A reciprocity or reciprocal agreement is a contract that establishes an ongoing working relationship between two entities. As part of the terms of this contract, both parties pledge to share resources and assist each other in achieving the stated goals for the entities. A typical reciprocal agreement will establish what is known as a quid pro quo relationship. This simply means that each party will extend the use of resources to the other, with the understanding that this exchange is designed to allow both parties to benefit.

Reciprocal Agreement Between Homeowners Associations

Description

How to fill out Reciprocal Agreement Between Homeowners Associations?

Aren't you sick and tired of choosing from numerous samples every time you require to create a Reciprocal Agreement Between Homeowners Associations? US Legal Forms eliminates the wasted time millions of American people spend browsing the internet for appropriate tax and legal forms. Our professional group of attorneys is constantly changing the state-specific Forms library, so that it always offers the right documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription need to complete easy steps before having the ability to download their Reciprocal Agreement Between Homeowners Associations:

- Make use of the Preview function and read the form description (if available) to make sure that it is the appropriate document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the proper sample for your state and situation.

- Make use of the Search field at the top of the page if you have to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your template in a needed format to finish, create a hard copy, and sign the document.

After you have followed the step-by-step instructions above, you'll always be able to sign in and download whatever document you need for whatever state you want it in. With US Legal Forms, completing Reciprocal Agreement Between Homeowners Associations templates or any other legal paperwork is not difficult. Get started now, and don't forget to examine your samples with certified attorneys!

Form popularity

FAQ

All HOAs must file a tax return each and every year. If your HOA is among the vast majority of HOAs that has no non-exempt function expenses we invite you to learn how to prepare your own Form 1120-H.

All HOAs must file a tax return each and every year. If your HOA is among the vast majority of HOAs that has no non-exempt function expenses we invite you to learn how to prepare your own Form 1120-H.

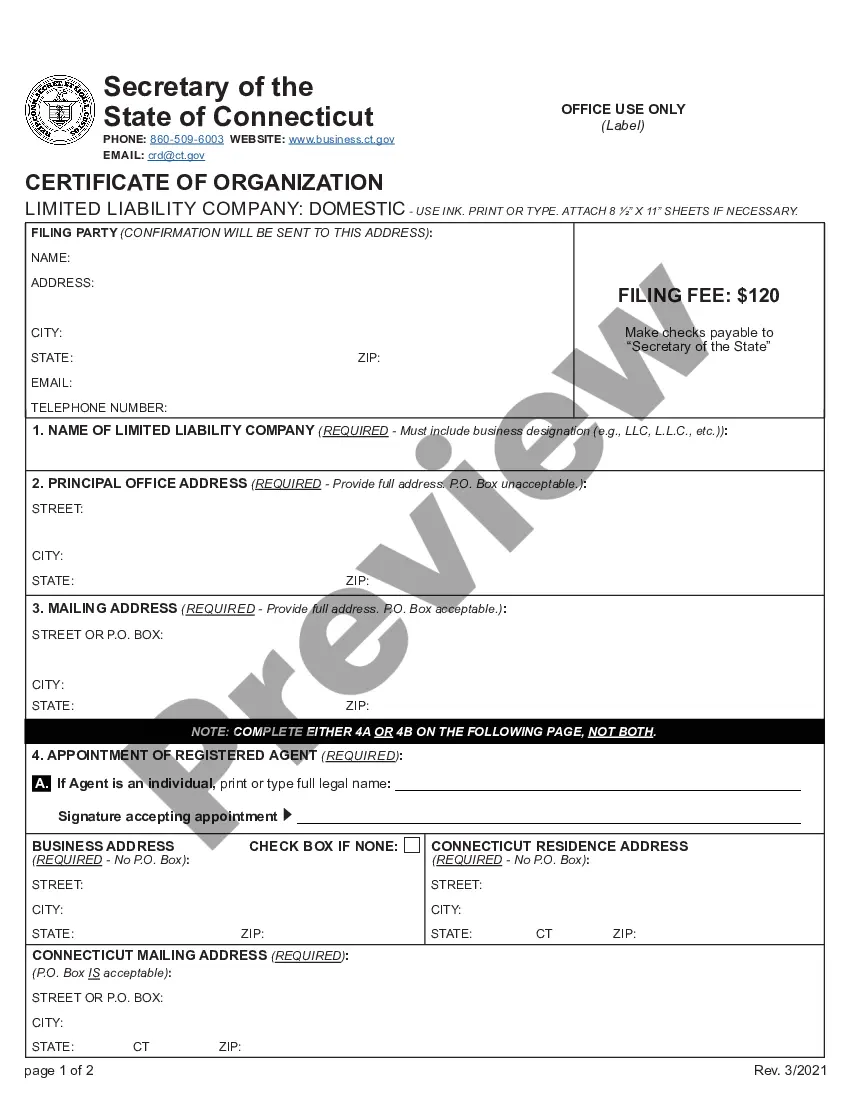

Association information. Tax year. Name. Gross Income. Dividends. Deductions. Salaries and wages. Tax and Payments. Taxable income. Signature. Signature of officer. Paid Preparer's Information. Authorization for IRS to discuss return with preparer.

At least 90% of annual expenses should be for the association's business. No private shareholder or individual should benefit from the association's earnings. At least 85% of housing units should be residential. The association must file Form 1120-H to enjoy Section 528 benefits.

Are HOAs tax exempt? Generally speaking, homeowners associations are tax-exempt. But, an HOA can apply for both federal and state income tax exemption. To qualify for federal tax exemption, an HOA would need to achieve 501(c)(4) or 501(c)(7) status.

The 1120H, U.S. Income Tax return for a Homeowners Association, cannot be electronically filed.

IRS Form 1120-H Filing Requirements At least 85% of the units are used by individuals for residential purposes. At least 60% of the gross income is derived from the membership fees, dues or assessments of owners in the association. This would also be called exempt function income.

In California, community associations are primarily nonprofit mutual benefit corporations.Even though they are nonprofit corporations, homeowner associations must file tax returns and pay taxes. Following is a summary of some of the more common 501(c) tax categories: 501(c)(3).