Letter to Lender for Produce the Note Request

Description Lender Letter

How to fill out Letter To Lender For Produce The Note Request?

Aren't you tired of choosing from numerous templates every time you want to create a Letter to Lender for Produce the Note Request? US Legal Forms eliminates the lost time countless American people spend surfing around the internet for perfect tax and legal forms. Our skilled crew of attorneys is constantly updating the state-specific Samples collection, so that it always has the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription need to complete a few simple actions before being able to download their Letter to Lender for Produce the Note Request:

- Use the Preview function and look at the form description (if available) to be sure that it’s the best document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the correct template for the state and situation.

- Use the Search field on top of the site if you need to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your template in a convenient format to complete, print, and sign the document.

As soon as you’ve followed the step-by-step instructions above, you'll always have the capacity to log in and download whatever document you require for whatever state you need it in. With US Legal Forms, completing Letter to Lender for Produce the Note Request samples or any other official paperwork is not hard. Get started now, and don't forget to look at your samples with accredited attorneys!

Form popularity

FAQ

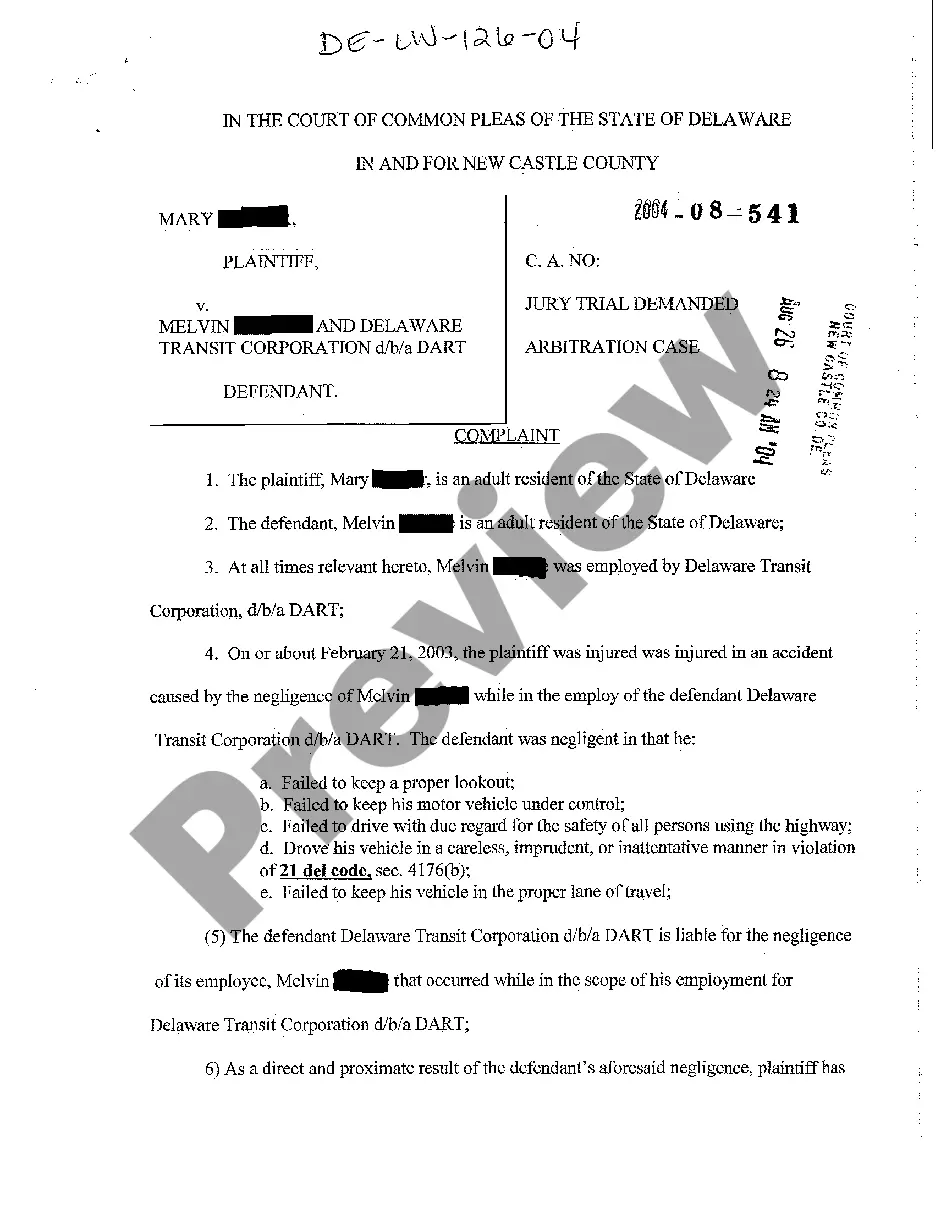

When a lender cannot produce a note, then they are not able to prove when they took ownership or assignment of the note. A court may dismiss the case as a result.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Who should sign the promissory note? In general, at least the borrower should sign the promissory note. Depending how much the parties trust each other, you may also wish to have the lender sign as well AND get the signatures notarized.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Can a lender foreclosure if they have lost the Mortgage Note? In some cases, a lender will lose the note during or before a foreclosure proceeding. When a lender cannot produce a note, then they are not able to prove when they took ownership or assignment of the note. A court may dismiss the case as a result.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

Three words of advice for strong mortgage letters of explanation: simple, short, and informative. The purpose of this letter is to provide information needed to make a decision about your loan. Be clear, with as much detail as possible, such as dates, account numbers, transaction IDs, etc.