Complaint for Accounting, Conversion, Damages Declaratory Judgment and for Specific

Description Damages Were Claim

How to fill out Damages Contract All?

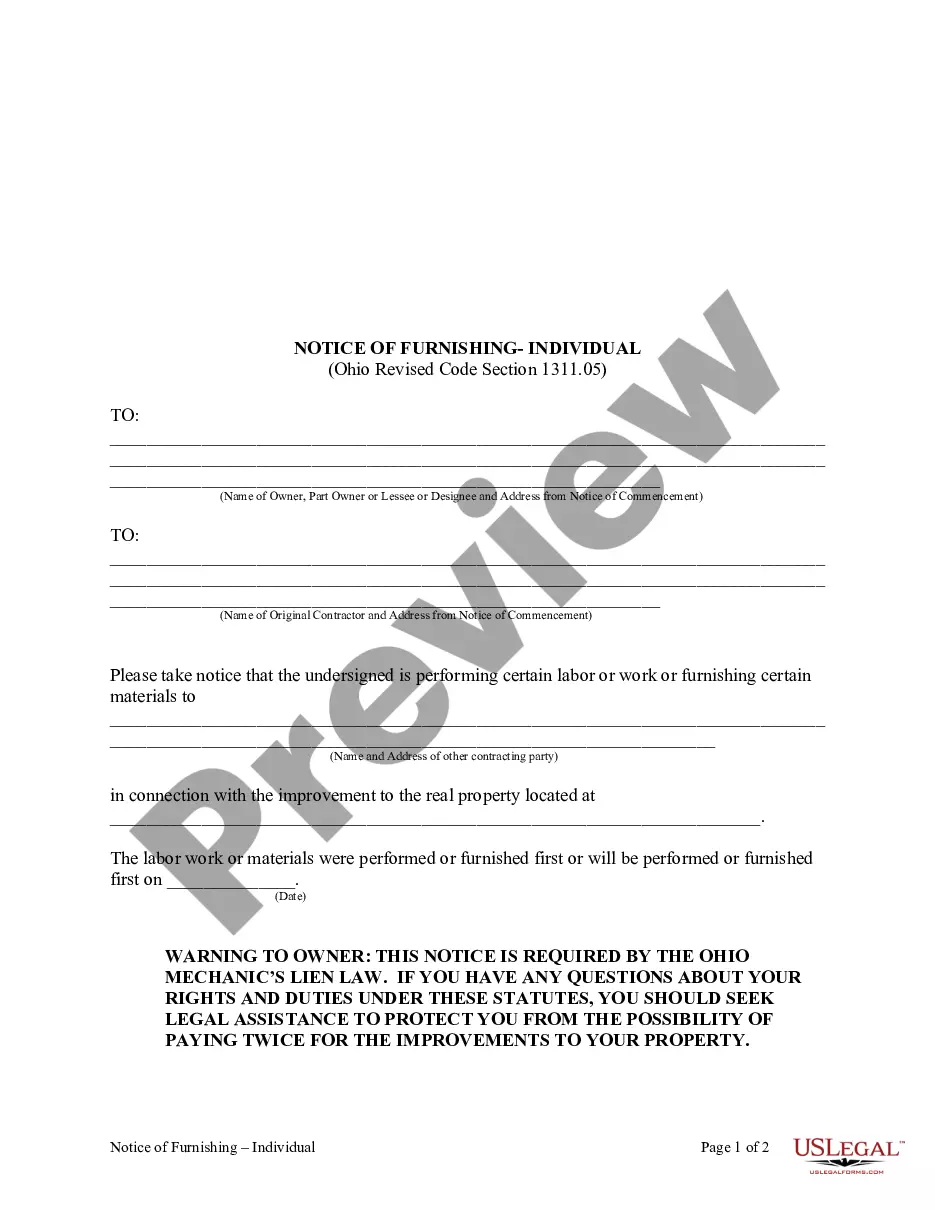

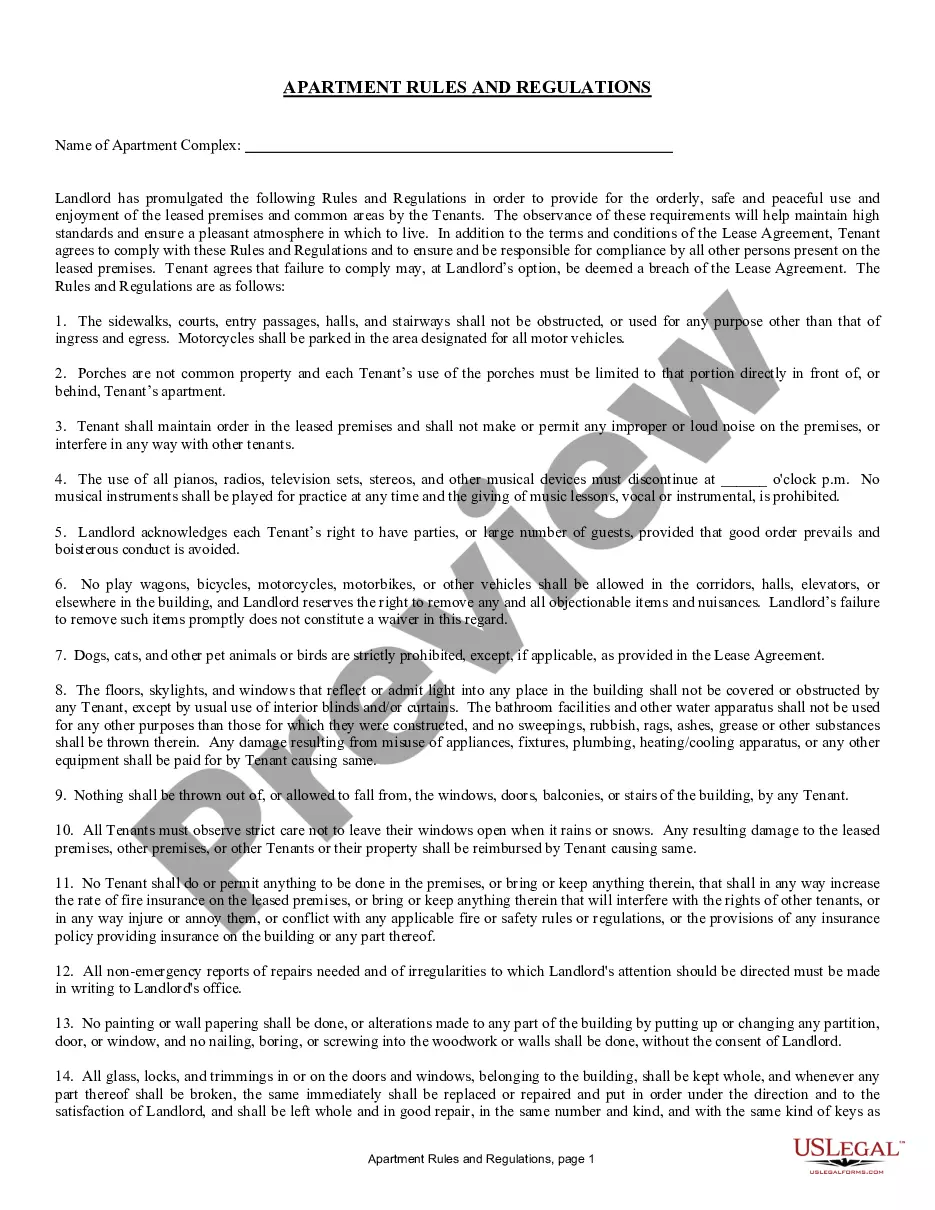

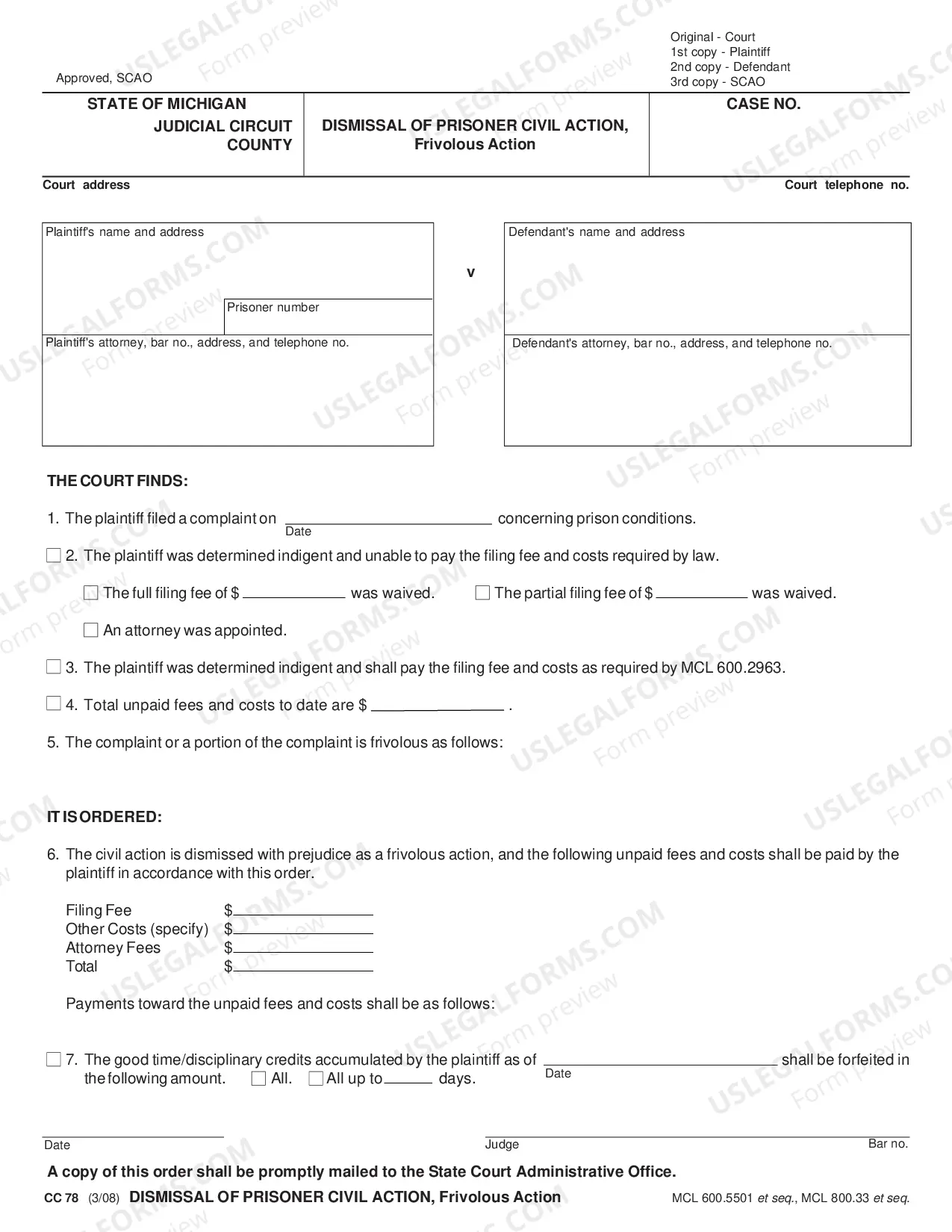

Aren't you sick and tired of choosing from countless samples each time you require to create a Complaint for Accounting, Conversion, Damages Declaratory Judgment and for Specific? US Legal Forms eliminates the lost time millions of Americans spend surfing around the internet for appropriate tax and legal forms. Our skilled group of attorneys is constantly upgrading the state-specific Forms collection, to ensure that it always provides the right documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have an active subscription need to complete easy steps before having the capability to download their Complaint for Accounting, Conversion, Damages Declaratory Judgment and for Specific:

- Make use of the Preview function and look at the form description (if available) to make sure that it’s the best document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct sample for the state and situation.

- Utilize the Search field at the top of the page if you want to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your template in a convenient format to finish, create a hard copy, and sign the document.

After you have followed the step-by-step recommendations above, you'll always be able to sign in and download whatever file you will need for whatever state you require it in. With US Legal Forms, finishing Complaint for Accounting, Conversion, Damages Declaratory Judgment and for Specific samples or other official paperwork is not hard. Get going now, and don't forget to double-check your examples with accredited attorneys!

Declaratory Judgment Form Sample Form popularity

Complaint Declaratory Judgment Form Sample Other Form Names

Damages Property Claim FAQ

If you are unsure if the FRC will be able to deal with your complaint, you can email us at complaints@frc.org.uk We usually ask complainants to submit an online complaints form so we may ask you to fill this out or to provide further specific information to help us decide if we can look into your complaint further.

Under Florida law, an accounting is a cause of action in which a party requests an equitable settlement of claims and liabilities arising out of its relationship with another party.The most common equitable accounting action stems from lawsuits concerning partnership disputes.

If you need to report the unethical or illegal behavior of your accounting colleague or employer, seek legal counsel either in-house or from an independent firm or access your company's whistleblowing resources.

The Financial Reporting Council (FRC) promotes transparency and integrity in business. It regulates auditors, accountants and actuaries, and sets the UK's Corporate Governance and Stewardship Codes.

If you want to make a complaint about your accountant/auditor or a firm of accountants/auditors, you should initially contact the Prescribed Accountancy Body ('PAB') of which the accountant/auditor/firm is a member. Please click here for contact details for the PABs.

If your accountant is insured You can sue your accountant irrespective of whether they have professional indemnity insurance, but if they are not covered, the likelihood of receiving compensation is much lower.

If you are unsure if the FRC will be able to deal with your complaint, you can email us at complaints@frc.org.uk We usually ask complainants to submit an online complaints form so we may ask you to fill this out or to provide further specific information to help us decide if we can look into your complaint further.

An action for an accounting is an equitable cause of action. As discussed below, for statute of limitations purposes, the cause of action for an accounting must sometimes be distinguished from the remedy of an accounting.

An account of profits (sometimes referred to as an accounting for profits or simply an accounting) is a type of equitable remedy most commonly used in cases of breach of fiduciary duty.