Revocable Trust for Child

Description

How to fill out Revocable Trust For Child?

Use US Legal Forms to get a printable Revocable Trust for Child. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most complete Forms catalogue on the internet and provides cost-effective and accurate templates for customers and legal professionals, and SMBs. The documents are grouped into state-based categories and some of them can be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Click Download next to any template you need and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to quickly find and download Revocable Trust for Child:

- Check to ensure that you get the right form in relation to the state it is needed in.

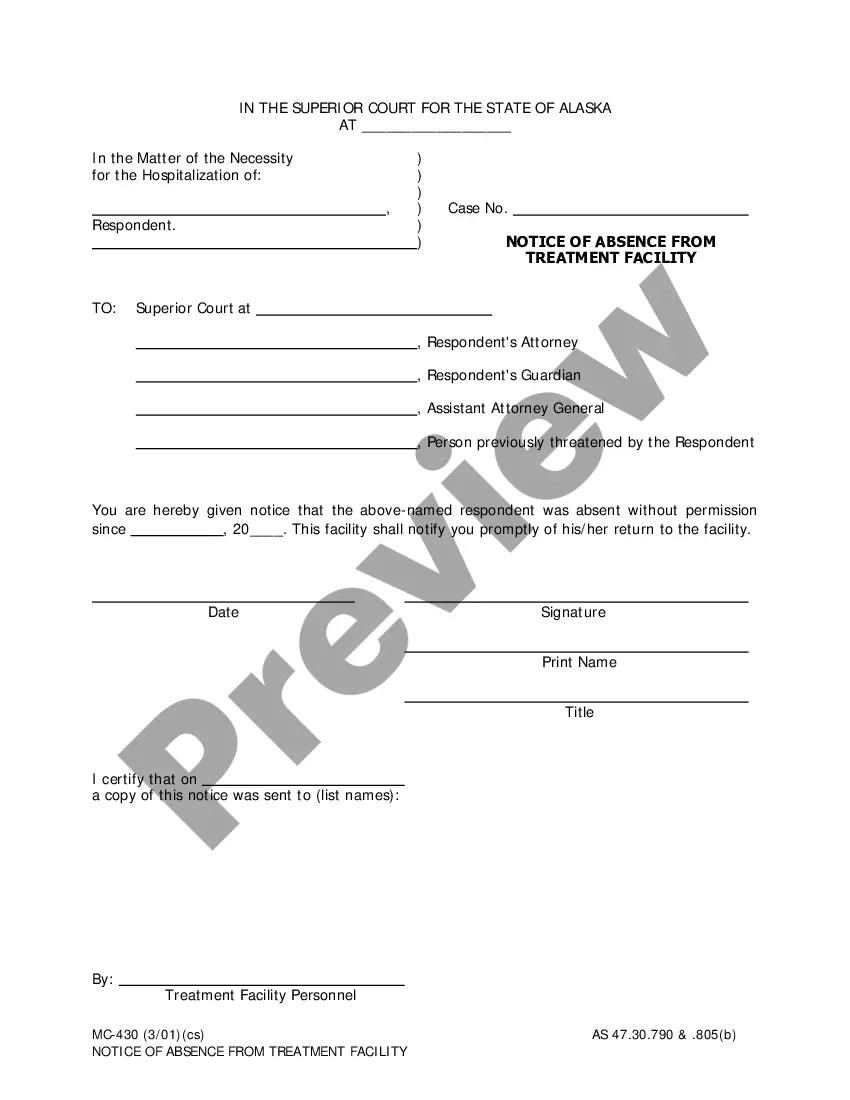

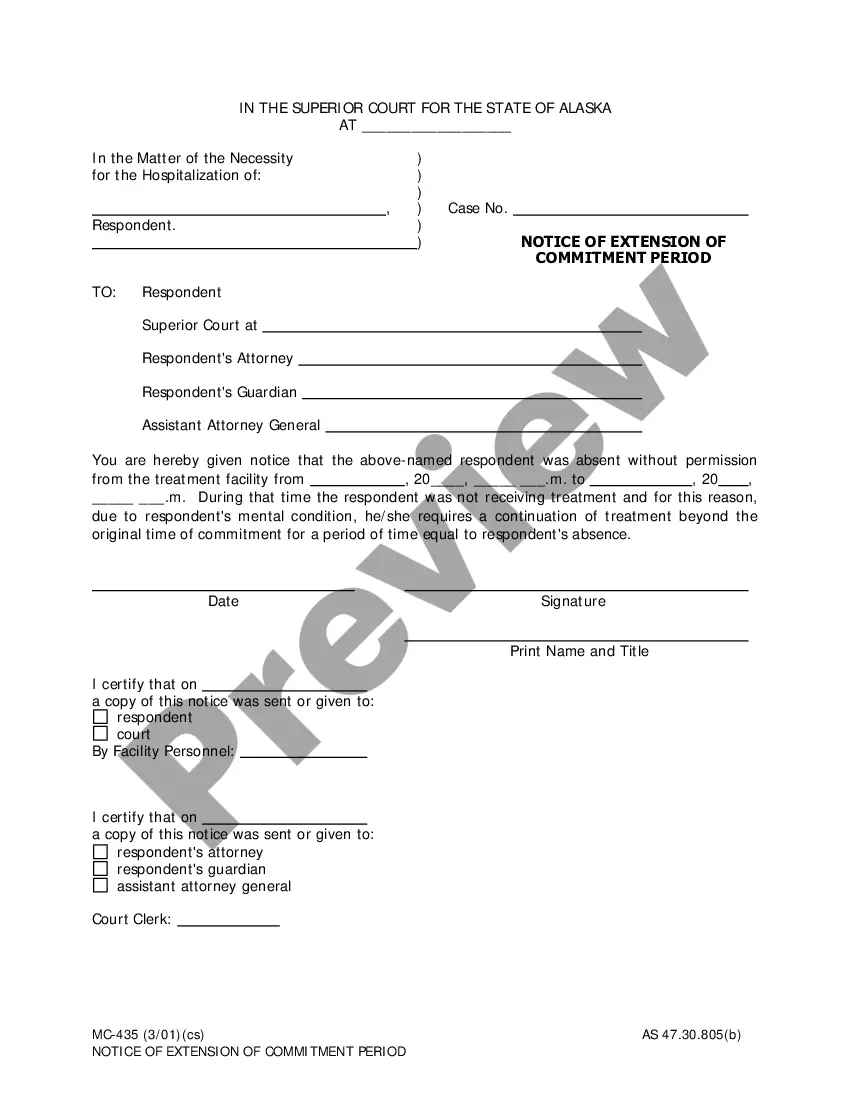

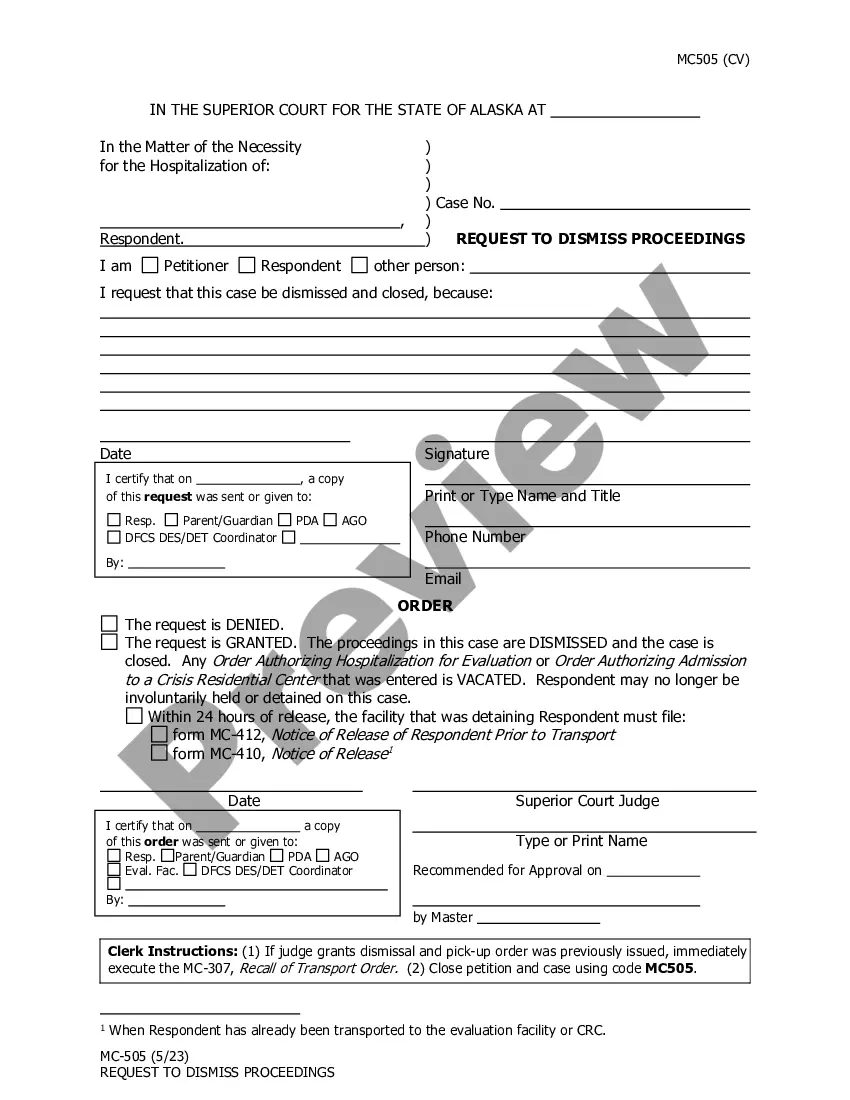

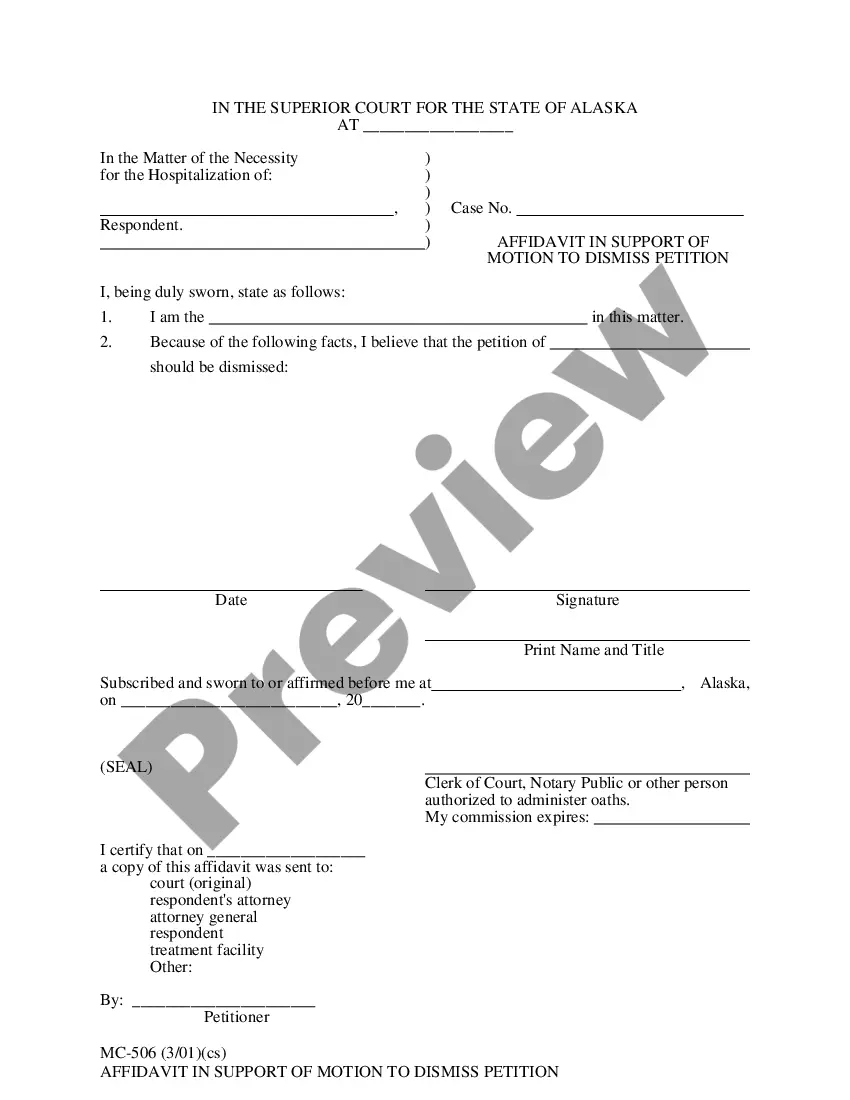

- Review the document by reading the description and by using the Preview feature.

- Hit Buy Now if it is the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search field if you want to get another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Revocable Trust for Child. Over three million users have utilized our platform successfully. Choose your subscription plan and obtain high-quality documents in just a few clicks.

Form popularity

FAQ

A well-planned, well-managed trust can give your child or heir a solid head start on adulthood. It can also provide them with guaranteed financial security later in life, or ensure your assets are distributed only to certain family members in the unlikely event of your child's untimely death.

A trust gives you the ability to name specific beneficiaries, and once you do, your intentions cannot be changed after the fact. This means that you will be able to specifically name your children as beneficiaries of the trustand even exclude certain children if that is your choiceand your wishes will be carried out.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

Select a trustee. As stated above, when a grantor creates a trust, they must name a trustee. Decide the terms of the trust. Create the necessary trust documents. Transfer assets into the trust.

To manage and control spending and investments to protect beneficiaries from poor judgment and waste; To avoid court-supervised probate of trust assets and be private; To protect trust assets from the beneficiaries' creditors;To reduce income taxes or shelter assets from estate and transfer taxes.

A well-planned, well-managed trust can give your child or heir a solid head start on adulthood. It can also provide them with guaranteed financial security later in life, or ensure your assets are distributed only to certain family members in the unlikely event of your child's untimely death.

Beneficiaries of a trust typically pay taxes on the distributions they receive from the trust's income, rather than the trust itself paying the tax. However, such beneficiaries are not subject to taxes on distributions from the trust's principal.

A Revocable Living Trust DefinedAssets can include real estate, valuable possessions, bank accounts and investments. As with all living trusts, you create it during your lifetime.