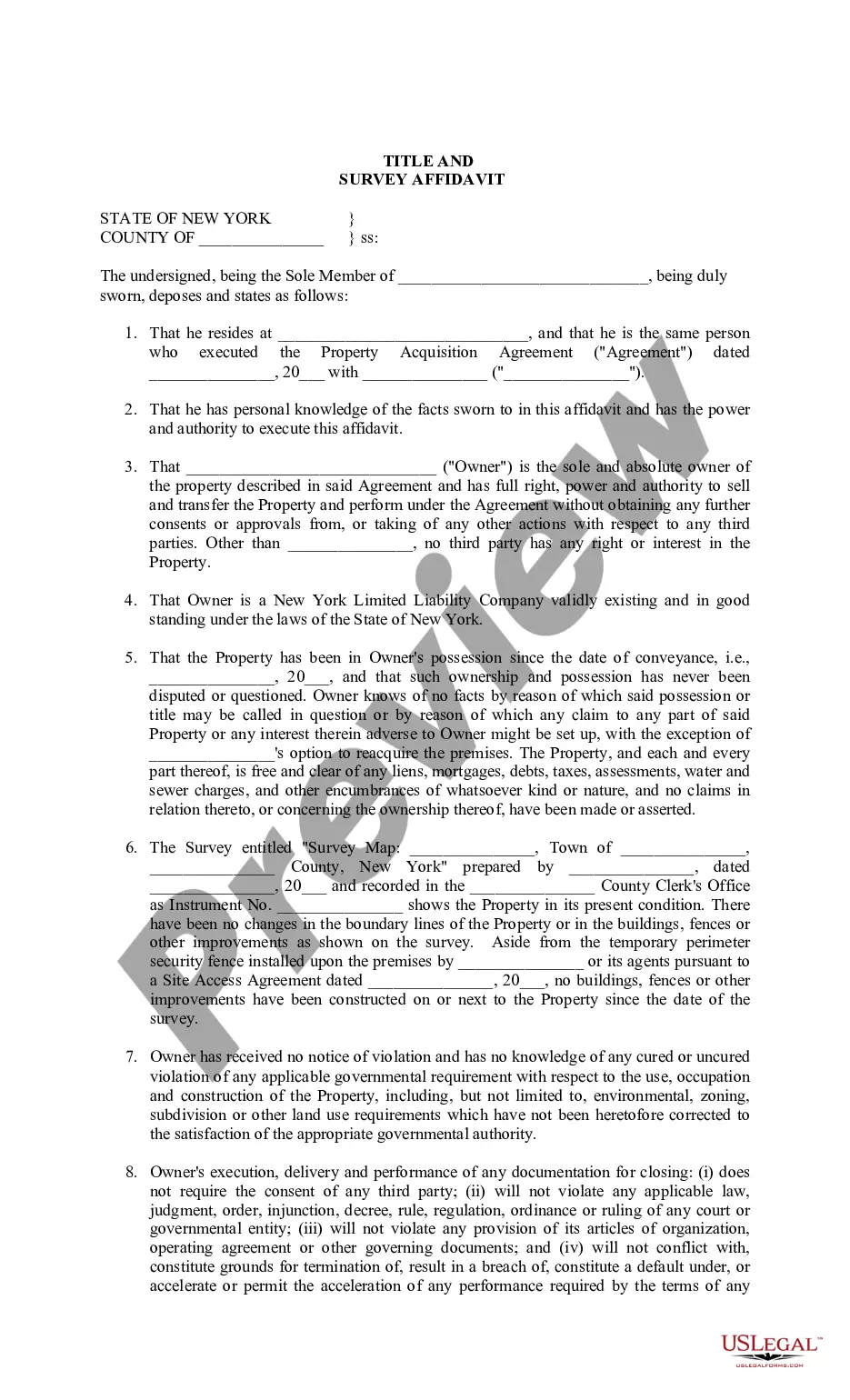

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

Aren't you tired of choosing from numerous samples each time you want to create a Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually? US Legal Forms eliminates the lost time millions of Americans spend surfing around the internet for appropriate tax and legal forms. Our professional group of attorneys is constantly modernizing the state-specific Templates collection, to ensure that it always provides the proper documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Users who don't have a subscription should complete quick and easy steps before having the capability to get access to their Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually:

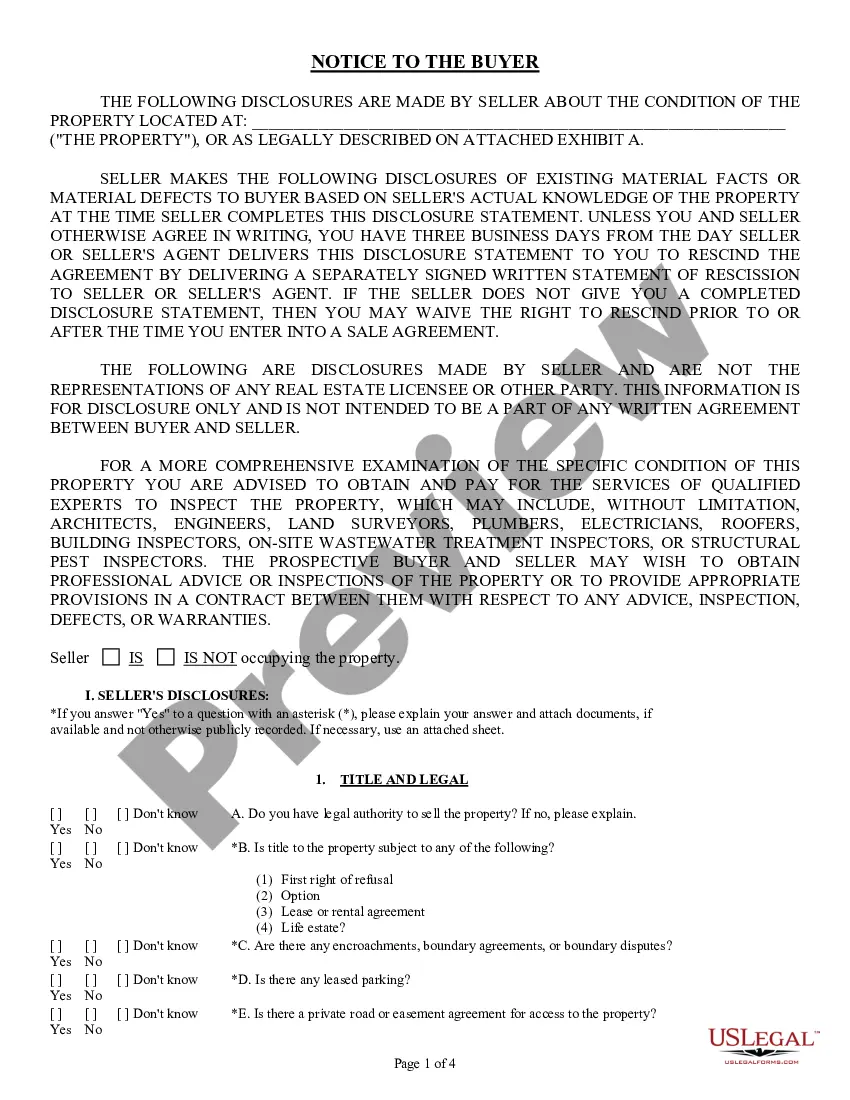

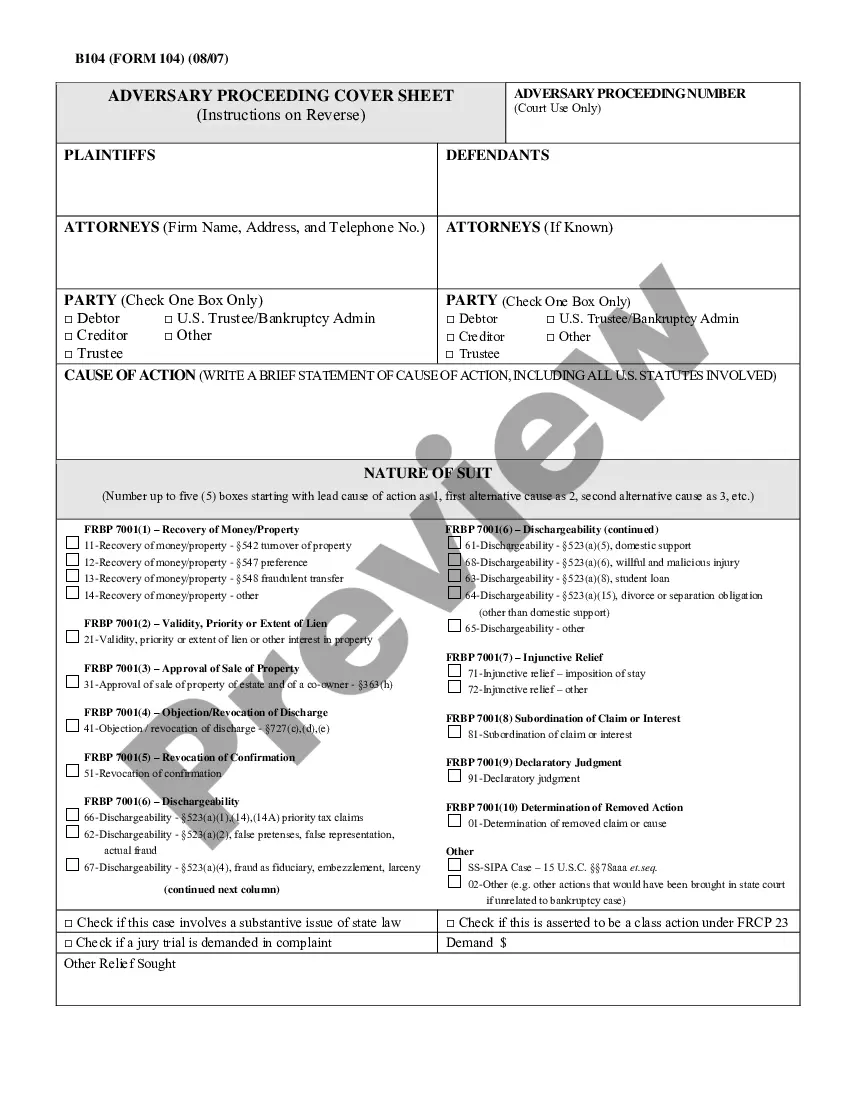

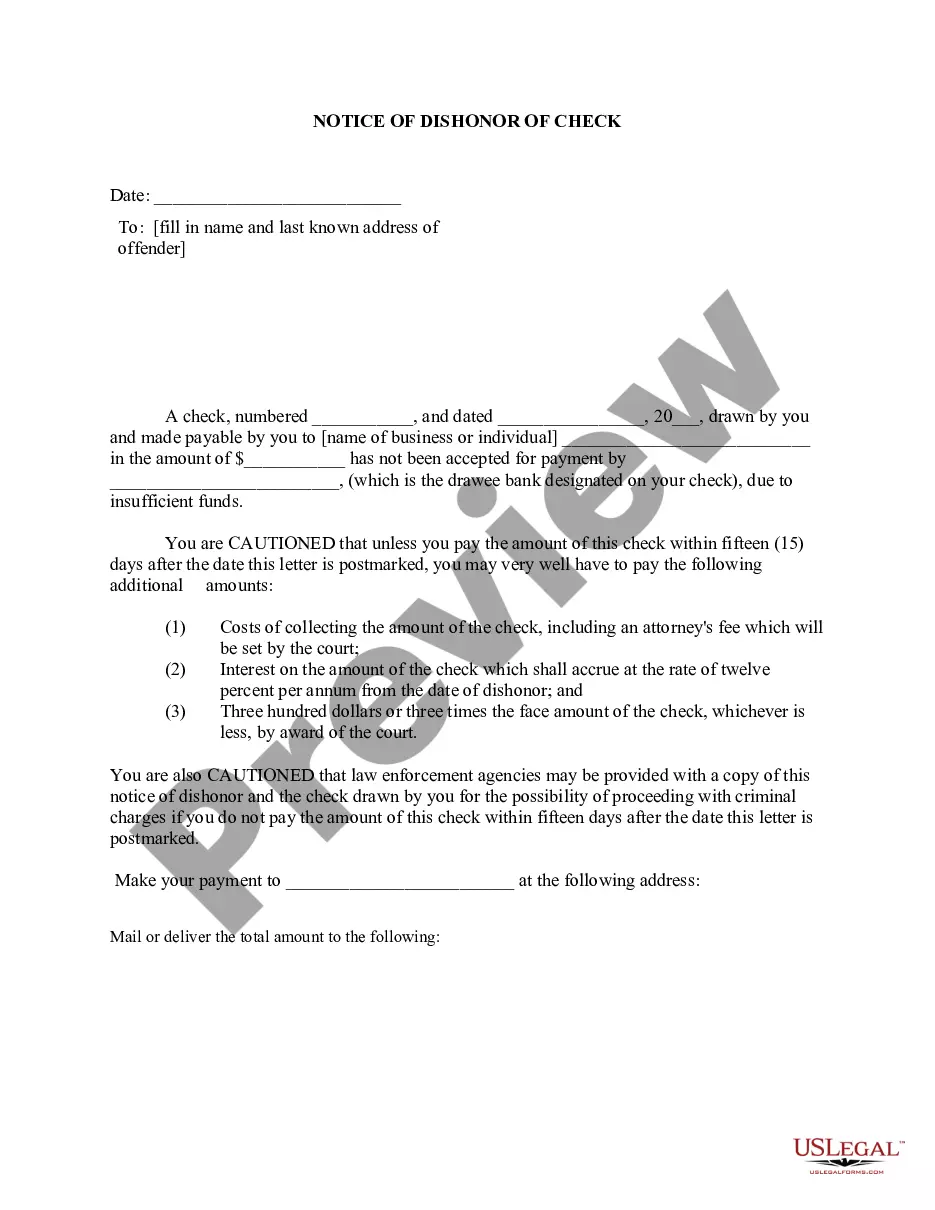

- Make use of the Preview function and read the form description (if available) to make sure that it’s the proper document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate example for the state and situation.

- Utilize the Search field on top of the page if you have to look for another file.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your template in a convenient format to complete, print, and sign the document.

After you’ve followed the step-by-step instructions above, you'll always have the capacity to log in and download whatever file you require for whatever state you need it in. With US Legal Forms, finishing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually samples or other official documents is not hard. Begin now, and don't forget to look at the samples with certified attorneys!

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Promissory notes are commonly written by banks, lenders and attorneys, but a promissory note written properly can be just as legal when entered into by two individuals.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.In effect, promissory notes can enable anyone to be a lender.

Step 1 Agree to Terms. Before both parties sit down to write an agreement, the following should be verbally agreed upon: Step 2 Run a Credit Report. Step 3 Security and Co-Signer(s) Step 4 Writing the Promissory Note. Step 5 Paying Back the Borrowed Money.

The borrower and the lender execute the promissory note, and as a result, the borrower becomes legally bound to repay the loan to the lender. If the borrower does not repay the loan, the lender can pursue legal action. If the borrower does fully repay the loan, the lender should mark the promissory note paid in full.

Amount or principal : State the face amount of the money borrowed. Interest rate : If the loan involves interest, the promissory note should include the interest rate charged.For a promissory note to be legally enforceable, the document needs the signature of each party.

Demand promissory notes are notes that do not carry a specific maturity date, but are due on demand of the lender. Usually the lender will only give the borrower a few days' notice before the payment is due. Promissory notes may be used in combination with security agreements.

Calculating Compound InterestCompound interest uses a more complicated formula: You must add 1 to the interest rate (for example, a 5 percent interest rate would mean 1 + 0.05 = 1.05) and then raise the total to the power of whatever the number of periods is for repayment.