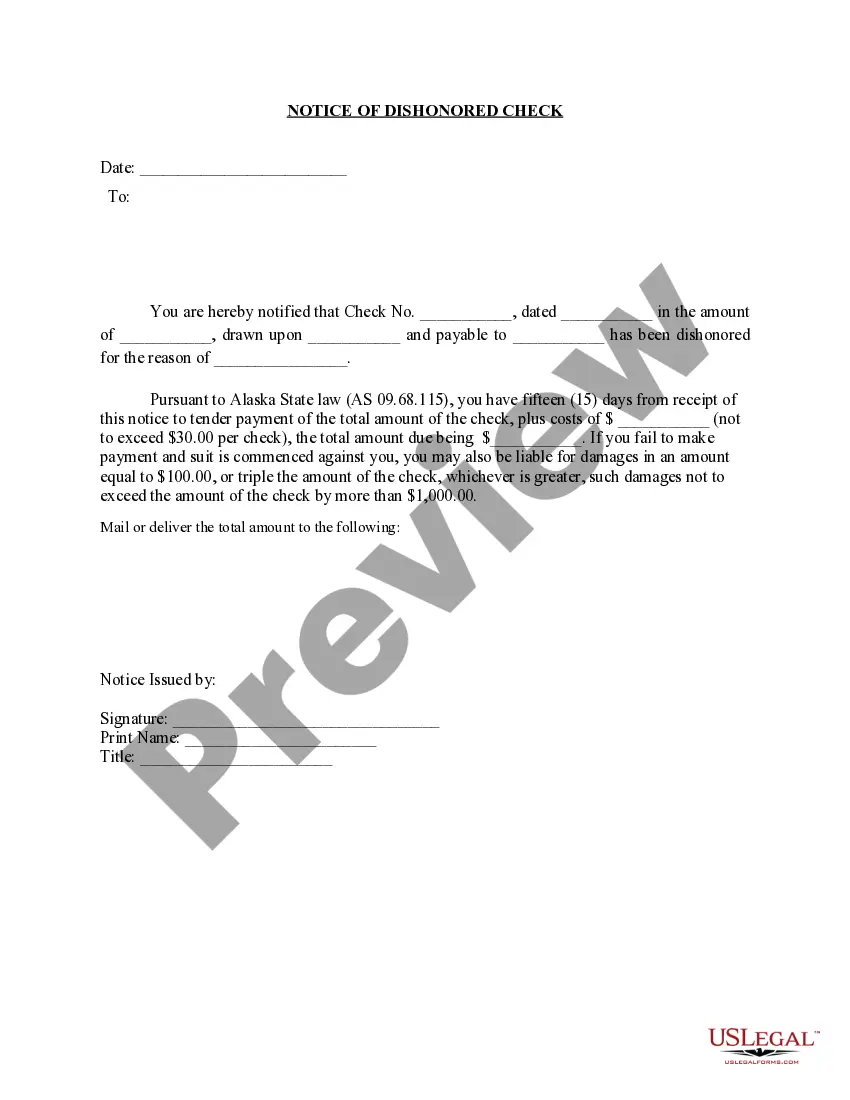

Sample Letter for Insufficient Funds

Description Letter Funds

How to fill out Insufficient Sample?

Use US Legal Forms to get a printable Sample Letter for Insufficient Funds. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms catalogue online and provides cost-effective and accurate samples for consumers and lawyers, and SMBs. The templates are grouped into state-based categories and many of them can be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

For people who don’t have a subscription, follow the tips below to easily find and download Sample Letter for Insufficient Funds:

- Check to ensure that you have the proper form with regards to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Hit Buy Now if it’s the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Use the Search field if you need to find another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Sample Letter for Insufficient Funds. More than three million users have utilized our platform successfully. Select your subscription plan and get high-quality documents in a few clicks.

Insufficient Funds Letter Form popularity

Letter Funds Template Other Form Names

Insufficient Funds Template FAQ

Contact the Bank First. Call Your Customer. Send a Certified Letter. Call Your Local District Attorney's Office. Use a Check Recovery Service. Contact a Collection Agency.

Lack Of Funds Once you have opted in, your bank can choose to approve ATM withdrawals even if you have exhausted your line of credit or withdrawn all of the cash from your savings. When this happens, an ATM withdrawal could cause your account to go into the negative and your bank can assess an overdraft fee.

Contact person affected by NSF. First things first, make sure you contact the affected person as soon as possible if you have insufficient funds. Pay the outstanding balance. Pay the affected individual the amount that you owe them. Pay NSF fees. Keep receipts.

When there are not enough funds in your checking account to cover the payment written against it, then the check will bounce.

Dear name, I am writing in to apologize for the inconvenience caused to you because the check check no. was returned due to insufficient funds. I cannot tell you how embarrassed I am feeling because of this.

Many banks allow credit and debit card transactions to go through, even if the card user is over their credit limit or has insufficient funds in their checking account. The transaction would process, and the card user would get hit with an over-limit fee and possible additional penalty fees each day.

Visit the branch: You can also go to a branch of the bank the check draws on and try to cash it. The money you need (if it exists) will be at the check writer's bank, not yours. When you visit the bank in person, you may also be able to avoid a returned-check fee for depositing bad checks.

Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

Writing bad checks is a crime. Penalties for people who tender checks knowing there are insufficient funds in their accounts vary by state. Some states require an intent to fraud. But in the majority of states, the crime is considered a misdemeanor.