Revocable Trust for House

Description

How to fill out Revocable Trust For House?

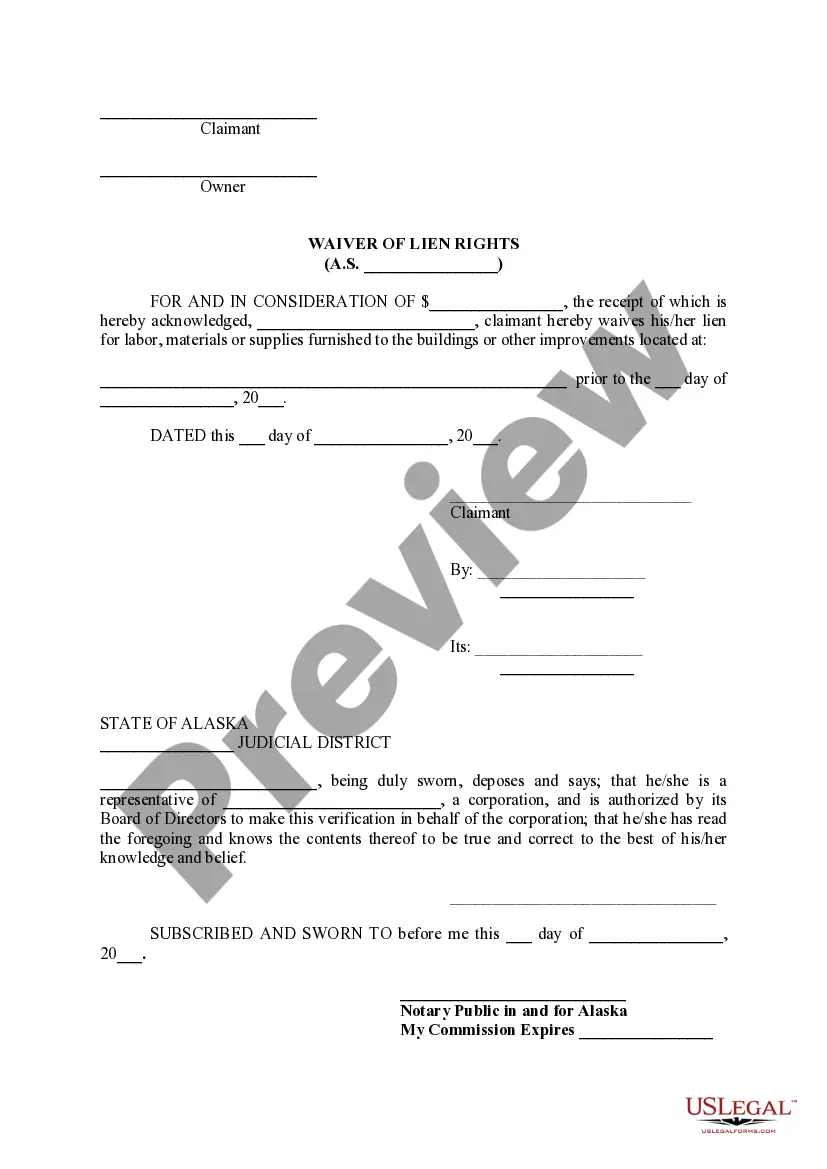

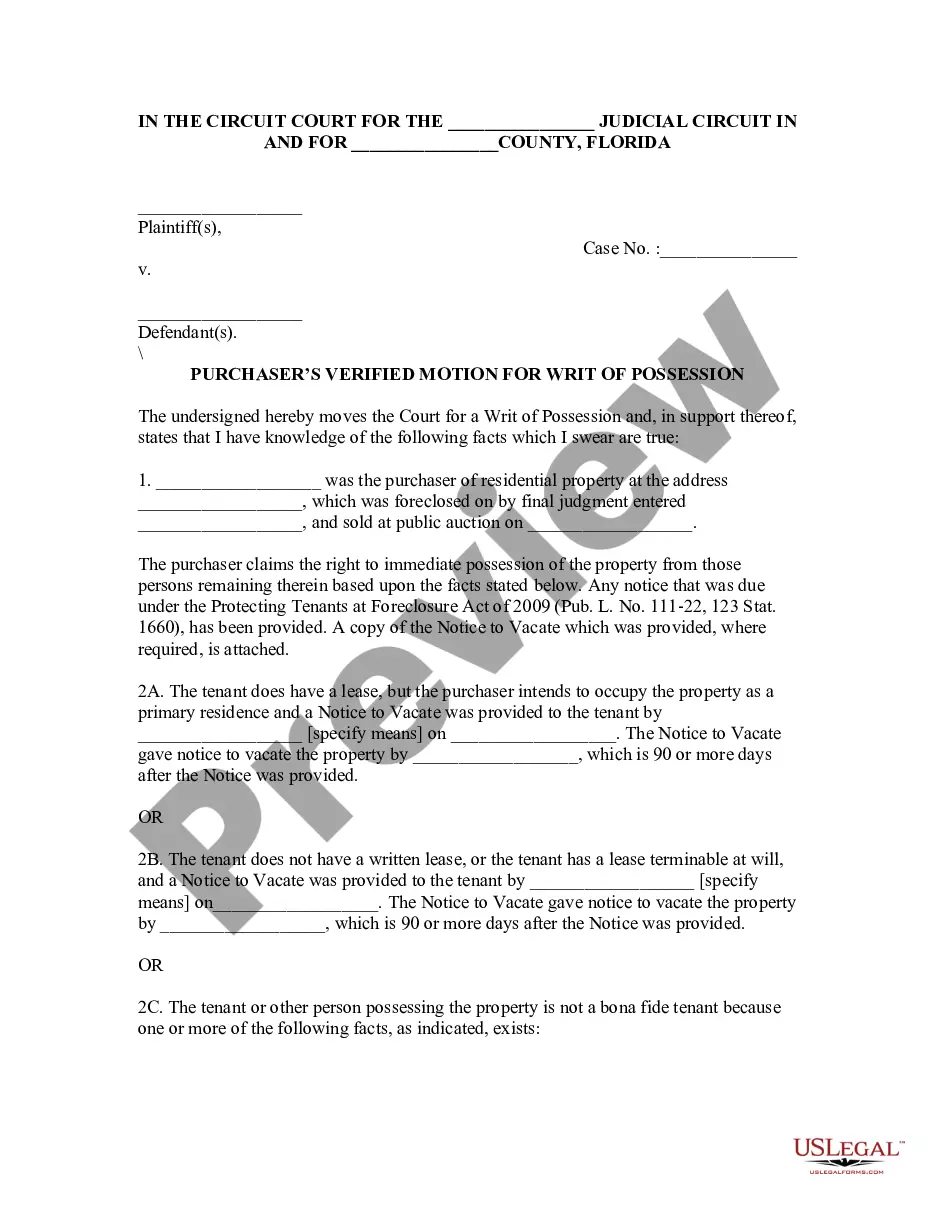

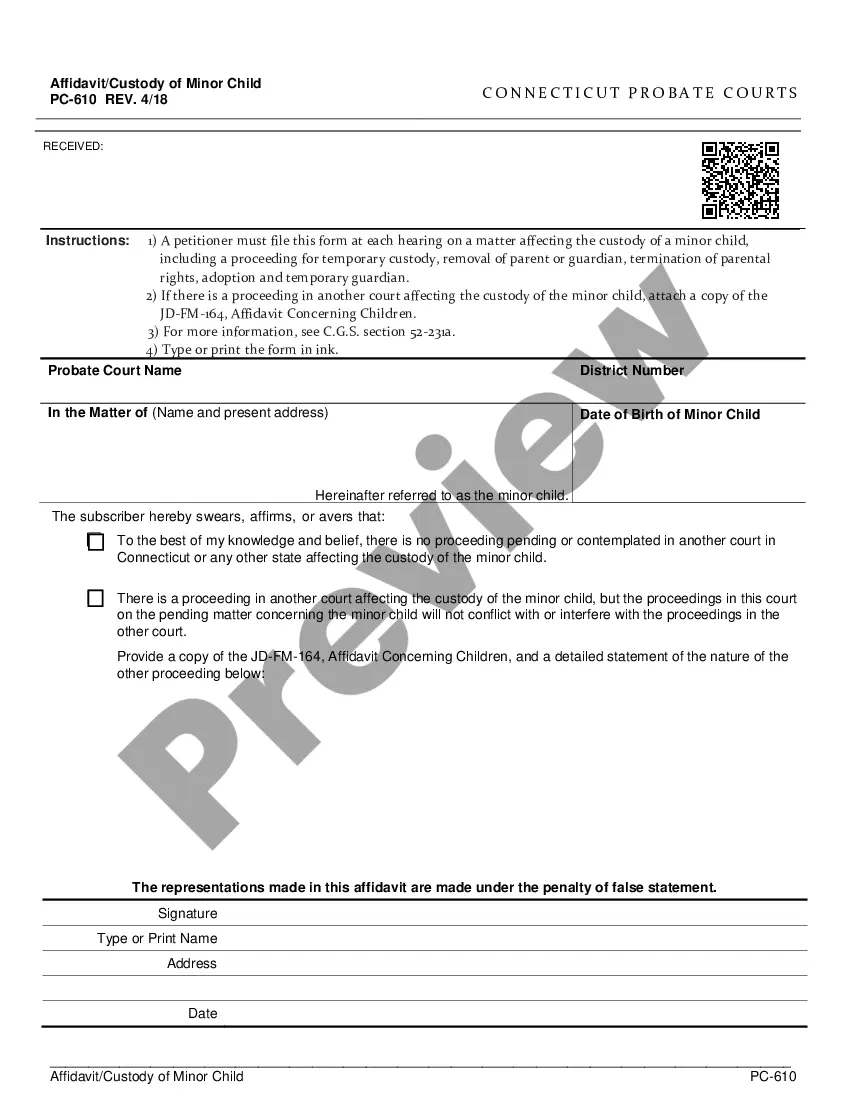

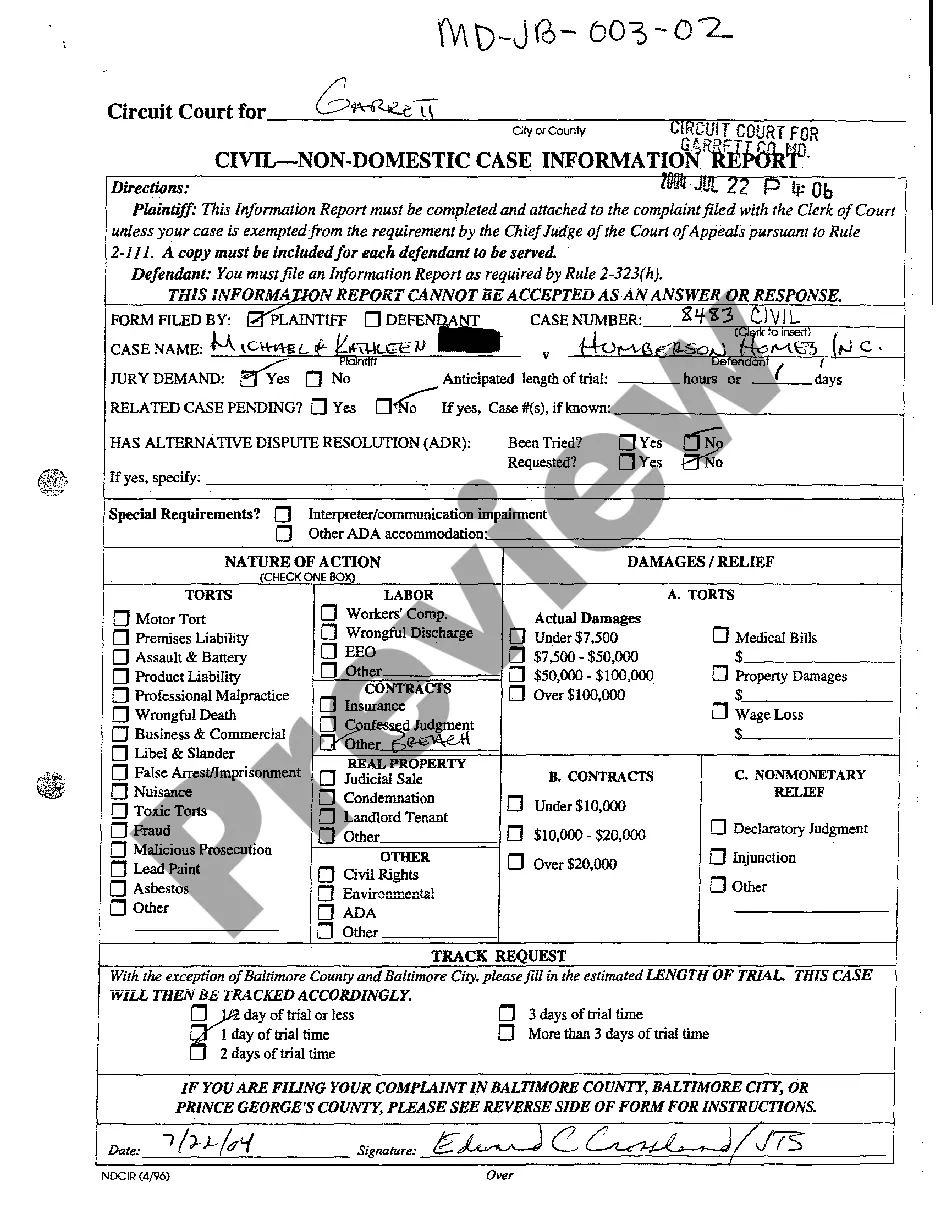

Use US Legal Forms to obtain a printable Revocable Trust for House. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most extensive Forms catalogue online and provides affordable and accurate templates for customers and attorneys, and SMBs. The templates are categorized into state-based categories and a few of them might be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download Revocable Trust for House:

- Check to ensure that you get the right template with regards to the state it’s needed in.

- Review the form by reading the description and using the Preview feature.

- Click Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search engine if you need to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Revocable Trust for House. Above three million users have already used our platform successfully. Choose your subscription plan and get high-quality documents within a few clicks.

Form popularity

FAQ

Creation of a Trust To create a trust, the property owner (called the "trustor," "grantor," or "settlor") transfers legal ownership to a family member, professional, or institution (called the "trustee") to manage that property for the benefit of another person (called the "beneficiary").

Due to changes in the tax laws, most revocable trusts can now be treated as part of a decedent's estate for federal income tax purposes.

As far as the Internal Revenue Service is concerned, trust property belongs to the grantor. The grantor names a trustee to manage the assets, but during their lifetime, most people name themselves in this position. A successor trustee is named to carry on when the grantor dies or becomes incapacitated.

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

When the maker of a revocable trust, also known as the grantor or settlor, dies, the assets become property of the trust. If the grantor acted as trustee while he was alive, the named co-trustee or successor trustee will take over upon the grantor's death.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

Trust property refers to the assets placed into a trust, which are controlled by the trustee on behalf of the trustor's beneficiaries.Estate planning allows for trust property to pass directly to the designated beneficiaries upon the trustor's death without probate.

A Revocable Living Trust DefinedAssets can include real estate, valuable possessions, bank accounts and investments. As with all living trusts, you create it during your lifetime.