Right of First Refusal Clause for Shareholders' Agreement

Description Right Of First Refusal Clause

How to fill out Right First Refusal?

Aren't you tired of choosing from countless samples every time you want to create a Right of First Refusal Clause for Shareholders' Agreement? US Legal Forms eliminates the wasted time countless American people spend exploring the internet for ideal tax and legal forms. Our skilled team of attorneys is constantly updating the state-specific Forms library, so that it always provides the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have a subscription need to complete a few simple actions before having the ability to get access to their Right of First Refusal Clause for Shareholders' Agreement:

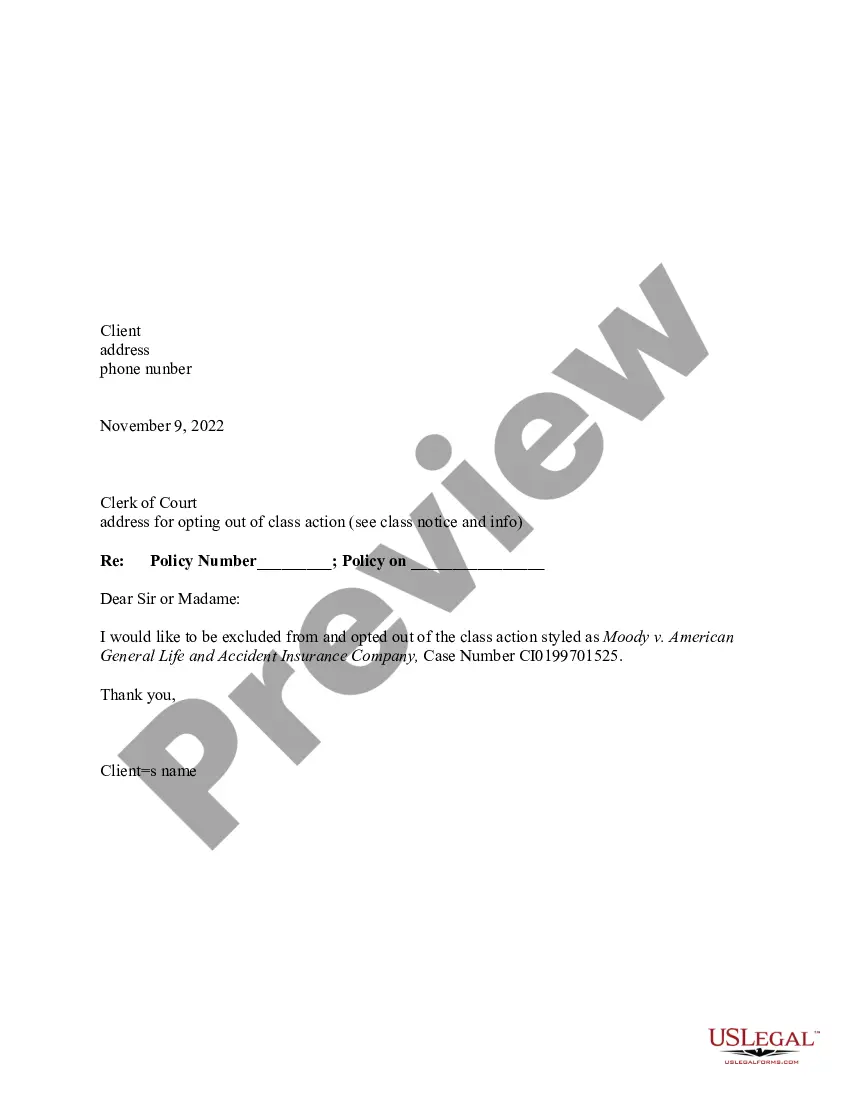

- Utilize the Preview function and look at the form description (if available) to ensure that it is the proper document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct sample for the state and situation.

- Make use of the Search field on top of the web page if you have to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your document in a convenient format to finish, print, and sign the document.

After you have followed the step-by-step instructions above, you'll always be capable of log in and download whatever file you require for whatever state you want it in. With US Legal Forms, finishing Right of First Refusal Clause for Shareholders' Agreement templates or other official documents is not difficult. Get going now, and don't forget to double-check your samples with certified attorneys!

Right First Refusal Clause Template Form popularity

Shareholders Agreement Form Other Form Names

First Refusal Agreement FAQ

Is a shareholders agreement legally binding? Once a shareholders agreement has been signed it should be legally binding, provided that it complies with the usual 4 aspects of a contract: offer, acceptance, consideration and an intention to create legal relations.

Is a shareholders agreement legally binding? Once a shareholders agreement has been signed it should be legally binding, provided that it complies with the usual 4 aspects of a contract: offer, acceptance, consideration and an intention to create legal relations.

Right of first refusal (ROFR), also known as first right of refusal, is a contractual right to enter into a business transaction with a person or company before anyone else can. If the party with this right declines to enter into a transaction, the obligor is free to entertain other offers.

This is because a shareholders agreement is a contract between the shareholders and as such any action taken in breach of it may lead to a right to claim damages, but will usually not affect the legal validity of the act complained of.

The common consequence is reduction of the contract price, remedy of the defect, compensation for damage and interest for delay. It is only possible to rescind the contract when the breach is fundamental. The parties may also agree on the consequences of the breach of agreement when making a contract or separately.

Introduction. Why have a Shareholders' Agreement? Identify the interests of the Shareholders. Identify Shareholder Value. Identify who will make decisions - Shareholders or Directors? Decide how the voting power of Shareholders should add up. Decide on the issues that the Shareholders' Agreement should cover.

Normally an agreement can only be changed by unanimous agreement among the shareholders or partners. A deed of variation, or an entirely new agreement, will need to be drawn up and signed by all the shareholders or partners.

Breach of the agreement in certain circumstances by a party; Expiration of a fixed term; The occurrence of an event that indicates either the success or failure of the venture;

It is also known as last look provision. A ROFR furnishes non-disposing investors with the privilege to acknowledge or reject a proposal by a selling investor after the selling investor has called for an offer for their shares from an outsider purchaser.