Report on the filing or determination of an action regarding a patent

Description Report On The Filing Or Determination Of An Action Regarding A Patent Or Trademark

How to fill out Report On The Filing Or Determination Of An Action Regarding A Patent?

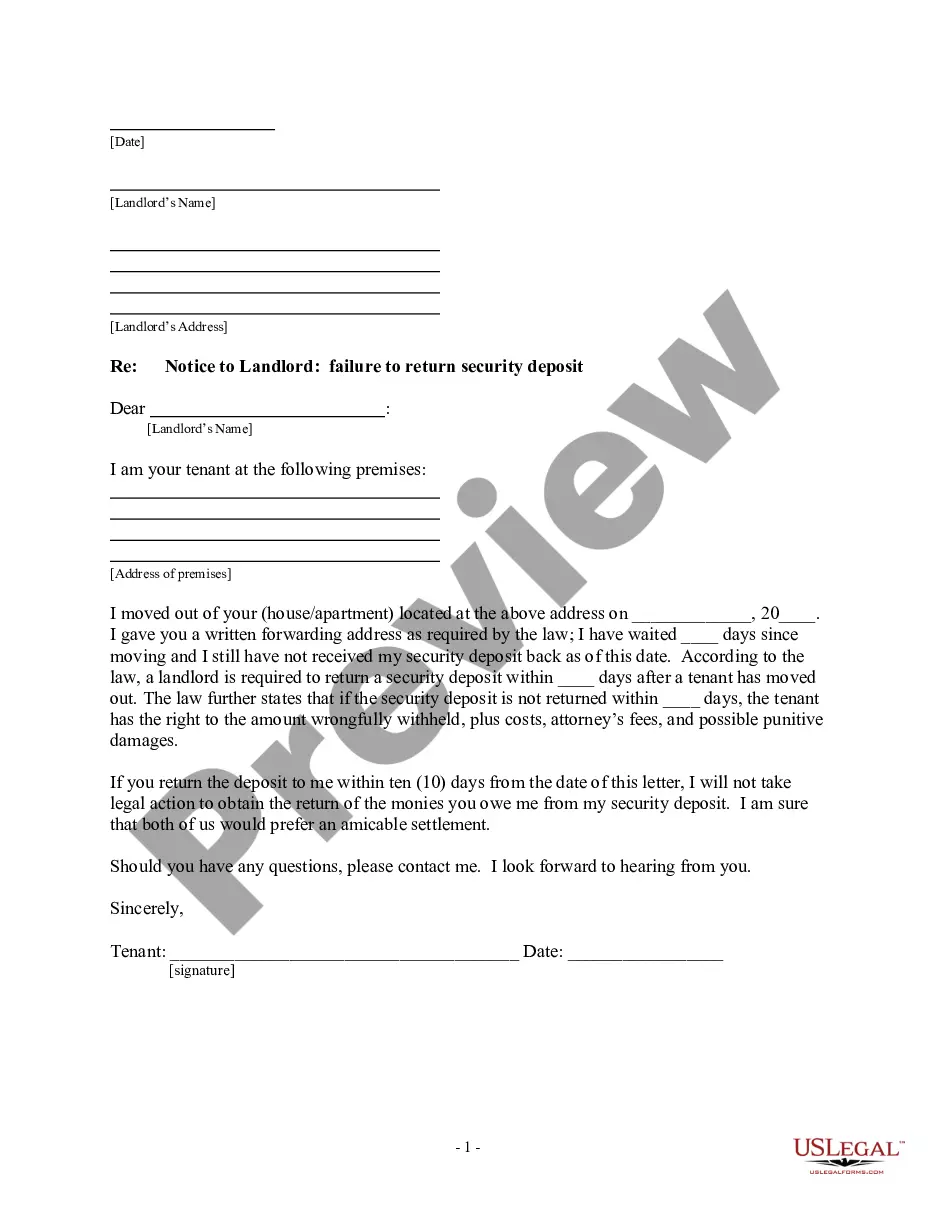

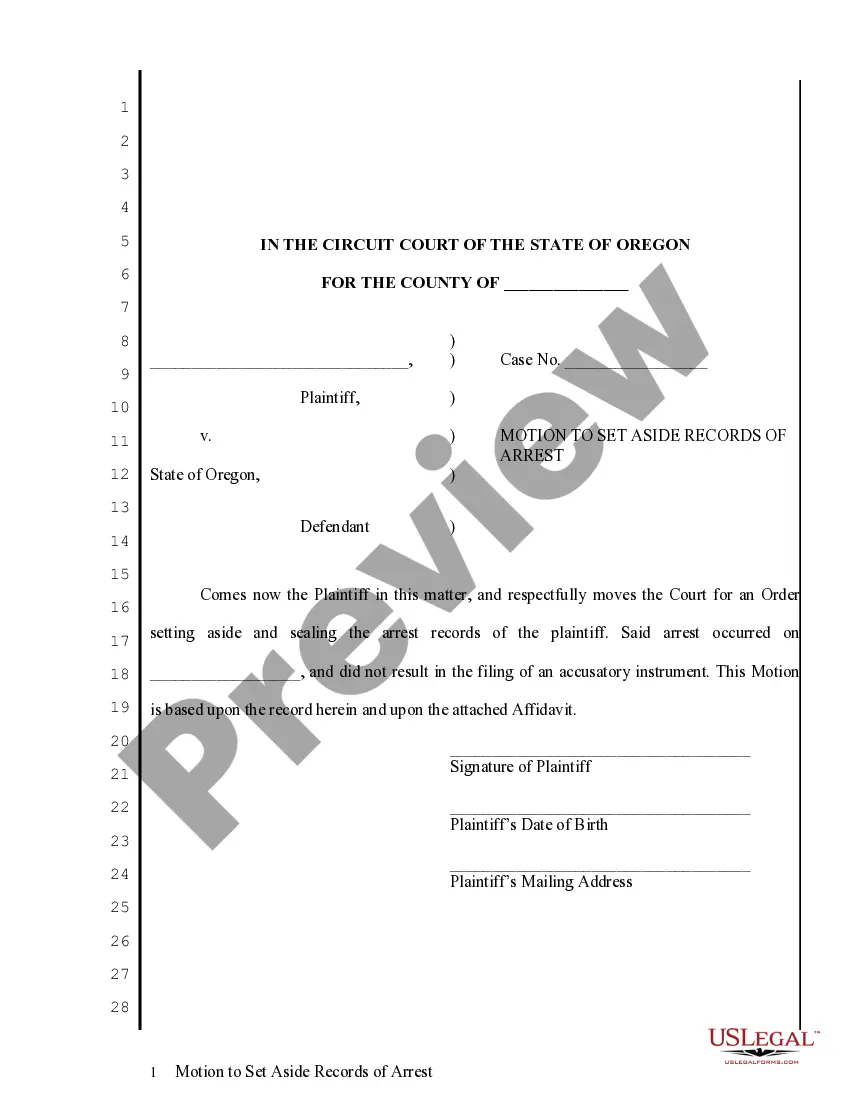

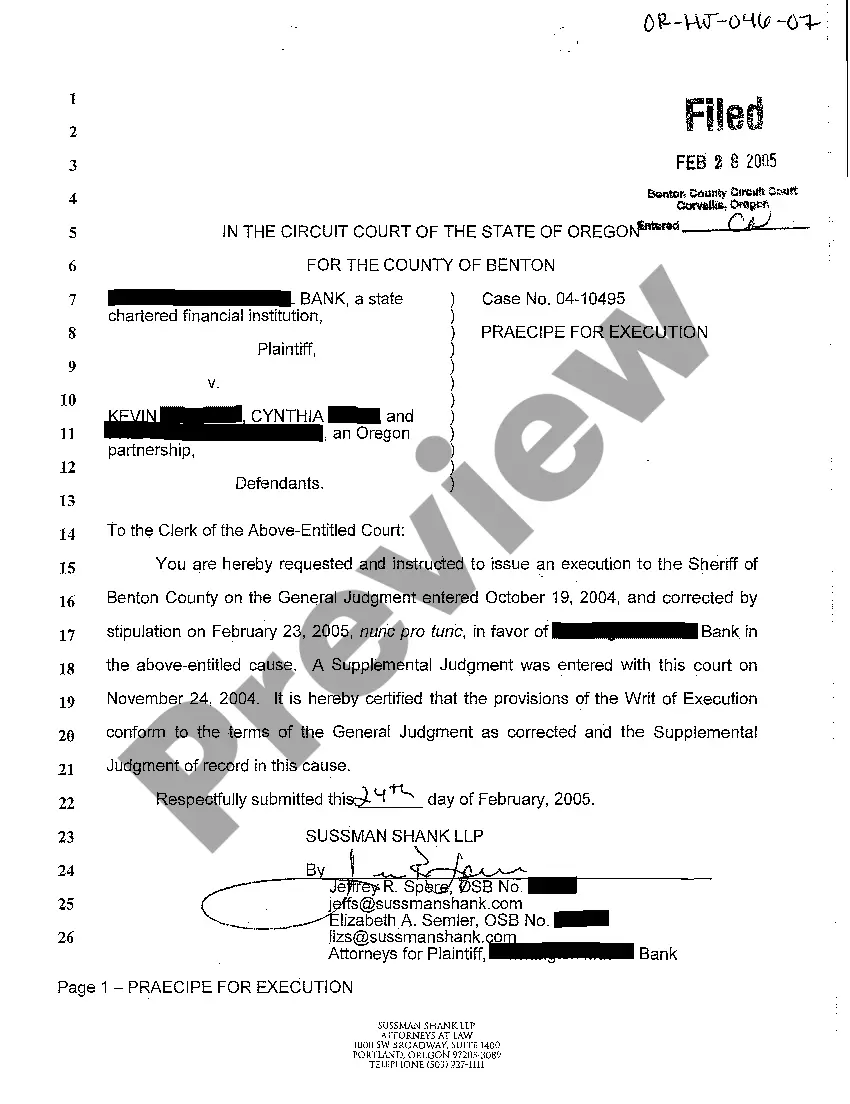

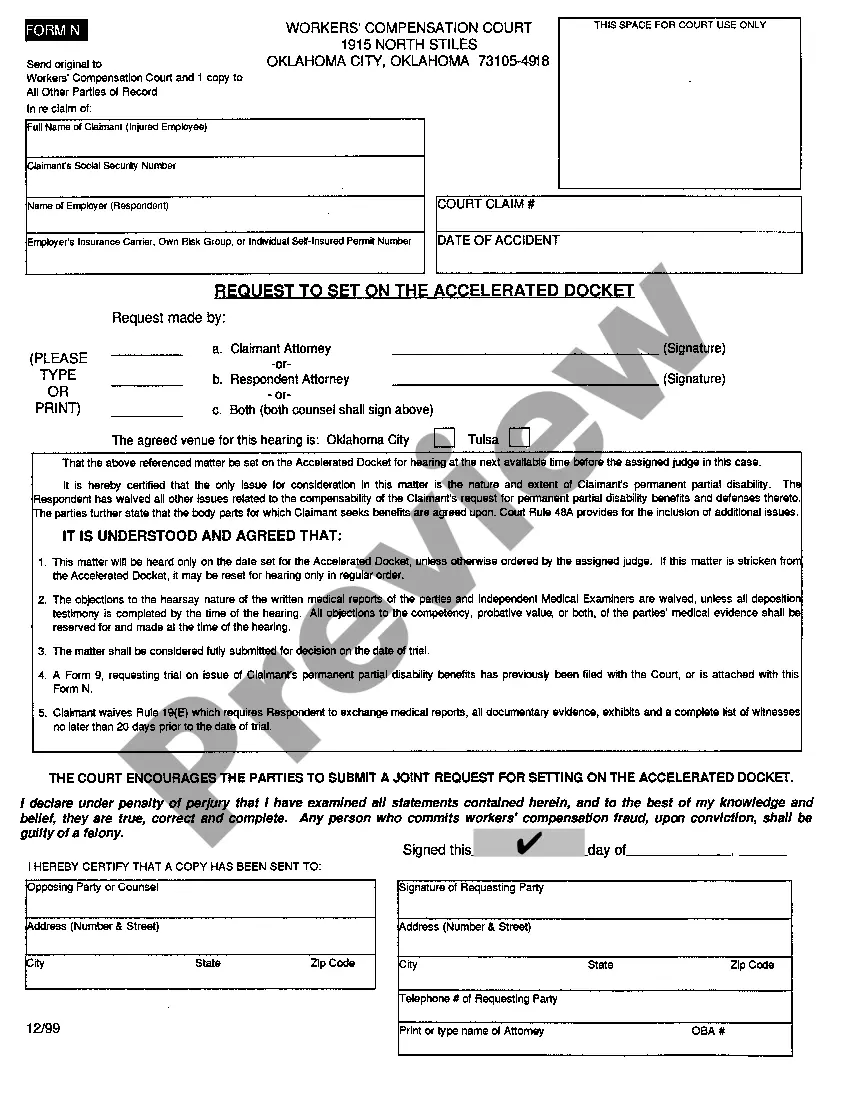

Aren't you tired of choosing from numerous samples each time you need to create a Report on the filing or determination of an action regarding a patent? US Legal Forms eliminates the lost time millions of American citizens spend surfing around the internet for suitable tax and legal forms. Our skilled team of attorneys is constantly updating the state-specific Samples catalogue, so it always has the appropriate files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription should complete a few simple actions before being able to download their Report on the filing or determination of an action regarding a patent:

- Use the Preview function and read the form description (if available) to make sure that it’s the best document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper sample to your state and situation.

- Make use of the Search field at the top of the webpage if you need to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your template in a needed format to complete, create a hard copy, and sign the document.

After you’ve followed the step-by-step instructions above, you'll always have the ability to sign in and download whatever document you want for whatever state you need it in. With US Legal Forms, finishing Report on the filing or determination of an action regarding a patent templates or other legal paperwork is easy. Get started now, and don't forget to look at the examples with accredited lawyers!

Filing Of Action Form popularity

Report Filing File Other Form Names

FAQ

Create an annual report for your Florida LLC. Find your LLC at Sunbiz.org, where you will file your annual report online. Upload your annual report in order to Sunbiz.org by May 1 each year.

The State of Florida requires you to file an annual report for your LLC.The annual report is due each year by May 1. The current filing fee for LLCs is $138.75.

After a certain amount of time past the due date, if the report still isn't filed, the jurisdiction will revoke your company's good standing or put it into a forfeited status.Most states require the past due annual report as well as an additional certificate of reinstatement and more fees.

In Florida, an annual report is a regular filing that your LLC must complete every year. An annual report is essentially updating your registered agent address and paying a $138.75 fee. All LLCs are required to file their annual report with the Florida Department of State.

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929, when lawmakers mandated standardized corporate financial reporting. The intent of the required annual report is to provide public disclosure of a company's operating and financial activities over the past year.

Annual reports are entity information updates due to the secretary of state each year. LLCs, corporations, and nonprofits are required to file annual reports to maintain good standing. Due dates, filing fees, and forms vary greatly by entity type and whether the entity is domestic or foreign to the state.

Gives information on the company's financial position. Introduce you're the key members of the business to stakeholders and the general public. Tells shareholders and employees the company's strategy for growth in the coming year. Useful as a decision-making tool for managers.

To ask a question or report a problem concerning your investments, your investment account or a financial professional, contact us online or call the SEC's toll-free investor assistance line at (800) 732-0330 (if outside of the U.S., call 1-202-551-6551). Visit Investor.gov, the SEC's website for individual investors.

After a certain amount of time past the due date, if the report still isn't filed, the jurisdiction will revoke your company's good standing or put it into a forfeited status.Most states require the past due annual report as well as an additional certificate of reinstatement and more fees.