Sample Letter for Construction Lien Notice

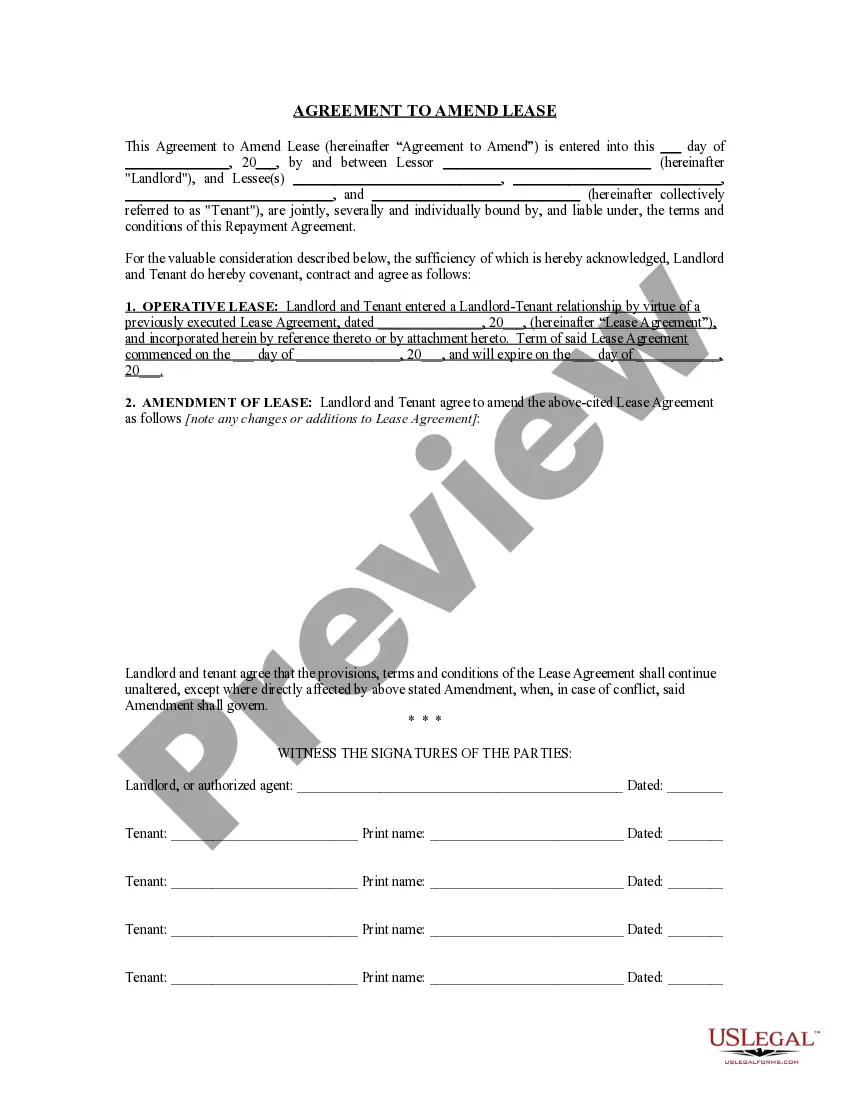

Description Sample Lien Form

How to fill out Lien Sample Form?

Use US Legal Forms to obtain a printable Sample Letter for Construction Lien Notice. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms catalogue on the internet and offers reasonably priced and accurate templates for consumers and lawyers, and SMBs. The documents are categorized into state-based categories and a number of them might be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For those who do not have a subscription, follow the tips below to quickly find and download Sample Letter for Construction Lien Notice:

- Check to make sure you have the right form with regards to the state it’s needed in.

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it’s the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search field if you need to get another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Sample Letter for Construction Lien Notice. Over three million users have already utilized our platform successfully. Choose your subscription plan and have high-quality forms within a few clicks.

Construction Lien Notice Form popularity

Sample Letter Form Other Form Names

Construction Notice Form Sample FAQ

Someone who is owed money is generally not able to just put a lien on property without first securing a judgment. Securing a judgment requires the creditor to sue the debtor. This may be through circuit court in many jurisdictions. If under a certain dollar amount, this suit may be through the small claims court.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

A property lien is a legal claim to specific assets that have been granted by the courts. A creditor must file and receive approval for a property lien through a county records office or state agency. Each jurisdiction has its own rules and regulations governing property liens.

The Indian Contract Act, 1872 classifies the Right of Lien into two types: Particular Lien and General Lien.

Unpaid taxes: If you fail to pay your income or property taxes, the IRS or county may issue a tax lien against the house. Owed child support: Unpaid child or spousal support, if ruled necessary by a court, can result in a property lien.

The short answer to that question is usually no. If somebody owes you money you could sue them, you could obtain a judgment, you can obtain what's called a "judgment lien" and once you get the judgment lien, you can have the court record that against their property including the real estate.

A judicial lien is created when a court grants a creditor an interest in the debtor's property, after a court judgment.The lien is the first step by the judgment creditor in a process that will culminate in a sale of the attached property, to satisfy the judgment debt.

Voluntary and Involuntary Liens. Creditors, such as a mortgage or car lender, can ask borrowers to put up the purchased property as collateral as part of the condition of the loan. Creditors With Involuntary Liens. Judgment Liens. Other Types of Involuntary Liens.