Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

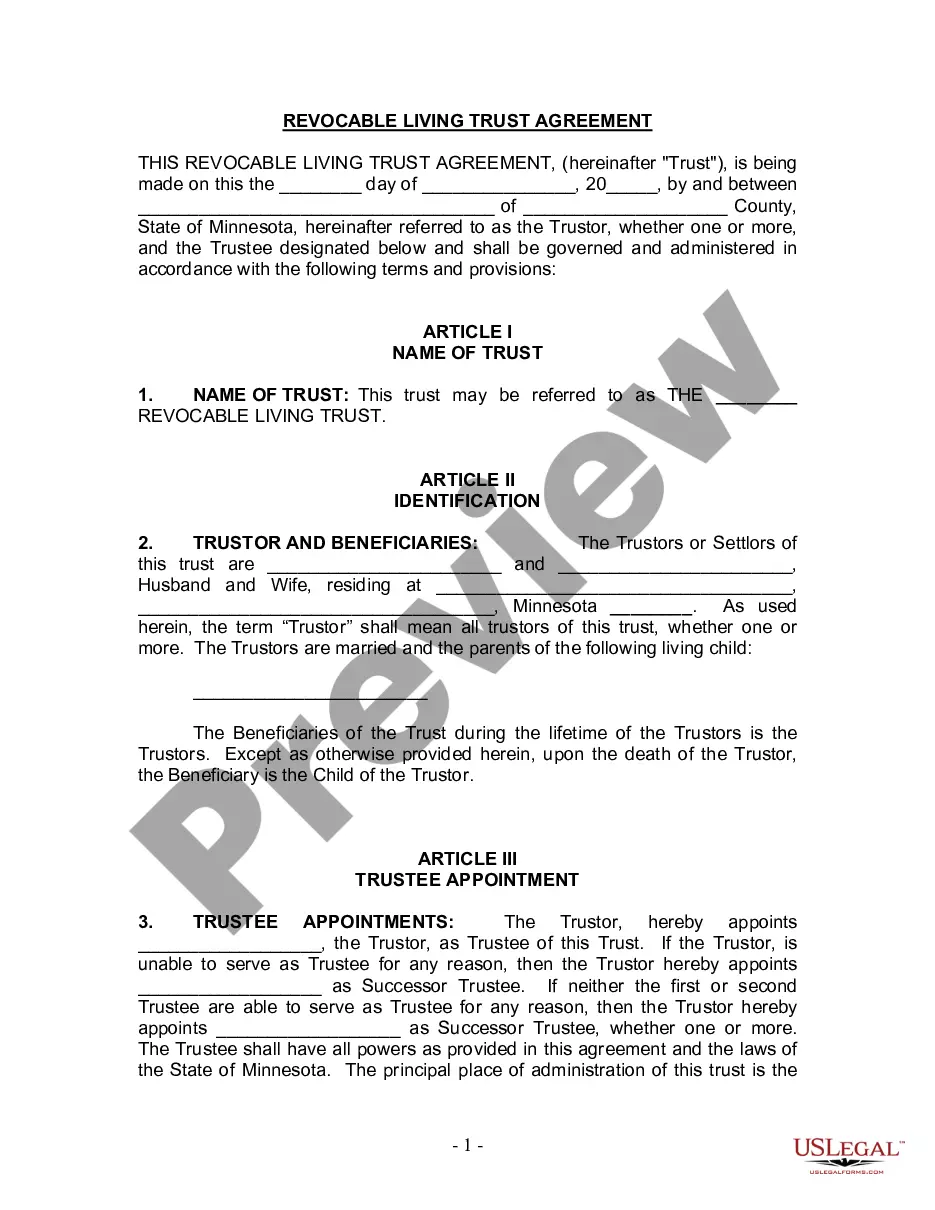

General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping

Description Accounting Tax Record

How to fill out General Accounting Record?

Aren't you tired of choosing from countless samples each time you want to create a General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping? US Legal Forms eliminates the lost time countless American citizens spend exploring the internet for suitable tax and legal forms. Our skilled team of lawyers is constantly updating the state-specific Forms library, to ensure that it always has the right documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription should complete quick and easy steps before being able to get access to their General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping:

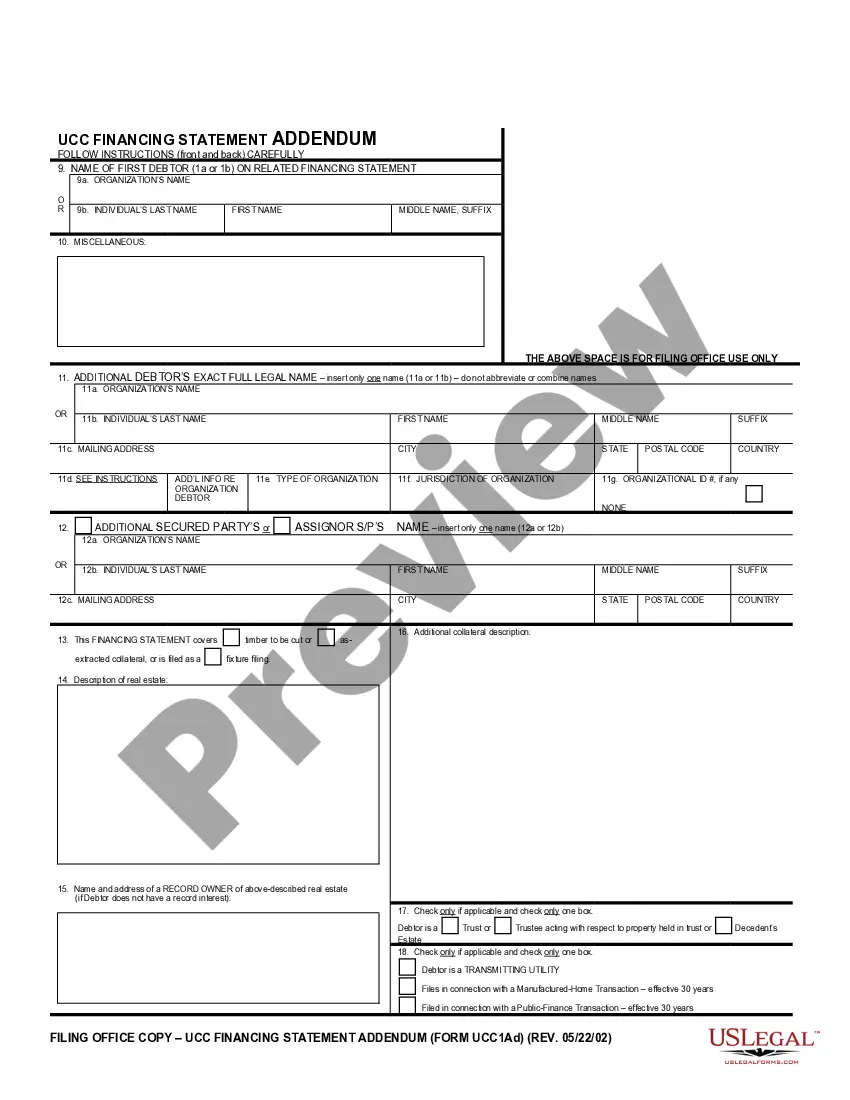

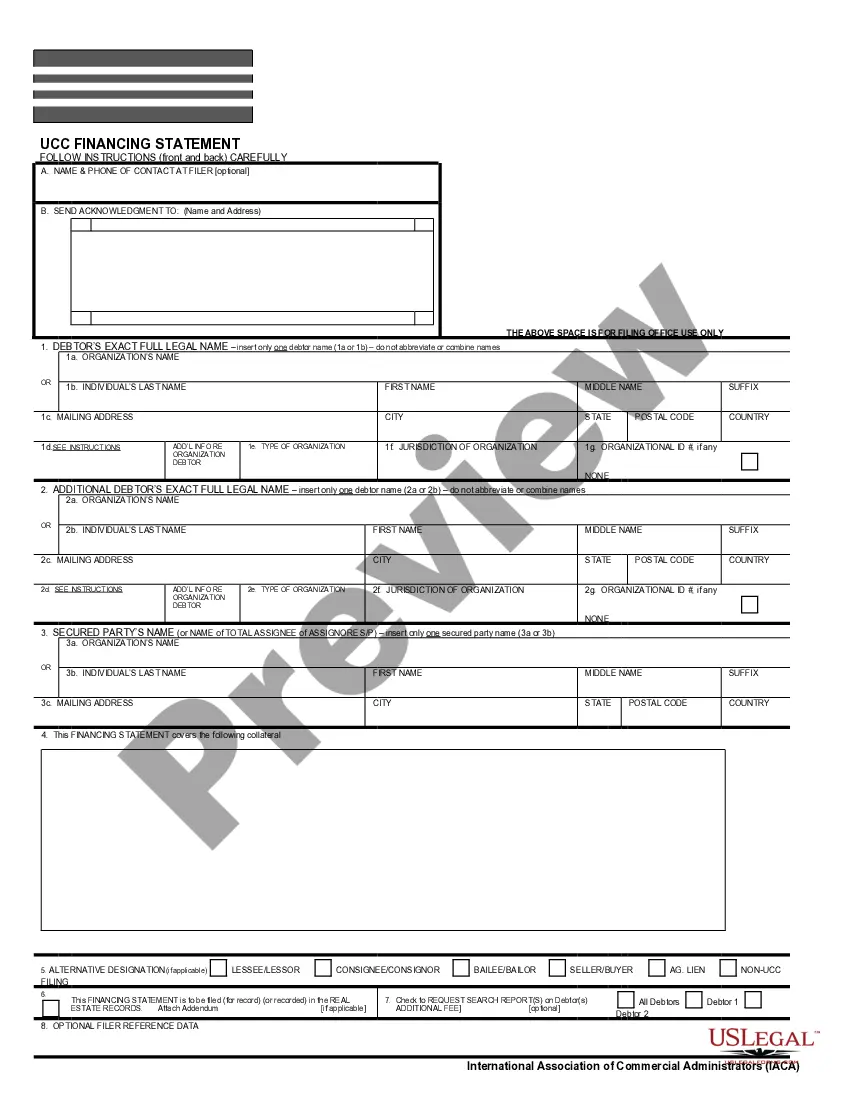

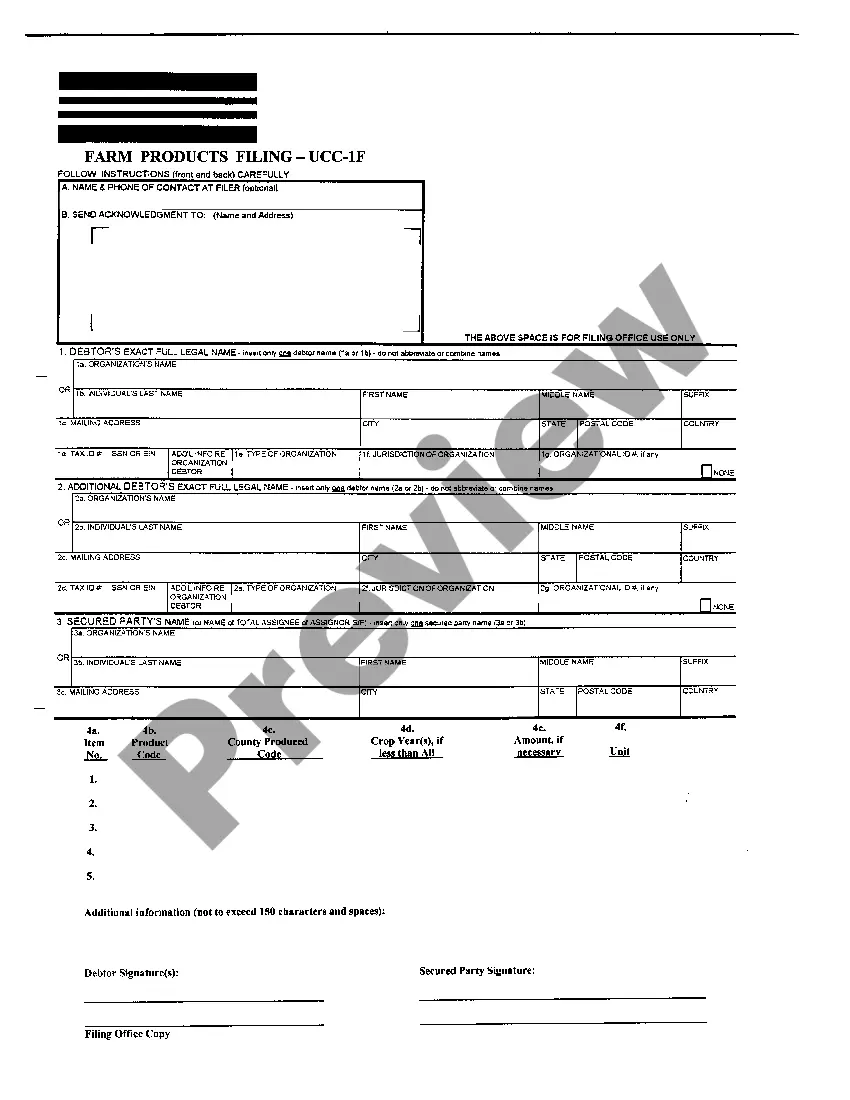

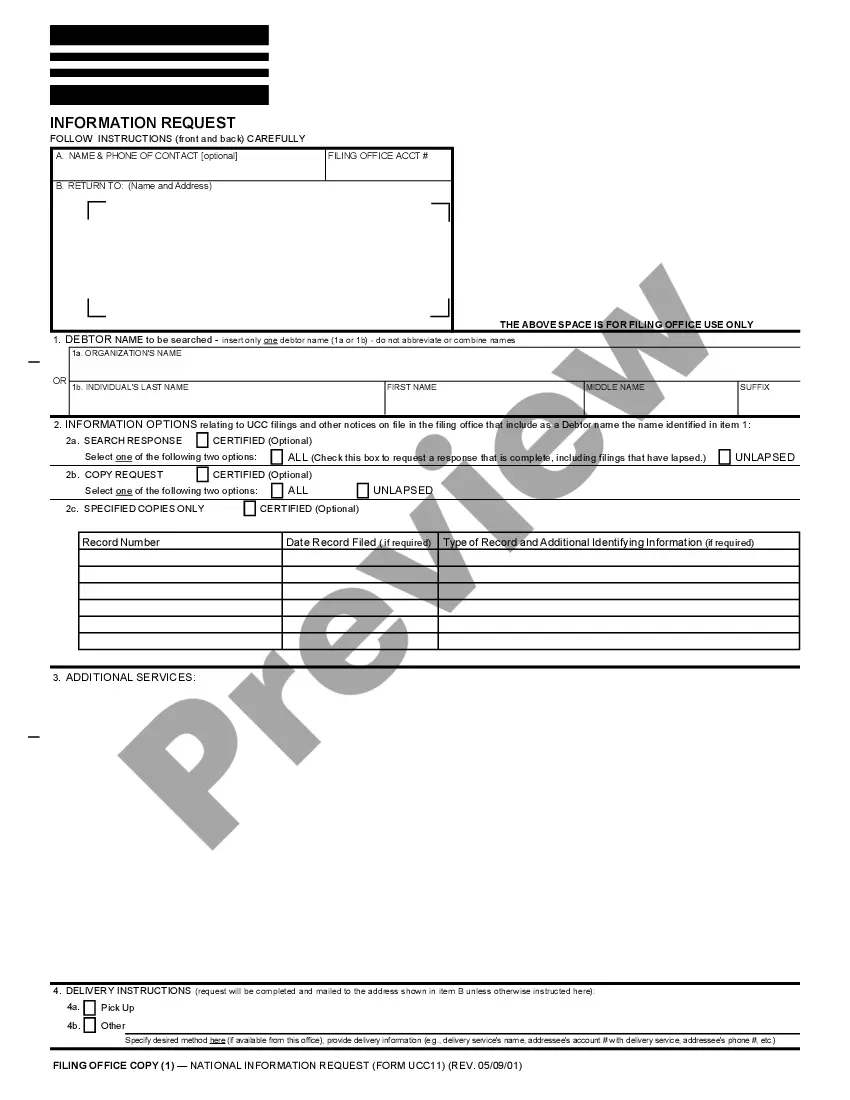

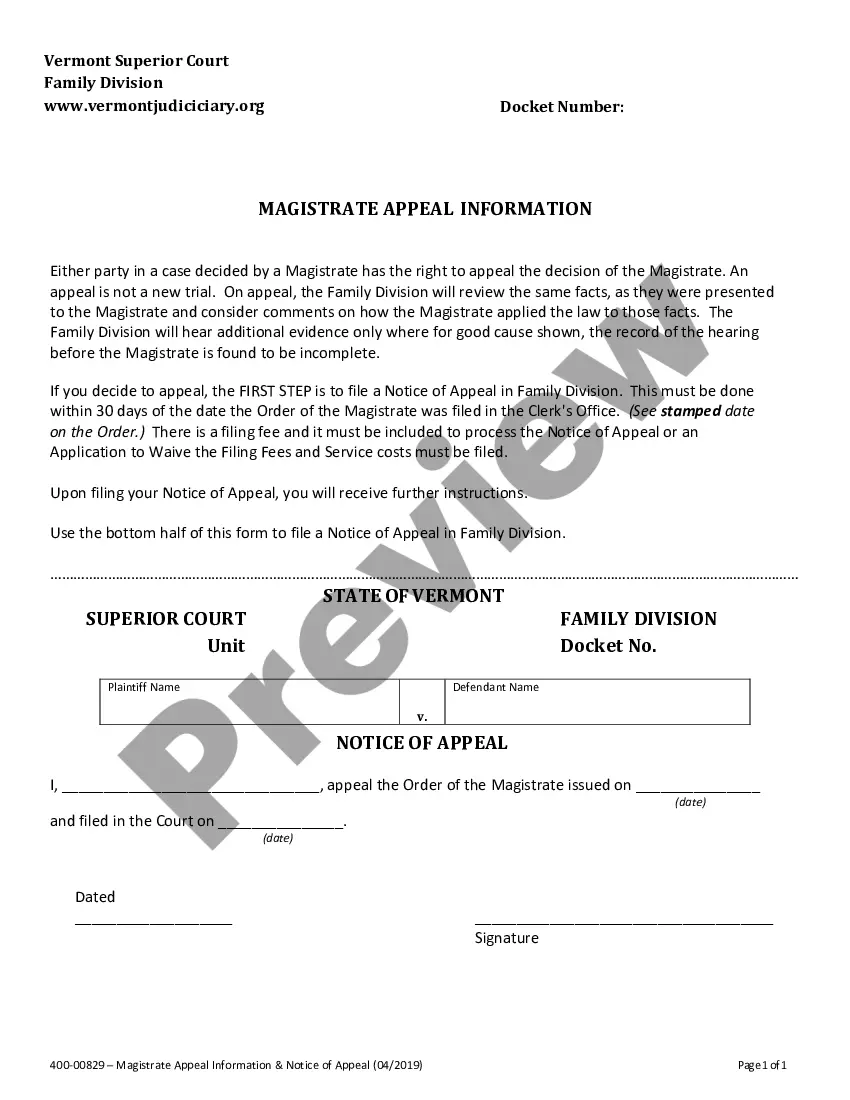

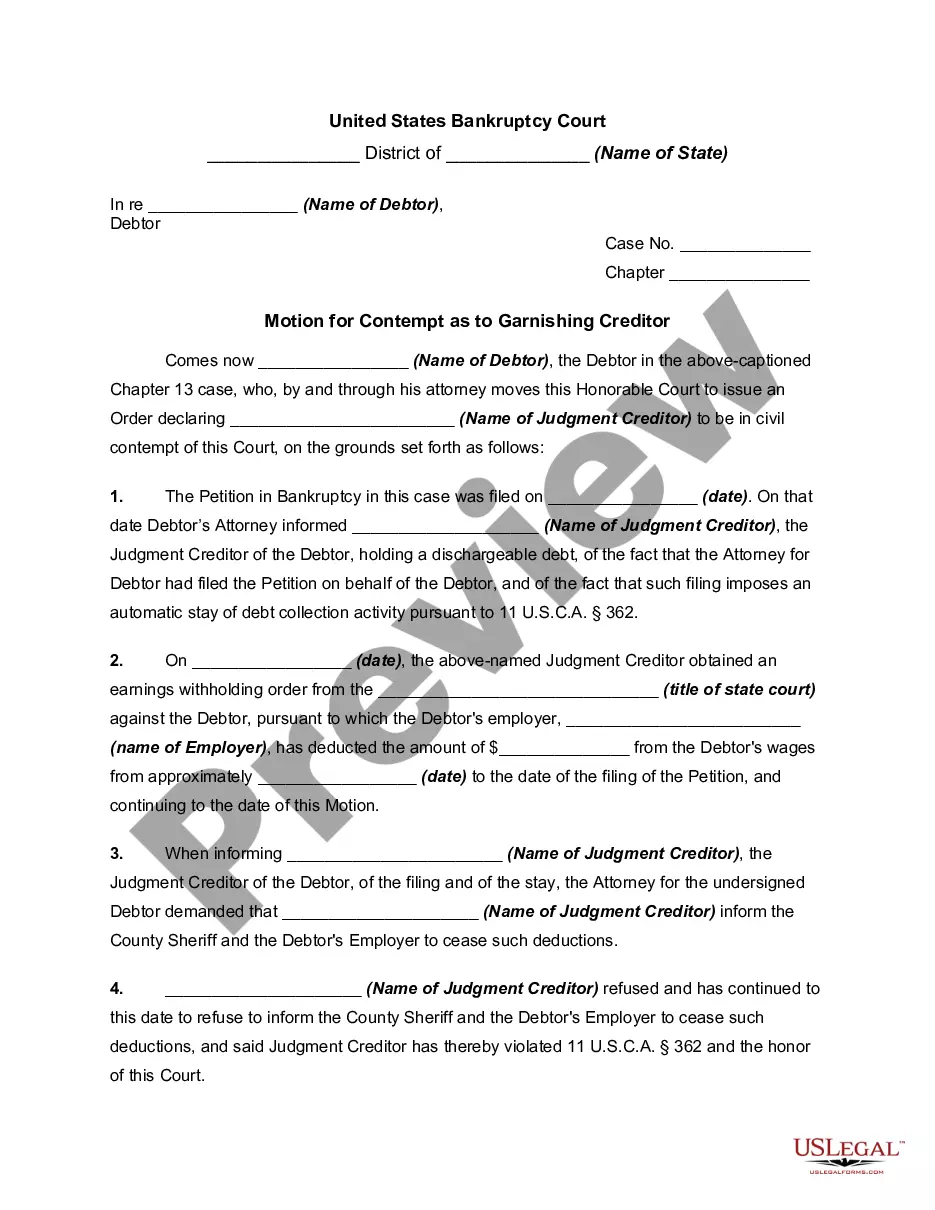

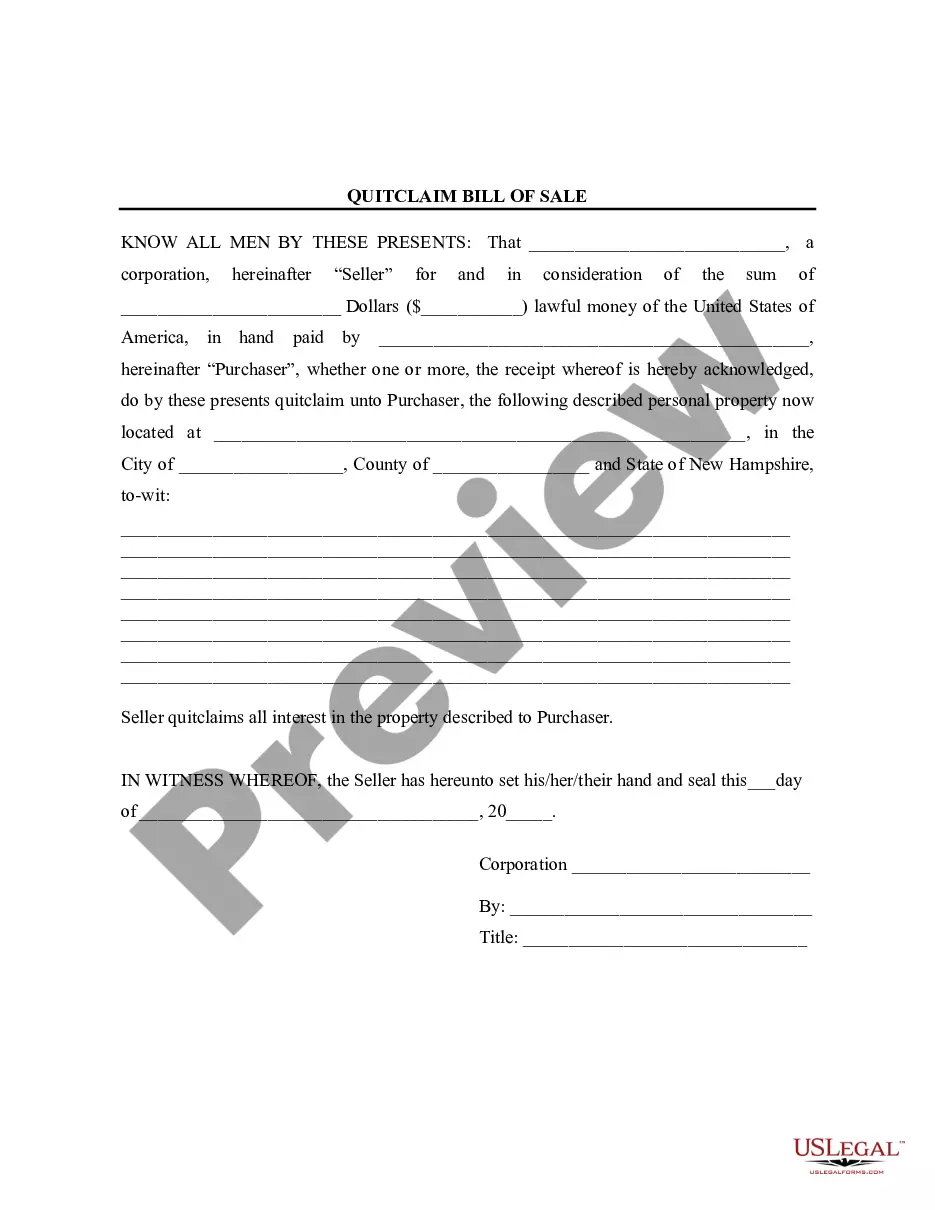

- Make use of the Preview function and read the form description (if available) to be sure that it’s the appropriate document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the proper example to your state and situation.

- Utilize the Search field at the top of the webpage if you need to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your template in a convenient format to finish, create a hard copy, and sign the document.

Once you have followed the step-by-step recommendations above, you'll always be capable of sign in and download whatever document you want for whatever state you require it in. With US Legal Forms, completing General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping samples or other legal documents is not hard. Begin now, and don't forget to look at the samples with certified lawyers!

Consultant Tax Form Form popularity

Consultant Accounting Complete Other Form Names

Consultant Agreement Tax FAQ

Specifically, the provision of bookkeeping services, valuation reports, internal audit outsourcing, actuarial services and financial information design and implementation will not impair independence provided it is reasonable to conclude that the results of the service will not be subject to audit procedures during an

As a general rule, auditor-provided tax services don't raise independence issues, so long as the company's audit committee approves the arrangement.Also, the Public Company Accounting Oversight Board (PCAOB) prohibits auditors from providing tax services under certain circumstances.

Audits typically are performed by an independent, certified accounting firm. There was a time CPA firms were associated strictly with financial maneuvers, but these firms today offer an array of consulting services to their clients.

UNDER THE SEC RULES, CPAs WILL BE ALLOWED TO provide tax-minimization services to audit clients, except for transactions that have no business purpose other than tax avoidance.They also are excluded from the rules that say compensating partners for procuring nonaudit services for the firm impairs their independence.

Bookkeeping. Financial information systems design and implementation. Appraisal or valuation services, fairness opinions, or contribution-in-kind reports. Actuarial services.

The auditing firm analyzes current and prior financial statements to determine not only if finances are in order, but also if the proper reports are being generated. Auditors review cash management procedures, accounting policies and controls, trial balance accounts and relationships with creditors.

Bookkeeping services are permitted, as long as the individuals performing these services are not the same individuals performing the audit.An accountant generally cannot provide bookkeeping services to an SEC audit client.

Non-audit services are any professional services provided by a qualified public accountant during the period of an audit engagement which are not connected to an audit or review of an institution's financial statements.

The SEC rules on audit independence are often organized into five key areas: (A) Prohibited Non-Audit Services; (B) Audit Committee Pre-Approval of Services; (C) Partner Rotation; (D) Conflict of Interest; and (E) Increased Communication and Disclosure.