Sample Letter for Compromise on a Debt

Description Compromise Agreement

How to fill out Sample Debt Form Template?

Among numerous free and paid samples which you get on the web, you can't be certain about their reliability. For example, who created them or if they’re competent enough to deal with what you require those to. Always keep calm and use US Legal Forms! Discover Sample Letter for Compromise on a Debt samples created by skilled legal representatives and prevent the costly and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to write a document for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you are seeking. You'll also be able to access all your previously acquired templates in the My Forms menu.

If you are utilizing our website the very first time, follow the guidelines listed below to get your Sample Letter for Compromise on a Debt with ease:

- Make sure that the document you find is valid in your state.

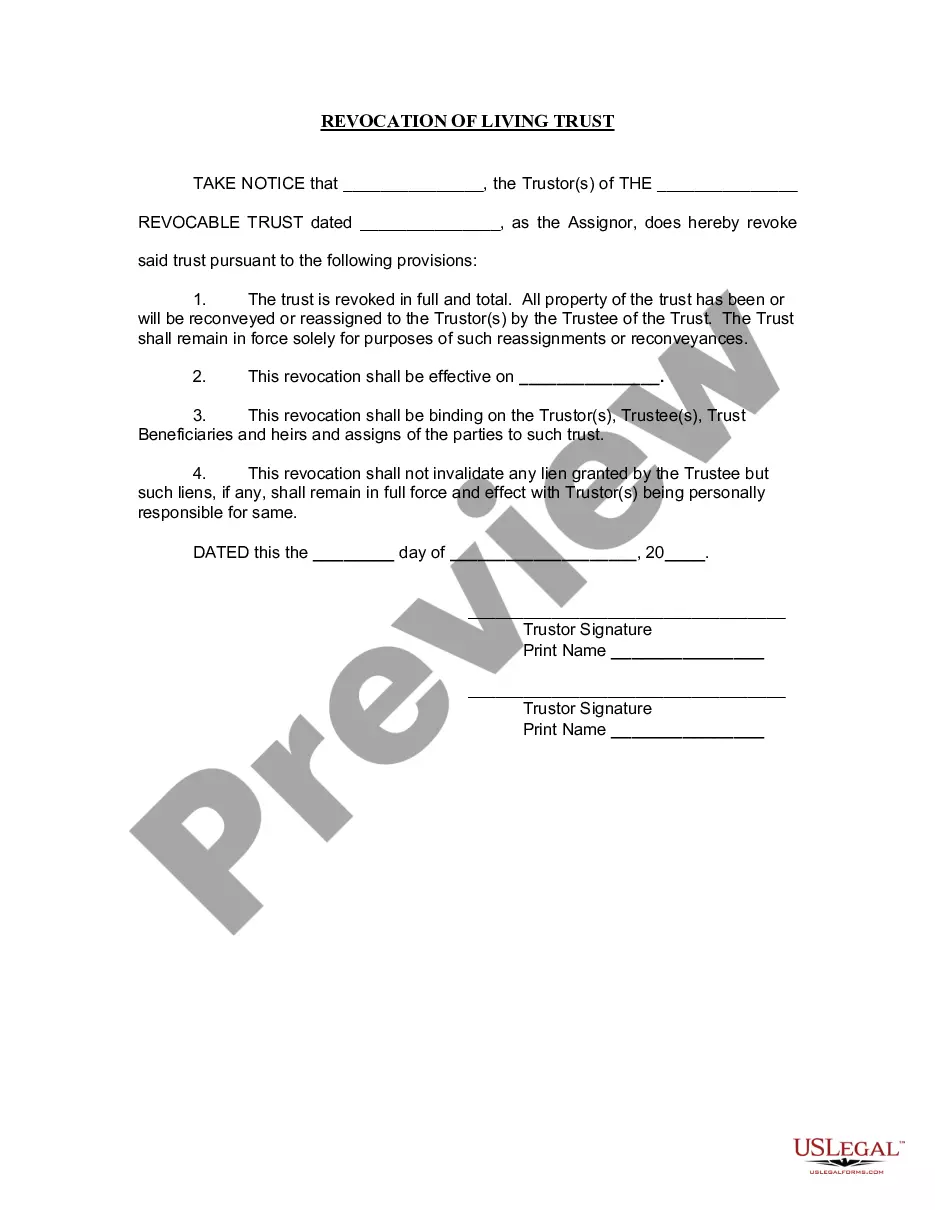

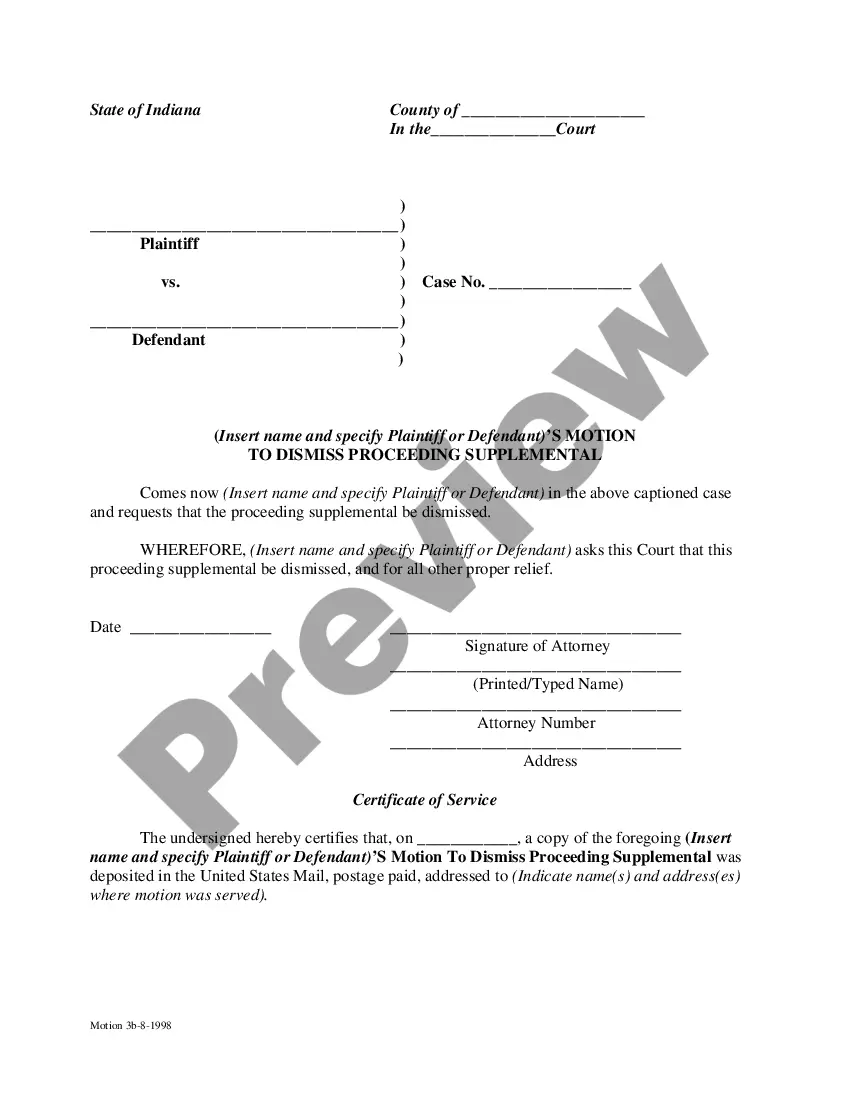

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or find another sample utilizing the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

As soon as you have signed up and purchased your subscription, you can use your Sample Letter for Compromise on a Debt as many times as you need or for as long as it stays valid where you live. Edit it in your preferred editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Sample Compromise Template Form popularity

Sample Compromise Other Form Names

Letter Compromise Form FAQ

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

Hardship Examples. There are a variety of situations that may qualify as a hardship. Keep it original. Be honest. Keep it concise. Don't cast blame or shirk responsibility. Don't use jargon or fancy words. Keep your objectives in mind. Provide the creditor an action plan.

I respectfully request that you forgive my alleged debt, as my condition precludes any employment, and my current and future income does not support any debt repayment. Please respond to my request in writing to the address below at your earliest convenience. Thank-you in advance for your understanding of my situation.

A study by the Center for Responsible Lending showed that on average debts are settled at 48% of the outstanding balance. But that balance increases 20 percent due to late fees and other charges the creditor might impose during negotiation.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

Verify that it's your debt. Understand your rights. Consider the kind of debt you owe. Consider hardship programs. Offer a lump sum. Mention bankruptcy. Speak calmly and logically. Be mindful of the statute of limitations.

Aim to Pay 50% or Less of Your Unsecured Debt If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offerabout 15%and negotiate from there.

When writing a debt settlement letter, it's important to be explicit and detailed. Treat the letter as a contract between you and your creditor. Include your personal information and account number for easy identification. You'll need to outline the amount you can pay and what you expect in return.