A receipt is a written acknowledgment by the recipient of payment for goods, payment of a debt or receiving property from another. An acknowledgment receipt is a recipient's confirmation that the items were received by the recipient.

Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children

Description

How to fill out Receipt For Money Paid Or Expenses Incurred On Behalf Of Payor's Children?

Aren't you tired of choosing from countless samples every time you require to create a Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children? US Legal Forms eliminates the lost time millions of American people spend exploring the internet for appropriate tax and legal forms. Our expert team of attorneys is constantly updating the state-specific Templates library, so it always offers the appropriate files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have a subscription should complete simple actions before having the capability to download their Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children:

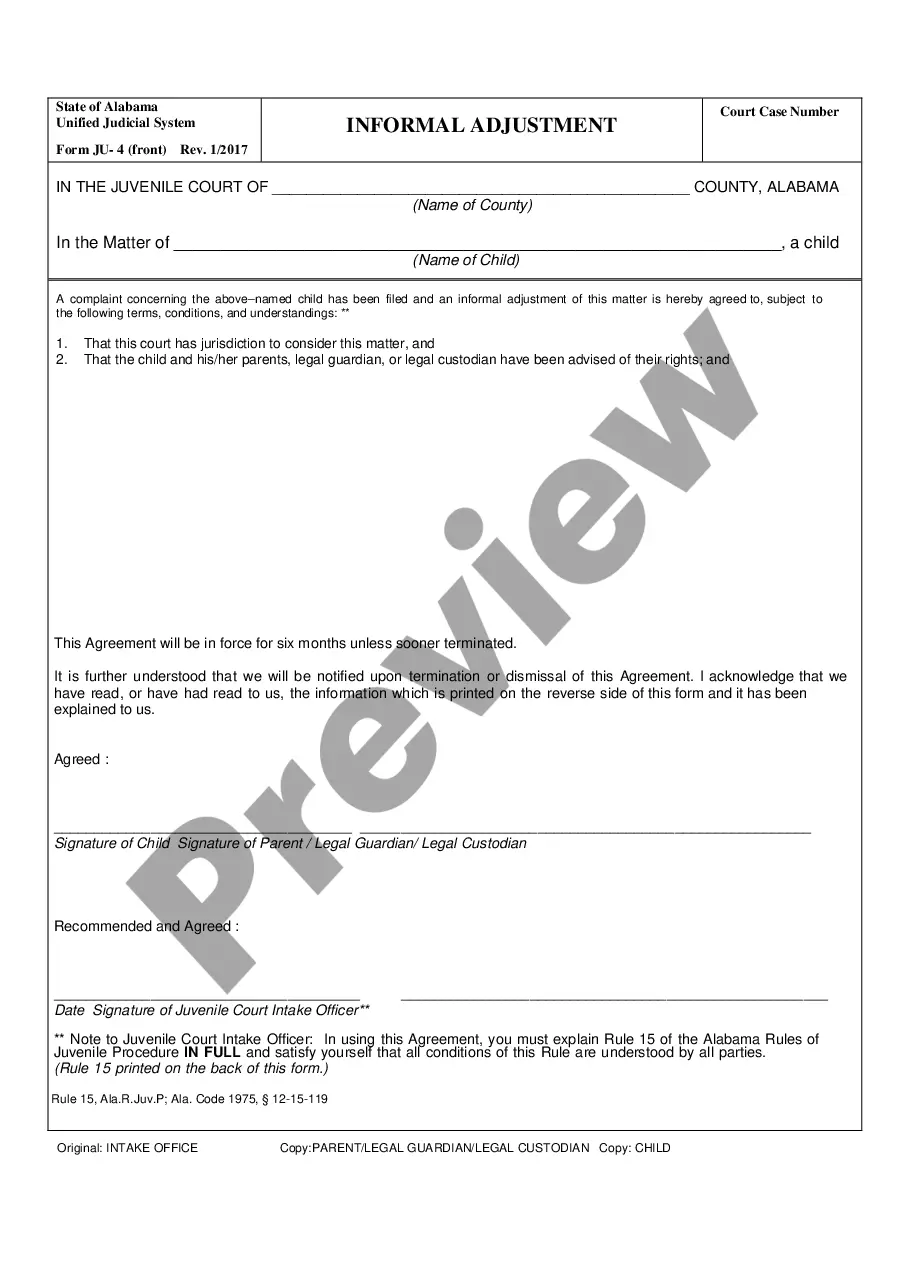

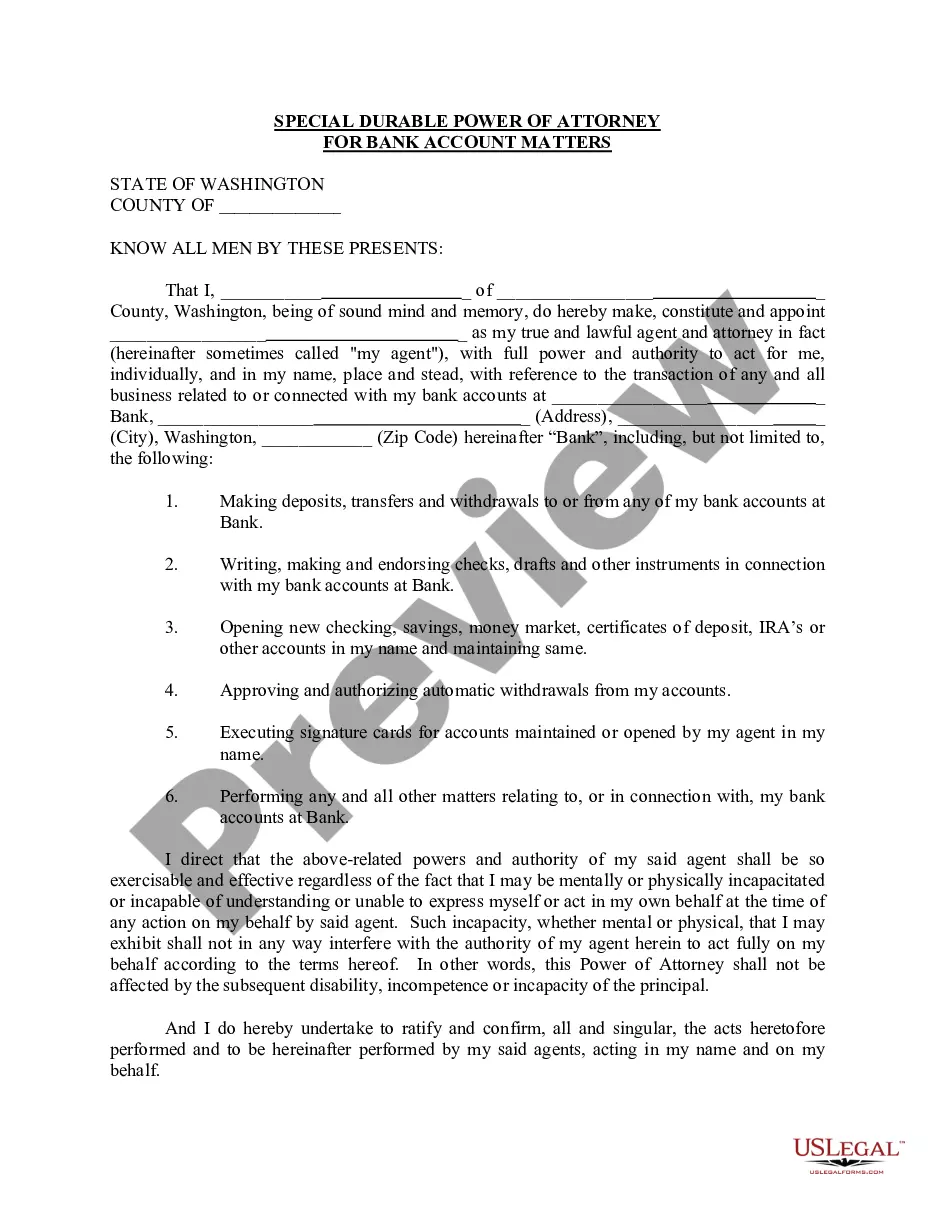

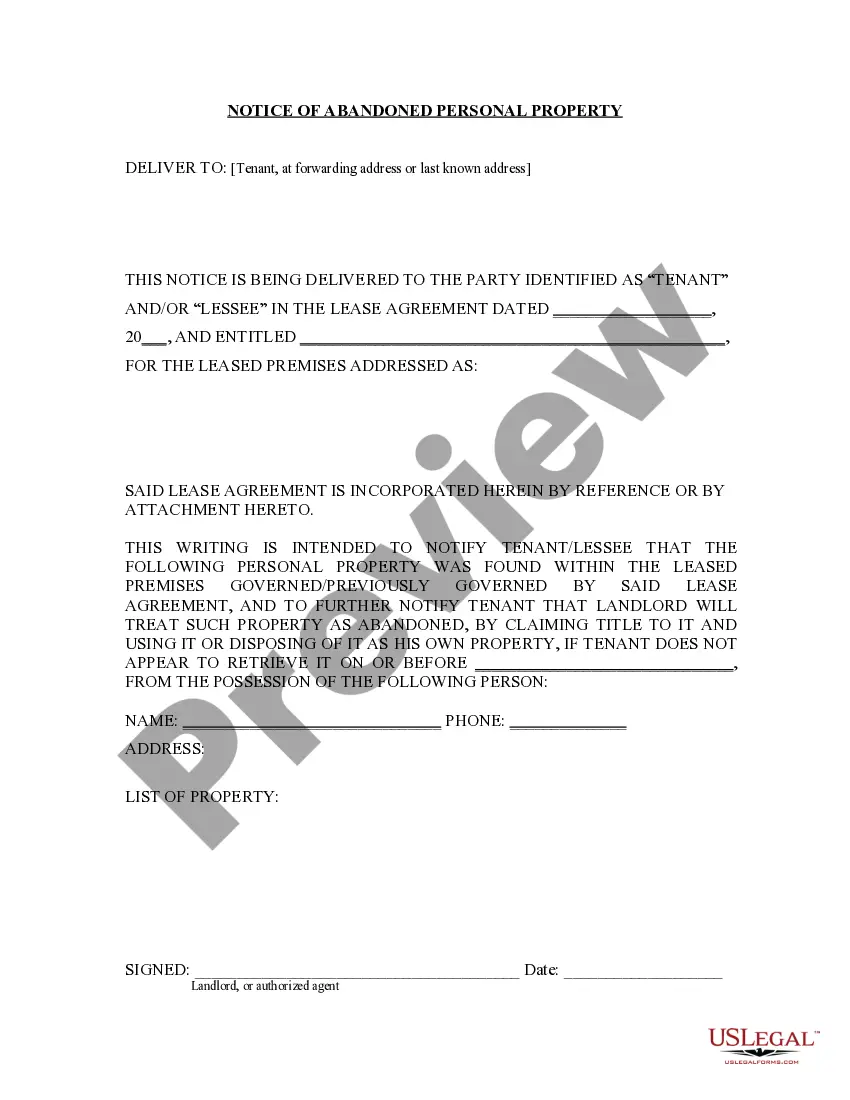

- Utilize the Preview function and read the form description (if available) to be sure that it is the best document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the correct sample for your state and situation.

- Use the Search field at the top of the webpage if you have to look for another file.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your sample in a convenient format to finish, print, and sign the document.

After you’ve followed the step-by-step instructions above, you'll always have the ability to sign in and download whatever document you require for whatever state you require it in. With US Legal Forms, finishing Receipt for Money Paid or Expenses Incurred on Behalf of Payor's Children samples or any other official files is easy. Get going now, and don't forget to double-check your examples with accredited attorneys!

Form popularity

FAQ

A bill is something you, as a customer must pay. A bill is an invoice in that it has the itemized list of products sold or services provided, along with the amount of money owed for each item, and a total amount owed.In other words, an invoice is sent, and a bill is received.

Write down the payment method and the customer's name. On the last line of the receipt write the customer's full name. If they paid by credit card, have them sign the bottom of the receipt. Then, make a copy of the receipt and keep it for your records and hand the customer the original receipt.

PIA - Payment in advance. Net 7 - Payment seven days after invoice date. Net 10 - Payment ten days after invoice date. Net 30 - Payment 30 days after invoice date. Net 60 - Payment 60 days after invoice date. Net 90 - Payment 90 days after invoice date. EOM - End of month.

An invoice is a payment demand issued by a seller to the buyer of goods or services, after the sale. It details what goods have been provided, or what work has been done, and how much must be paid in return.

The term 'Payable By Invoice' means a company bills their customer for the purchase of goods and services through invoice. The invoice includes important details like pricing for good received and services rendered, other costs, company information and a due date.

In the header section of the invoice, under Invoice Number and Invoice Date, create a line for Invoice Due. If you require payment before releasing goods or performing services, you might write, Payment due in advance. You might say that payment is Due upon receipt when the buyer receives the goods or when

The name and address of the business or individual receiving the payment. The name and address of the person making the payment. The date the payment was made. A receipt number. The amount paid. The reason for the payment. How the payment was made (credit card, cash, etc)

The date and time of the purchase. the number of items purchased and price totals. the name and location of the business the items have been bought from. Any VAT charged. method of payment. returns policy.

What Is a Payment Receipt? A payment receipt, also referred to as a receipt for payment, is an accounting document that a business provides its customer as proof of full or partial payment toward a product or service. Payment receipts typically include the following information about the transaction: Business name.