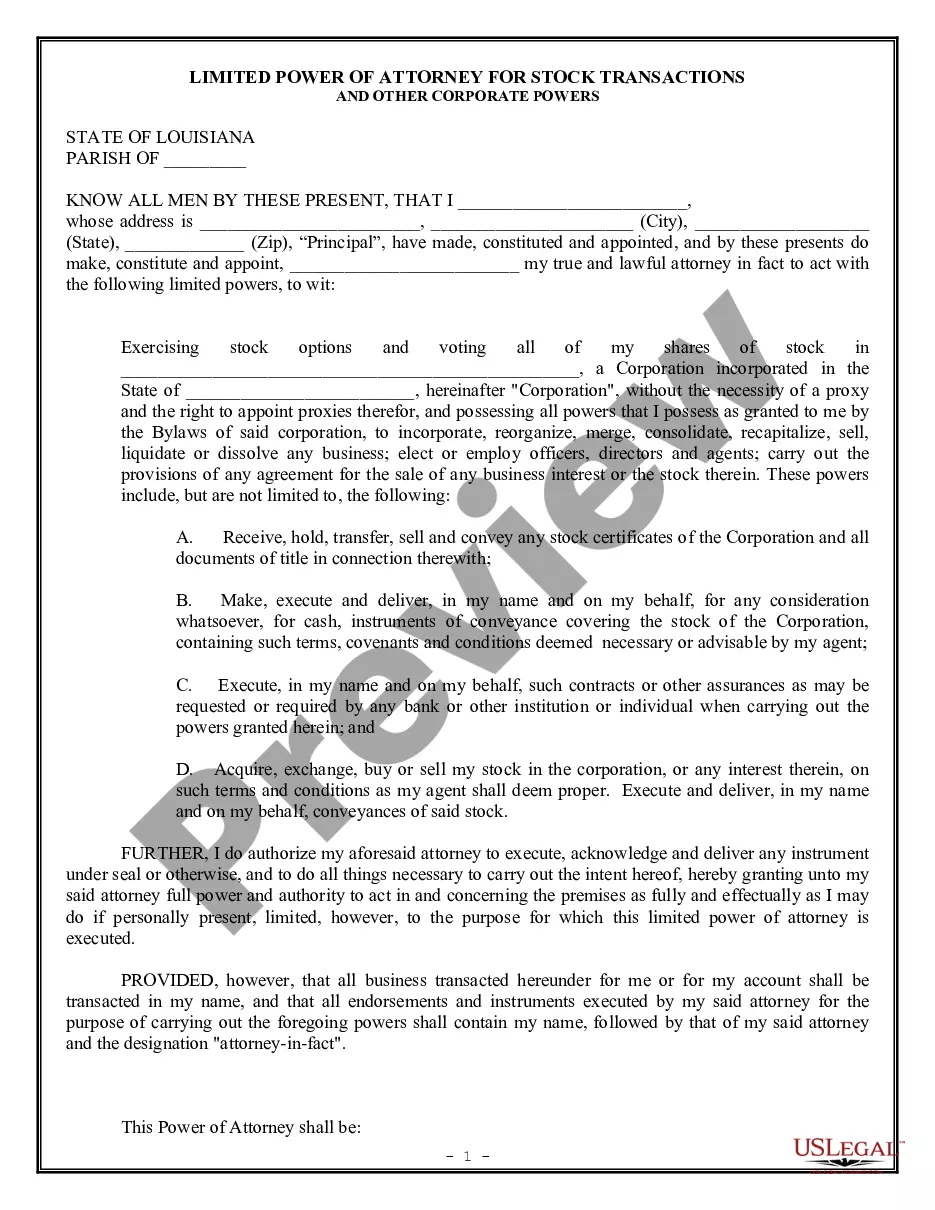

No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

Collection Agency's Return of Claim as Uncollectible

Description

How to fill out Collection Agency's Return Of Claim As Uncollectible?

Aren't you tired of choosing from hundreds of samples each time you need to create a Collection Agency's Return of Claim as Uncollectible? US Legal Forms eliminates the wasted time numerous American people spend browsing the internet for ideal tax and legal forms. Our expert group of attorneys is constantly upgrading the state-specific Templates collection, so that it always offers the right files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have a subscription need to complete a few simple steps before being able to download their Collection Agency's Return of Claim as Uncollectible:

- Use the Preview function and look at the form description (if available) to make sure that it’s the best document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the correct sample to your state and situation.

- Utilize the Search field at the top of the page if you need to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your sample in a convenient format to finish, create a hard copy, and sign the document.

After you’ve followed the step-by-step recommendations above, you'll always have the capacity to log in and download whatever file you will need for whatever state you want it in. With US Legal Forms, finishing Collection Agency's Return of Claim as Uncollectible templates or other official paperwork is easy. Get going now, and don't forget to recheck your examples with certified attorneys!

Form popularity

FAQ

To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. To record the bad debt recovery transaction, debit your Accounts Receivable account and credit your Bad Debts Expense account. Next, record the bad debt recovery transaction as income.

Write Off the Bad Debt Once you've determined that an unpaid invoice is worthless, you can write it off when it comes time to file taxes. If an unpaid invoice from a previous year becomes worthless, you'll have to file an amended return for a refund of the tax you paid.

You might get sued. The debt collector may file a lawsuit against you if you ignore the calls and letters. If you then ignore the lawsuit, this could lead to a judgment and the collection agency may be able to garnish your wages or go after the funds in your bank account.

A business deducts its bad debts, in full or in part, from gross income when figuring its taxable income.Nonbusiness Bad Debts - All other bad debts are nonbusiness. Nonbusiness bad debts must be totally worthless to be deductible. You can't deduct a partially worthless nonbusiness bad debt.

Generally speaking, you cannot deduct expenses from a previous year on this year's tax return. You can only deduct expenses in the year that you paid for them.Deductions, income or anything else from a previous year cannot be claimed with the current year's tax information.

IRS rules say you can only deduct a bad debt in the year it becomes worthless. If you have a court judgment against the debtor and have tried to collect for several years with no success, then you can write the debt off. If the IRS questions the deduction, you will have to show you took reasonable steps to collect.

In general, judgements levied on you through a small claims court case are not deductible expenses on your tax return.The IRS allows you to deduct legal fees if you paid the fees in an attempt to produce or collect taxable income, keep your job, for divorce advice or to collect taxable alimony.

Because it generally generates a loss when it is written off, bad debt recovery usually produces income. In accounting, the bad debt recovery credits the allowance for bad debts or bad debt reserve categories and reduces the accounts receivable category in the books.

A debt collector may settle for around 50% of the bill, and Loftsgordon recommends starting negotiations low to allow the debt collector to counter. If you are offering a lump sum or any alternative repayment arrangements, make sure you can meet those new repayment parameters.