Most debt counselors say that it is a good idea to talk to the people to whom you owe money. If you ignore the problem it will only get worse. You may find that you are paying extra interest and your debts are just getting bigger every day. Many creditors try to be understanding and if you tell them why you are unable to pay, then they will sometimes be willing to reach a compromise.

Letter to Creditors Informing Them of Fixed Income and Financial Hardship

Description Letter Them Hardship

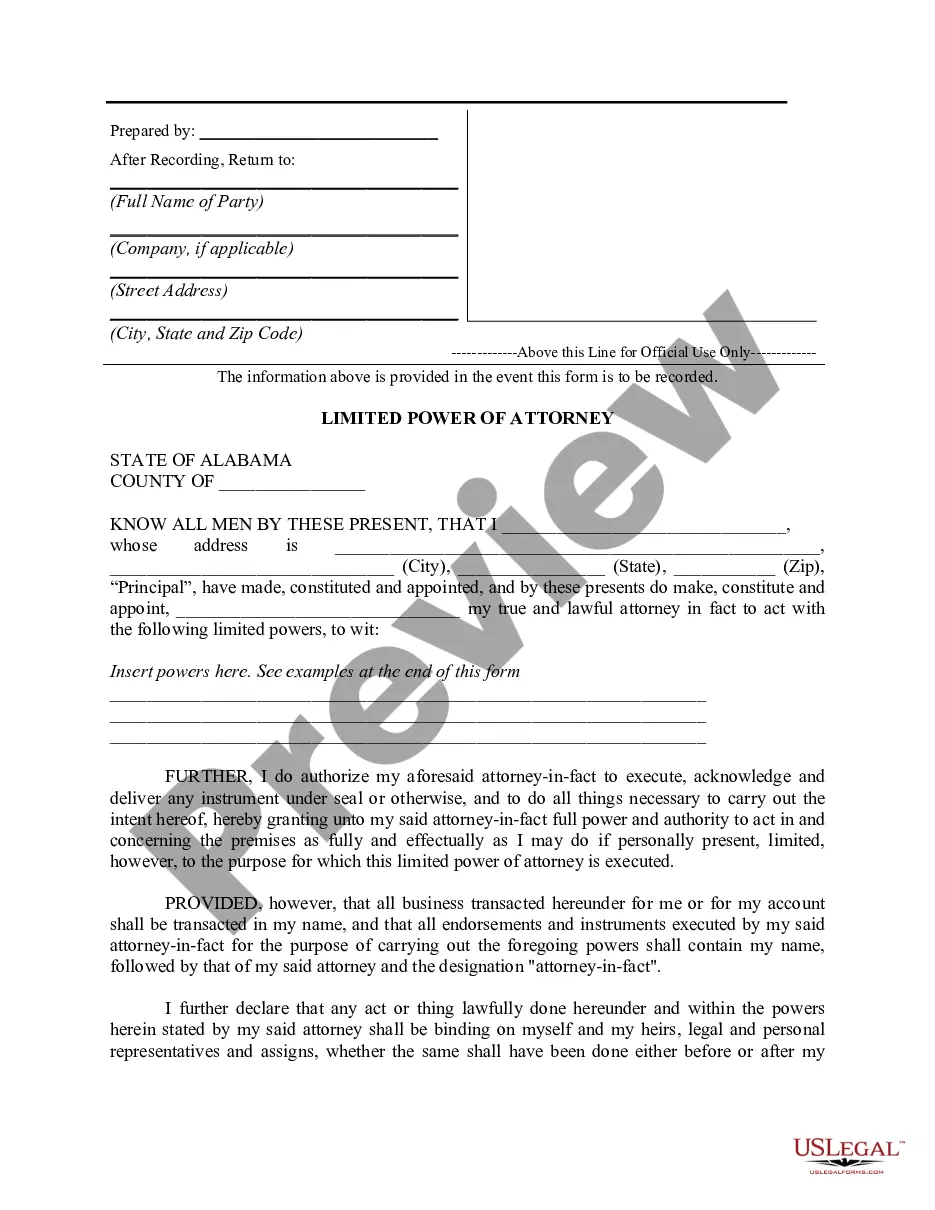

How to fill out Creditors Hardship?

Aren't you tired of choosing from countless templates every time you want to create a Letter to Creditors Informing Them of Fixed Income and Financial Hardship? US Legal Forms eliminates the wasted time countless American citizens spend surfing around the internet for perfect tax and legal forms. Our skilled crew of lawyers is constantly modernizing the state-specific Forms collection, to ensure that it always provides the right files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription need to complete easy steps before having the ability to download their Letter to Creditors Informing Them of Fixed Income and Financial Hardship:

- Utilize the Preview function and look at the form description (if available) to ensure that it is the correct document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper template to your state and situation.

- Use the Search field at the top of the page if you need to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your file in a convenient format to finish, print, and sign the document.

After you’ve followed the step-by-step guidelines above, you'll always have the ability to sign in and download whatever document you want for whatever state you need it in. With US Legal Forms, finishing Letter to Creditors Informing Them of Fixed Income and Financial Hardship templates or other legal paperwork is not difficult. Get going now, and don't forget to double-check your samples with accredited attorneys!

Letter Hardship Form Form popularity

Letter Creditors Document Other Form Names

Creditors Financial Hardship FAQ

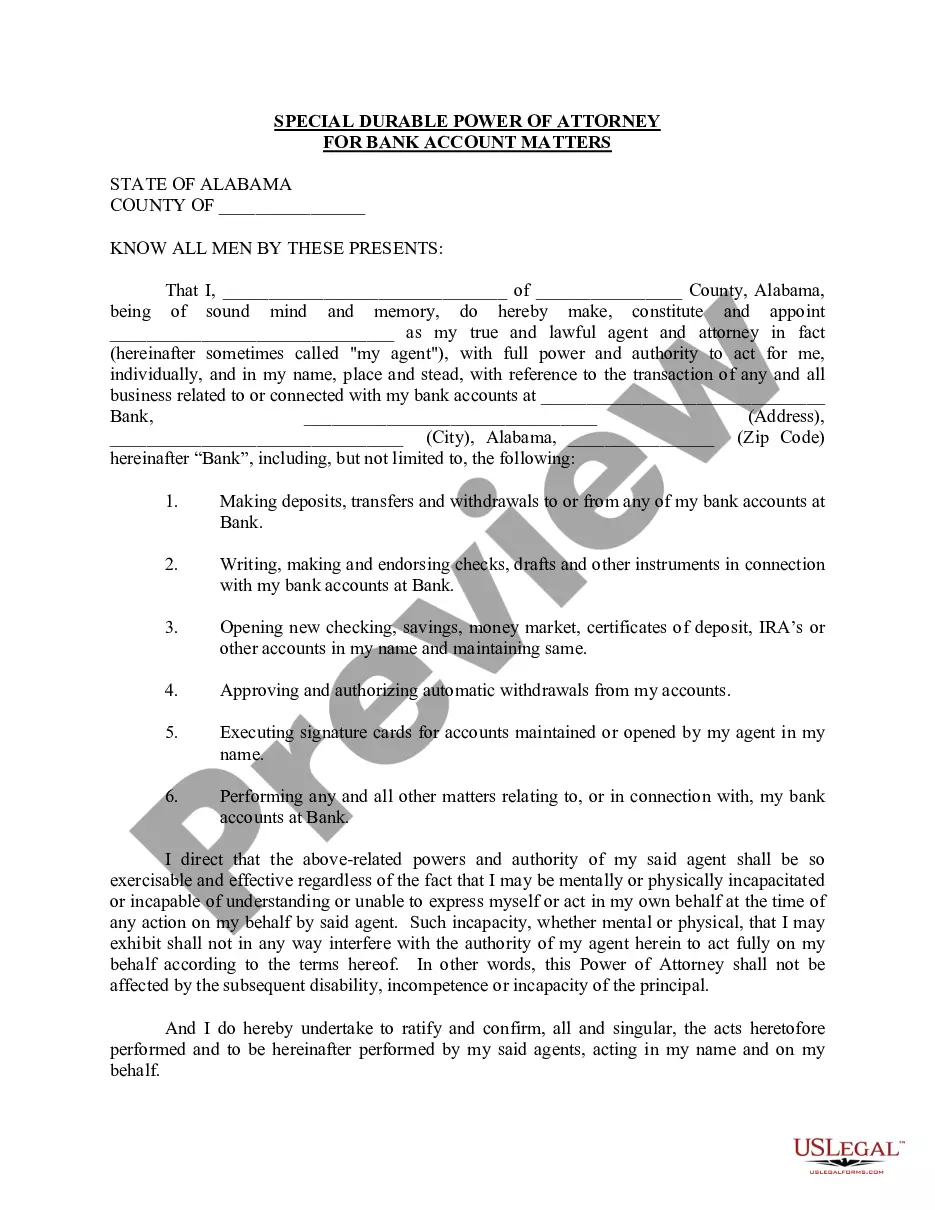

Proof of income (pay stubs, offer letter, etc.) proof of other income (e.g., alimony, child support, disability benefits) an expense sheet laying out all your expenses. tax returns (two years worth of returns) profit and loss statement. current bank statements.

Financial hardship typically refers to a situation in which a person cannot keep up with debt payments and bills or if the amount you need to pay each month is more than the amount you earn, due to a circumstance beyond your control.

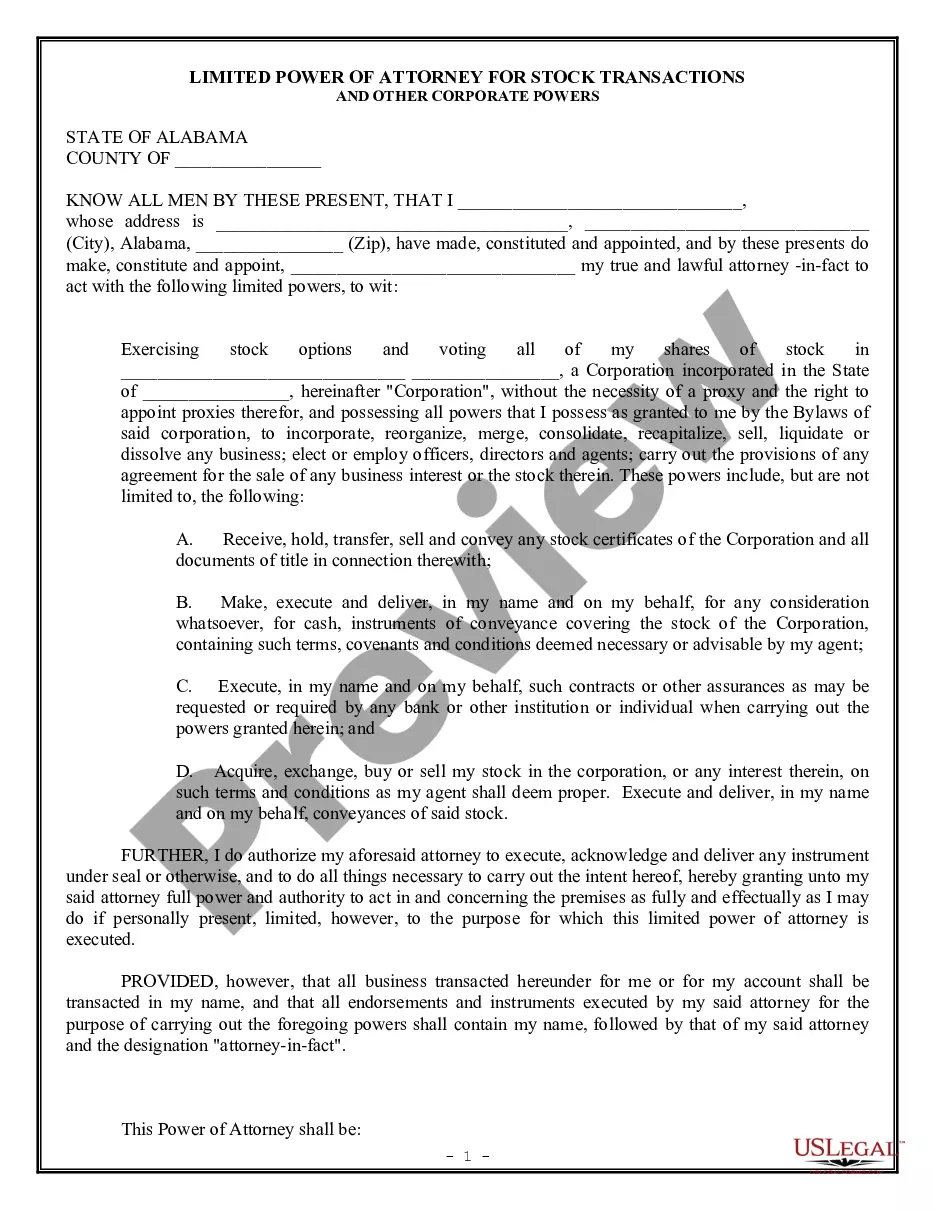

Name, address, phone number, date, loan number. Short introduction asking for permission to sell your home in a short sale. Hardship details and neighborhood comparables. Assertion that the only other alternative is foreclosure.

Keep the letter concise. Typically, lenders spend less than five minutes reading a hardship letter so it's in your interest to restrict the letter to a single page. Explain your situation. Keep your request specific. Restate your request.

Keep the letter concise. Typically, lenders spend less than five minutes reading a hardship letter so it's in your interest to restrict the letter to a single page. Explain your situation. Keep your request specific. Restate your request.

Proof of income (pay stubs, offer letter, etc.) proof of other income (e.g., alimony, child support, disability benefits) an expense sheet laying out all your expenses. tax returns (two years worth of returns) profit and loss statement. current bank statements.

Keep it original. Be honest. Keep it concise. Don't cast blame or shirk responsibility. Don't use jargon or fancy words. Keep your objectives in mind. Provide the creditor an action plan. Talk to a Financial Couch.

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)

What Is A Financial Hardship Letter? A hardship letter is a letter you write to your lender to let them know about your financial difficulties. In it, you'll ask for and ask for some form of mortgage assistance or debt relief.