A Trust is an entity which owns assets for the benefit of a third person (beneficiary). Trusts can be revocable or irrevocable. An irrevocable trust is an arrangement in which the grantor departs with ownership and control of property. Usually this involves a gift of the property to the trust. The trust then stands as a separate taxable entity and pays tax on its accumulated income. Trusts typically receive a deduction for income that is distributed on a current basis. Because the grantor must permanently depart with the ownership and control of the property being transferred to an irrevocable trust, such a device has limited appeal to most taxpayers.

Irrevocable Trust Agreement for Benefit of Trustor's Children and Grandchildren

Description

Key Concepts & Definitions

Irrevocable Trust Agreement for Benefit of Trustor: An irrevocable trust is a type of trust where its terms cannot be modified, amended, or terminated without the permission of the grantor's named beneficiary or beneficiaries. In the context of 'for benefit of trustor', it implies that the trust is set up in such a manner that the trustor, though relinquishing control of the assets, still indirectly benefits from the trust during their lifetime.

Step-by-Step Guide to Setting Up an Irrevocable Trust

- Decide the Purpose: Determine the specific reasons for setting up the trust, such as asset protection, tax planning, or estate planning.

- Select Assets: Identify which assets to transfer into the trust. These can include real estate, investments, cash, or other valuables.

- Choose a Trustee: Select a reliable and trustworthy trustee to manage the trust. This can be an individual or an institution.

- Draft the Agreement: Work with an attorney to create the trust agreement that details all the terms, conditions, and beneficiary rights.

- Execute the Trust: Sign the trust document and transfer assets to formally establish the irrevocable trust.

- File Necessary Paperwork: Complete any necessary registration or filing with appropriate agencies, depending on the state laws.

Risk Analysis of Irrevocable Trusts

- Lack of Flexibility: Once established, it's challenging to alter the terms of the trust, which can be problematic if the trustor's financial situation or objectives change.

- Dependence on Trustee: The trust's success heavily depends on the trustee's integrity and management skills.

- Tax Implications: There can be unforeseen tax consequences that should be analyzed with the help of a tax professional.

Comparison Table of Trust Agreement Types

| Type of Trust | Flexibility | Control by Trustor | Tax Benefits |

|---|---|---|---|

| Irrevocable Trust | Low | None | High |

| Revocable Trust | High | Full | Medium |

| Charitable Trust | Medium | Limited | High |

FAQ

- Who can set up an irrevocable trust? Any individual can create an irrevocable trust, provided they have legal capacity to contract.

- Can changes be made to an irrevocable trust? Typically, no. Changes are very restricted once an irrevocable trust is created.

- Are irrevocable trusts taxable? Irrevocable trusts may be subject to different tax rules, but generally, the trust itself pays taxes on income, or the beneficiaries pay taxes on the income received.

Key Takeaways

- Irrevocable trusts offer significant benefits like asset protection and tax advantages but require careful planning and consideration due to their inflexibility and the permanent transfer of control over assets.

- Choosing the right trustee and drafting a clear trust agreement are critical steps in the trust setup process.

- Always consult with legal and tax professionals when setting up an irrevocable trust to ensure compliance and maximization of benefits.

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

Aren't you sick and tired of choosing from countless samples each time you require to create a Irrevocable Trust Agreement for Benefit of Trustor's Children and Grandchildren? US Legal Forms eliminates the lost time countless Americans spend searching the internet for appropriate tax and legal forms. Our expert crew of lawyers is constantly updating the state-specific Templates collection, so it always provides the proper files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have a subscription should complete simple actions before having the capability to download their Irrevocable Trust Agreement for Benefit of Trustor's Children and Grandchildren:

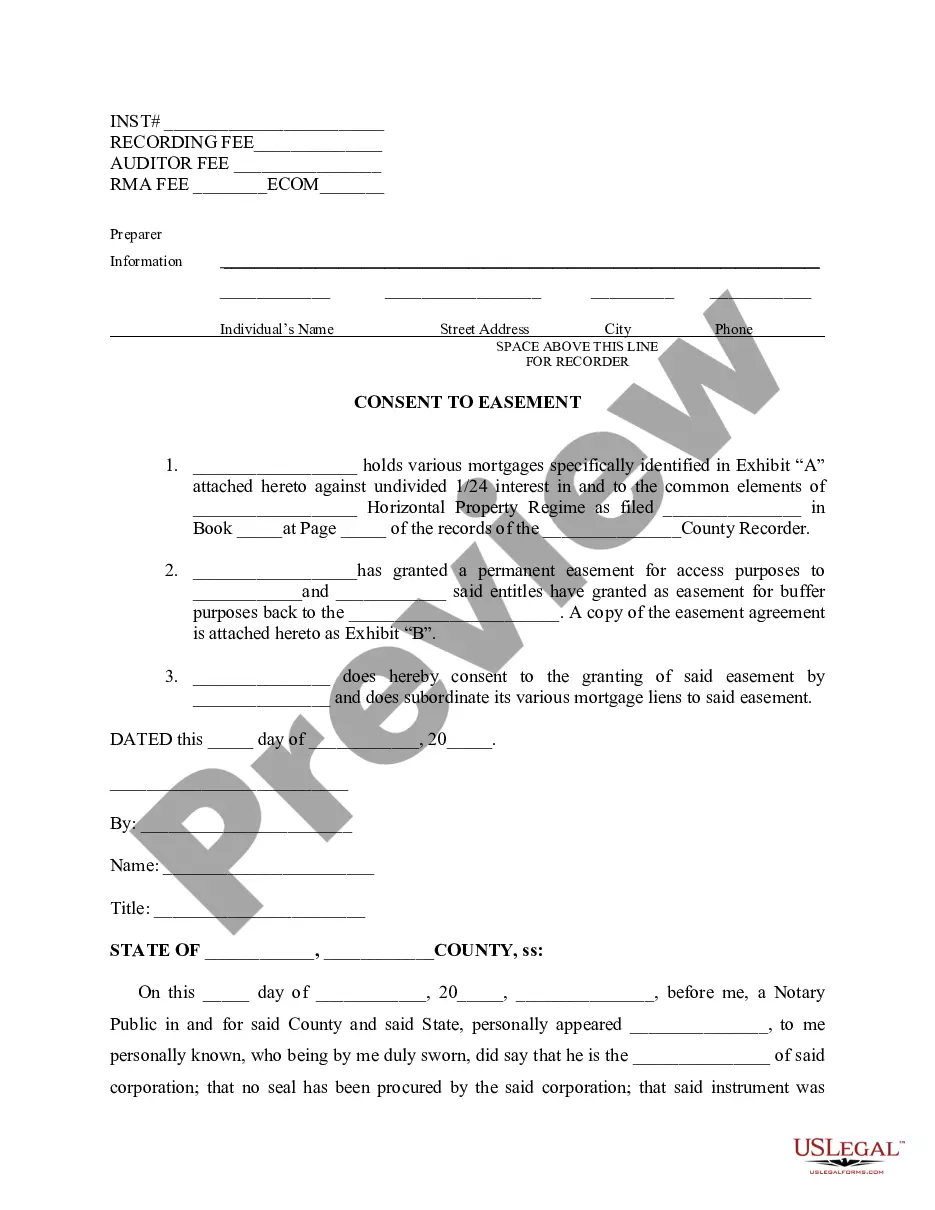

- Utilize the Preview function and read the form description (if available) to ensure that it’s the correct document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the right example for the state and situation.

- Make use of the Search field at the top of the site if you have to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your template in a convenient format to complete, print, and sign the document.

As soon as you have followed the step-by-step recommendations above, you'll always have the ability to log in and download whatever file you need for whatever state you need it in. With US Legal Forms, finishing Irrevocable Trust Agreement for Benefit of Trustor's Children and Grandchildren samples or other legal documents is not hard. Get started now, and don't forget to double-check your samples with accredited attorneys!

Form popularity

FAQ

A grandparent can open a savings account for their grandchild in the child's name as long as they have documentation, such as the child's birth certificate. There are lots of accounts specifically for children but the most important point is the rate paid, rather than any gimmicks.

A trust is a legal entity that you transfer ownership of your assets to, perhaps in order to decrease the value of your estate or to simplify passing on assets to your intended beneficiaries after you die. An estate planning attorney may charge at least $1,000 to create a trust for you.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

Set guidelines on how you'd like the money to be used. Release funds at key milestoneslike graduating college, getting married, or turning 35over your grandchild's lifetime, rather than all at once. Help protect the inheritance from potential depletion due to lack of financial literacy or other financial challenges.

Determine the purpose of the trust and who the beneficiaries will be. Determine how the trust will be funded. Determine who will manage the trust. Sign a trust deed. Transfer assets into the trust.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary.The grantor can receive income from the trust to the maximum amount allowed by Medicaid.

Discretionary trust the trustees have absolute power to decide how the assets in the trust are distributed. You could set up this kind of trust for your grandchildren and leave it to the trustees (who could be the grandchildren's parents) to decide how to divide the income and capital between the grandchildren.

Set guidelines on how you'd like the money to be used. Release funds at key milestoneslike graduating college, getting married, or turning 35over your grandchild's lifetime, rather than all at once. Help protect the inheritance from potential depletion due to lack of financial literacy or other financial challenges.