Assignment or Sale of Interest in Limited Liability Company (LLC)

Description Assignment Interest Llc

How to fill out Sale Limited Liability Company?

Aren't you tired of choosing from hundreds of templates each time you want to create a Assignment or Sale of Interest in Limited Liability Company (LLC)? US Legal Forms eliminates the wasted time millions of American citizens spend searching the internet for ideal tax and legal forms. Our professional crew of lawyers is constantly modernizing the state-specific Samples library, to ensure that it always has the appropriate files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

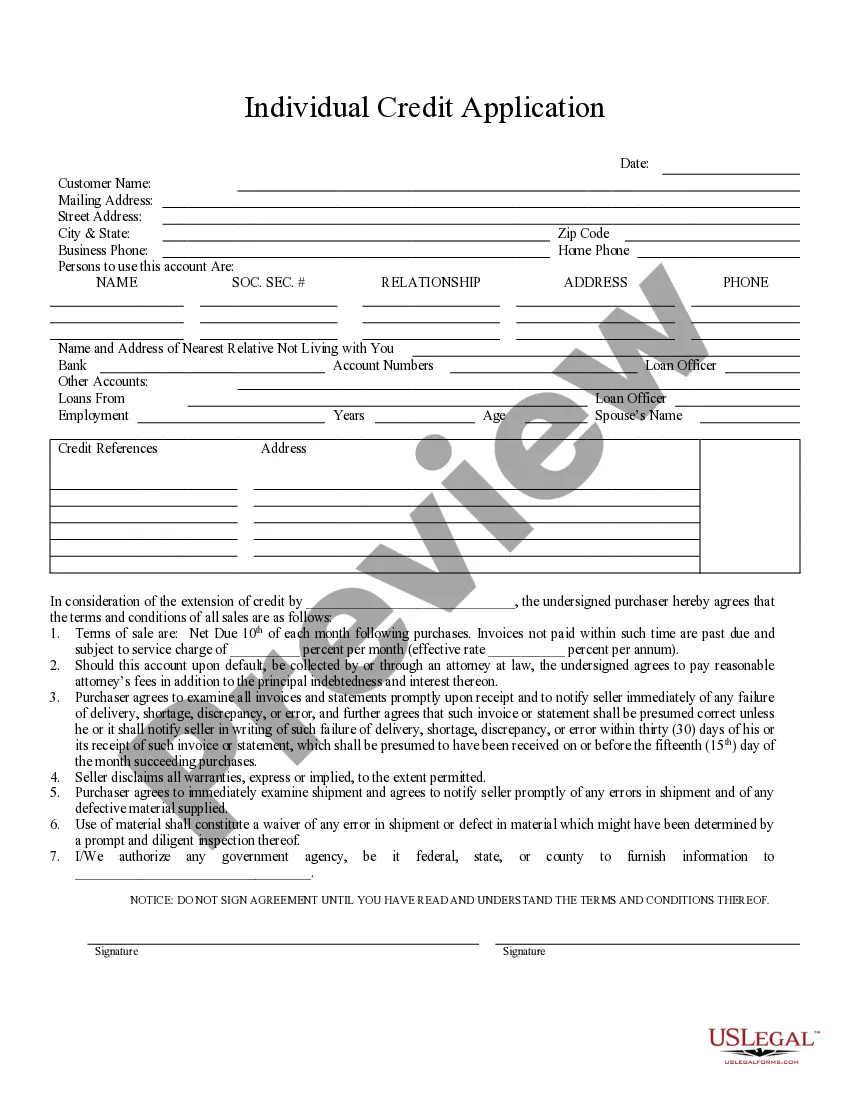

Users who don't have a subscription need to complete simple steps before being able to download their Assignment or Sale of Interest in Limited Liability Company (LLC):

- Make use of the Preview function and look at the form description (if available) to be sure that it is the proper document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the proper template to your state and situation.

- Utilize the Search field on top of the site if you want to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your file in a required format to complete, print, and sign the document.

After you’ve followed the step-by-step instructions above, you'll always have the capacity to sign in and download whatever document you want for whatever state you require it in. With US Legal Forms, finishing Assignment or Sale of Interest in Limited Liability Company (LLC) templates or other official files is simple. Begin now, and don't forget to look at the examples with certified attorneys!

Encumbrance Assignee Reflected Form popularity

Limited Liability Llc Uslegal Other Form Names

Form Llc State FAQ

On a sale of an LLC interest, the selling member will recognize gain or loss based on the difference between the amount realized and the member's tax basis in its interest.

An LLC member can usually assign some or all of their interest in the LLC. If the member assigns their entire membership interest, the person taking the interest, called the assignee, steps into the shoes of the LLC member who is transferring the interest, called the assignor.

In strictly technical terms, no LLC can sell shares. Ownership in an LLC, or limited liability company, is based on a percentage of the company not by the number of shares owned.However, in practical terms an LLC can operate very similarly to a corporation that can sell shares.

Look at the last 24 to 36 months to establish an average monthly income. Subtract the company's debts and add the amount of any cash reserves. Multiply this result by a factor mutually agreed upon by the members to get the estimated value of the company. This may vary based on the industry and the company's stability.

Review the Operating Agreement. Understand State Requirements. Determine New Member Rights. Make an Offer and Draft a Purchase Agreement. Update the Operating Agreement and Capital Accounts Ledger. Update State-Required Forms.

Under the law, no member is required to accept a devaluation of his ownership interest without his consent. So the first step in selling an ownership percentage in an LLC is to obtain the consent of all existing members to the sale.

Look to the operating agreement. An LLC is a business entity that offers the liability protections of a corporation without the complexity of a corporate structure. Follow the operating agreement's requirements. Determine the value of your interest. Complete the remaining documentation.

Assignment of interest in LLCs happens when a member communicates to other members his/her intention to transfer part or all of his ownership rights in the LLC to another entity.The member (assignor) and the person assigned (assignee) sign a document called the Membership Assignment of Interest.