Sample Letter concerning State Tax Commission Notice

Description Letter Commission Template

How to fill out Sample Letter Concerning State Tax Commission Notice?

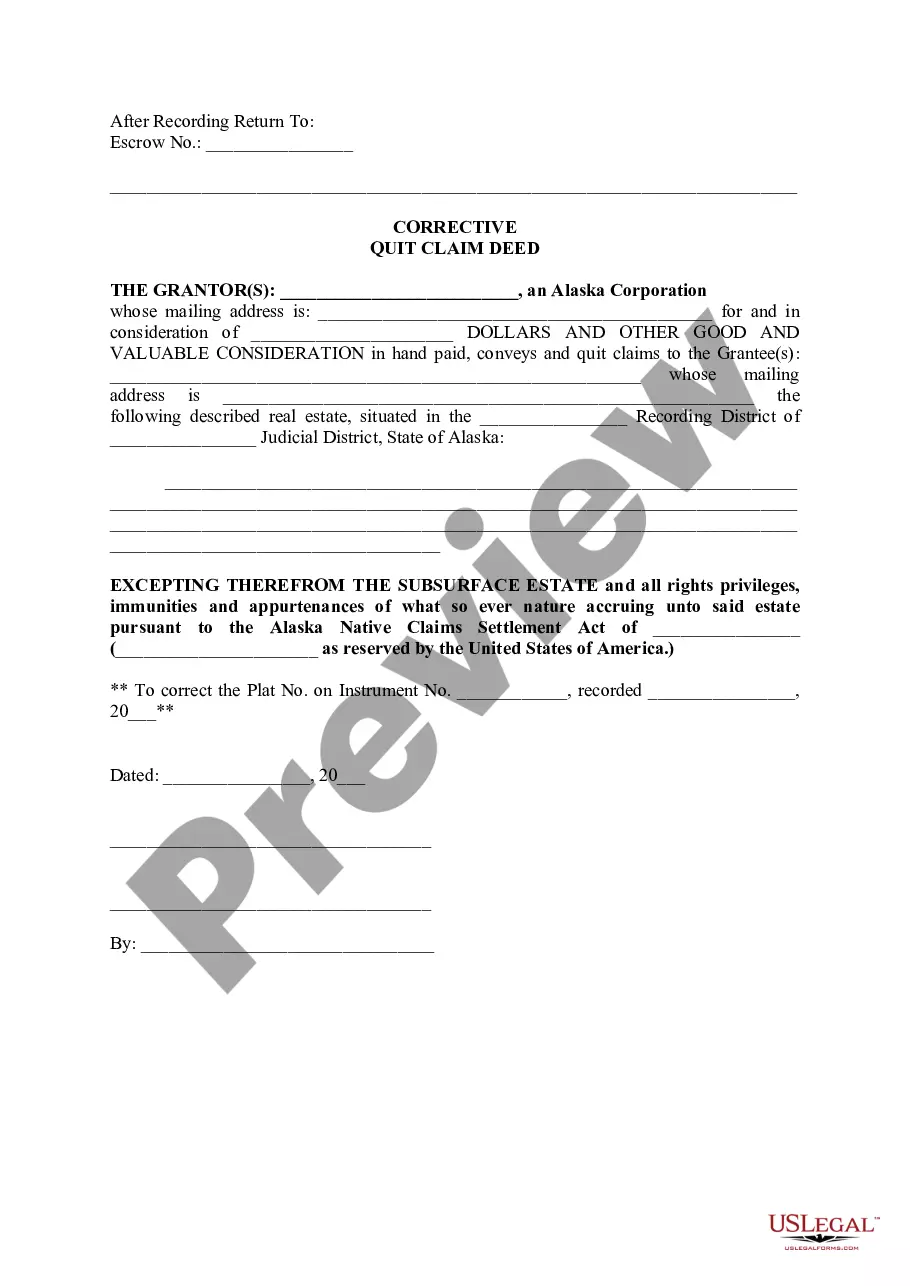

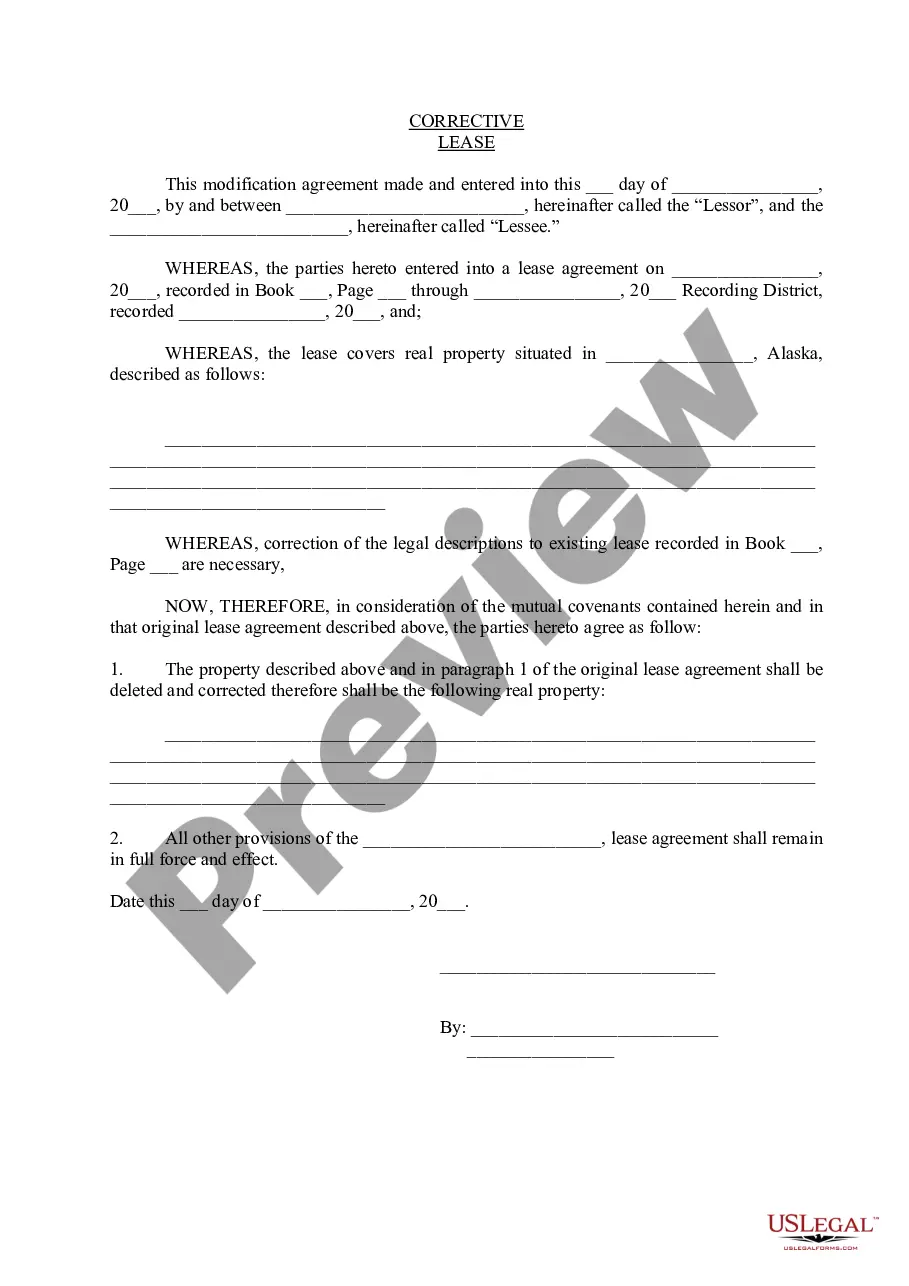

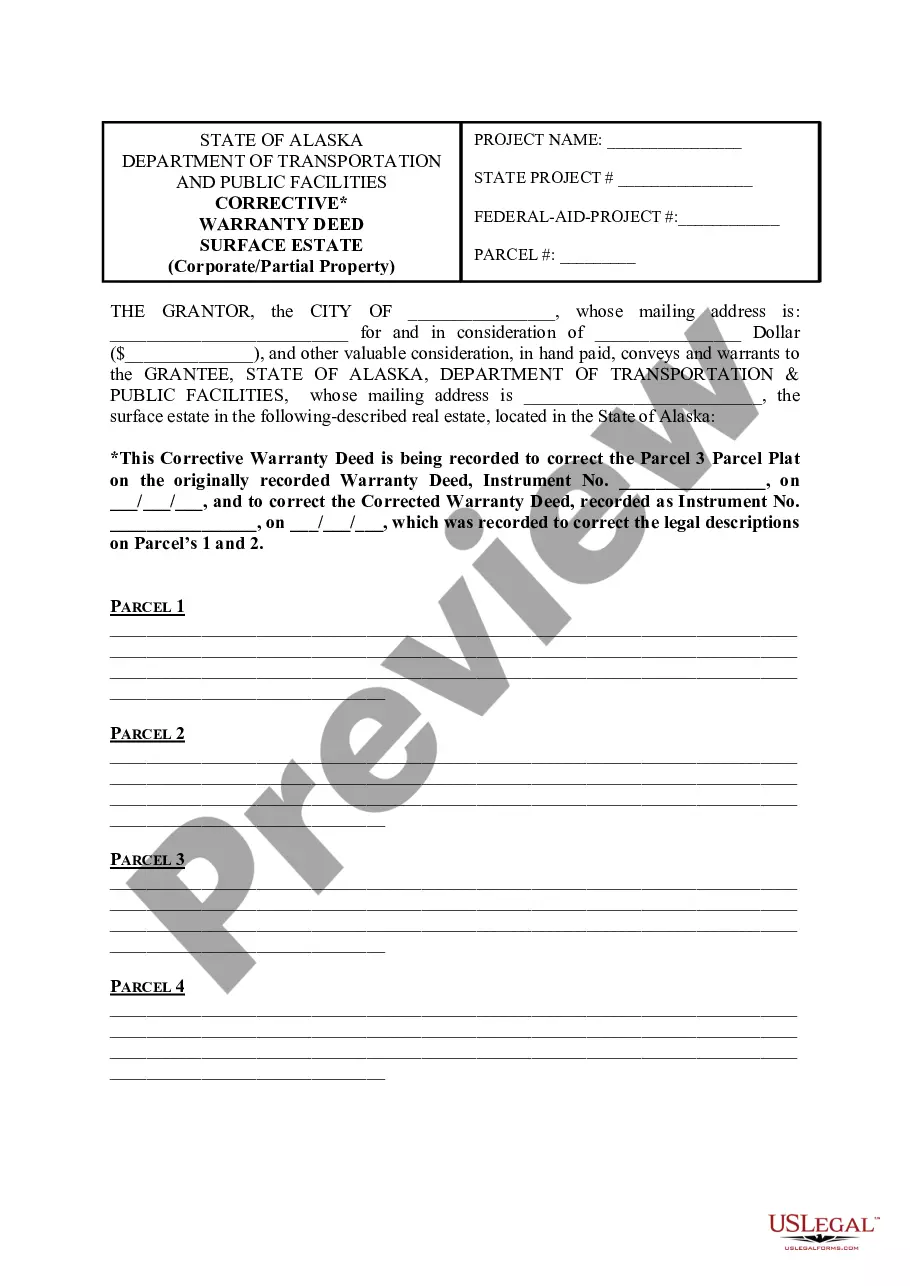

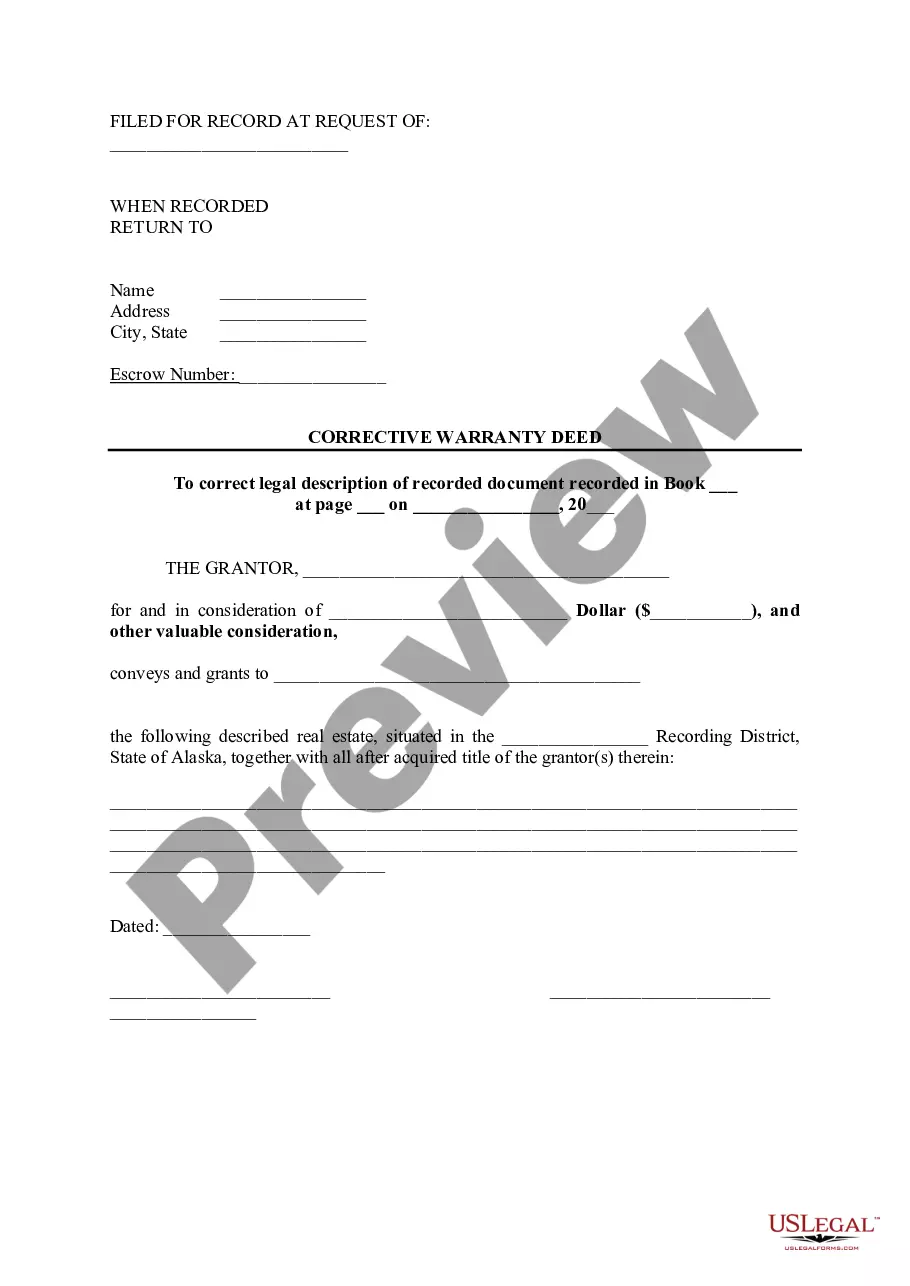

Use US Legal Forms to get a printable Sample Letter concerning State Tax Commission Notice. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms library online and offers cost-effective and accurate templates for customers and lawyers, and SMBs. The templates are categorized into state-based categories and some of them might be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download Sample Letter concerning State Tax Commission Notice:

- Check to ensure that you get the proper form in relation to the state it’s needed in.

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it’s the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to get another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Sample Letter concerning State Tax Commission Notice. Over three million users already have used our platform successfully. Select your subscription plan and get high-quality forms within a few clicks.

Sample Letter Tax Form popularity

Sample Concerning Tax Other Form Names

FAQ

Format Your Letter Create a subject line with Re: followed by your IRS notice number. You will see your IRS notice number in the upper right corner of the letter. Often, the notice number begins with CP or LP. On the second line below the subject line, write your Social Security number and name.

I am attaching my Form 16 B for your reference and I request you to kindly refund the extra amount of Rs 21,000/- paid by me. Kindly let me know in case I need to provide any other documents. The cheque for the amount of Rs 21,000/- may kindly be send on my residential address as mentioned in the form.

The IRS advises against it on its website, but you can still mail your paper tax forms and payments to them if you have no other option. And you can send traditional correspondence via snail maila stamped and mailed letterif you don't mind waiting a while for a response.

You should write a letter to explain why you disagree. Include any information and documents you want the IRS to consider. Mail your reply with the bottom tear-off portion of the notice. Send it to the address shown in the upper left-hand corner of the notice. Allow at least 30 days for a response.

This letter is to inform you, the taxpayer, of the services we will provide you, and the responsibilities you have for preparation of your tax return.Fees must be paid before your tax return is delivered to you or filed for you.

Format for Response Letter to income tax department for demand notice. Dear Sir, I request you to please refer to your notice under section ABC in context with assessment year 2016-17 in which it has been stated that a sum of INR 8450 is due on me as Income Tax.

The IRS says, Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors. Handwritten forms often result in name/TIN mismatches.Efiling is the most accurate and efficient way of filing 1099s, W2s, and other tax forms.

The letter must mention if the application is approved or rejected. The letter must be short and precise. If there are any changes to be made, the letter must explain the changes in details. The letter must be addressed to the proper authority at the company.