Revocable Trust for Real Estate

Description

How to fill out Revocable Trust For Real Estate?

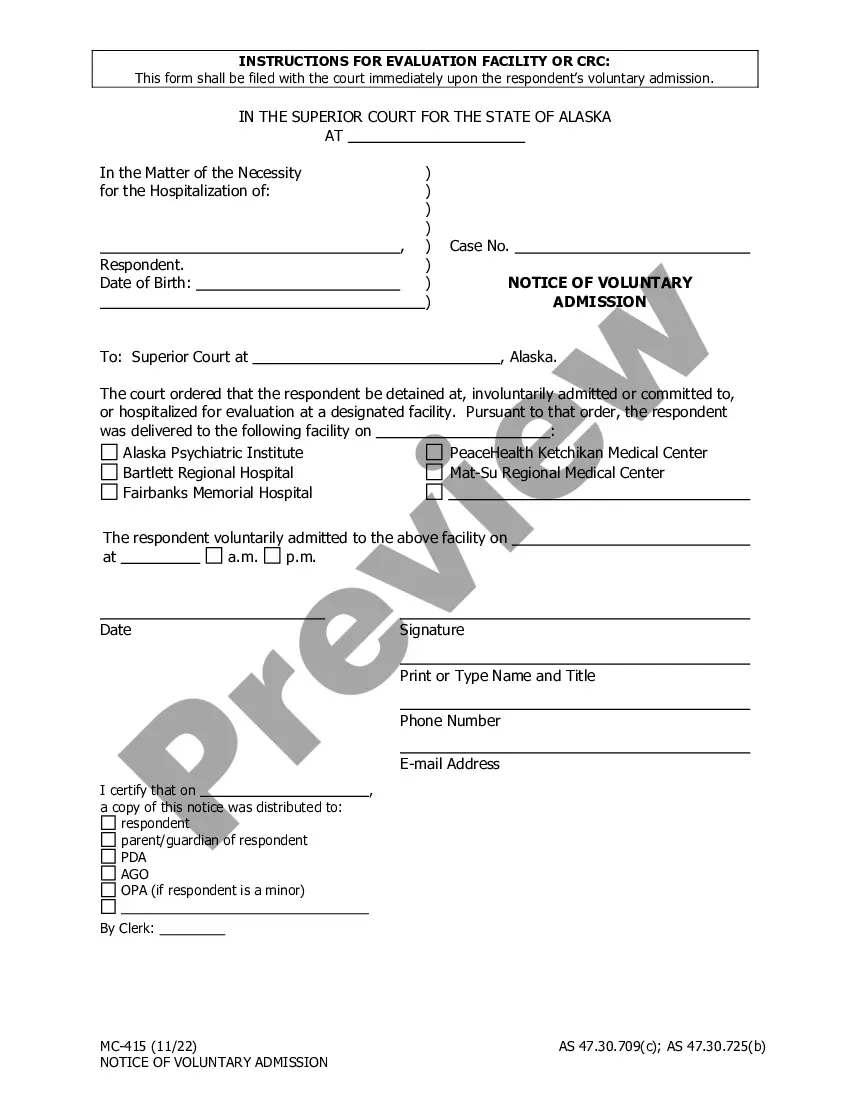

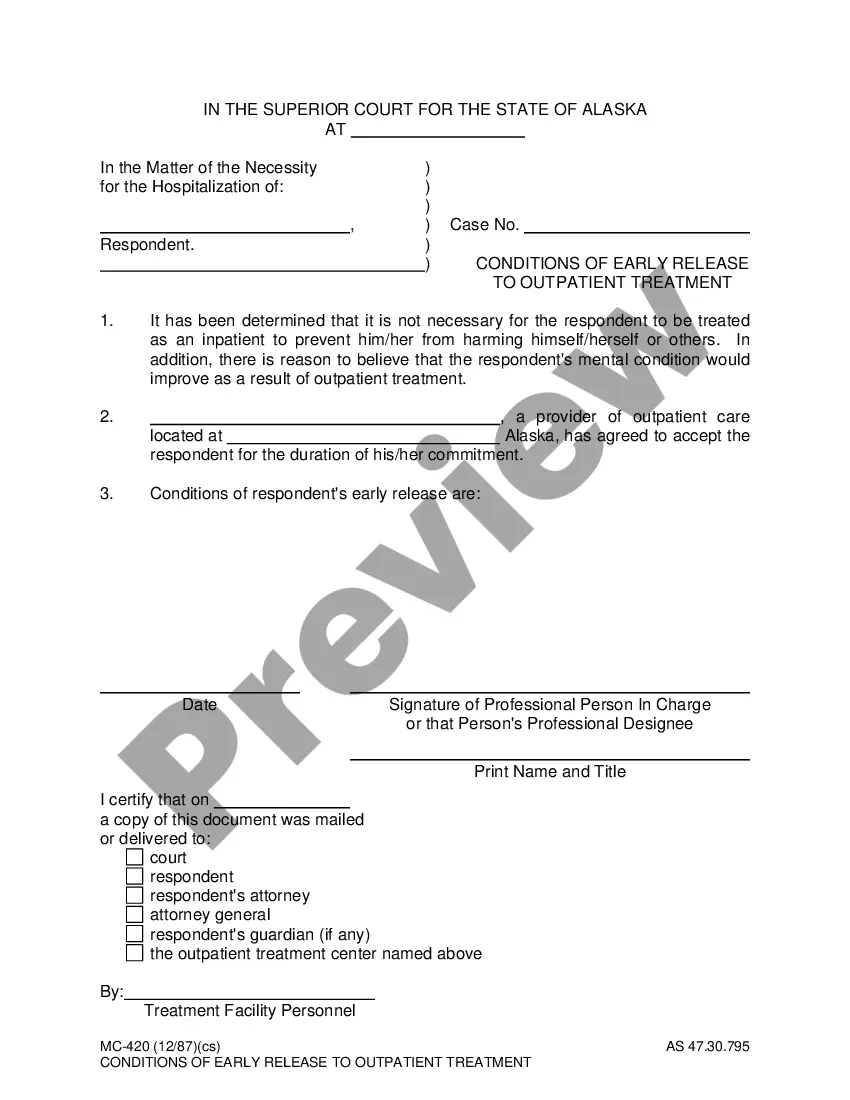

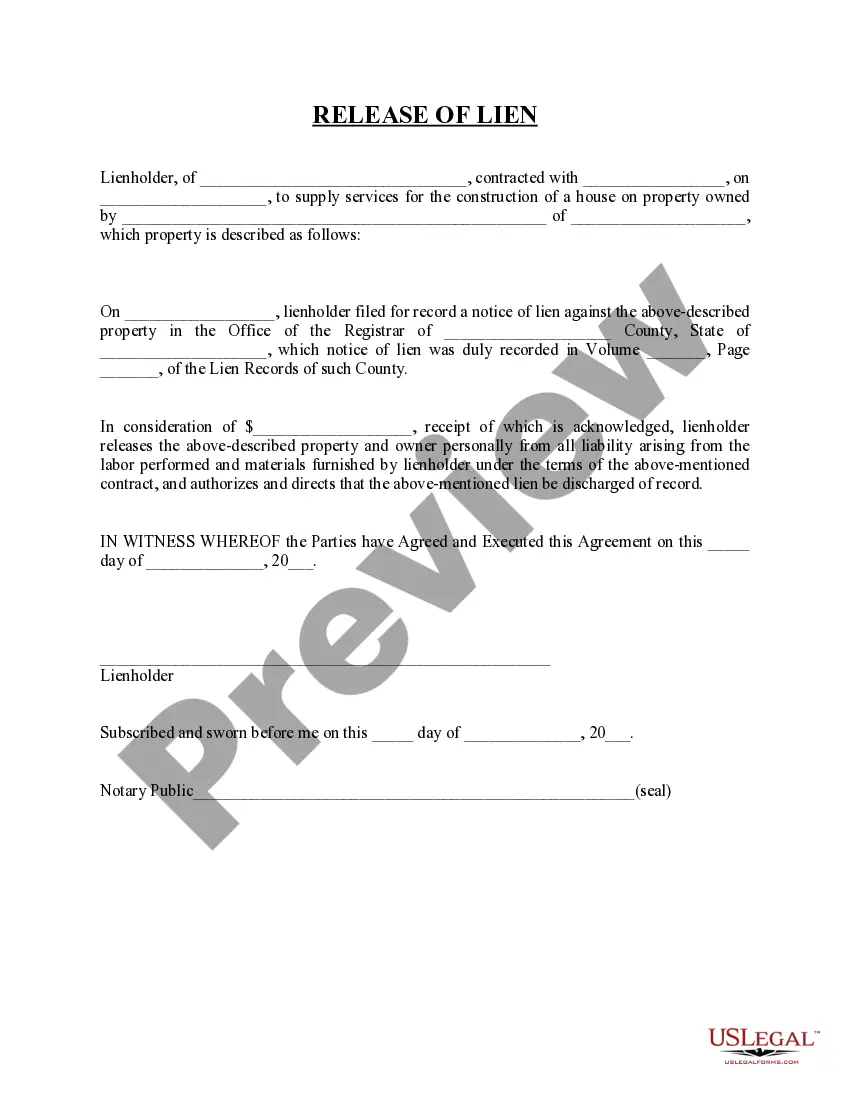

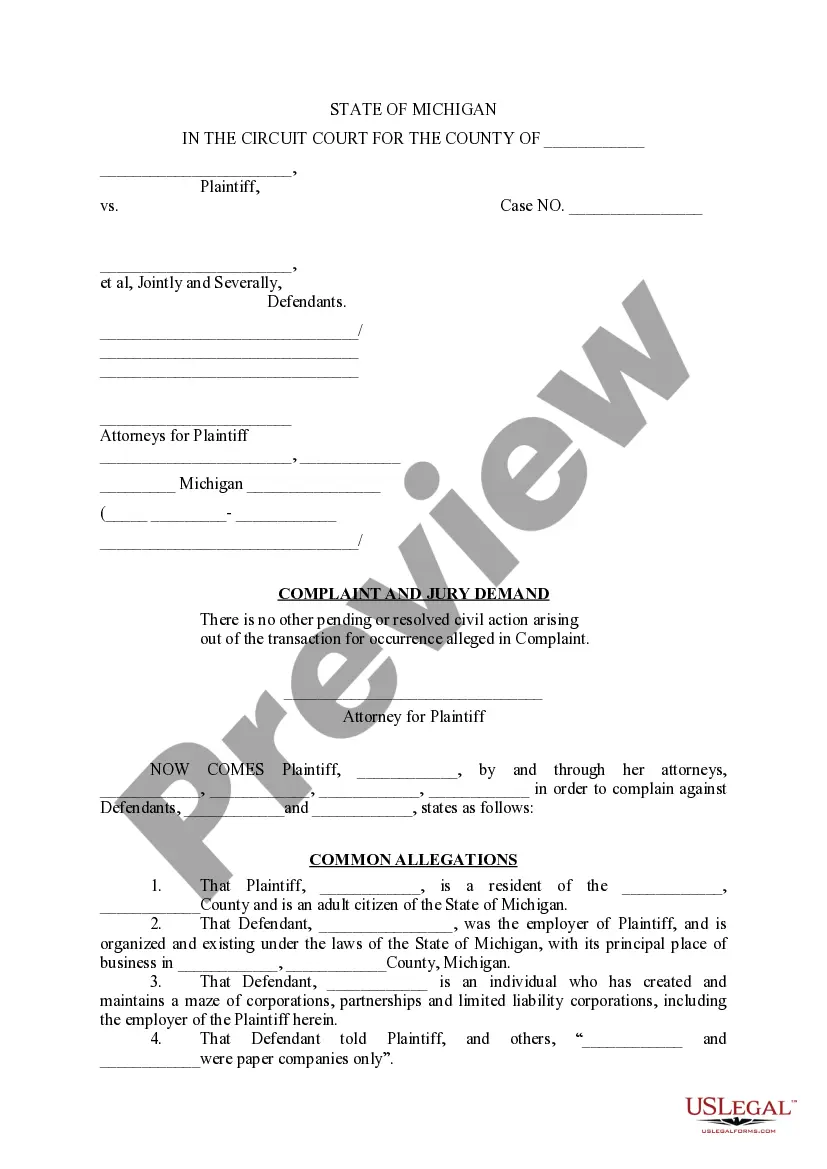

Use US Legal Forms to get a printable Revocable Trust for Real Estate. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms library online and provides affordable and accurate templates for consumers and attorneys, and SMBs. The templates are categorized into state-based categories and a few of them can be previewed before being downloaded.

To download samples, users need to have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download Revocable Trust for Real Estate:

- Check to ensure that you have the proper form in relation to the state it’s needed in.

- Review the form by looking through the description and using the Preview feature.

- Click Buy Now if it is the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Revocable Trust for Real Estate. Over three million users already have utilized our service successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Form popularity

FAQ

As far as the Internal Revenue Service is concerned, trust property belongs to the grantor. The grantor names a trustee to manage the assets, but during their lifetime, most people name themselves in this position. A successor trustee is named to carry on when the grantor dies or becomes incapacitated.

When the maker of a revocable trust, also known as the grantor or settlor, dies, the assets become property of the trust. If the grantor acted as trustee while he was alive, the named co-trustee or successor trustee will take over upon the grantor's death.

Many people use a revocable living trust because it gives them more control over the trust assets. Putting your house in a revocable trust still allows you to change the terms of the trust or remove the house from the trust if you want to.

Trust property refers to the assets placed into a trust, which are controlled by the trustee on behalf of the trustor's beneficiaries.Estate planning allows for trust property to pass directly to the designated beneficiaries upon the trustor's death without probate.

Many people use a revocable living trust because it gives them more control over the trust assets. Putting your house in a revocable trust still allows you to change the terms of the trust or remove the house from the trust if you want to.

A revocable trust is a part of estate planning that manages and protects the assets of the grantor as the owner ages. The trust can be amended or revoked as the grantor desires and is included in estate taxes.

Continuity of Management During Disability. Flexibility. Avoidance of Probate. Availability of Assets at Death. No Interruption in Investment Management. May Not Automatically Adapt to Changed Circumstances.

Due to changes in the tax laws, most revocable trusts can now be treated as part of a decedent's estate for federal income tax purposes.

Creation of a Trust To create a trust, the property owner (called the "trustor," "grantor," or "settlor") transfers legal ownership to a family member, professional, or institution (called the "trustee") to manage that property for the benefit of another person (called the "beneficiary").