Most states have adopted charitable solicitation laws designed to protect donors, the general public, and charities themselves from fraud. Generally, these laws require charities and their fundraisers to register with the state, describe their fundraising activities, file financial documents, and pay a fee that covers the administrative expenses of monitoring charities. The Federal Trade Commission authorizes the filing of complaints when it has reason to believe that the law has been or is being violated, and it appears to the Commission that a proceeding is in the public interest.

Fundraising Agreement

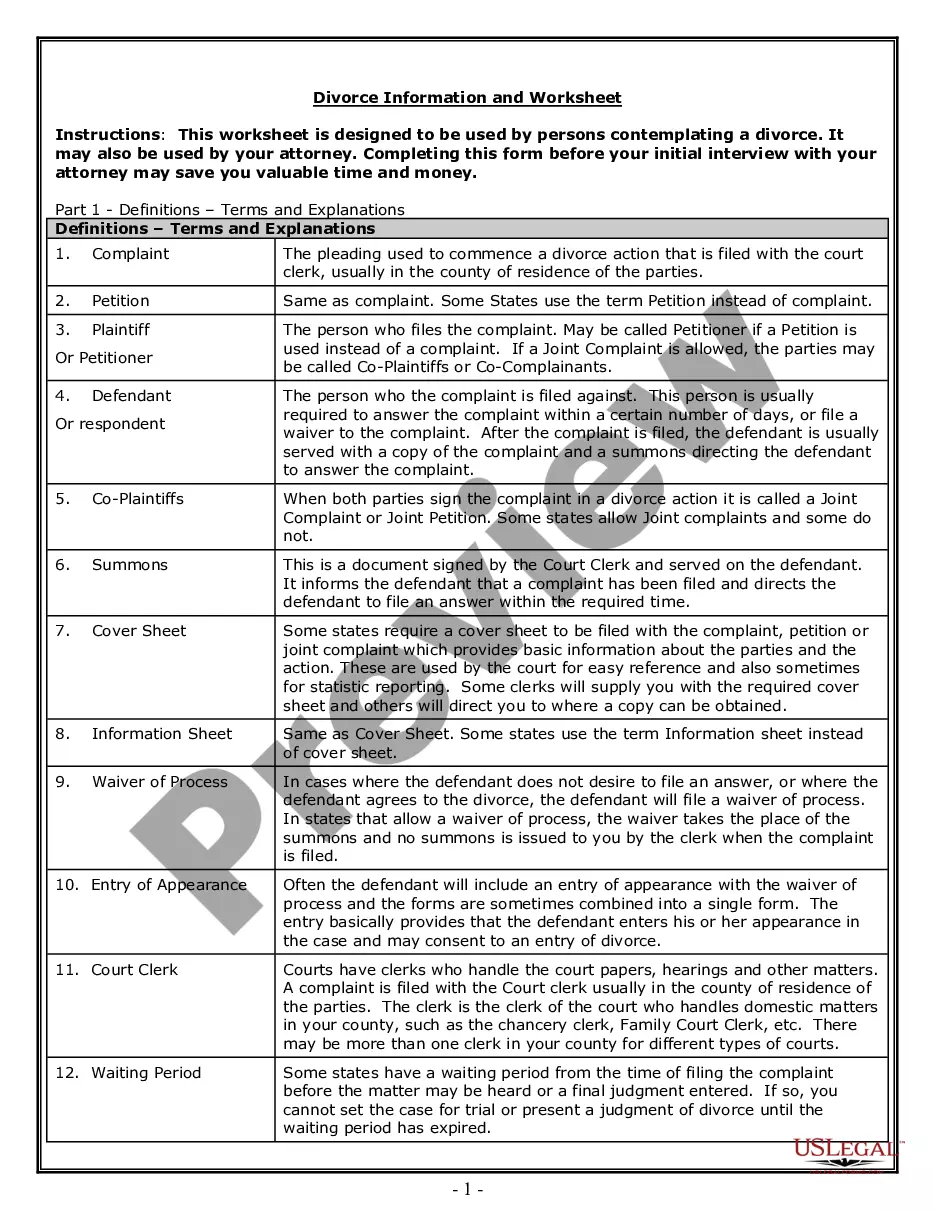

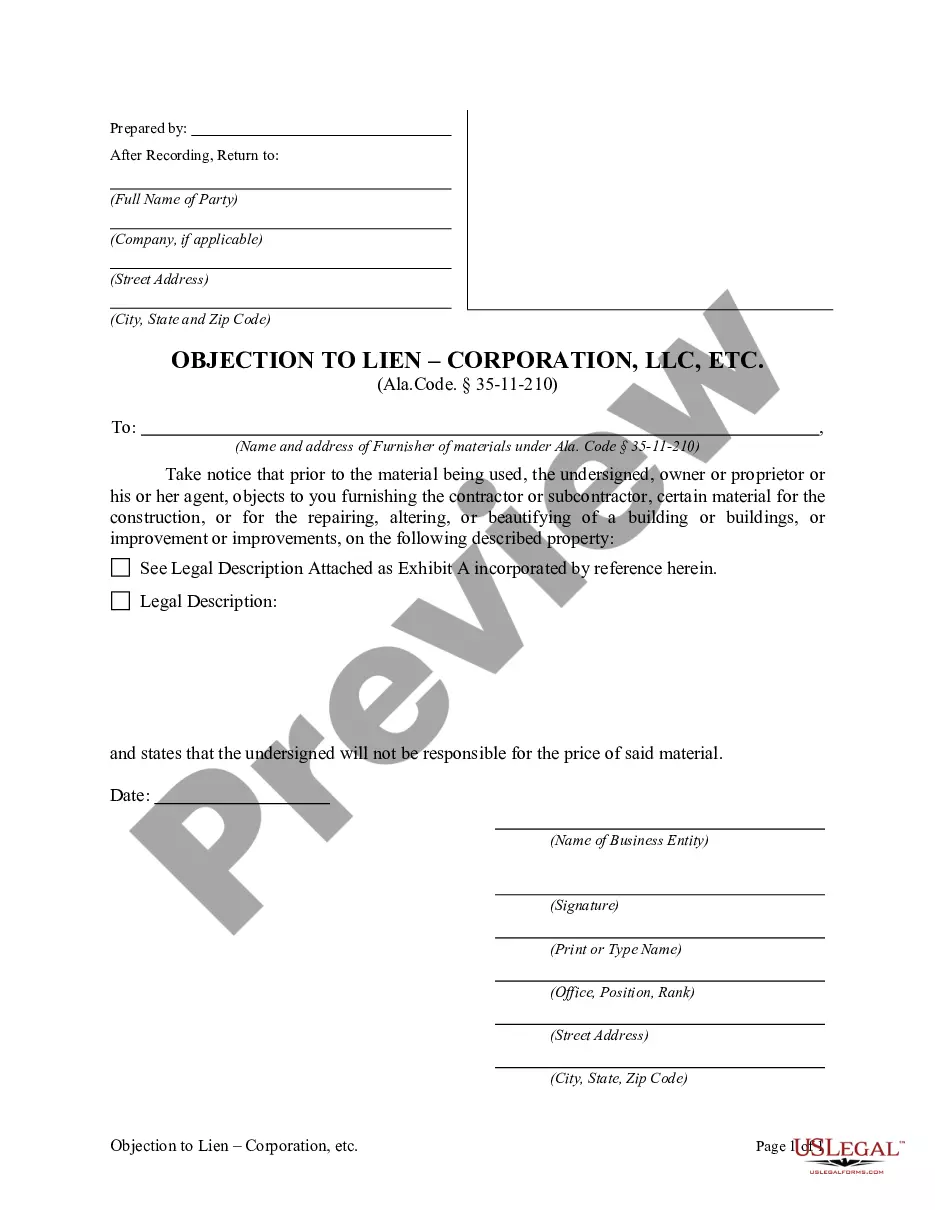

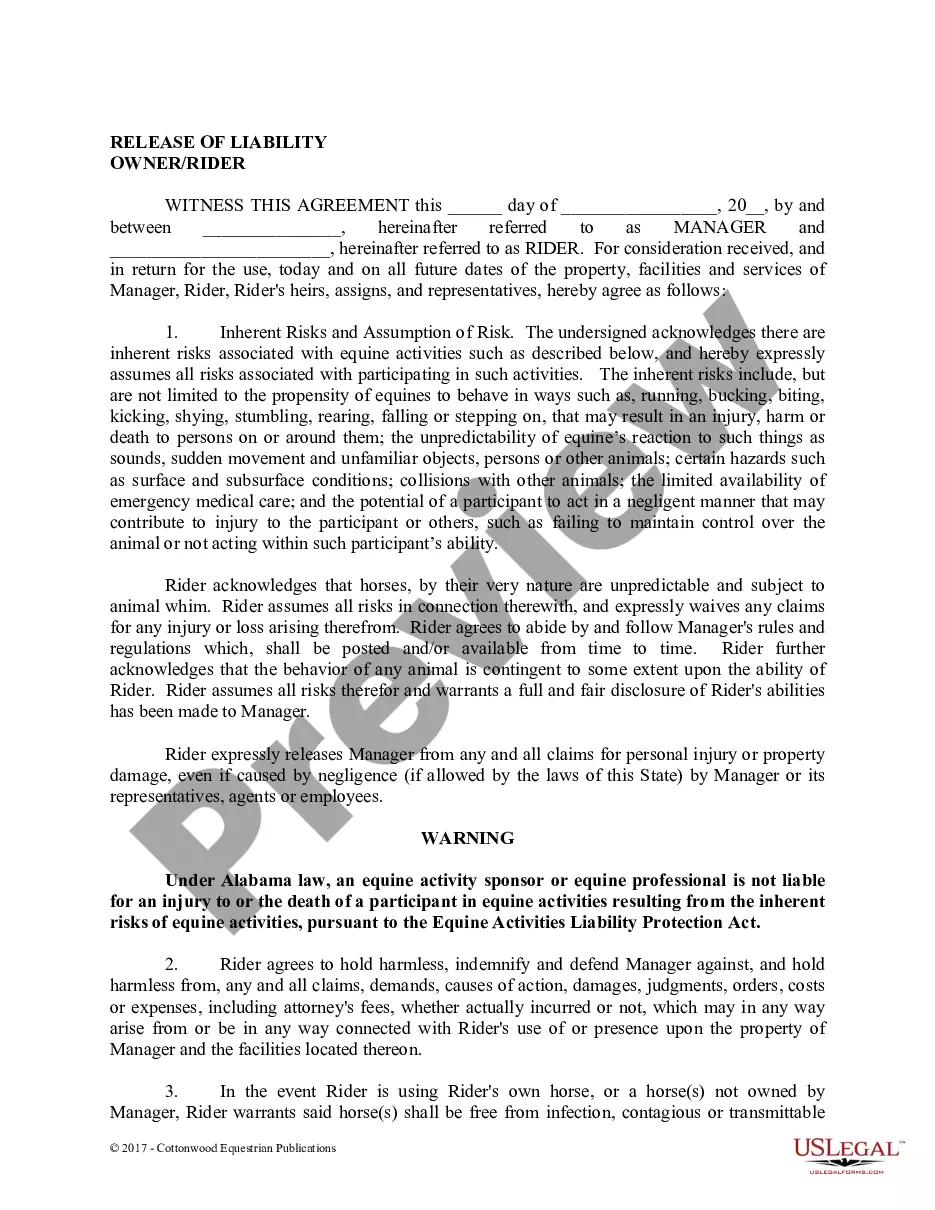

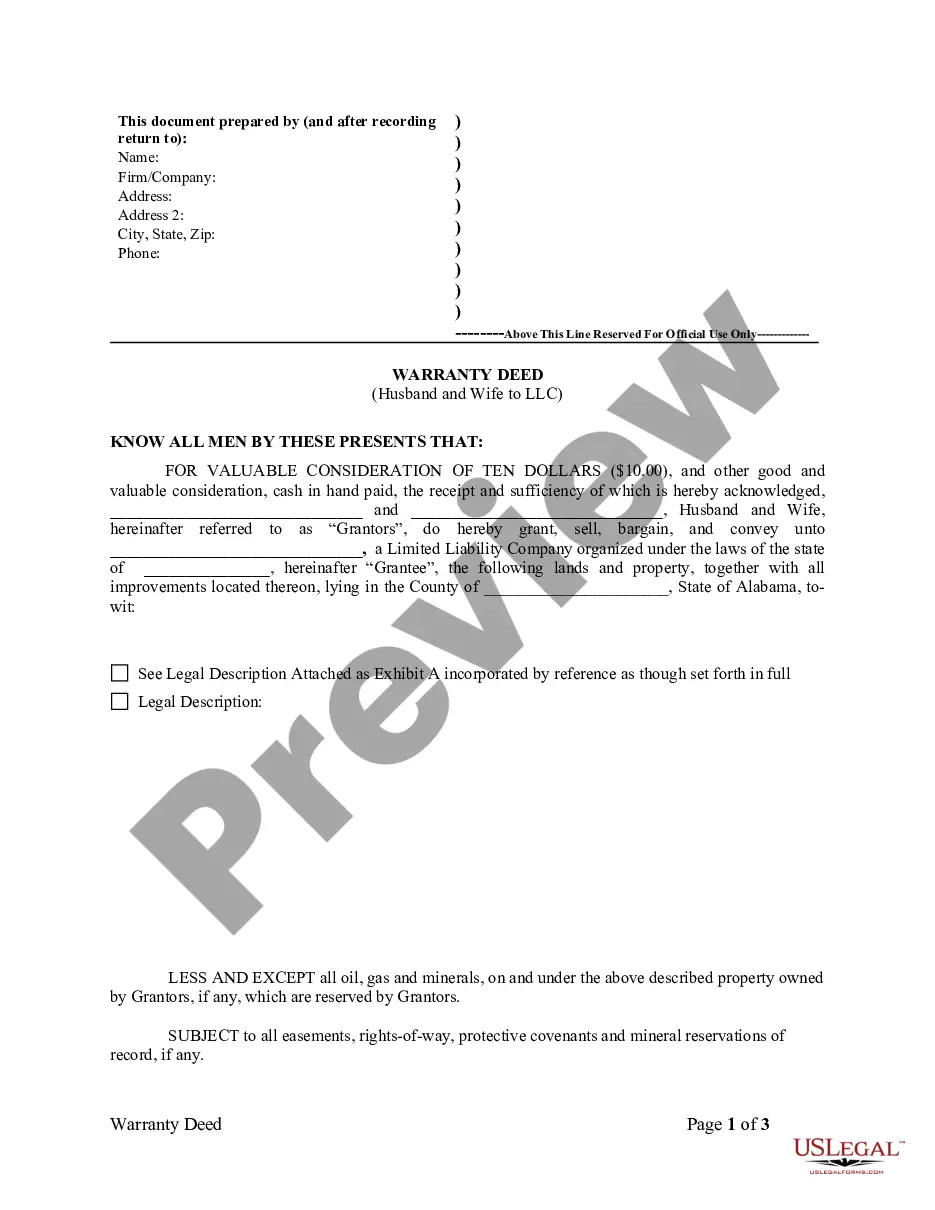

Description

How to fill out Fundraising Agreement?

Aren't you sick and tired of choosing from numerous samples every time you need to create a Fundraising Agreement? US Legal Forms eliminates the wasted time numerous American people spend exploring the internet for appropriate tax and legal forms. Our expert team of lawyers is constantly updating the state-specific Samples catalogue, to ensure that it always has the appropriate files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription should complete a few simple steps before being able to get access to their Fundraising Agreement:

- Utilize the Preview function and read the form description (if available) to make certain that it’s the correct document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct template to your state and situation.

- Utilize the Search field at the top of the site if you have to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your document in a convenient format to finish, print, and sign the document.

When you’ve followed the step-by-step instructions above, you'll always have the capacity to sign in and download whatever file you need for whatever state you need it in. With US Legal Forms, finishing Fundraising Agreement samples or other official paperwork is not hard. Get going now, and don't forget to look at the samples with certified lawyers!

Form popularity

FAQ

To Sum Up: Fundraising consultants will usually charge either a flat, retainer or hourly fee, depending on the type of project. Understand the payment structure before you sign a contract.

Fill out the Event name at the top. Fill out the date of our event. Fill out the team member name. Fill out the team member's e-mail. Fill out the phone number. Fill out the team name. Fill out the Team Captain's name. Enter the amounts from your accounting sheet in the correct column.

There are no hard and fast rules about when a not-for-profit organization may or may not pay commissions. The only guidance is the general consensus that it is ethically questionable for a not-for-profit organization to pay commissions to anyone in a fundraising capacity.

Launch Your Fundraiser. Don't worry, it's easy to start raising money for a personal cause, project, or life event! Add Images and Tell Your Unique Story. Upload pictures and images of the project, cause, or event that you're trying to raise money for to connect with your donors. Share Your Fundraiser. Say Thanks.

Can we pay our fundraiser a commission? It is NOT appropriate for a nonprofit to compensate a fundraising professional based on a percentage of the money raised. See Standard #21 of the AFP Code of Ethical Principles and Standards for professional fundraisers.

Step 1: Open the software and customize the format. Step 2: Merge rows for the header. Step 3: Mark rows and columns to make a table for the details of the products. Step 4: Make a table for the billing address.

A 15 percent fundraising expense ratio is often cited as the expected average. So let's start with the most elementary of analyses.

Attracting Individual Support and Donations. Soliciting Gifts From Major Donors. Holding a Capital Campaign. Promoting Legacy Gifts or Planned Giving.