Equipment Lease - Detailed

Description

How to fill out Equipment Lease - Detailed?

Aren't you sick and tired of choosing from numerous samples each time you require to create a Equipment Lease - Detailed? US Legal Forms eliminates the lost time countless American citizens spend browsing the internet for ideal tax and legal forms. Our expert group of lawyers is constantly modernizing the state-specific Forms library, so that it always offers the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription should complete a few simple steps before having the ability to get access to their Equipment Lease - Detailed:

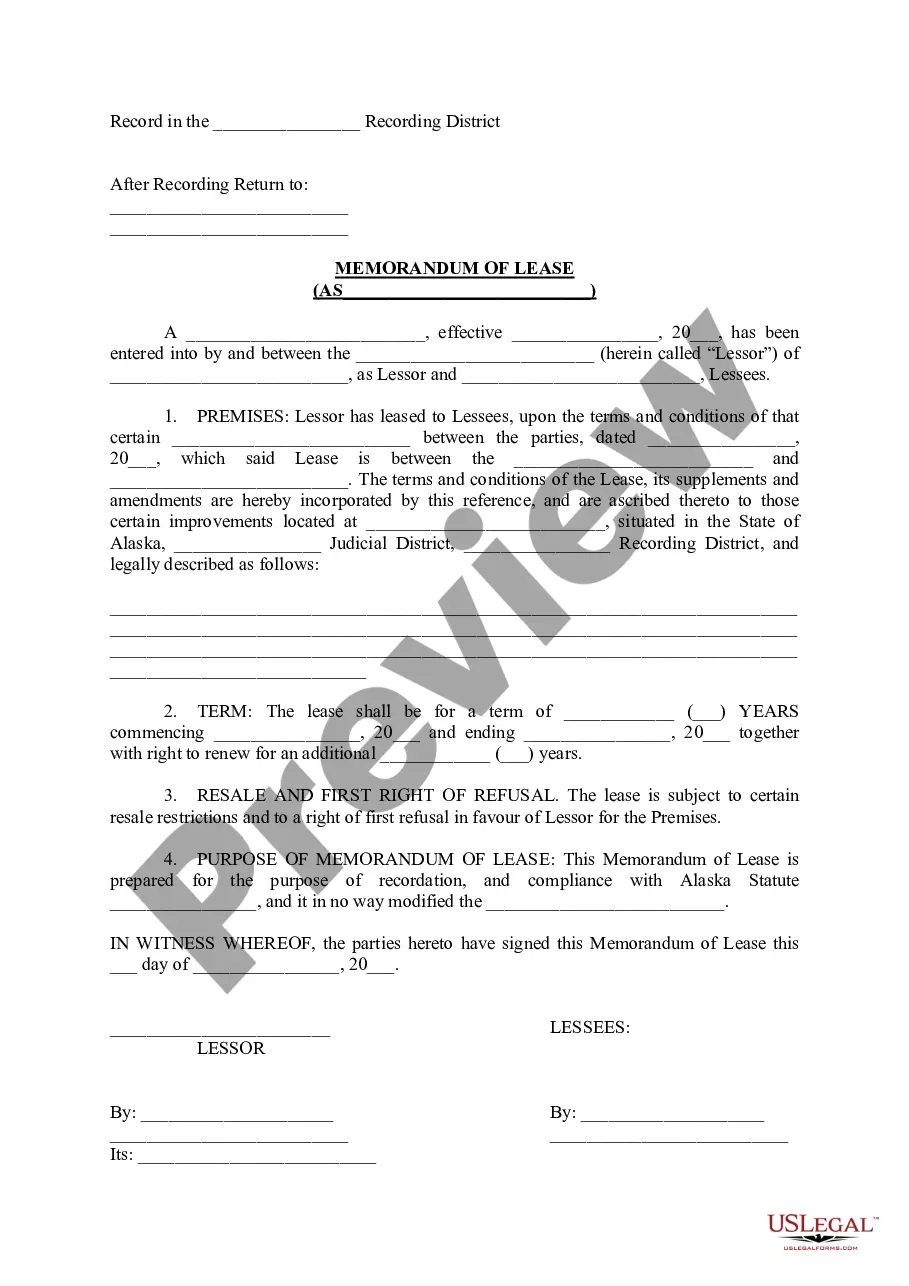

- Utilize the Preview function and read the form description (if available) to be sure that it is the proper document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right template for your state and situation.

- Make use of the Search field on top of the page if you want to look for another document.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your file in a convenient format to finish, create a hard copy, and sign the document.

When you have followed the step-by-step instructions above, you'll always have the capacity to log in and download whatever file you will need for whatever state you require it in. With US Legal Forms, completing Equipment Lease - Detailed samples or any other legal files is not difficult. Get started now, and don't forget to examine your samples with accredited lawyers!

Form popularity

FAQ

Leasing companies will be quick to tell you that your lease agreement cannot be canceled. Which is true because the only way you can get out of a lease is by completing all the payments early and paying the inevitable additional costs and penalties for doing so?

In simple terms, equipment leasing has some similarities to an equipment loan, however it's the lender that buys the equipment and then leases (rents) it back to you for a flat monthly fee. Most equipment leases come at a fixed interest rate and fixed term to keep those payments the same every month.

Equipment leasing is a type of financing in which the small business owner rents the equipment rather than purchasing it. Business owners can lease expensive equipment such as machinery, vehicles, computers and other tools needed to run a business.

Leases are usually easier to obtain and have more flexible terms than loans for buying equipment. This can be a significant advantage if you have bad credit or need to negotiate a longer payment plan to lower your costs.

At the end of the lease, you typically have the option to purchase the equipment at its fair market value, as determined by the leasing company, renew the lease, or return the equipment. An FMV lease is an operating lease, which means it doesn't offer the benefits or responsibilities of ownership to the small business.

There are two main types of leases that can be used to purchase used equipment: Operating leases and Capitol Finance leases. Operating Lease This type of lease offers the lowest payment in any kind of financing scheme.There's also a tax advantage because the equipment is both considered an asset and a liability.

In simple terms, equipment leasing has some similarities to an equipment loan, however it's the lender that buys the equipment and then leases (rents) it back to you for a flat monthly fee. Most equipment leases come at a fixed interest rate and fixed term to keep those payments the same every month.

Definition: The Equipment Leasing Company is a non-banking finance company which is primarily engaged in the business of leasing of equipment or financing of such activity.The lease period is generally shorter than the economic life of the asset and is also called as an Open End Lease Agreement.

In simple terms, equipment leasing has some similarities to an equipment loan, however it's the lender that buys the equipment and then leases (rents) it back to you for a flat monthly fee. Most equipment leases come at a fixed interest rate and fixed term to keep those payments the same every month.