Adjustable Rate Rider - Variable Rate Note

Description Round Rate Maturity

How to fill out Adjustable Note Form Trust Fillable?

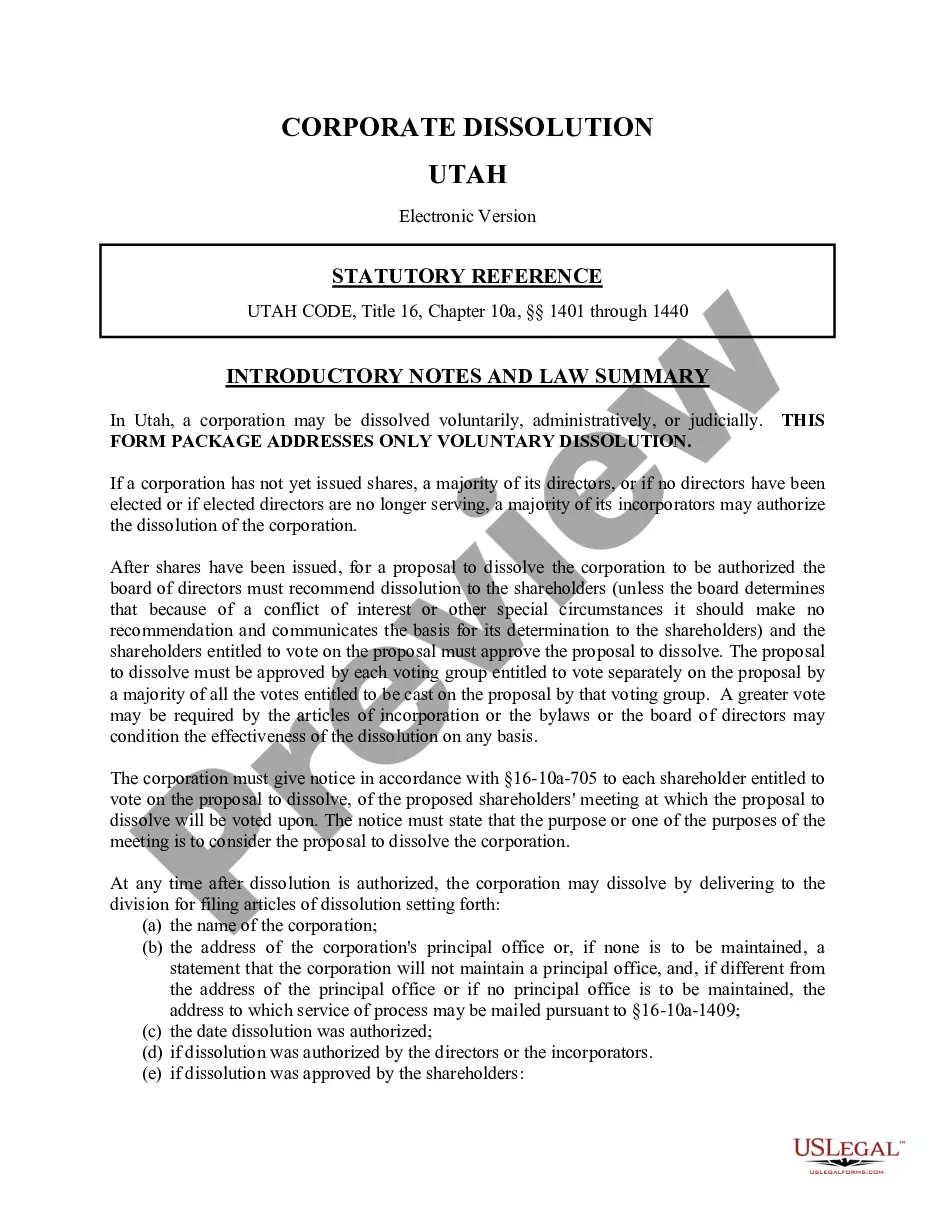

Aren't you sick and tired of choosing from hundreds of templates every time you want to create a Adjustable Rate Rider - Variable Rate Note? US Legal Forms eliminates the lost time an incredible number of American citizens spend surfing around the internet for suitable tax and legal forms. Our professional crew of lawyers is constantly upgrading the state-specific Templates collection, so that it always has the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription need to complete simple actions before being able to get access to their Adjustable Rate Rider - Variable Rate Note:

- Utilize the Preview function and look at the form description (if available) to ensure that it’s the best document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the right template to your state and situation.

- Utilize the Search field at the top of the page if you need to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your sample in a required format to complete, create a hard copy, and sign the document.

After you’ve followed the step-by-step instructions above, you'll always be capable of log in and download whatever file you require for whatever state you require it in. With US Legal Forms, finishing Adjustable Rate Rider - Variable Rate Note templates or other legal documents is simple. Get started now, and don't forget to examine your samples with certified lawyers!

Adjustable Rate Form Mortgage Form popularity

Mortgage Deed Trust Template Other Form Names

What Is An Adjustable Rate Rider FAQ

Interest caps come in two versions: A periodic adjustment cap, which limits the amount the inter- est rate can adjust up or down from one adjustment period to the next after the first adjustment, and A lifetime cap, which limits the interest-rate increase over the life of the loan.

A variable rate mortgage is one where the interest rates change with the market but the monthly payments are always the same. An adjustable rate mortgage is one where the monthly payments can change when the interest rate changes.For variable rate mortgages, more of your payment will go towards the interest.

There are two types of caps: (1) annual, and (2) life-of-the-loan. The annual cap restricts the amount your interest rate can change, up or down, in any given year, while the life-of-the-loan cap limits the maximum (and minimum) interest rate you can pay for as long as you have the mortgage.

Adjustable-rate mortgage riders explain that the interest rate on the loan will change on a set date.The terms of this rider allow a lender to collect the property rent if you default on the loan. The rent the lender collects goes toward the outstanding loan balance.

An interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price.For example, a borrower who is paying the LIBOR rate on a loan can protect himself against a rise in rates by buying a cap at 2.5%.

The index changes based on the market. Changes in the index, along with your loan's margin, determine the changes to the interest rate for an adjustable-rate mortgage loan. The lender decides which index your loan will use when you apply for the loan, and this choice generally won't change after closing.

Initial cap: Your interest rate can only change by up to 2% the first time it adjusts. Periodic cap: Each change after that is limited to 1% every 6 months. Lifetime cap: Throughout the rest of the loan term, the most the interest rate can increase or decrease is 5% from the fixed rate.

THIS NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN MY INTEREST RATE AND MY MONTHLY PAYMENT. THIS NOTE LIMITS THE AMOUNT MY INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MAXIMUM RATE I MUST PAY.

With an adjustable-rate mortgage, the initial interest rate is fixed for a period of time. After this initial period of time, the interest rate resets periodically, at yearly or even monthly intervals.The interest rate for ARMs is reset based on a benchmark or index, plus an additional spread called an ARM margin.