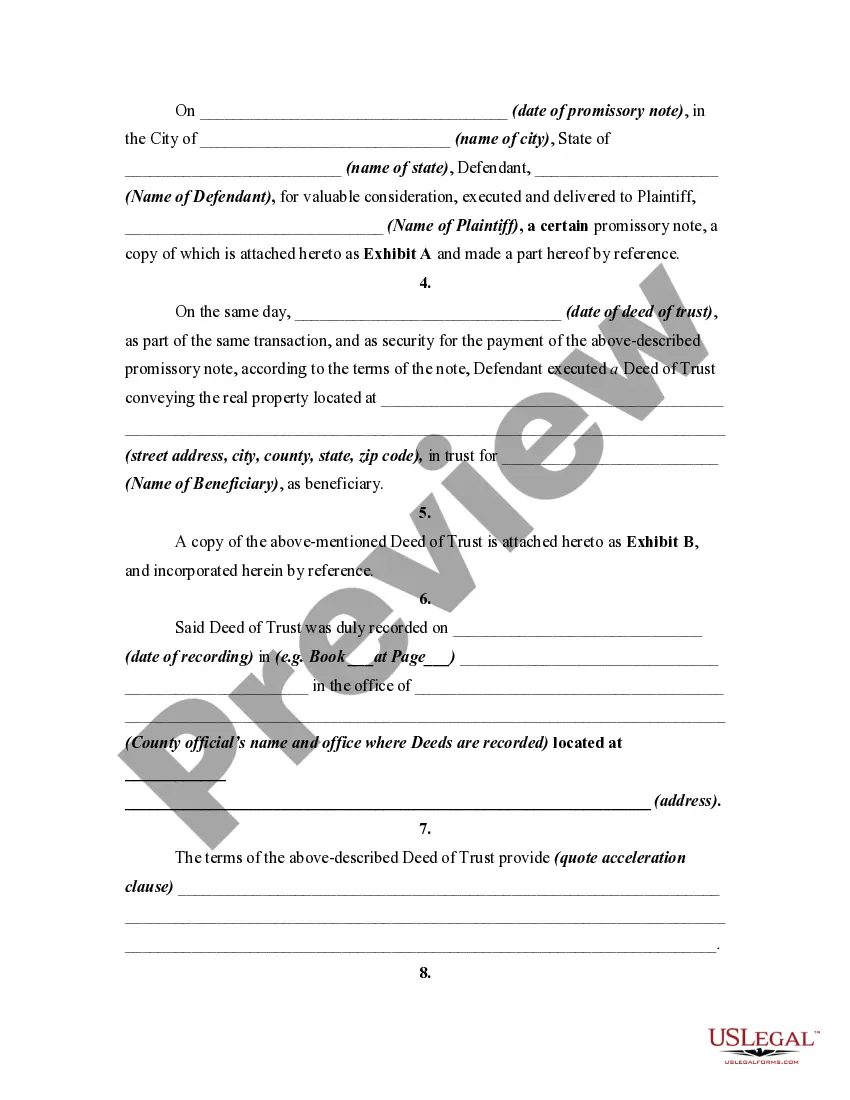

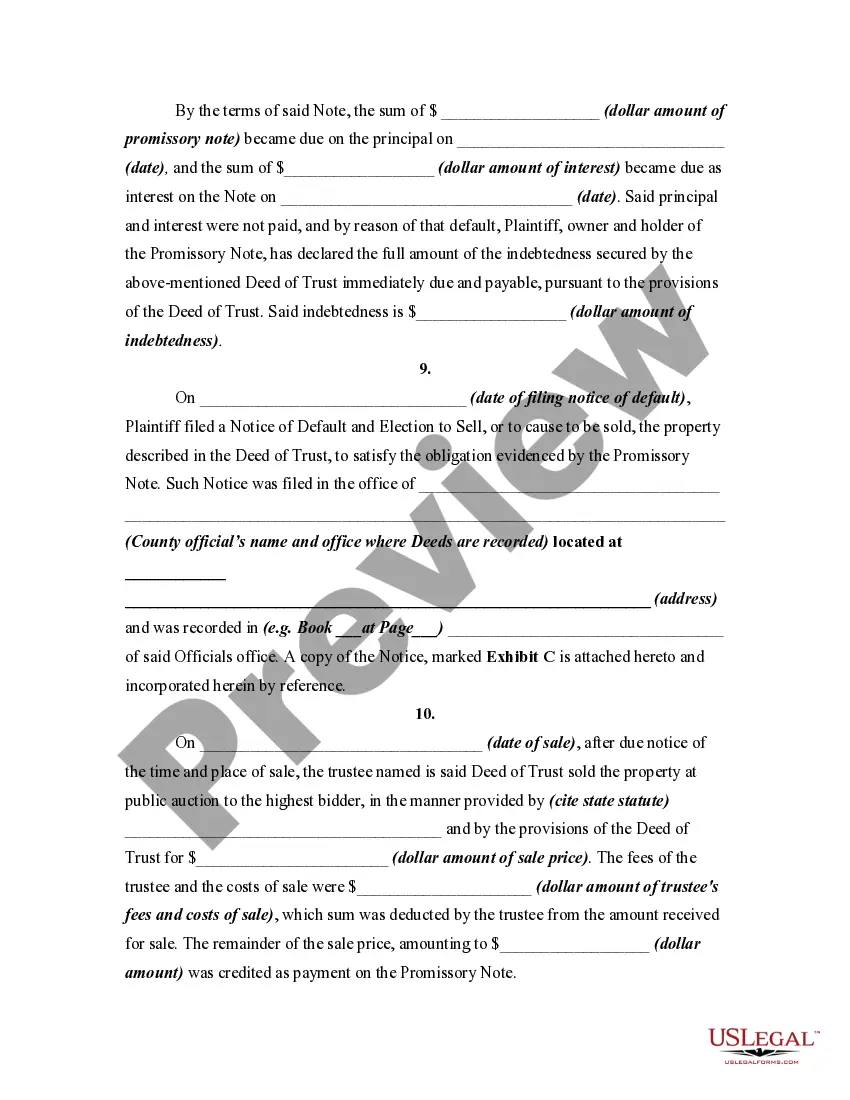

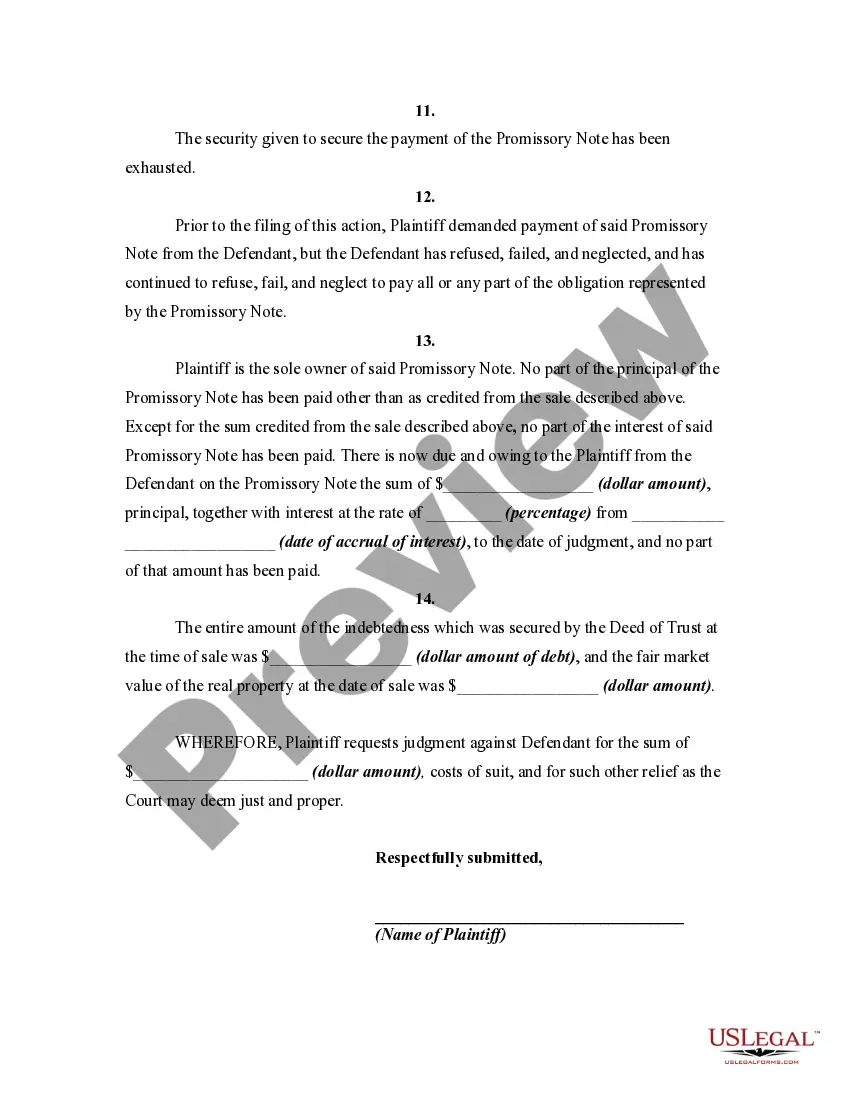

A deficiency judgment is typically in an amount equal to the difference between the funds received from a court sale of property and the balance remaining on a debt. Deficiency judgments are commonly issued when a property owner fails to pay amounts owed on a mortgage and the property securing the mortgage is sold to satisfy the debt, but the proceeds from the sale are less than the amount owed.

Deficiency judgments are not allowed in all states. In order to get a deficiency judgment in most states, the party owed money must file a suit for judicial foreclosure instead of just foreclosing on real property. However, some states allow a lawsuit for a deficiency after foreclosure on the mortgage or deed of trust. Local laws should be consulted for specific requirements in your area.