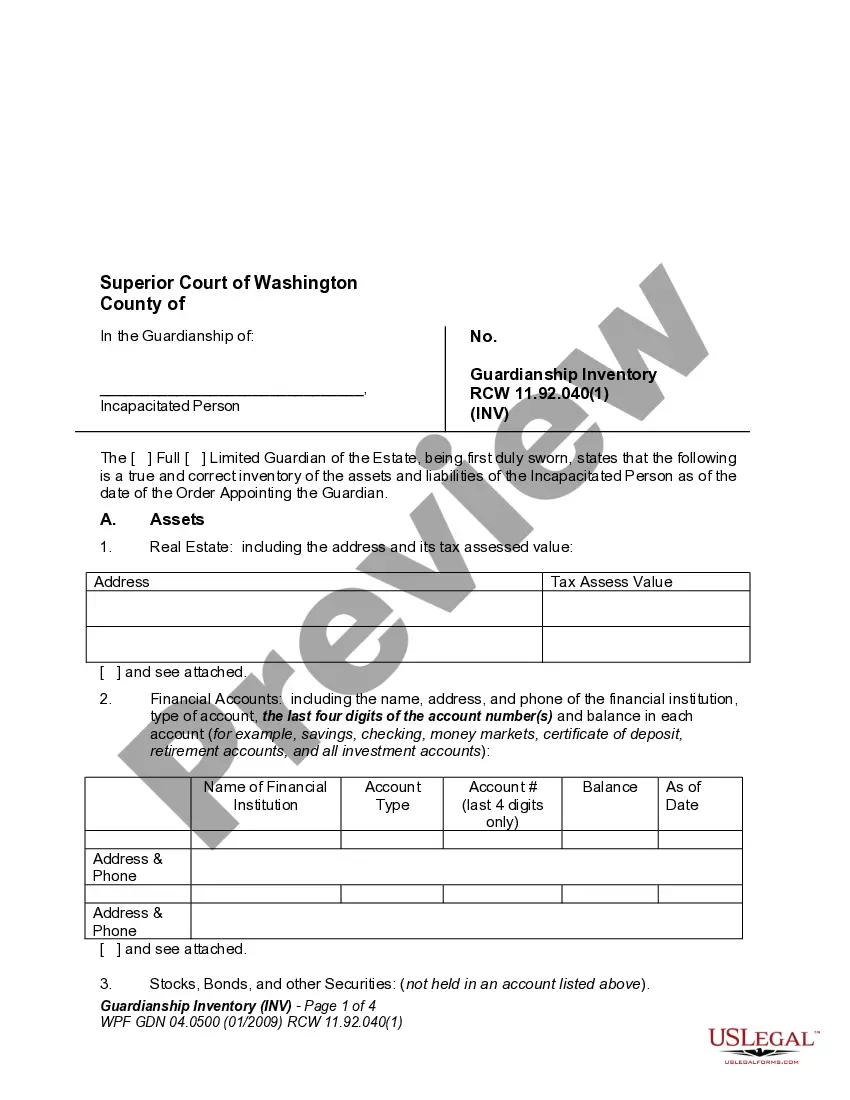

Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency

Description Personal Information Form Template

How to fill out Notice Credit Form?

Aren't you sick and tired of choosing from hundreds of samples each time you want to create a Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency? US Legal Forms eliminates the wasted time numerous Americans spend exploring the internet for suitable tax and legal forms. Our expert group of attorneys is constantly upgrading the state-specific Templates collection, to ensure that it always has the appropriate files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Users who don't have an active subscription need to complete easy steps before having the capability to download their Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency:

- Utilize the Preview function and look at the form description (if available) to make sure that it is the correct document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right sample for your state and situation.

- Make use of the Search field at the top of the site if you need to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your document in a required format to finish, print, and sign the document.

After you’ve followed the step-by-step guidelines above, you'll always be capable of sign in and download whatever file you need for whatever state you need it in. With US Legal Forms, finishing Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency templates or any other official files is not difficult. Begin now, and don't forget to double-check your samples with certified lawyers!

Credit Information Form Template Form popularity

Credit Personal Consumer Other Form Names

Personal Information Form Sample FAQ

Adverse action is defined in the Equal Credit Opportunity Act and the FCRA to include:a refusal to grant credit in the amount or terms requested. a negative change in account terms in connection with an unfavorable review of a consumer's account 5 U.S.C. § 1691(d)(6); FCRA A§ 603(k)

Adverse action is defined in the Equal Credit Opportunity Act and the FCRA to include: a denial or revocation of credit. a refusal to grant credit in the amount or terms requested. a negative change in account terms in connection with an unfavorable review of a consumer's account 5 U.S.C. § 1691(d)(6); FCRA A§ 603(k)

Give notice of the adverse action; Give the name, address, and telephone number of the credit reporting agency which provided the credit report (the telephone number must be toll free if the agency compiles and maintains consumer files on a nationwide basis);

Whenever a statement of a dispute is filed, unless there is rear sonable grounds to believe that it is frivolous or irrelevant, the consumer reporing agency shall, in any subsequent report containing the informaion in quesion, clearly note that it is disputed by the consumer and provide either the consumer s statement

Common violations of the FCRA include: Creditors give reporting agencies inaccurate financial information about you. Reporting agencies mixing up one person's information with another's because of similar (or same) last name or social security number. Agencies fail to follow guidelines for handling disputes.

In the hiring process, adverse action means a company is considering not hiring the applicant or that they may withdraw an offer. Usually, this is based on an adverse report on a consumer report or background check.

An adverse action occurs when an employer behaves in a way that puts an individual or a group of people at a disadvantage as far as equal employment opportunities go. For example, take an employee who files a lawsuit against his or her employer.

If applicable, financial institutions can provide a combined notice of adverse action to all consumer applicants to comply with multiple-applicant requirements under the FCRA, provided a credit score is not required for the adverse action notice because a score was not relied upon in taking adverse action.

A statement of action taken by the creditor. Either a statement of the specific reasons for the action taken or a disclosure of the applicant's right to a statement of specific reasons and the name, address, and telephone number of the person or office from which this information can be obtained.