General Partnership Agreement - version 2

Description General Partnership Agreement Template

How to fill out Partnership Version Document?

Aren't you tired of choosing from countless samples every time you need to create a General Partnership Agreement - version 2? US Legal Forms eliminates the wasted time numerous Americans spend browsing the internet for ideal tax and legal forms. Our professional crew of lawyers is constantly upgrading the state-specific Forms library, so that it always has the right files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

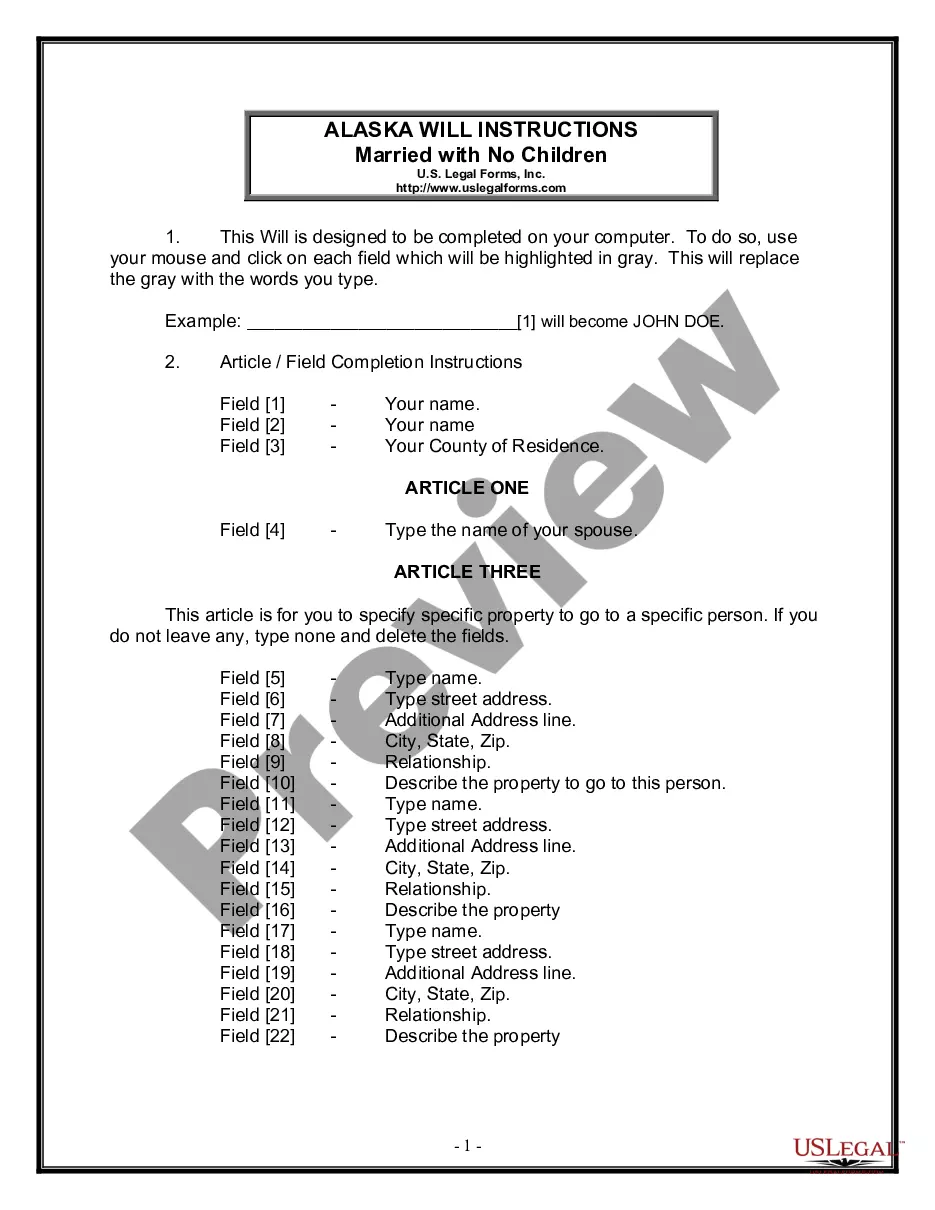

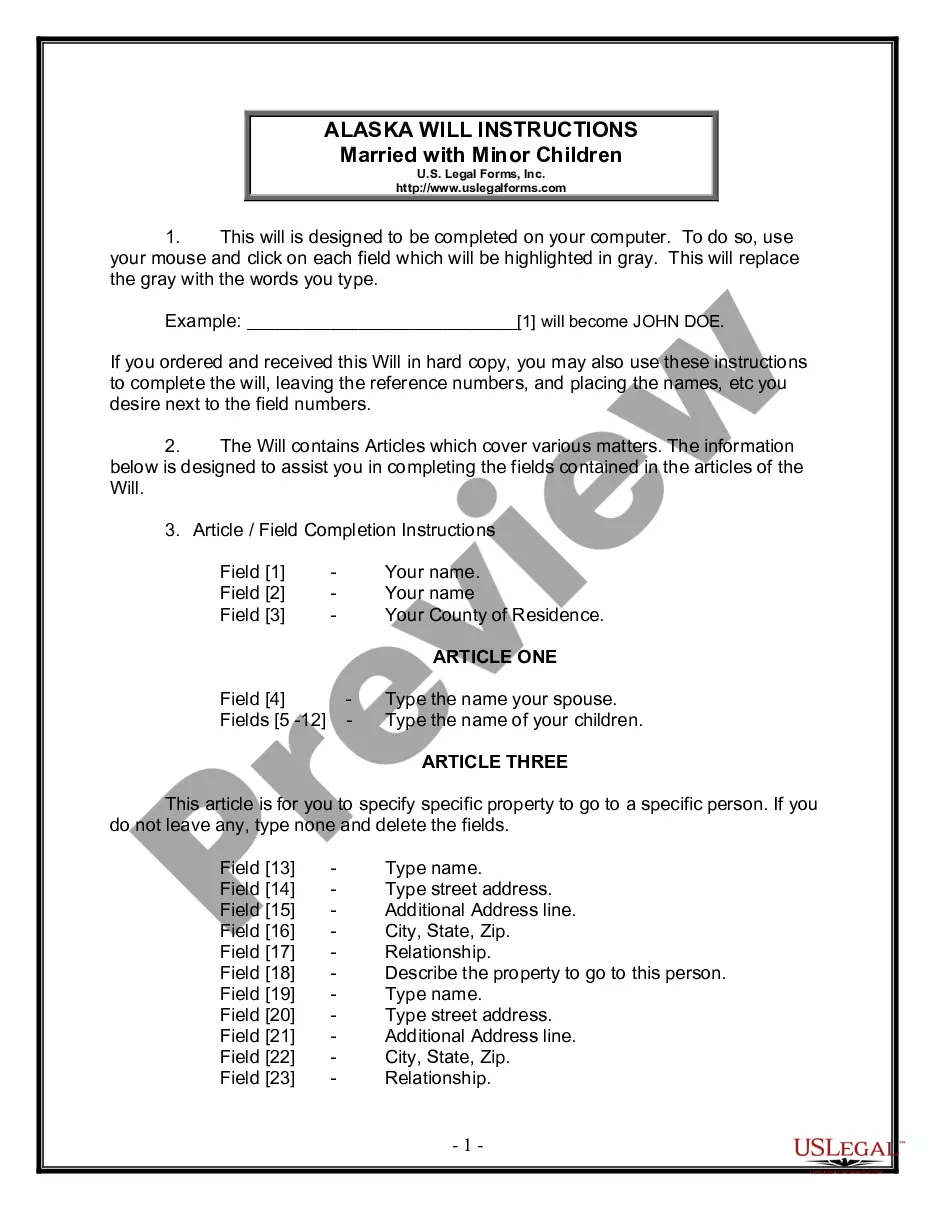

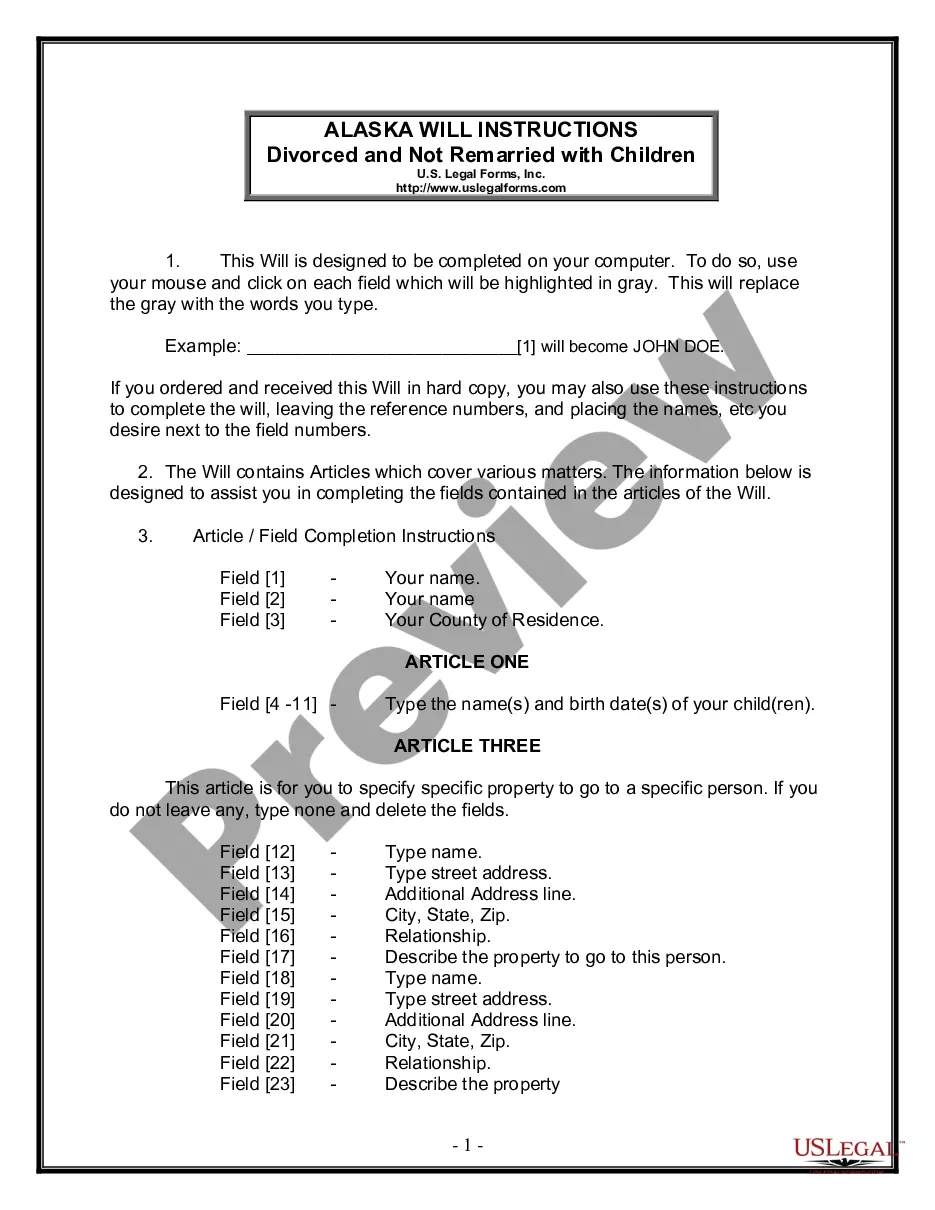

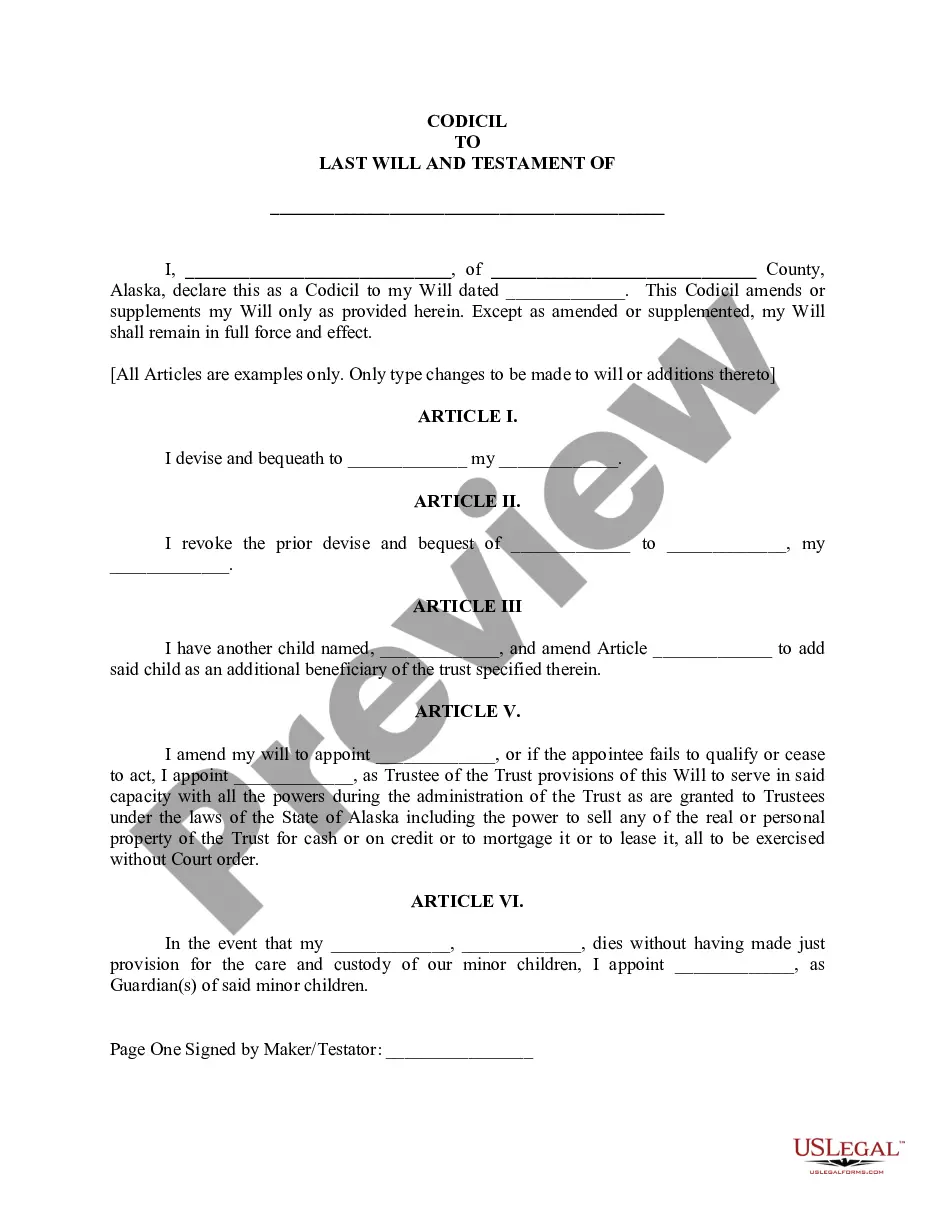

Users who don't have a subscription need to complete easy steps before having the ability to download their General Partnership Agreement - version 2:

- Use the Preview function and look at the form description (if available) to ensure that it’s the best document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate template to your state and situation.

- Use the Search field on top of the page if you have to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your document in a convenient format to finish, create a hard copy, and sign the document.

When you’ve followed the step-by-step recommendations above, you'll always have the ability to sign in and download whatever document you require for whatever state you require it in. With US Legal Forms, finishing General Partnership Agreement - version 2 samples or other official paperwork is not hard. Get started now, and don't forget to double-check your examples with certified attorneys!

General Partnership Agreement Pdf Form popularity

What Does A Partnership Agreement Look Like Other Form Names

Partnership Version Agreement FAQ

Partnership DeedPartnership deeds, in very simple words, are an agreement between partners of a firm. This agreement defines details like the nature of the firm, duties, and rights of partners, their liabilities and the ratio in which they will divide profits or losses of the firm.

Like any contractual agreement, partnership agreements do not have to be in writing, as verbal agreements are also legally binding.In a partnership, each person is liable for the debts and actions of the other partners, so the contractual relationship and obligations need to be completely transparent.

Types of Partnership General Partnership, Limited Partnership, Limited Liability Partnership and Public Private Partnership.

Name of the partnership. Contributions to the partnership. Allocation of profits, losses, and draws. Partners' authority. Partnership decision-making. Management duties. Admitting new partners. Withdrawal or death of a partner.

Your Partnership's Name. Partnership Contributions. Allocations profits and losses. Partners' Authority and Decision Making Powers. Management. Departure (withdrawal) or Death. New Partners. Dispute Resolution.

LLC partnership (also known as a multi-member LLC) Limited liability partnership (LLP) Limited partnership (LP) General partnership (GP)

Name of your partnership. Contributions to the partnership and percentage of ownership. Division of profits, losses and draws. Partners' authority. Withdrawal or death of a partner.

For example, let's say that Fred and Melissa decide to open a baking store. The store is named F&M Bakery. By opening a store together, Fred and Melissa are both general partners in the business, F&M Bakery. It is important to note that each general partner must be involved in the business.