A discretionary trust is a trust where the beneficiaries and/or their entitlements to the trust fund are not fixed, but are determined by the criteria set out in the trust instrument by trustor. Discretionary trusts can be discretionary in two respects. First, the trustees usually have the power to determine which beneficiaries (from within the class) will receive payments from the trust. Second, trustees can select the amount of trust property that the beneficiary receives. Although most discretionary trusts allow both types of discretion, either can be allowed on its own. It is permissible in most legal systems for a trust to have a fixed number of beneficiaries and for the trustees to have discretion as to how much each beneficiary receives.

Discretionary Distribution Trust for the Benefit of Trustor's Children with Discretionary Powers over Accumulation and Distribution of Principal and Income Separate Trust for each Beneficiary

Description Discretionary Trust

How to fill out Principal Discretion?

Aren't you sick and tired of choosing from hundreds of templates each time you require to create a Discretionary Distribution Trust for the Benefit of Trustor's Children with Discretionary Powers over Accumulation and Distribution of Principal and Income Separate Trust for each Beneficiary? US Legal Forms eliminates the lost time numerous American citizens spend surfing around the internet for appropriate tax and legal forms. Our expert group of attorneys is constantly upgrading the state-specific Samples collection, to ensure that it always offers the right documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription need to complete simple steps before being able to get access to their Discretionary Distribution Trust for the Benefit of Trustor's Children with Discretionary Powers over Accumulation and Distribution of Principal and Income Separate Trust for each Beneficiary:

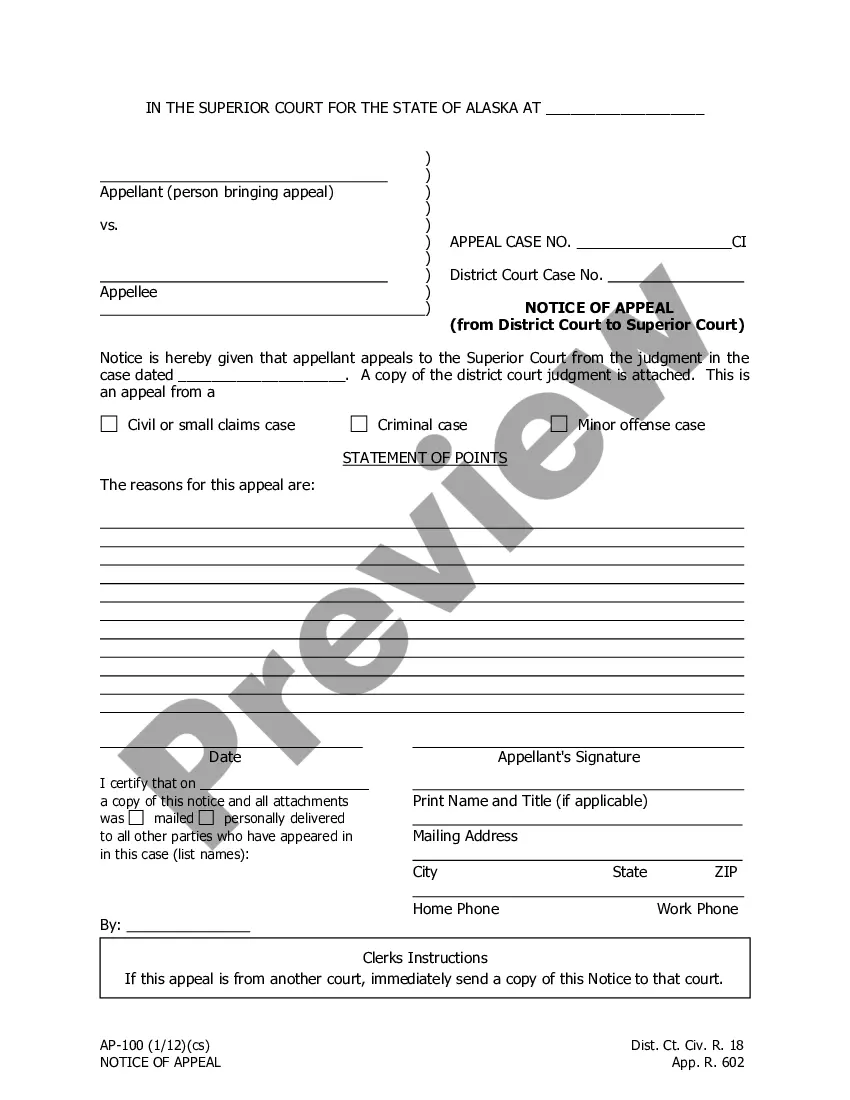

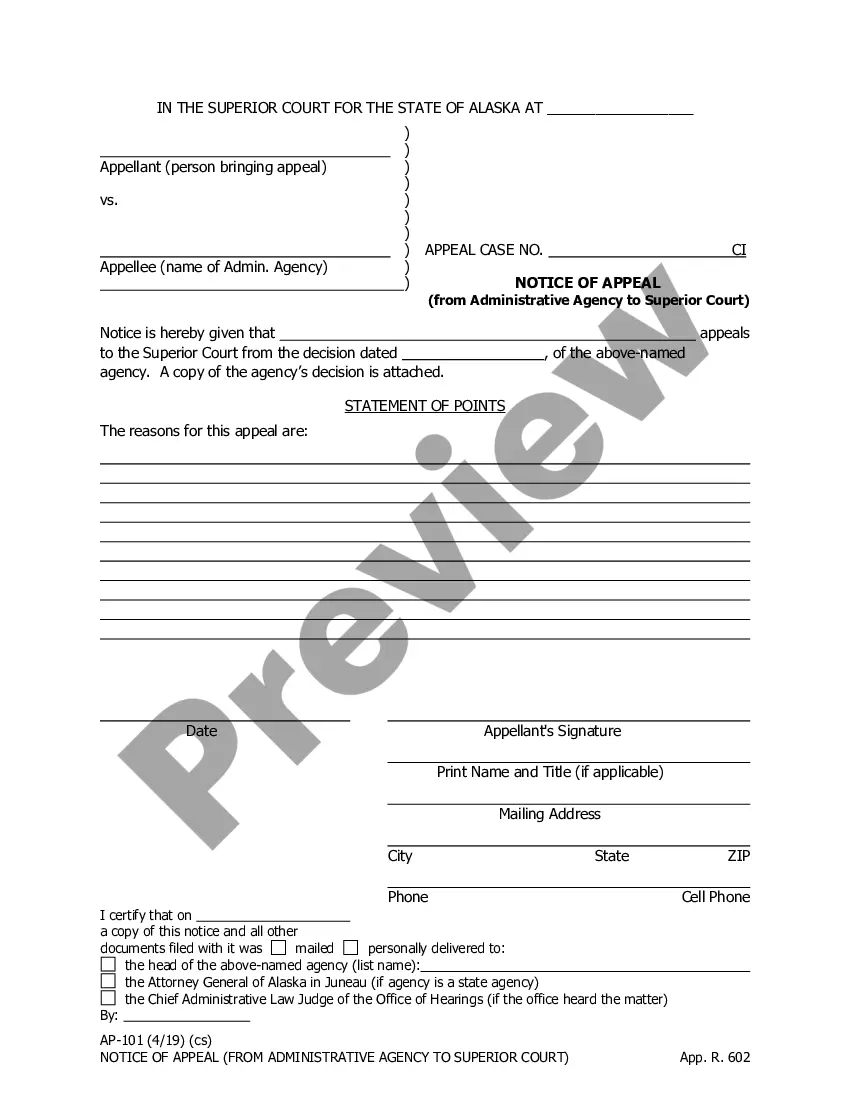

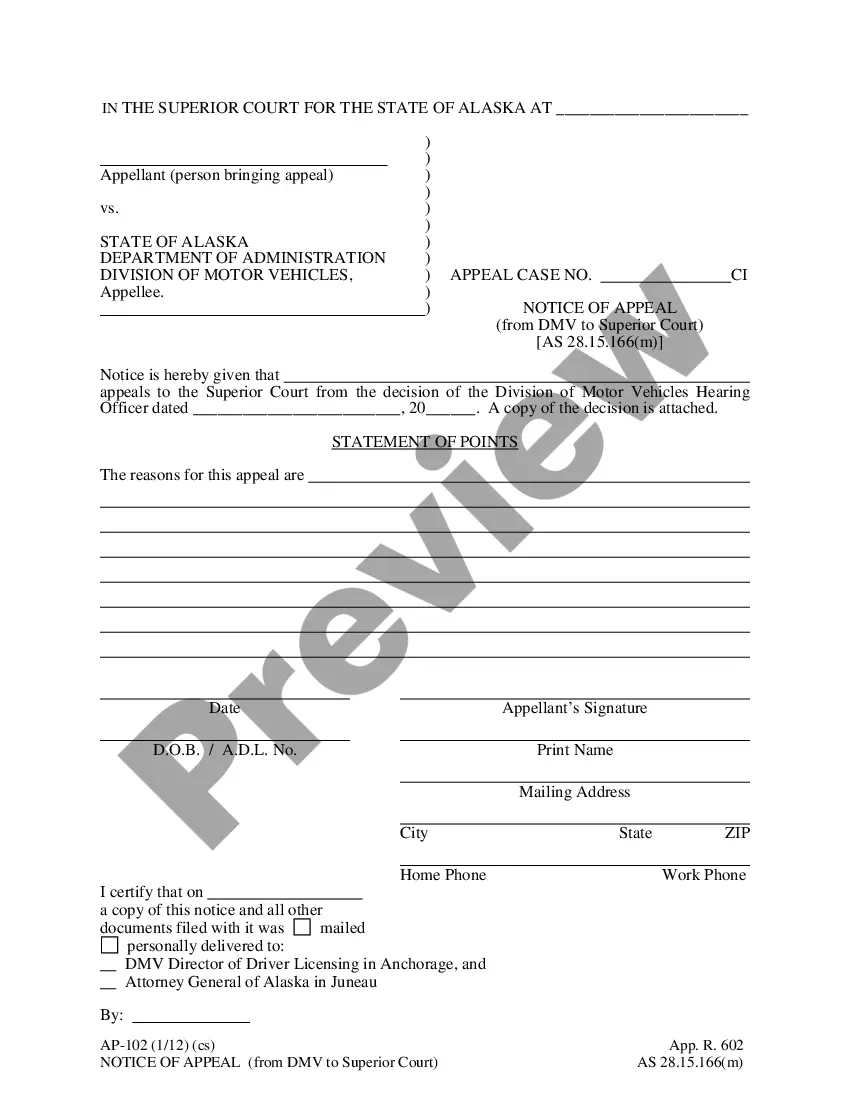

- Utilize the Preview function and look at the form description (if available) to make certain that it is the appropriate document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper template for the state and situation.

- Use the Search field on top of the web page if you need to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your template in a required format to complete, print, and sign the document.

When you’ve followed the step-by-step instructions above, you'll always have the capacity to sign in and download whatever file you want for whatever state you want it in. With US Legal Forms, finishing Discretionary Distribution Trust for the Benefit of Trustor's Children with Discretionary Powers over Accumulation and Distribution of Principal and Income Separate Trust for each Beneficiary templates or other official documents is simple. Begin now, and don't forget to double-check your examples with certified attorneys!

Discretionary Trustors Principal Form popularity

Distribution Trust Children Other Form Names

Distribution Trust Paper FAQ

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Select a custodian and a trustee. Decide when and how you want the child to receive the funds from the trust. Start drafting your trust documents. Consult with a trust fund attorney.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

What rights do the beneficiaries have? The beneficiaries under a discretionary trust have no 'proprietary interest' in the trust fund unless the trustees decide on a distribution. This means they do not own the beneficial interest under the trust merely a hope that they will benefit. They may never do so.

Discretionary beneficiaries are individuals or entities that a grantor names in a trust, life insurance policy, or retirement plan who will only receive their distributions at a time that has been deemed as appropriate, such as if they pass certain milestones in age or education.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

Distribution of trust funds after death The Trustee simply transfers all assets to the beneficiary. Distribution is also fairly easy if the trust document identifies all assets and specific amounts to be paid to each beneficiary.