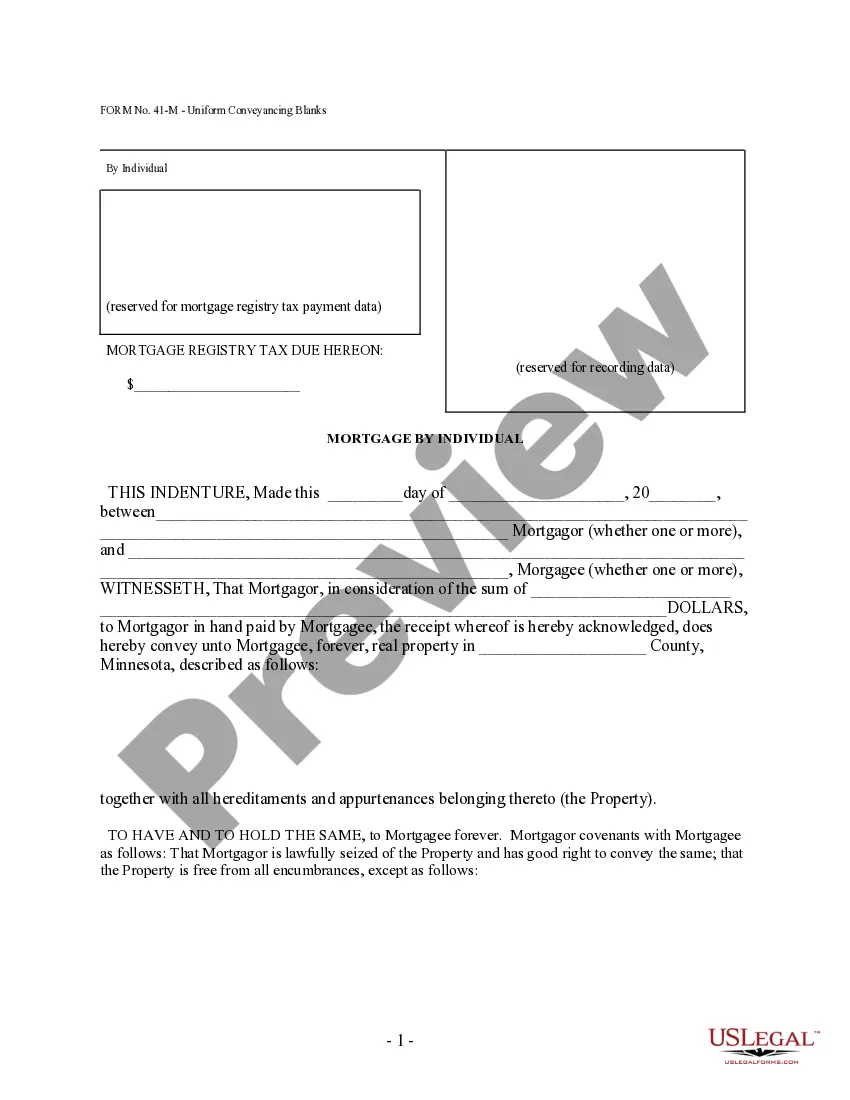

Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Engagement Letter Between Accounting Firm and Client For Tax Return Preparation

Description

How to fill out Engagement Letter Between Accounting Firm And Client For Tax Return Preparation?

Aren't you tired of choosing from countless templates each time you require to create a Engagement Letter Between Accounting Firm and Client For Tax Return Preparation? US Legal Forms eliminates the wasted time countless Americans spend exploring the internet for appropriate tax and legal forms. Our expert crew of lawyers is constantly modernizing the state-specific Samples library, to ensure that it always has the right documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription need to complete a few simple steps before being able to download their Engagement Letter Between Accounting Firm and Client For Tax Return Preparation:

- Make use of the Preview function and look at the form description (if available) to be sure that it’s the best document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper template for your state and situation.

- Use the Search field on top of the site if you have to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your sample in a needed format to complete, print, and sign the document.

When you have followed the step-by-step guidelines above, you'll always be able to sign in and download whatever file you require for whatever state you require it in. With US Legal Forms, finishing Engagement Letter Between Accounting Firm and Client For Tax Return Preparation samples or other legal paperwork is easy. Get started now, and don't forget to look at your examples with accredited attorneys!

Form popularity

FAQ

Secondly, an engagement letter is an important protection against malpractice lawsuits. Professional liability insurance providers recommend that tax preparers use a thorough and carefully worded engagement letter in order to protect themselves from litigation.

5. It is in the interest of both client and auditor that the auditor sends an engagement letter, preferably before the commencement of the engagement, to help in avoiding misunderstandings with respect to the engagement.

I am attaching my Form 16 B for your reference and I request you to kindly refund the extra amount of Rs 21,000/- paid by me. Kindly let me know in case I need to provide any other documents. The cheque for the amount of Rs 21,000/- may kindly be send on my residential address as mentioned in the form.

Engagement letters are the first and most critical line of defense against scope-of-service claims, helping to prevent claims by establishing clear responsibilities and managing client expectations as well as defending against claims by defining the scope of services and establishing limitations on the services to be

Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations.

The IRS says, Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors. Handwritten forms often result in name/TIN mismatches.Efiling is the most accurate and efficient way of filing 1099s, W2s, and other tax forms.

Format Your Letter Create a subject line with Re: followed by your IRS notice number. You will see your IRS notice number in the upper right corner of the letter. Often, the notice number begins with CP or LP. On the second line below the subject line, write your Social Security number and name.

A Good Introduction. Identify the Scope of Work. Identify How Long It Will Take. Write Out the Payment Terms. Include What You Need from the Client. Include What the Client Needs from You. Obtain Signatures from Both Parties.

Using engagement letters can help reduce professional liability insurance (or E&O insurance) premiums and many insurers require it. If insurers require them, then engagement letters must reduce liability and risk of doing business.