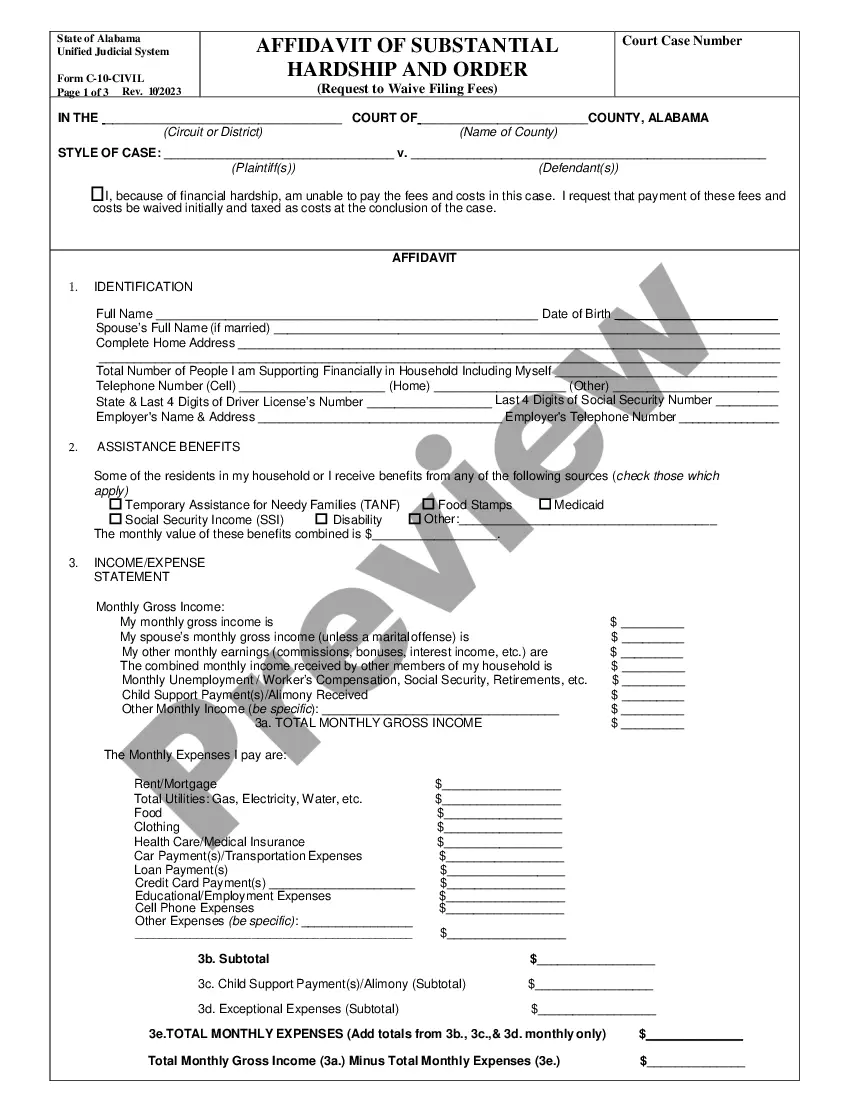

A loan workout is a series of steps taken by a lender with a borrower to resolve the problem of delinquent loan payments. Steps can include rescheduling loan payments into lower installments over a longer period of time so that the entire outstanding principal is eventually repaid. One of the items lenders often ask for during the loan workout or loan modification process is a hardship letter. A hardship letter is a written explanation as to what has caused you to fall behind on your mortgage. Some of the hardships that that lenders consider during the loan workout process are the following: Illness; Loss of Job; Reduced Income; Failed Business; Job Relocation; Death of Spouse or Co-Borrower; Incarceration; Divorce; Military Duty; and Damage to Property (e.g., natural disaster or fire).

Request to Lender or Loan Servicer for Loan Modification Due to Financial Hardship - Requesting Change to Fixed Rate of Interest of Adjustable Rate

Description

How to fill out Request To Lender Or Loan Servicer For Loan Modification Due To Financial Hardship - Requesting Change To Fixed Rate Of Interest Of Adjustable Rate?

Aren't you tired of choosing from hundreds of samples each time you want to create a Request to Lender or Loan Servicer for Loan Modification Due to Financial Hardship - Requesting Change to Fixed Rate of Interest of Adjustable Rate? US Legal Forms eliminates the lost time millions of American citizens spend exploring the internet for appropriate tax and legal forms. Our skilled team of lawyers is constantly changing the state-specific Samples catalogue, to ensure that it always provides the appropriate files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription need to complete simple steps before having the ability to get access to their Request to Lender or Loan Servicer for Loan Modification Due to Financial Hardship - Requesting Change to Fixed Rate of Interest of Adjustable Rate:

- Use the Preview function and read the form description (if available) to be sure that it’s the appropriate document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the correct example for the state and situation.

- Utilize the Search field on top of the web page if you have to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your document in a convenient format to finish, create a hard copy, and sign the document.

As soon as you have followed the step-by-step guidelines above, you'll always be capable of log in and download whatever document you need for whatever state you need it in. With US Legal Forms, finishing Request to Lender or Loan Servicer for Loan Modification Due to Financial Hardship - Requesting Change to Fixed Rate of Interest of Adjustable Rate samples or any other official documents is simple. Begin now, and don't forget to look at the examples with certified lawyers!

Form popularity

FAQ

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)

Illness or injury. Change of employment status. Loss of income. Natural disasters. Divorce. Death. Military deployment.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

Name, address, phone number, date, loan number. Short introduction asking for permission to sell your home in a short sale. Hardship details and neighborhood comparables. Assertion that the only other alternative is foreclosure.

Proof of income (pay stubs, offer letter, etc.) proof of other income (e.g., alimony, child support, disability benefits) an expense sheet laying out all your expenses. tax returns (two years worth of returns) profit and loss statement. current bank statements.

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

Hardship Examples. There are a variety of situations that may qualify as a hardship. Keep it original. Be honest. Keep it concise. Don't cast blame or shirk responsibility. Don't use jargon or fancy words. Keep your objectives in mind. Provide the creditor an action plan.

Do Not Ignore Your Lender. When facing foreclosure, your lender will likely contact you regularly. Stay in the Home. Collect Evidence. Contact a Foreclosure Defense Attorney. Contact Your Lender. Be Patient. Let Our Florida Foreclosure Defense Lawyers Help With Your Loan Modification.

Financial hardship typically refers to a situation in which a person cannot keep up with debt payments and bills or if the amount you need to pay each month is more than the amount you earn, due to a circumstance beyond your control.