Escrow Instructions in Short Form

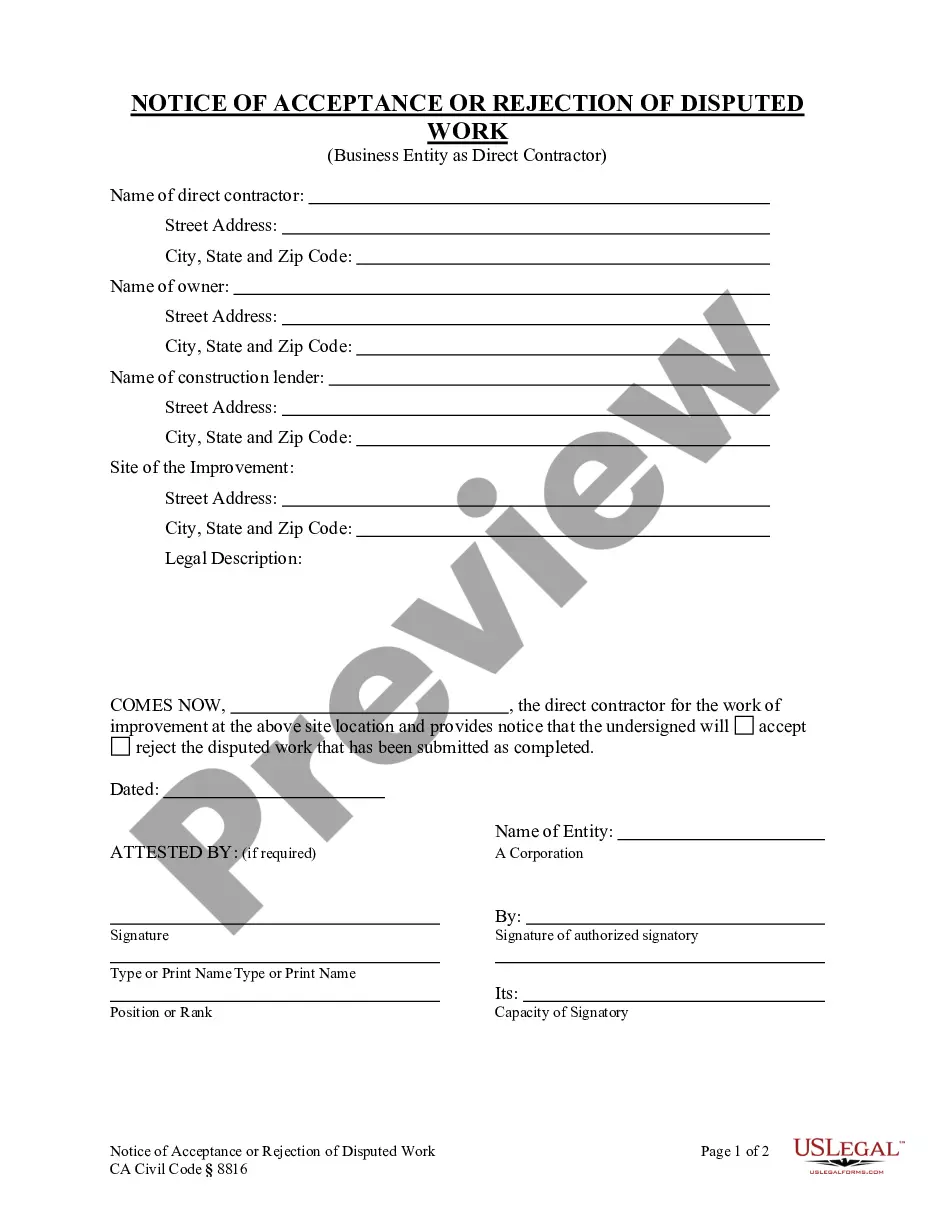

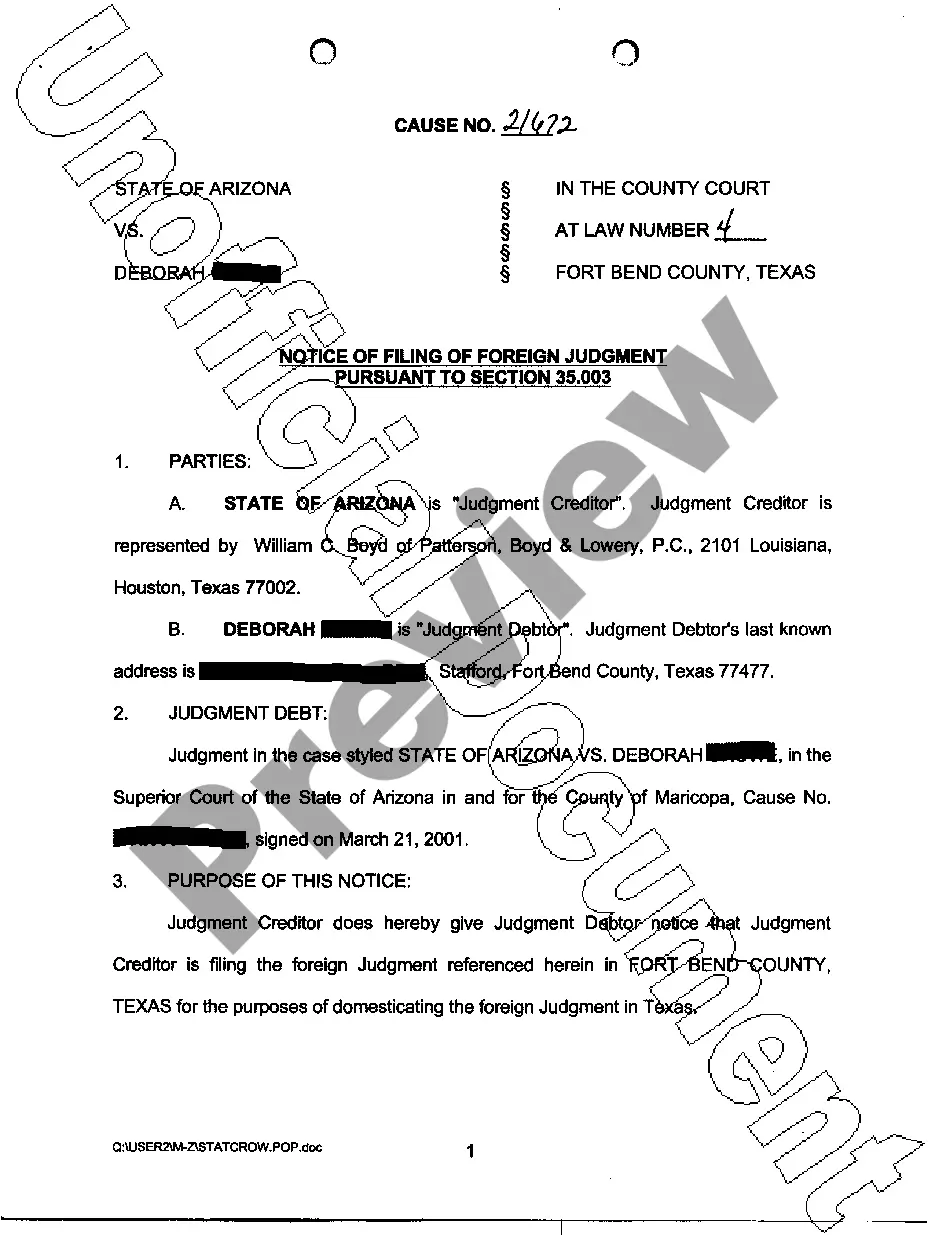

Description Escrow Instructions Template

How to fill out Escrow Examples?

Aren't you tired of choosing from countless samples each time you require to create a Escrow Instructions in Short Form? US Legal Forms eliminates the lost time numerous American citizens spend browsing the internet for appropriate tax and legal forms. Our professional group of attorneys is constantly upgrading the state-specific Templates catalogue, so that it always has the right files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Users who don't have an active subscription need to complete quick and easy actions before having the capability to download their Escrow Instructions in Short Form:

- Make use of the Preview function and look at the form description (if available) to make sure that it is the best document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct sample to your state and situation.

- Make use of the Search field on top of the web page if you need to look for another document.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your template in a convenient format to complete, create a hard copy, and sign the document.

Once you have followed the step-by-step recommendations above, you'll always have the ability to log in and download whatever file you will need for whatever state you need it in. With US Legal Forms, completing Escrow Instructions in Short Form samples or any other official files is not hard. Begin now, and don't forget to recheck your samples with accredited lawyers!

Escrow Forms Or Templates Form popularity

Escrow Example Other Form Names

Escrow Seller Listing FAQ

If your escrow account's balance is negative at the time of the escrow analysis, the lender may have used its own funds to cover your property tax or insurance payments. In such cases, the account has a deficiency. If the amount exceeds one month's escrow payment, the lender may give you two to 12 months to repay it.

Generally, an escrow account is a prerequisite if you're not putting at least 20% down on a home. So unless you're bringing a sizable chunk of cash to the closing table, escrow may be unavoidable. FHA loans, for example, always require buyers to set up escrow accounts.

PayPal does not work this way; they do not hold funds in escrow.Once the item has been shipped, it's too latethe scammer will get an item that they never paid for, and the seller will eventually realize that PayPal was never holding money for them.

PayPal does not work this way; they do not hold funds in escrow. The scammer is hoping that the seller will rush to ship the item and send over a tracking number in order to receive the money.

There are some advantages to going without an escrow service your money can earn you interest and you may be eligible for early payment discounts for some bills. But, the disadvantages are obvious you are required to pay your tax bills and insurance payments on time or risk losing your house.

Escrow is the use of a third party, which holds an asset or funds before they are transferred from one party to another. The third-party holds the funds until both parties have fulfilled their contractual requirements.

The major advantage of a mortgage escrow is that the lender assumes responsibility for paying your property taxes and homeowners insurance. This is also the major disadvantage. In addition, with an escrow the lender gets to keep the interest on your account.

Escrow is when a neutral third party holds on to funds during a transaction. In real estate, it's used as a way to protect both the buyer and seller during the home purchasing process.

Your mortgage lender or servicer is allowed to collect the amount of your homeowners insurance and property tax payments, plus a cushion, month in and month out, in escrow. While it's nice to not have to think about making these payments, this pro can be a con for savers who may be able to put the funds to better use.