Non-Disclosure Agreement for Potential Investors

Description Nda For Investors Sample

How to fill out Non-Disclosure Agreement For Potential Investors?

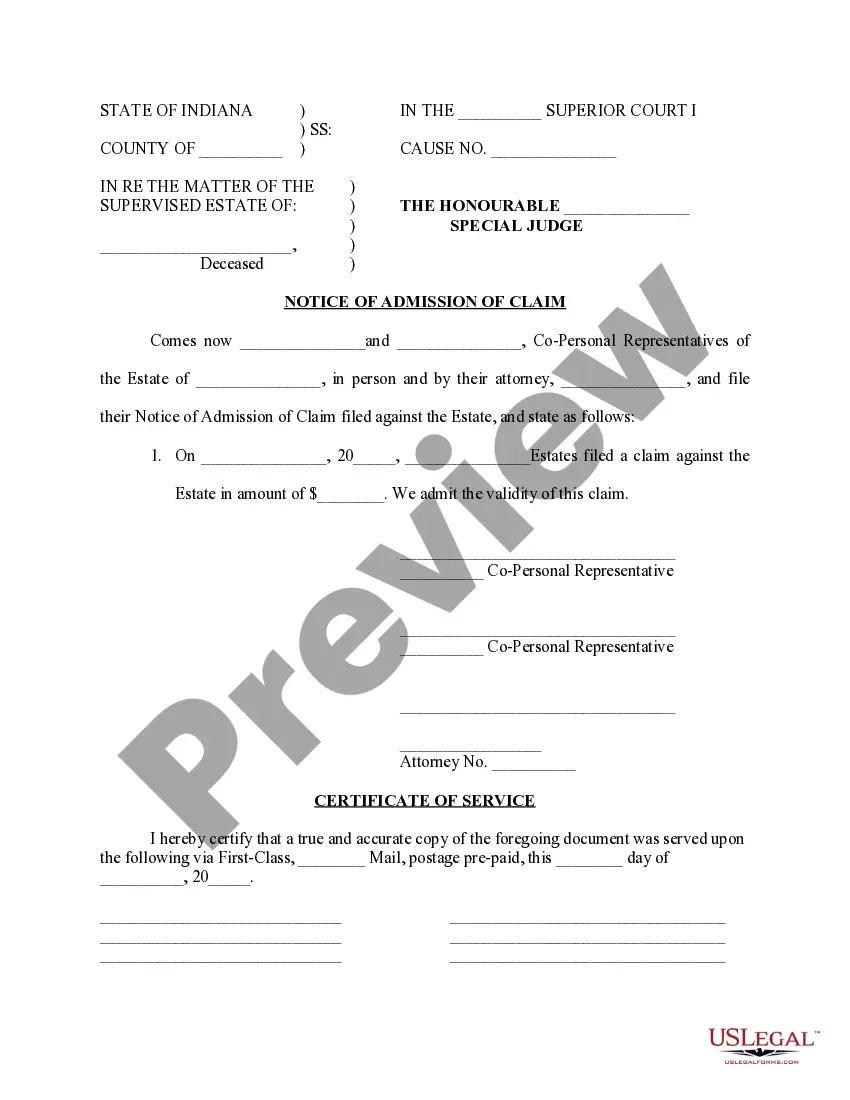

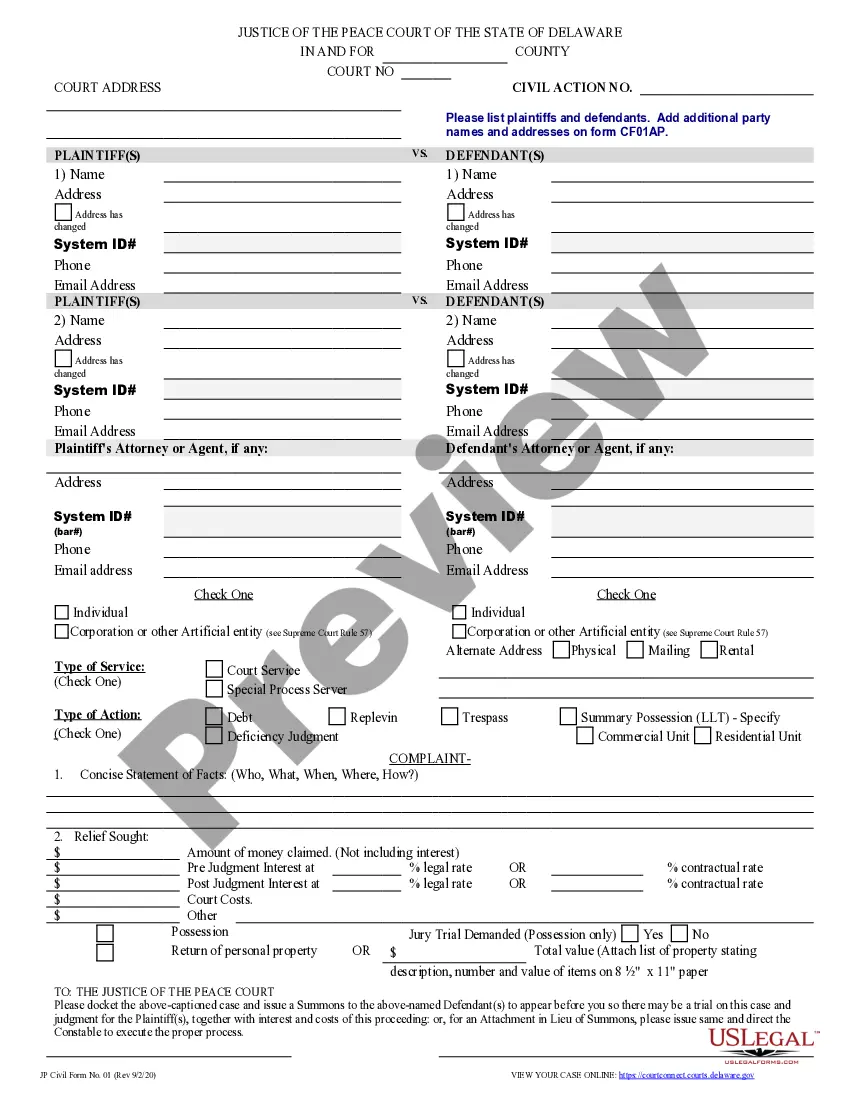

Use US Legal Forms to get a printable Non-Disclosure Agreement for Potential Investors. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms library online and offers affordable and accurate samples for consumers and lawyers, and SMBs. The documents are categorized into state-based categories and many of them can be previewed prior to being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Press Download next to any template you need and find it in My Forms.

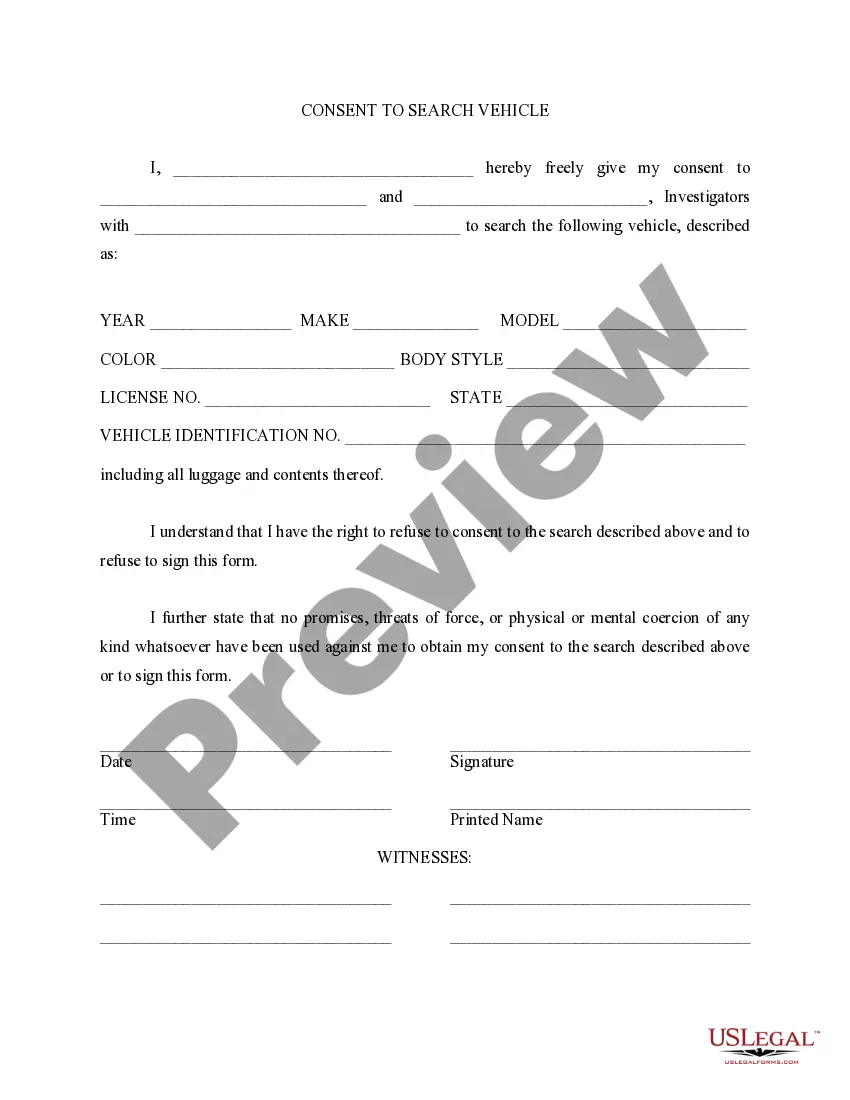

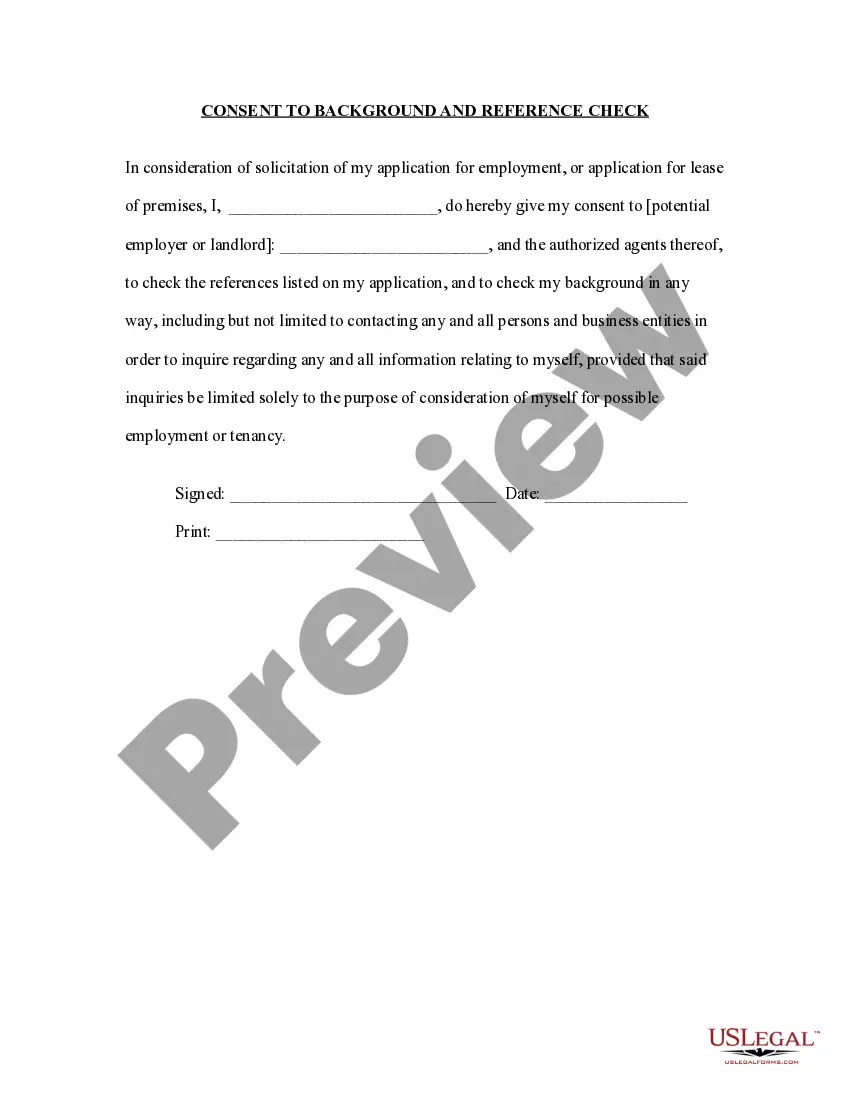

For people who don’t have a subscription, follow the tips below to quickly find and download Non-Disclosure Agreement for Potential Investors:

- Check out to make sure you have the right form in relation to the state it is needed in.

- Review the form by reading the description and by using the Preview feature.

- Hit Buy Now if it is the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Make use of the Search engine if you need to get another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Non-Disclosure Agreement for Potential Investors. More than three million users already have utilized our service successfully. Select your subscription plan and get high-quality forms in a few clicks.

Investor Nda Template Form popularity

Non Disclosure Agreement Document Other Form Names

FAQ

NDAs are legally enforceable contracts, but they're now coming under increased scrutiny from lawmakers, attorneys and legal experts.Companies often use them as part of an employment contract or settlement agreement to protect sensitive information like trade secrets.

In short -- investors don't sign NDAs. They won't sign your NDA.

The VC business has an unwritten rule on NDAs. And people who violate this rule risk losing credibility with investors even before meeting with them. The rule is simple: never ask a VC to sign an NDA unless your company absolutely needs one.

An NDA is typically a written agreement, extortion is not. The person paying for the NDA has legal recourse against the other party if information is revealed.The overlap is that a person or company may refuse to allow you to work for them if you refuse to agree to keep their confidential information secret.

NDAs keep people from sharing trade secrets, proprietary knowledge, client information, product information, and strategic plans. NDAs keep people from making a profit on any secret company information. NDAs usually say that a company owns things that get developed or produced during someone's employment.

If the NDA is fully executed by all parties, from the contract law perspective it should be binding. Go ahead and send copies of the fully executed NDA out, and make it a practice to do that right after you collect all of the signatures, with a cover...

The cold hard truth is that most NDAs do not hold up in court. Non-Disclosure Agreements are most effective in establishing a paper trail of confidential information as it relates to partnerships, and discouraging partners from misappropriating proprietary information.

Identification of the parties. Definition of what is deemed to be confidential. The scope of the confidentiality obligation by the receiving party. The exclusions from confidential treatment. The term of the agreement.

An NDA is only really useful as a legal document in the case that the parties end up in court. And if you end up in court, it's going to be expensive VERY, expensive.By requiring an NDA, these companies put up an unnecessary roadblock that slowed innovation. They are mired in paperwork for a false sense of security.