Disputed Open Account Settlement

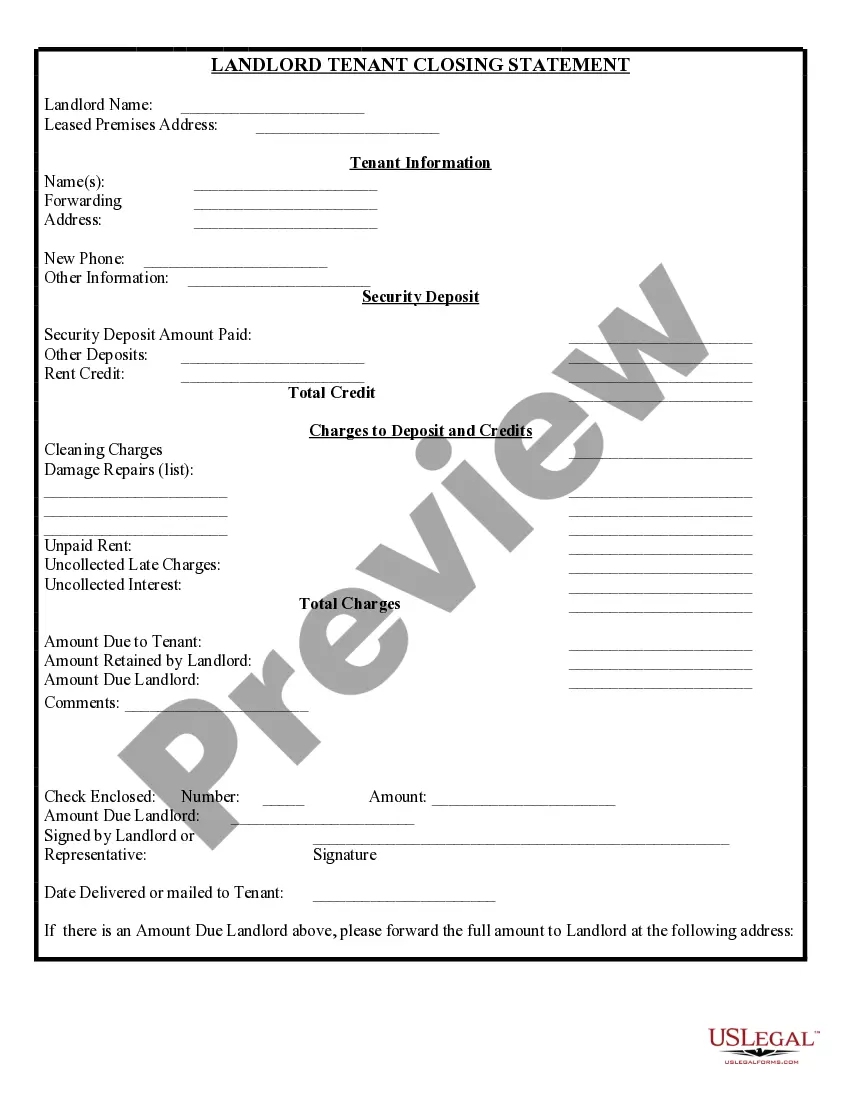

Description Disputed Settlement Statement

How to fill out Creditor Settle Parties?

Aren't you sick and tired of choosing from countless templates every time you want to create a Disputed Open Account Settlement? US Legal Forms eliminates the wasted time countless American people spend browsing the internet for ideal tax and legal forms. Our expert crew of lawyers is constantly changing the state-specific Samples catalogue, so it always offers the proper files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have an active subscription should complete simple steps before having the capability to get access to their Disputed Open Account Settlement:

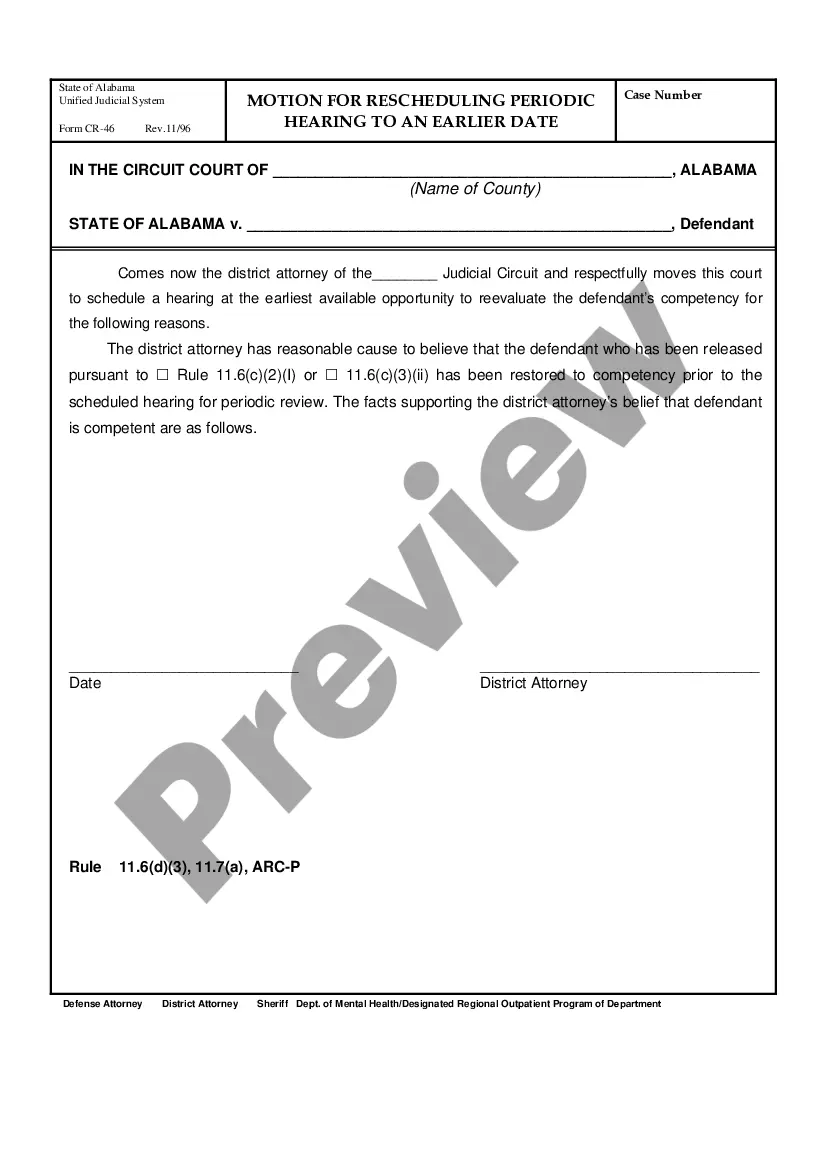

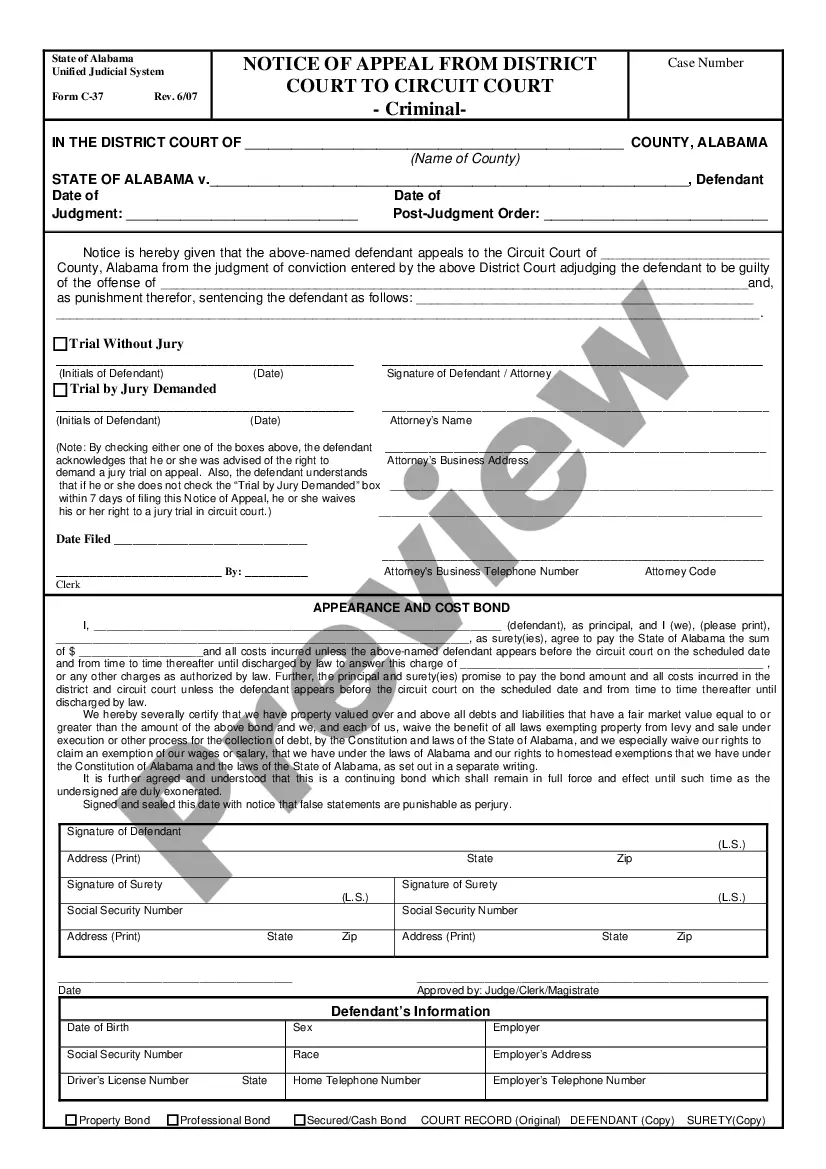

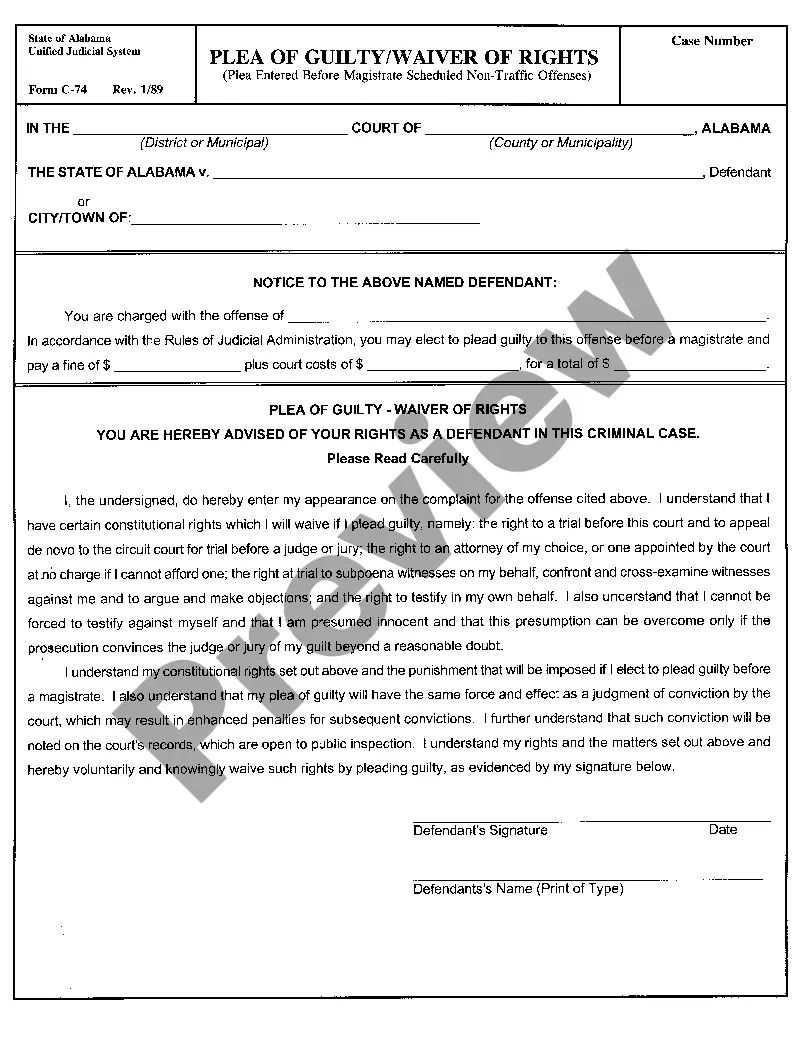

- Utilize the Preview function and read the form description (if available) to make certain that it is the proper document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the correct template for your state and situation.

- Use the Search field on top of the web page if you need to look for another document.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your file in a convenient format to finish, print, and sign the document.

When you have followed the step-by-step instructions above, you'll always be able to sign in and download whatever file you will need for whatever state you need it in. With US Legal Forms, finishing Disputed Open Account Settlement samples or any other official documents is not difficult. Begin now, and don't forget to recheck your samples with accredited lawyers!

Disputed Settlement Contract Form popularity

Settle Agreement Agrees Other Form Names

Debtor Creditor Settle FAQ

If the closed account includes negative information that's older than seven years, you can use the credit report dispute process to remove the account from your credit report.

If you have a poor and/or thin credit history, it could take 12 to 24 months from the time you settled your last debt for your credit score to recover. Either way, you'll benefit from debt settlement if that means you're no longer missing payments.

Monitor your credit report. As you begin to settle your debts, keep an eye on your credit report. Apply for new credit. Become an authorized user. Pay your bills on time and in full. Get a small loan.

Once an account has been settled or defaults it will remain on your report for six years from the date the debt was settled, written off or defaulted, whichever happened first. Live accounts will remain on your Equifax Credit Report indefinitely.

Yes, settling a debt instead of paying the full amount can affect your credit scores.Settling an account instead of paying it in full is considered negative because the creditor agreed to take a loss in accepting less than what it was owed.

Yes, settling a debt instead of paying the full amount can affect your credit scores.Settling an account instead of paying it in full is considered negative because the creditor agreed to take a loss in accepting less than what it was owed.

Try asking for pay for delete As a part of your debt settlement negotiation, you can request your creditor to remove the settlement account deleted from your report. You can suggest this in exchange by upping the amount you're offering to pay.

After finding a way to pay in full or at least some, the lender should remove the account from your credit report. Keep in mind the negative effects of the account will be removed since it is considered to be paid, but the ragged payment history will still be available on your account.

A settled account remains on your credit report for seven years from its original delinquency date.