Sample Letter for Land Deed of Trust

Description

How to fill out Sample Letter For Land Deed Of Trust?

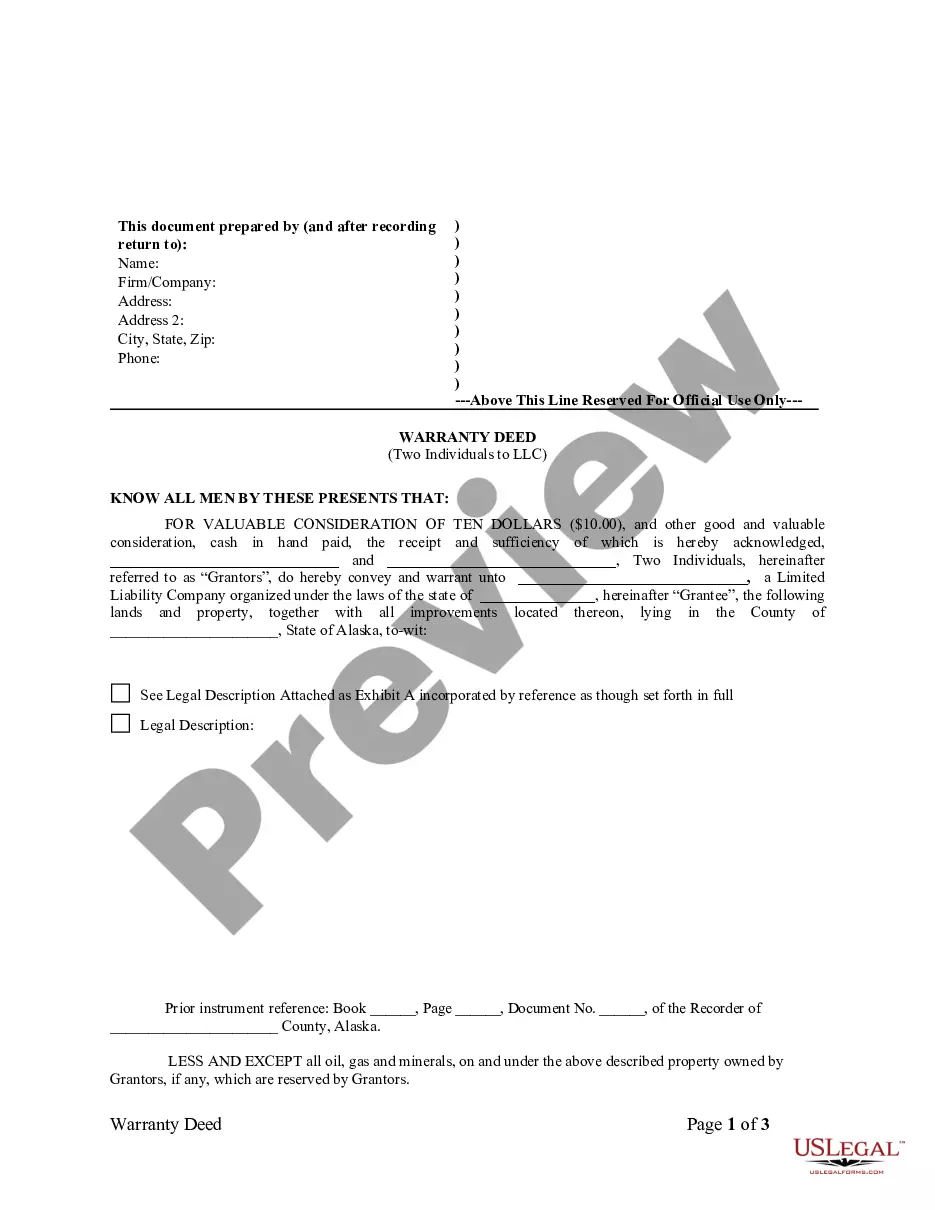

Use US Legal Forms to get a printable Sample Letter for Land Deed of Trust. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms catalogue online and provides reasonably priced and accurate templates for consumers and lawyers, and SMBs. The documents are grouped into state-based categories and a number of them might be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Press Download next to any template you want and find it in My Forms.

For those who do not have a subscription, follow the tips below to quickly find and download Sample Letter for Land Deed of Trust:

- Check to ensure that you have the correct template with regards to the state it’s needed in.

- Review the document by looking through the description and by using the Preview feature.

- Press Buy Now if it is the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Use the Search engine if you want to find another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Sample Letter for Land Deed of Trust. Above three million users already have used our service successfully. Choose your subscription plan and obtain high-quality forms within a few clicks.

Form popularity

FAQ

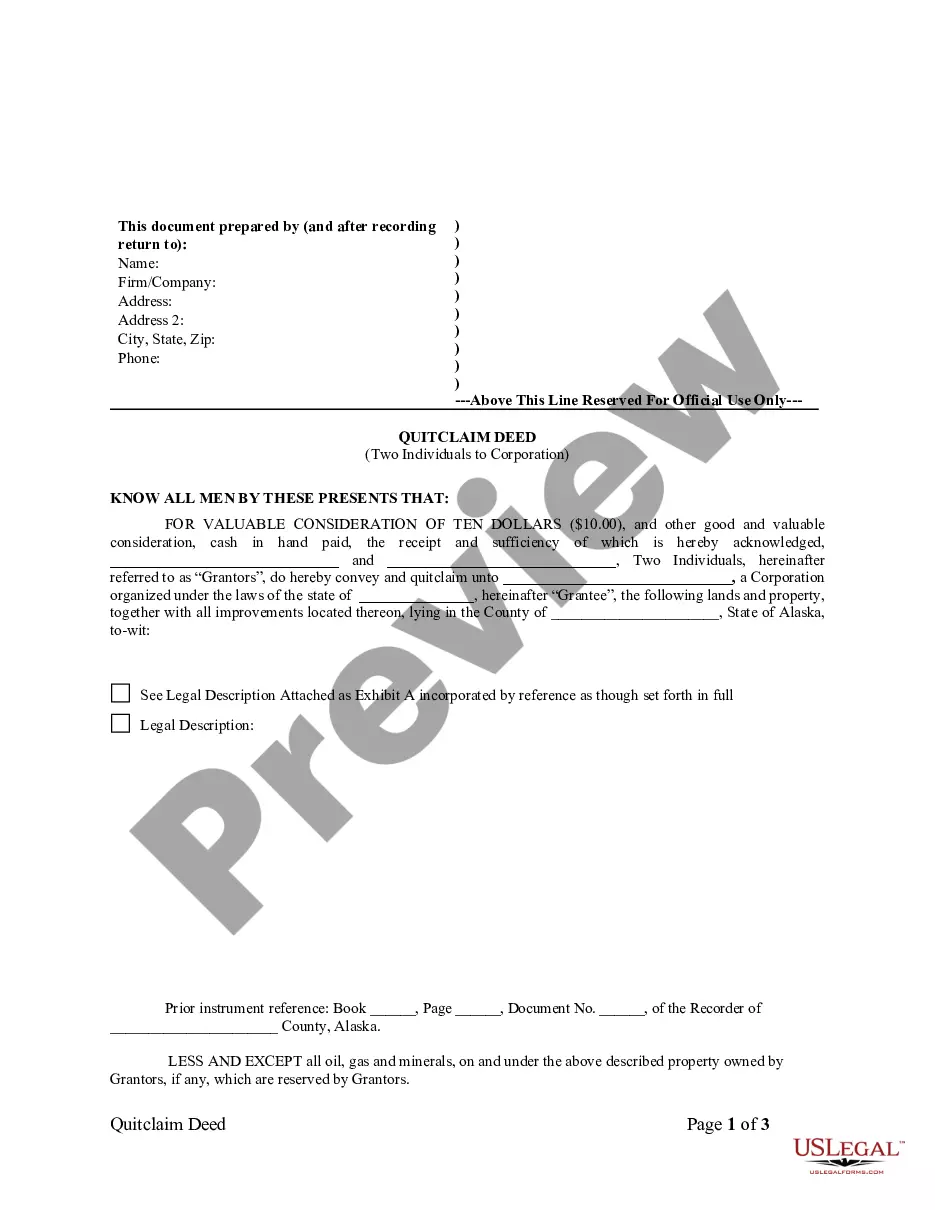

A deed of trust includes most of the same information as a mortgage, including:A legal description of the property that's used as security or collateral for the mortgage. The names of parties: trustee, trustor, and beneficiary. The inception and maturity dates of the loan.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

A trust deedalso known as a deed of trustis a document sometimes used in real estate transactions in the U.S. It is a document that comes into play when one party has taken out a loan from another party to purchase a property.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.

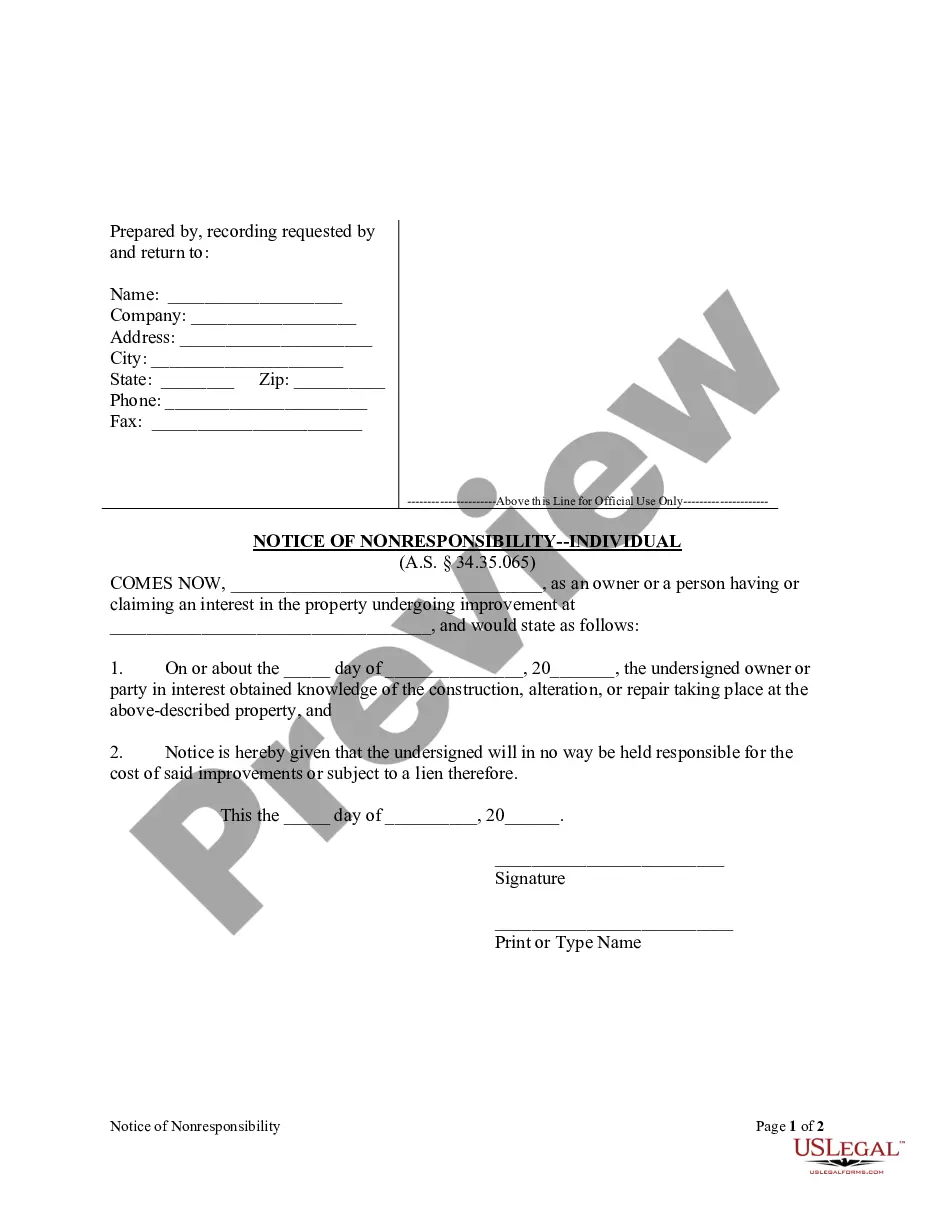

When you are ready to sign a deed of trust, the parties will need to sign in the presence of a notary public.The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

The terms "title" and "deed of trust" are associated with real estate transactions. They're closely related to each other, but are slightly different. The title to your property contains a detailed history of past owners and liens. A deed of trust is a type of security instrument used by your mortgage lender.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.