Employment Verification Letter for Independent Contractor

Description Subcontractor Verification Letter

How to fill out How To Fill Out Verification Of Employment Loss Of Income Form Florida?

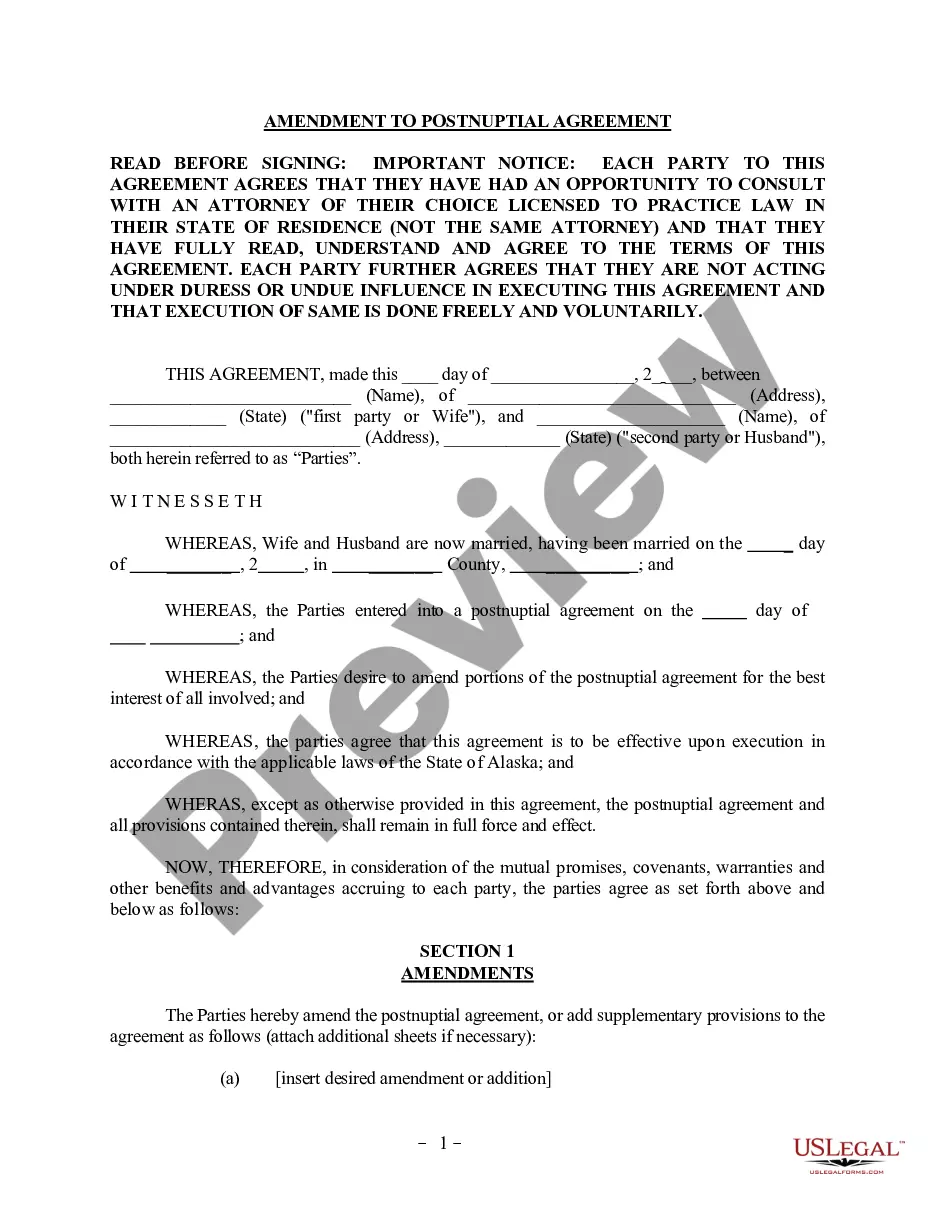

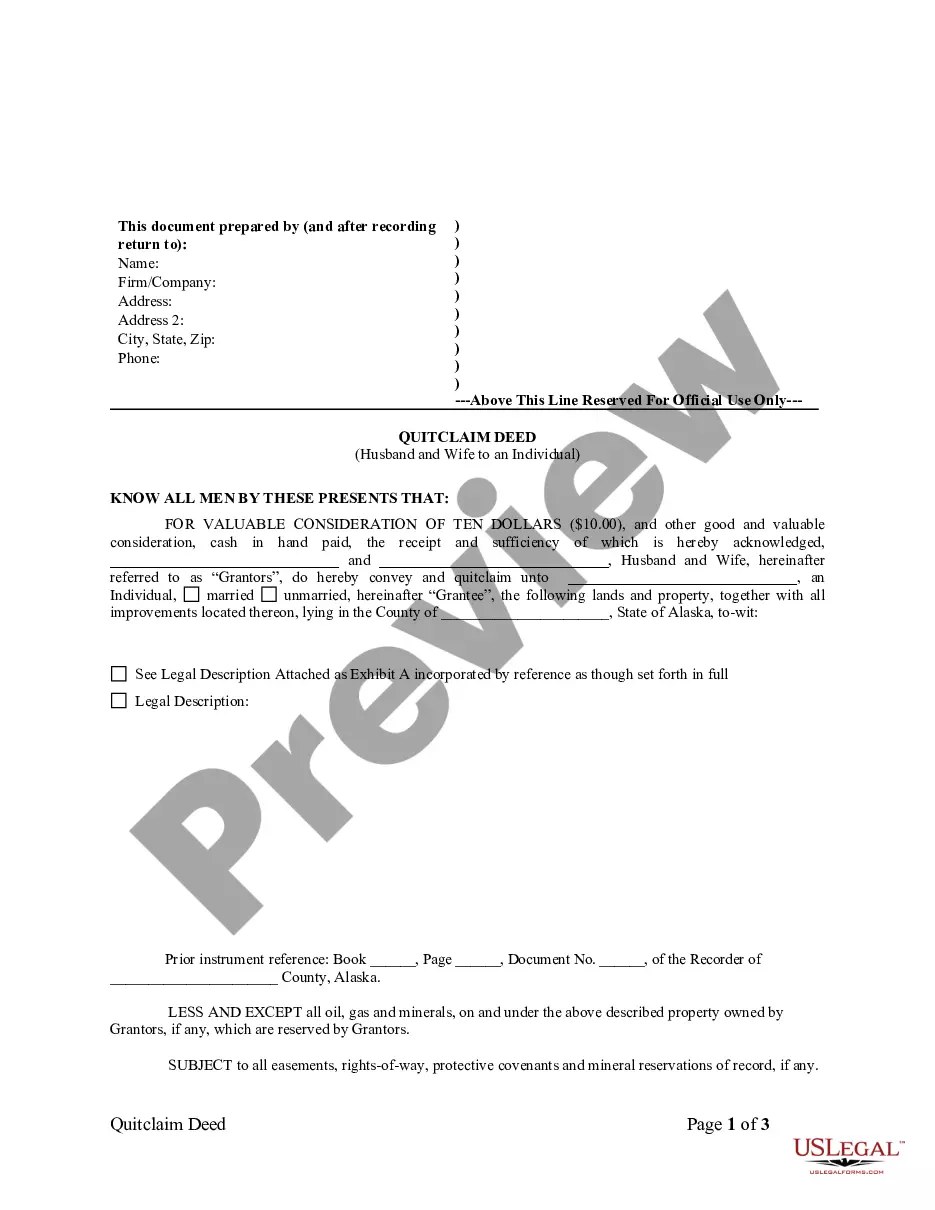

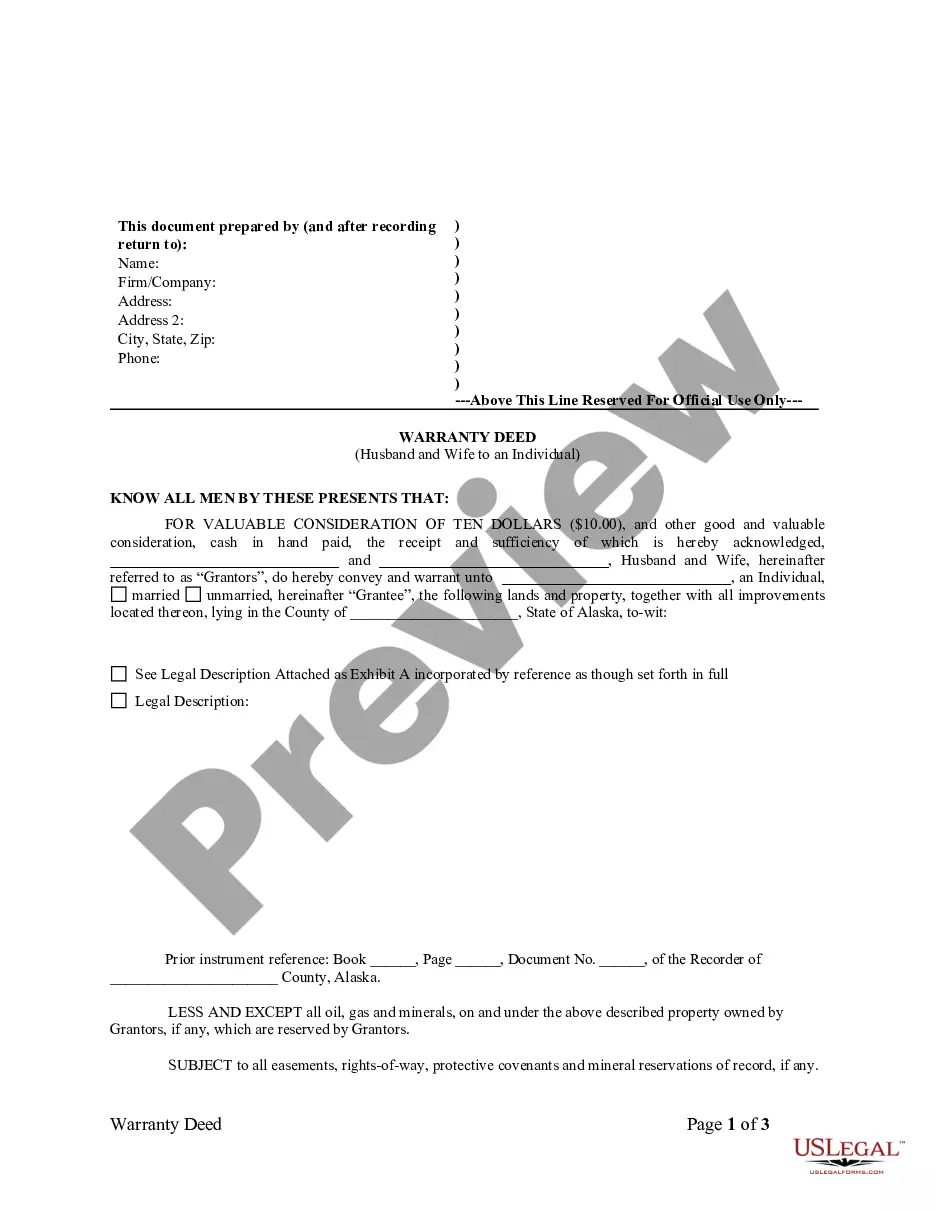

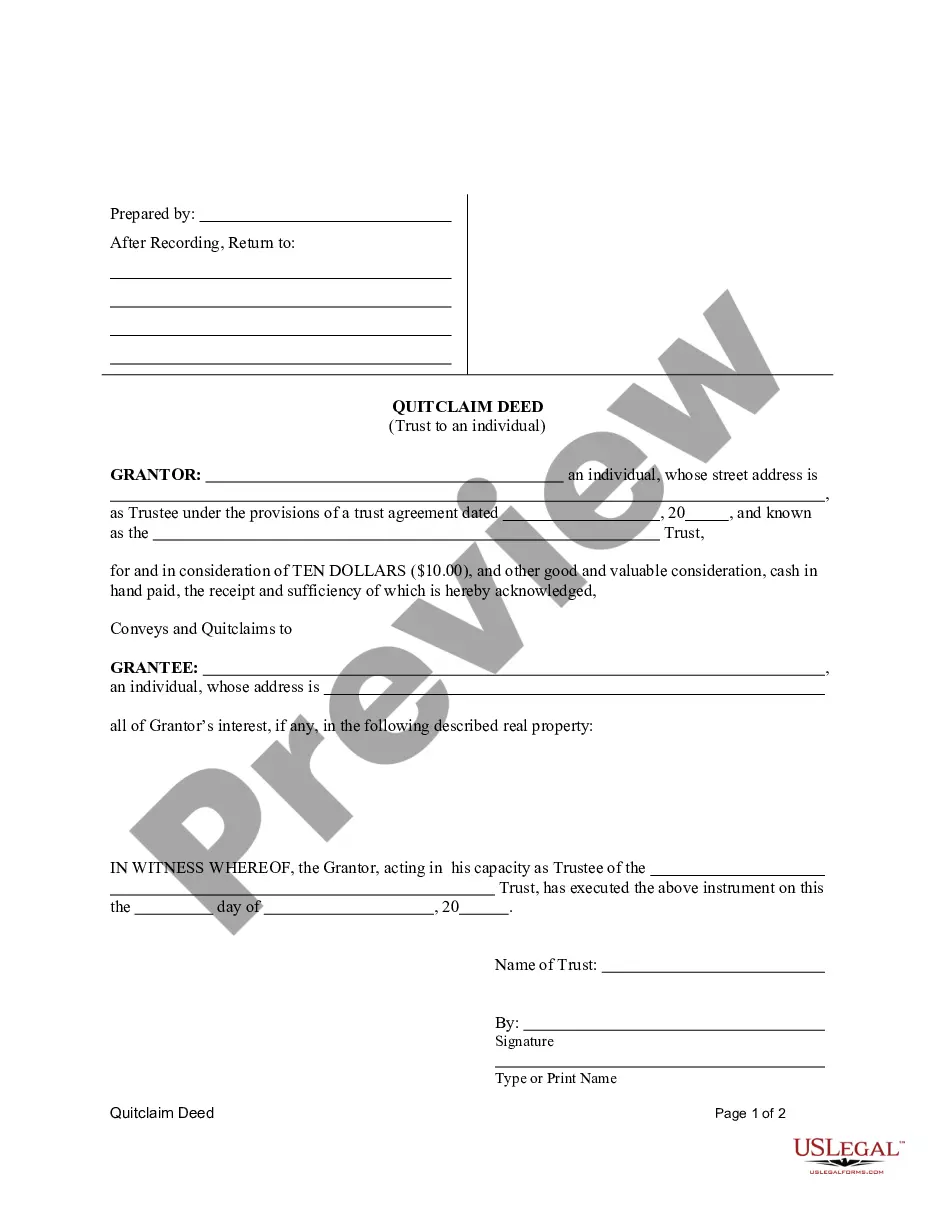

Use US Legal Forms to get a printable Employment Verification Letter for Independent Contractor. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms library on the web and provides affordable and accurate templates for customers and lawyers, and SMBs. The templates are grouped into state-based categories and many of them might be previewed before being downloaded.

To download samples, users need to have a subscription and to log in to their account. Click Download next to any template you need and find it in My Forms.

For those who don’t have a subscription, follow the tips below to quickly find and download Employment Verification Letter for Independent Contractor:

- Check to make sure you get the right template in relation to the state it is needed in.

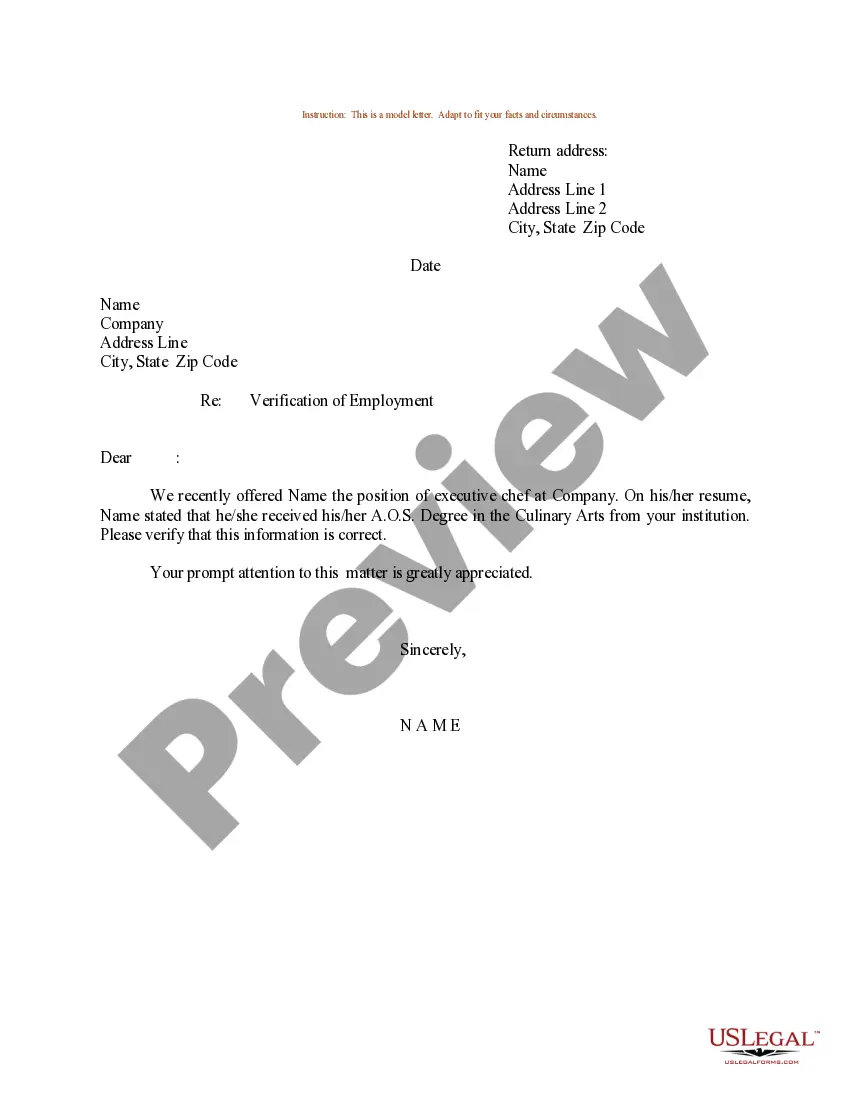

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it’s the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to find another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Employment Verification Letter for Independent Contractor. Over three million users have utilized our platform successfully. Choose your subscription plan and have high-quality forms within a few clicks.

Lance Employment Verification Letter Form popularity

Employment Verification For Independent Contractors Other Form Names

Work Certification Letter FAQ

Do employers need to complete employment verification checks for independent contractors? No.However, it is important to note that businesses and individuals may not hire independent contractors if they are aware that the independent contractor is not authorized to work in the United States.

Wage and Tax Statement for Self Employed (1099). These forms prove your wages and taxes as a self employed individual. Profit and Loss Statement or Ledger Documentation. Bank Statements.

In general, we would not recommended that you ask to see their work authorization unless you have a company policy or practice in place in which you verify work authorization for all independent contractors.

Proof of employment letter Also known as an employment verification letter, this is an official document written by an employer, typically on company letterhead.Employee salary information. Employee's hire date. Employee's job title and responsibilities.

So, can you write a proof of income letter for self employment on your own behalf? The answer is yes. Write an income verification letter and use the following accepted documentation to prove your income: IRS Form 1099 Miscellaneous Income used by freelancers to record any job that paid $600 or more.

Write the company's information. Include a statement verifying that the employee does indeed work at this place of employment, as well as the date he or she began working. Sign the document. Current Employee. Past Employee. Best Practices.

The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Verification letters for independent contractors must, at the very least, specify dates of work, rate of pay, and hours/project fees that have been contracted.

Step 2 Include a self-declaration statement. In your letter include the name of your company, if self-employed, or the company you worked for. Step 3 Include specific dates of employment. Step 4 Include a detailed list of tasks performed during this period of time.

Lying during employment verification is particularly risky because you're often risking your reputation with several organizations, including the party requesting verification and your current or former employer.