Sale of Partnership to Corporation

Description

How to fill out Sale Of Partnership To Corporation?

Aren't you tired of choosing from countless templates every time you need to create a Sale of Partnership to Corporation? US Legal Forms eliminates the lost time millions of American citizens spend browsing the internet for suitable tax and legal forms. Our expert team of lawyers is constantly modernizing the state-specific Forms catalogue, so that it always provides the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription need to complete a few simple actions before having the capability to get access to their Sale of Partnership to Corporation:

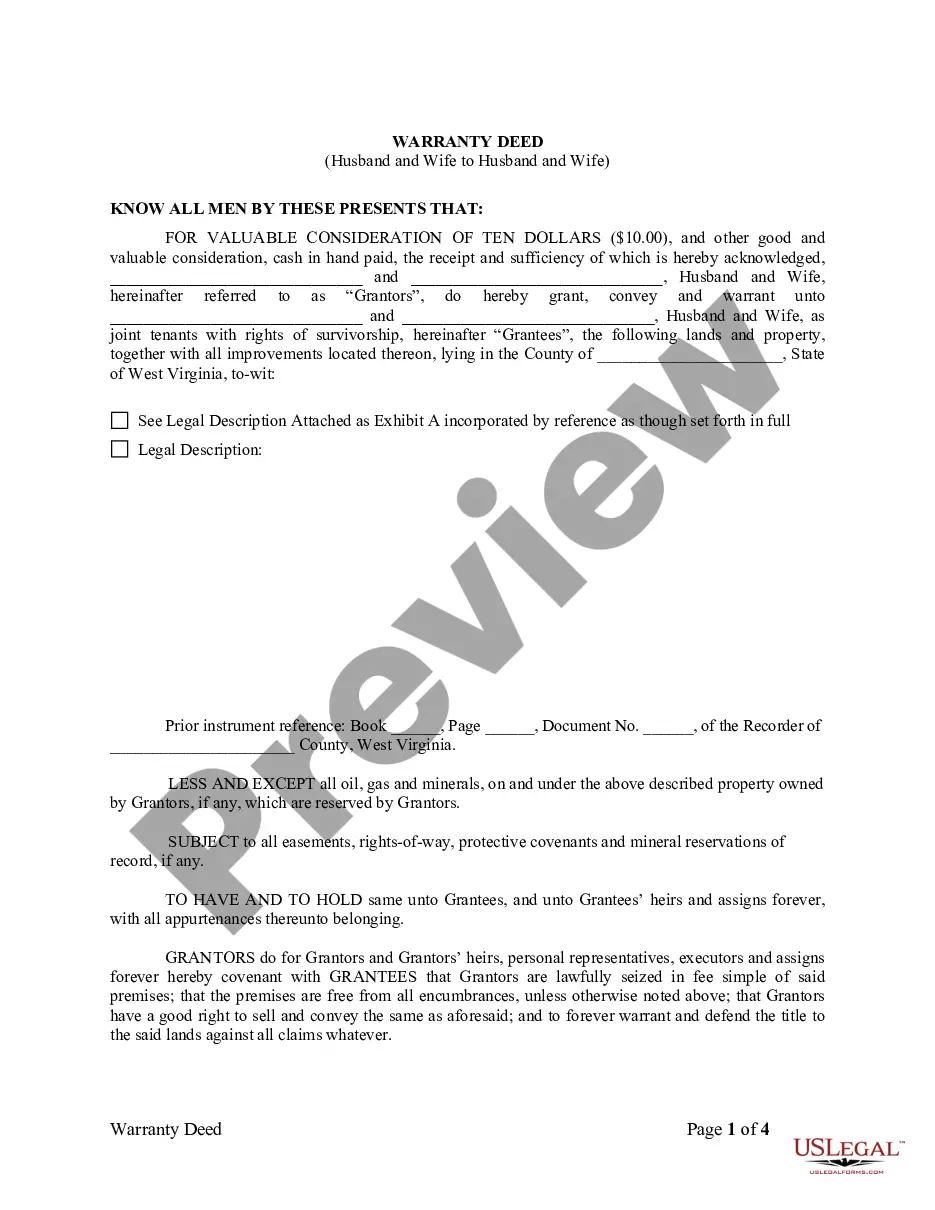

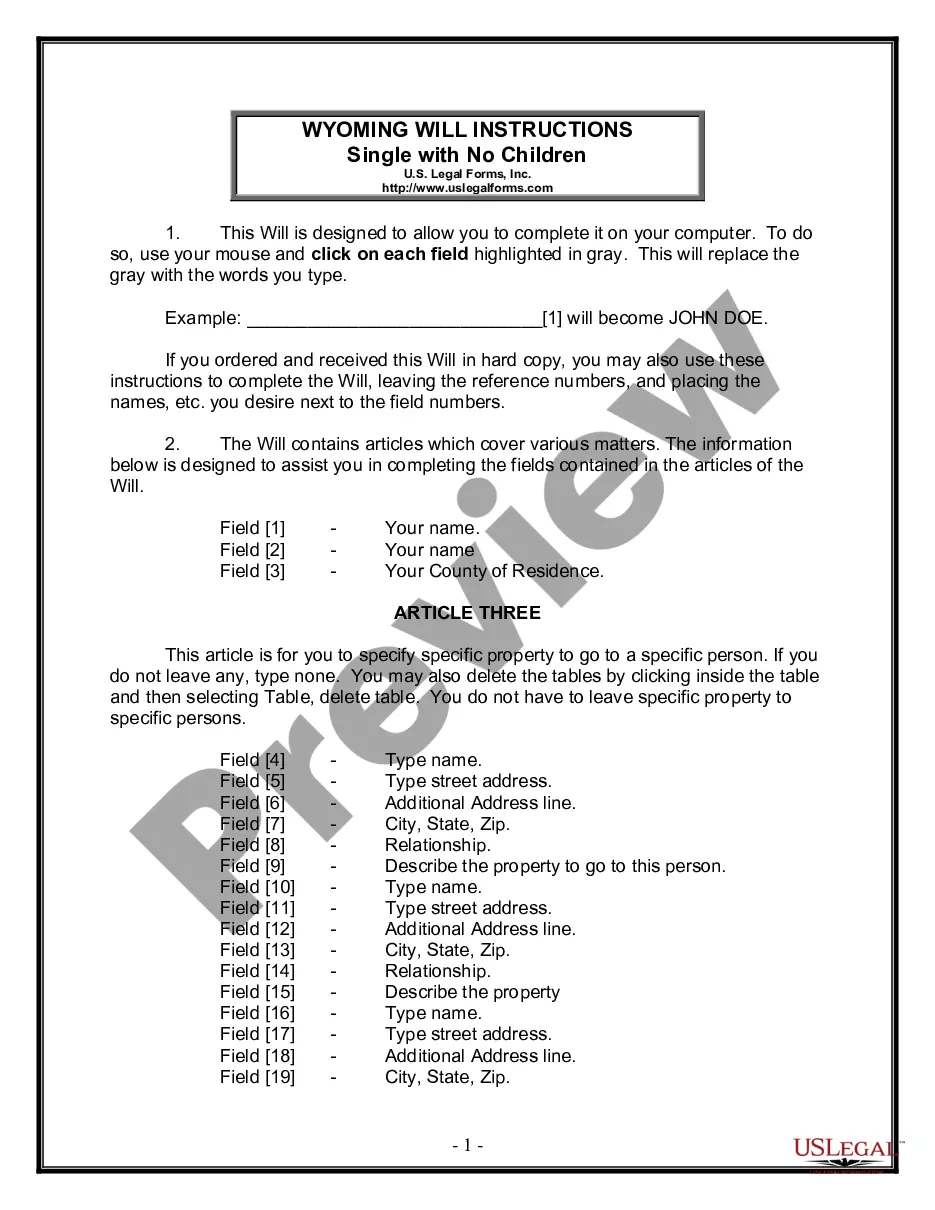

- Utilize the Preview function and read the form description (if available) to ensure that it is the appropriate document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the correct template for your state and situation.

- Use the Search field at the top of the site if you need to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your document in a needed format to complete, create a hard copy, and sign the document.

When you have followed the step-by-step guidelines above, you'll always be capable of log in and download whatever file you require for whatever state you require it in. With US Legal Forms, completing Sale of Partnership to Corporation samples or any other legal paperwork is not hard. Get going now, and don't forget to look at your examples with accredited attorneys!

Form popularity

FAQ

Partnerships are not taxed on the company's income, but each partner is taxed on their individual share of business profits.Most businesses begin as sole-proprietorships or partnerships, and eventually incorporate to protect the owners.

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

The sale of an entire partnership business generally takes one of two forms: the partners sell all of their partnership interests, or. the partnership sells some or all of its assets, and distributes the cash and any remaining property to the partners.

A partner may withdraw from a partnership by either sale or liquidation of their interest. The former is taxable. The seller-partner will recognize ordinary income to the extent that the gain from the sale of their interest is attributable to unrealized receivables and inventory.

An LLC can transition to a corporation, but conversion might mean more paperwork and taxes. If the owners of your LLC agree, you can convert your company to a corporation. Some states have a streamlined process that allows you to easily transition your LLC to a corporation.

As stated above, conversion from a partnership to a corporate status can be done by liquidating (dissolving) the current business entity or by transferring ownership of the current entity over to the corporation.Second, the partnership may liquidate by contributing partnership assets to the new corporate entity.

By default, LLCs with more than one member are treated as partnerships and taxed under Subchapter K of the Internal Revenue Code.And, once it has elected to be taxed as a corporation, an LLC can file a Form 2553, Election by a Small Business Corporation, to elect tax treatment as an S corporation.

Buyouts over time agree that the purchasing partner will pay the bought out partner a predetermined amount over time until their ownership has been fully purchased. Similarly, an earn-out pays the partner out over time but requires the partner to stay with the company during a defined transition period.

For federal tax purposes, you can simply make an election for the LLC to be taxed as an S Corporation. All you need to do is fill out a form and send it to the IRS. Once the LLC is classified for federal tax purposes as a Corporation, it can file Form 2553 to be taxed as an S Corporation.