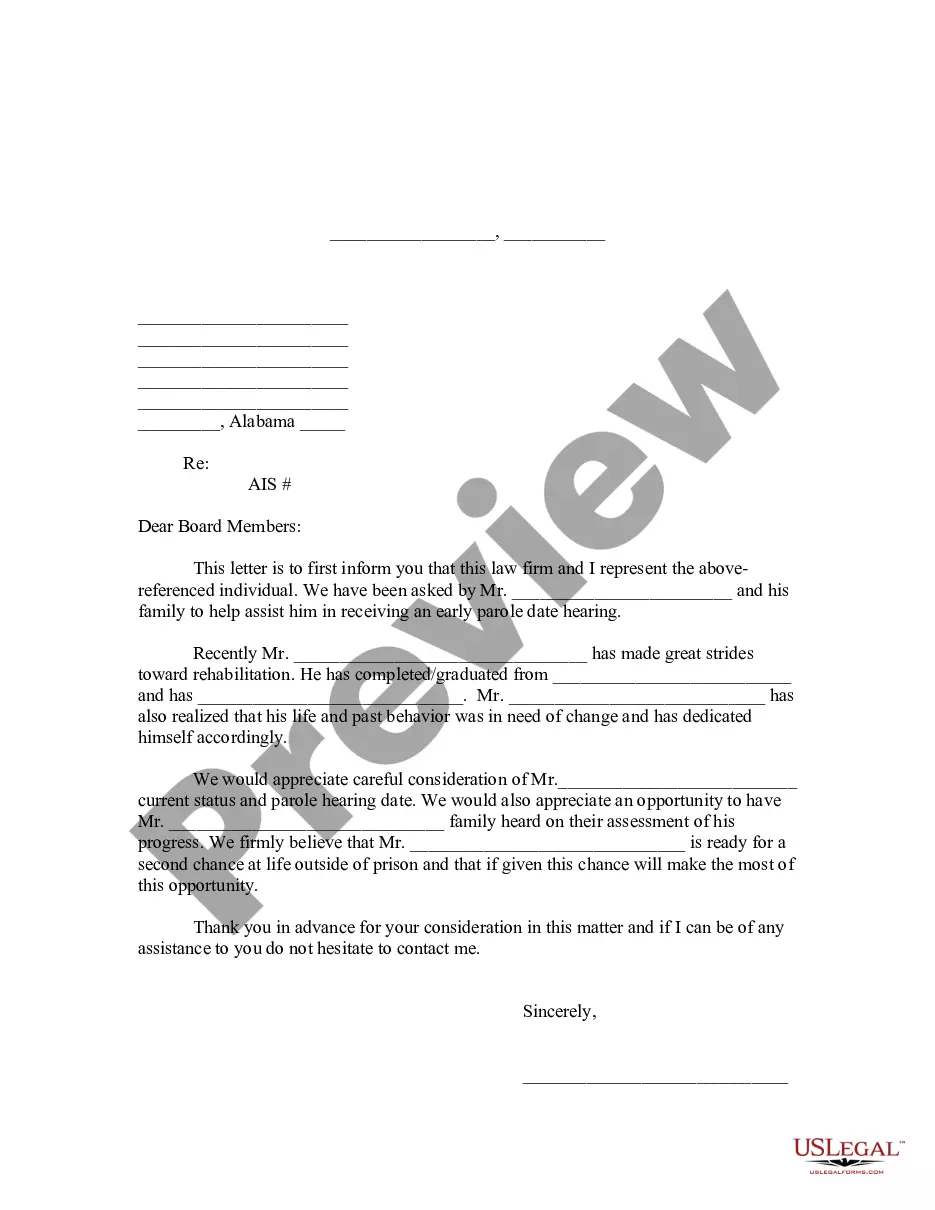

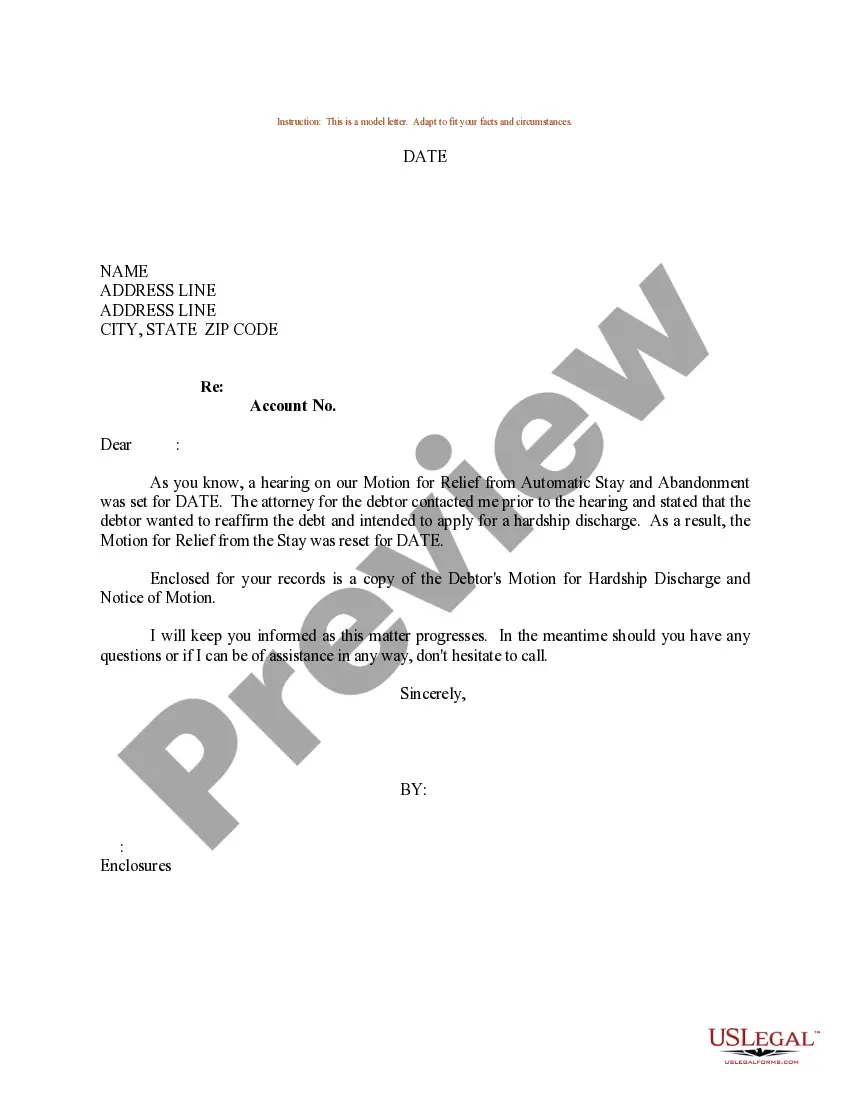

Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion

Description Hardship Letter

How to fill out Debtors Motion Order?

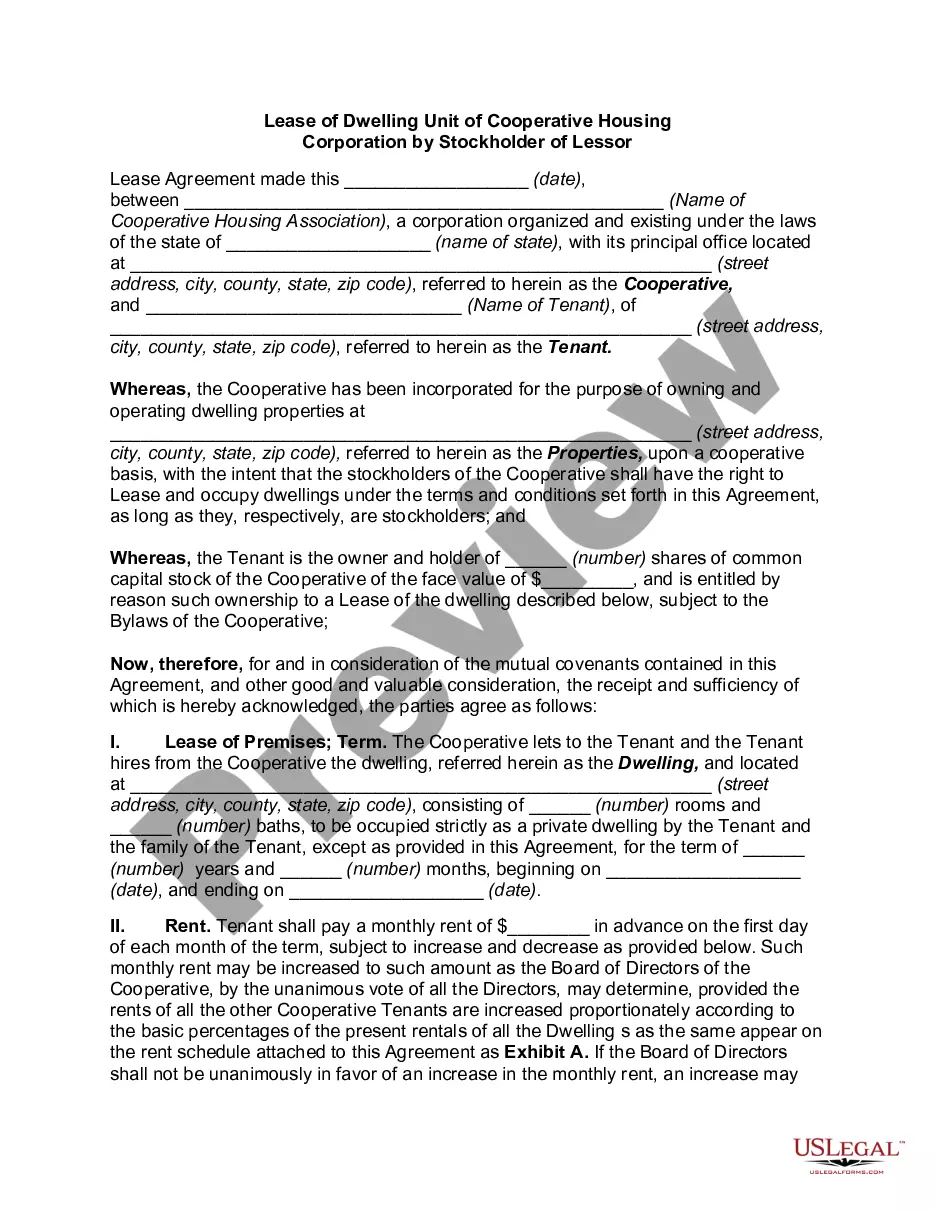

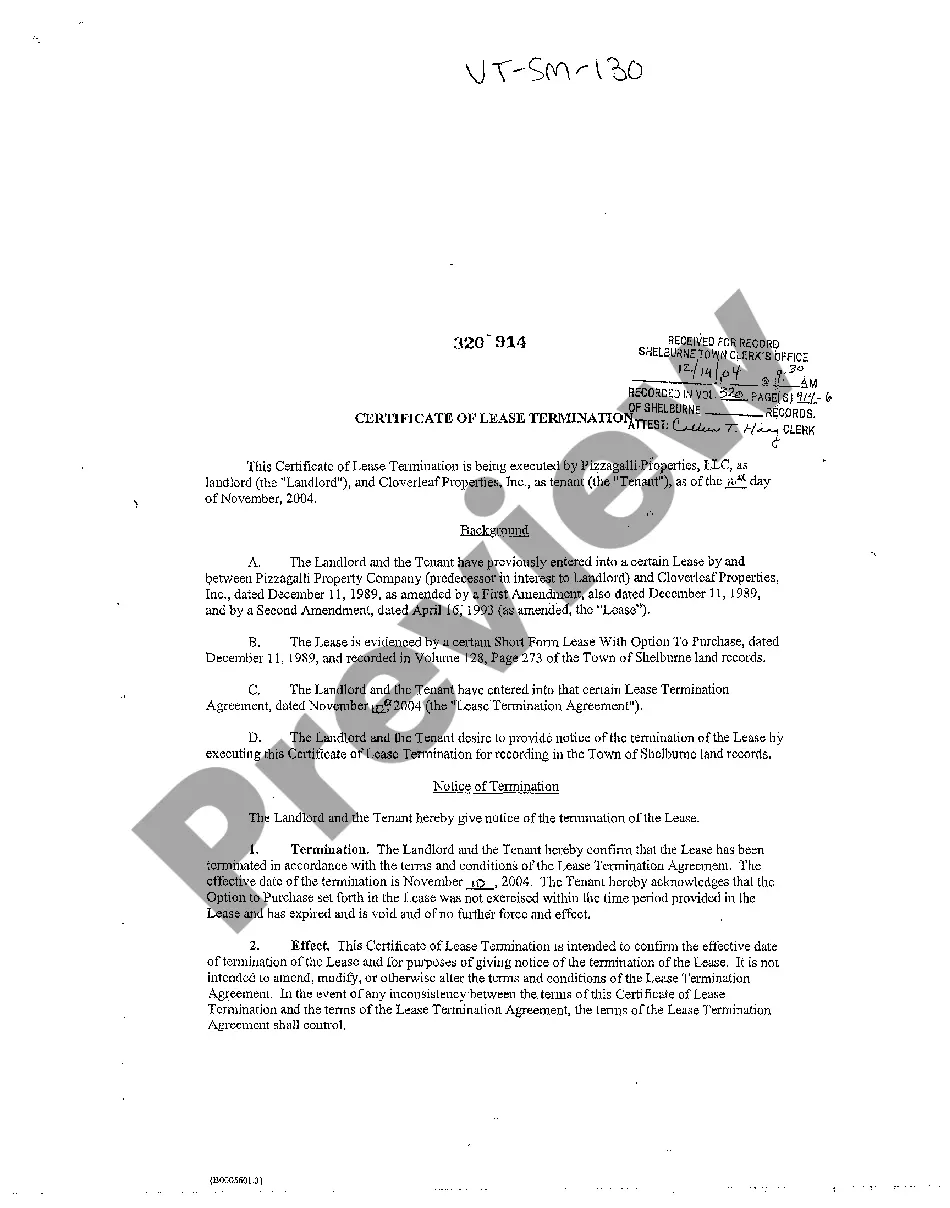

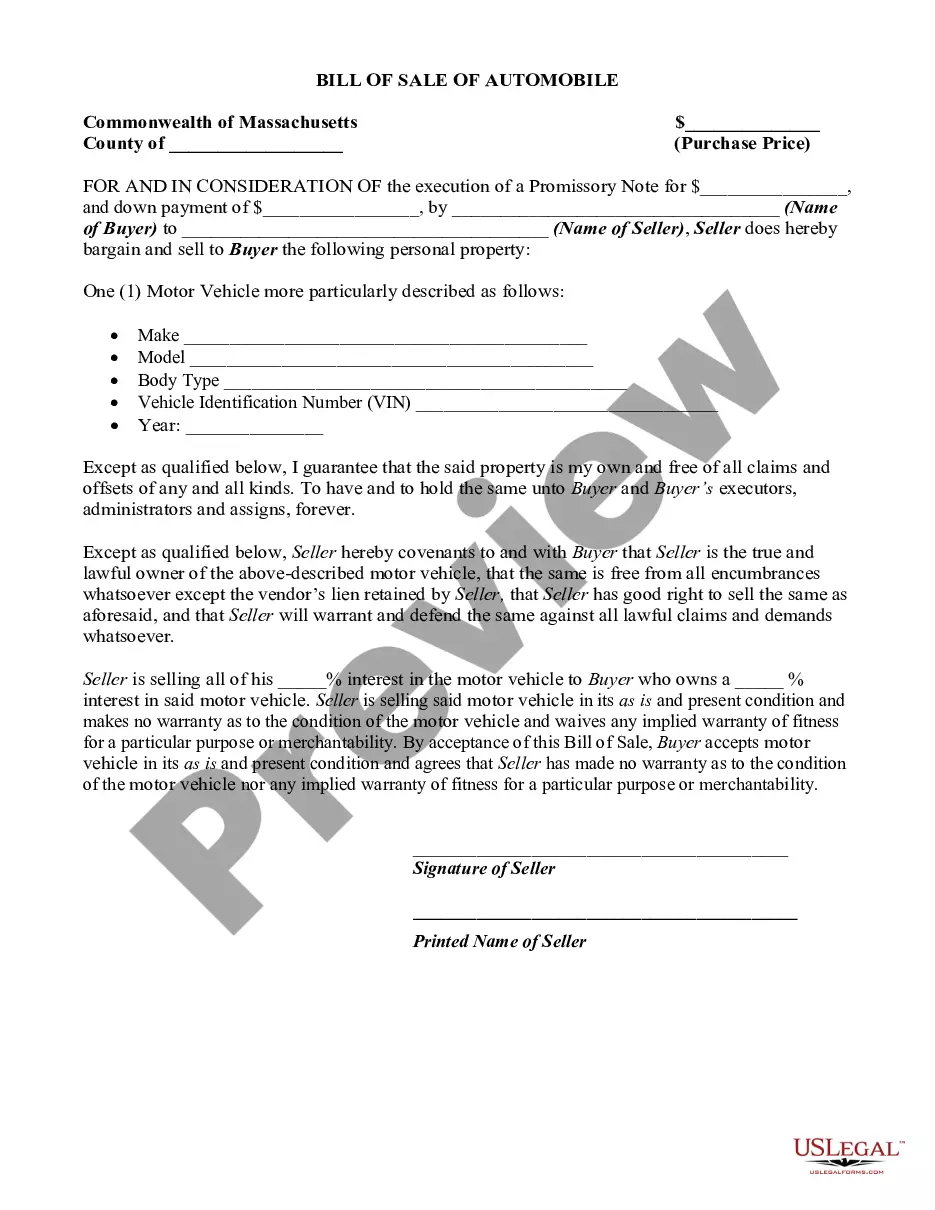

Use US Legal Forms to obtain a printable Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms library on the internet and provides affordable and accurate templates for consumers and legal professionals, and SMBs. The templates are categorized into state-based categories and many of them might be previewed before being downloaded.

To download samples, users must have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to quickly find and download Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion:

- Check to make sure you have the right template in relation to the state it’s needed in.

- Review the form by reading the description and using the Preview feature.

- Press Buy Now if it is the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search field if you want to get another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion. Over three million users already have used our platform successfully. Select your subscription plan and obtain high-quality forms within a few clicks.

Hardship Discharge Form popularity

Motion Discharge Notice Other Form Names

Motion To Stay Example FAQ

Hardship Examples. There are a variety of situations that may qualify as a hardship. Keep it original. Be honest. Keep it concise. Don't cast blame or shirk responsibility. Don't use jargon or fancy words. Keep your objectives in mind. Provide the creditor an action plan.

Hardship Examples. There are a variety of situations that may qualify as a hardship. Keep it original. Be honest. Keep it concise. Don't cast blame or shirk responsibility. Don't use jargon or fancy words. Keep your objectives in mind. Provide the creditor an action plan.

Financial hardship is difficulty in paying the repayments on your loans and debts when they are due. There are often two main reasons for financial hardship: You could afford the loan when it was obtained but a change of circumstances has occurred after getting the loan; or.

Financial hardship typically refers to a situation in which a person cannot keep up with debt payments and bills or if the amount you need to pay each month is more than the amount you earn, due to a circumstance beyond your control.

Make the letter concise. Do not write pages explaining your hardship. State your response to the hardship. You need to describe the steps you have taken in response to the difficulty. Clearly state what you want. You can include enclosures. The conclusion.

Illness or injury. Change of employment status. Loss of income. Natural disasters. Divorce. Death. Military deployment.

Proof of income (pay stubs, offer letter, etc.) proof of other income (e.g., alimony, child support, disability benefits) an expense sheet laying out all your expenses. tax returns (two years worth of returns) profit and loss statement. current bank statements.

The IRS may agree that you have a financial hardship (economic hardship) if you can show that you cannot pay or can barely pay your basic living expenses.The IRS has standards for food, clothing and miscellaneous; housing and utilities; transportation and out-of-pocket health care expenses.

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)