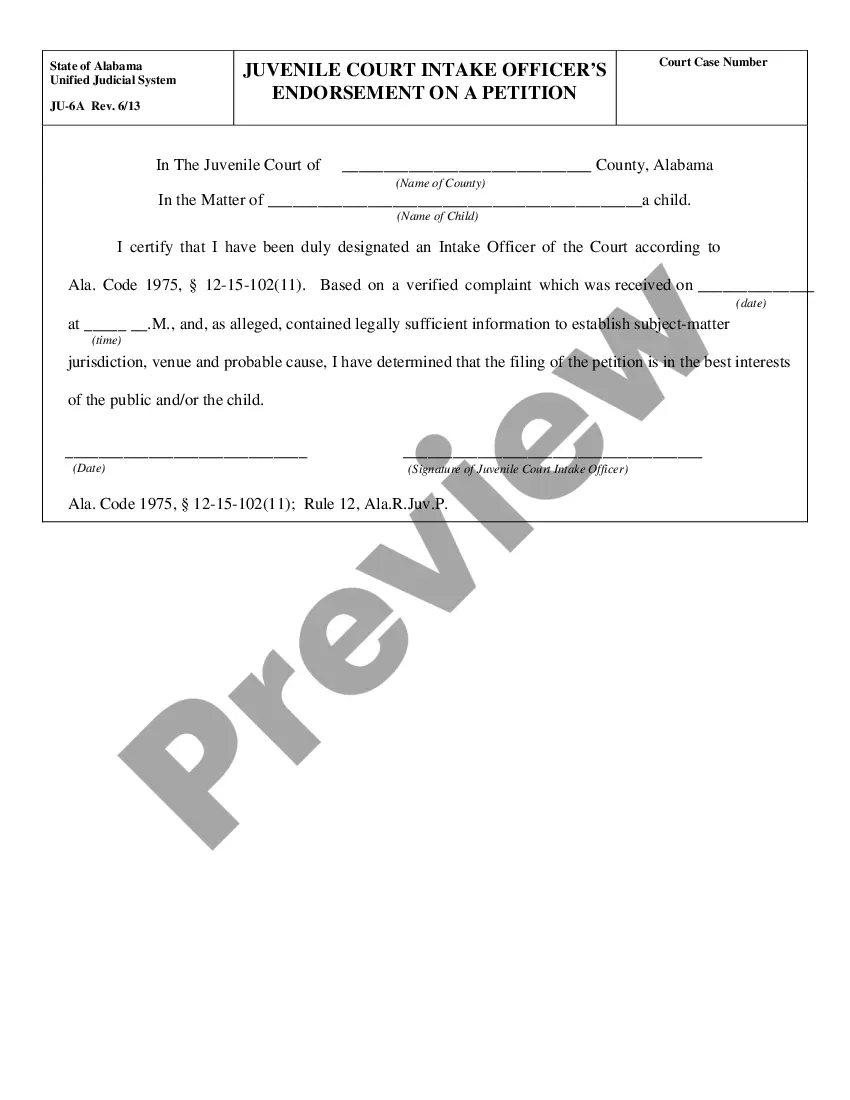

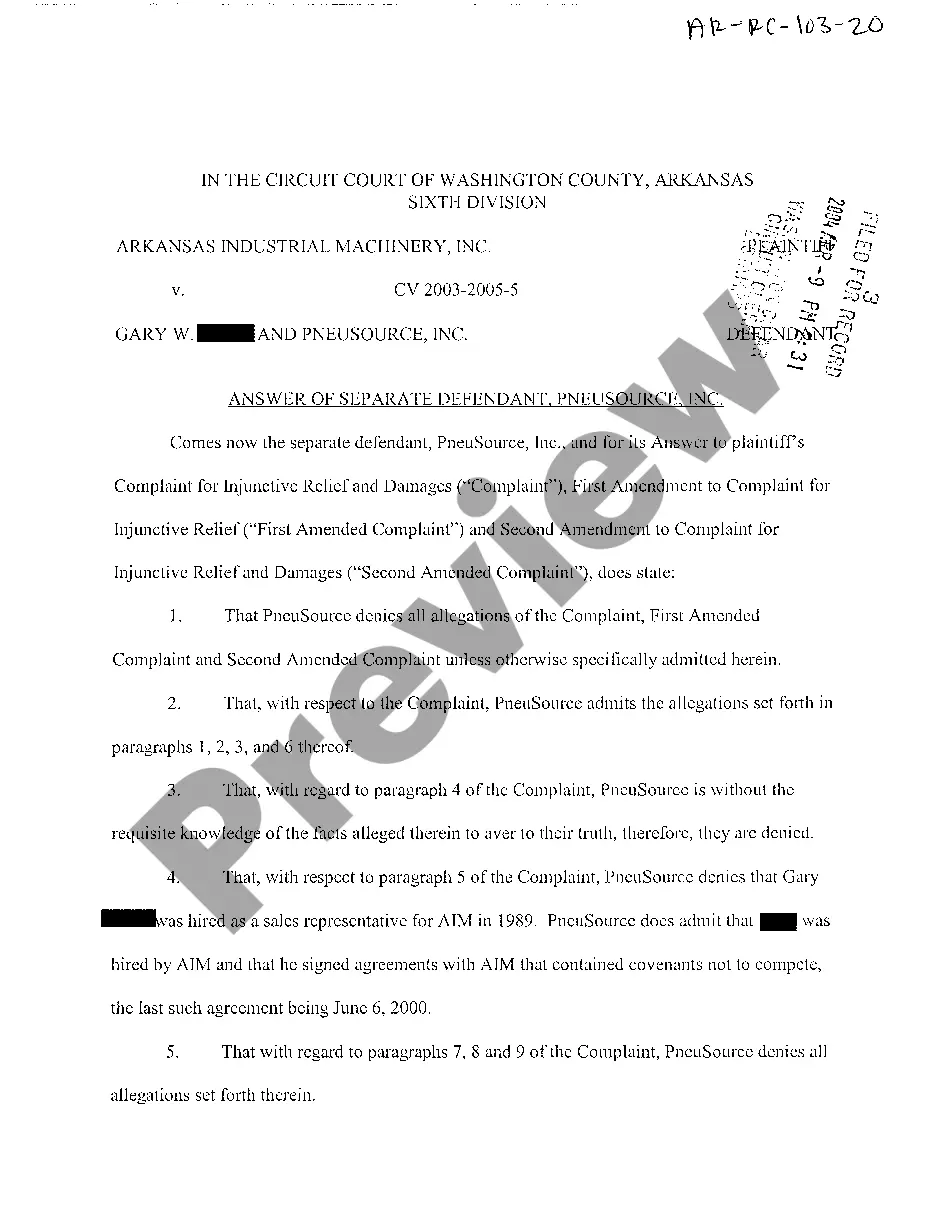

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete

Description Contract Confidentiality

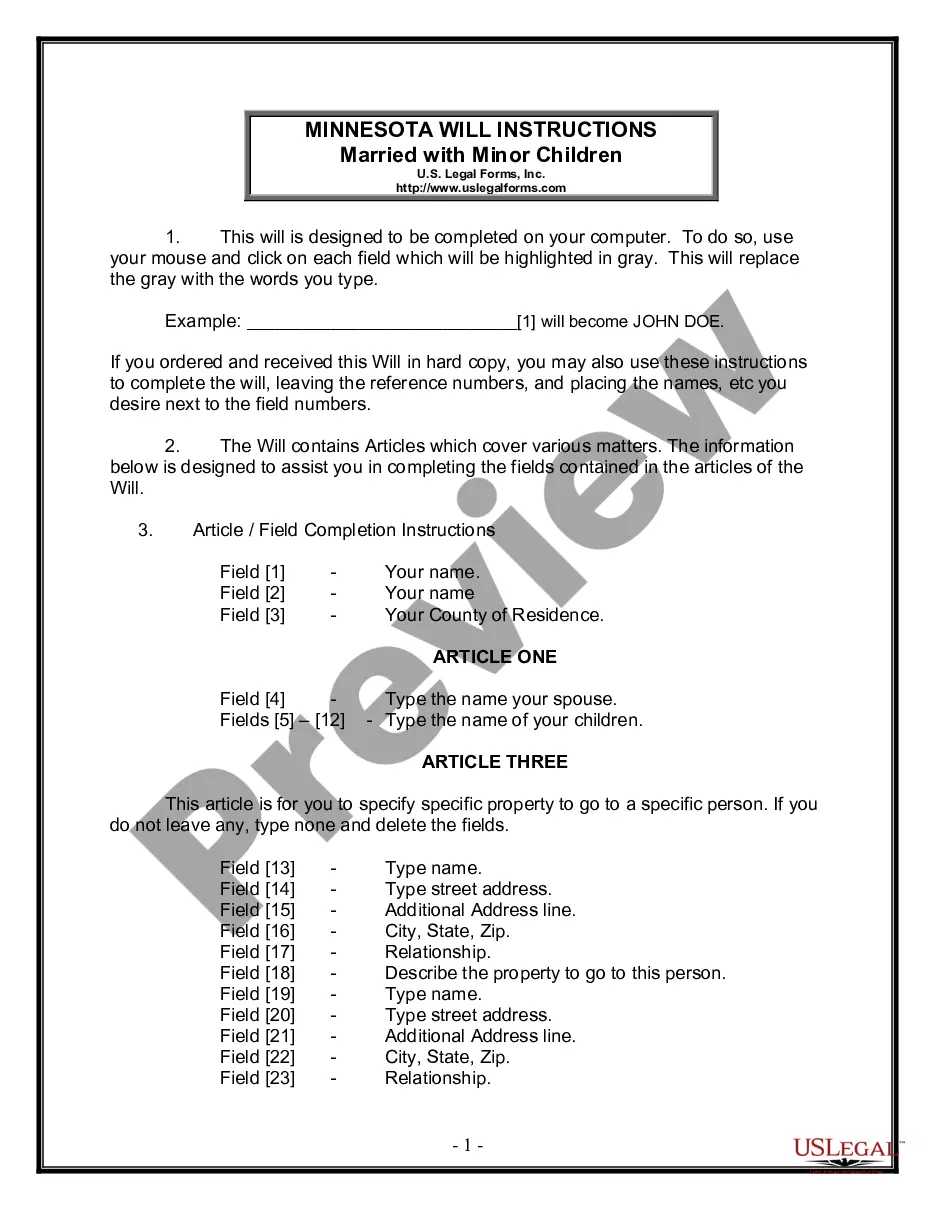

How to fill out Contractor Confidentiality Agreement Form?

Aren't you sick and tired of choosing from hundreds of samples every time you want to create a Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete? US Legal Forms eliminates the wasted time millions of American citizens spend surfing around the internet for appropriate tax and legal forms. Our skilled group of lawyers is constantly upgrading the state-specific Forms catalogue, to ensure that it always has the appropriate files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Users who don't have an active subscription need to complete a few simple actions before having the ability to get access to their Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete:

- Use the Preview function and read the form description (if available) to ensure that it is the correct document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the correct example to your state and situation.

- Use the Search field at the top of the site if you need to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your template in a needed format to complete, print, and sign the document.

After you have followed the step-by-step recommendations above, you'll always be capable of sign in and download whatever document you want for whatever state you want it in. With US Legal Forms, finishing Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete samples or any other official paperwork is simple. Get started now, and don't forget to recheck your examples with accredited attorneys!

Contract Consultant Agreement Sample Form popularity

Contract Contractor Covenant Other Form Names

Consultant Self Employed FAQ

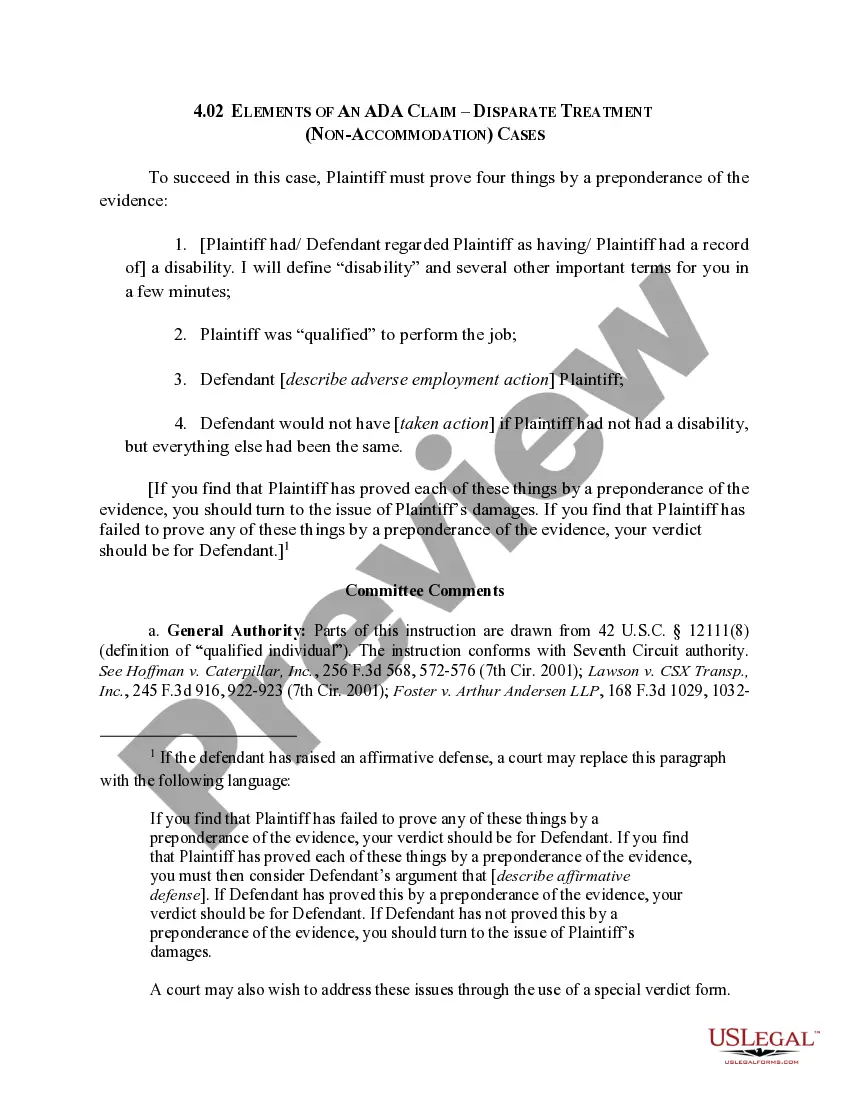

A non-compete agreement prevents your contractors and employees from going to work for a competitor prior to leaving your business. You can simply insert a non-solicitation clause to prevent contractors from stealing your clients.

If you run a small business that hires 1099 contractors, also known as independent contractors, it is vital that you have them sign an independent contractor contract. This is because there is a significant gray area between who is classified as an independent contractor and who is classified as an employee.

Do not designate someone as a 1099 Employee if: Company provides training on a certain method of job performance. Tools and materials are provided. Employees must follow set schedule. You provide benefits such as vacation, overtime pay, etc.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Noncompetition agreements are illegal in California under Ca. B&P Code §16600. It does not matter if you were an independent contractor or an employee. Noncompetition agreements are illegal.

A. No. Being labeled an independent contractor, being required to sign an agreement stating that one is an independent contractor, or being paid as an independent contractor (that is, without payroll deductions and with income reported by an IRS Form 1099 rather than a W-2), is not what determines employment status.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

1. Not Having a Written Contract.The taxing, labor and employment, and insurance authorities expect a written contract that states that the worker is an independent contractor and will be paid as such with no tax withholding, no benefits, etc.

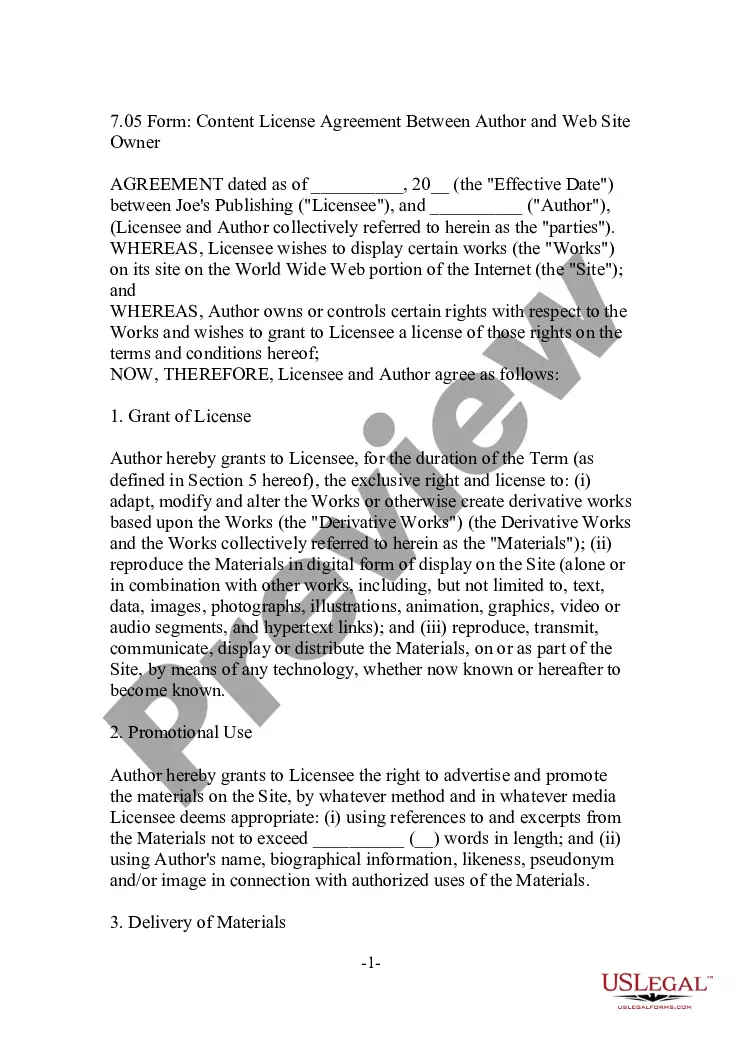

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.