This form is a post-nuptial agreement between husband and wife. A post-nuptial agreement is a written contract executed after a couple gets married, to settle the couple's affairs and assets in the event of a separation or divorce. Like the contents of a prenuptial agreement, it can vary widely, but commonly includes provisions for division of property and spousal support in the event of divorce, death of one of the spouses, or breakup of marriage.

Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse

Description Spouses Disclaimer

How to fill out Disclaimer Property Residence?

Aren't you sick and tired of choosing from hundreds of templates each time you want to create a Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse? US Legal Forms eliminates the wasted time numerous American citizens spend surfing around the internet for ideal tax and legal forms. Our professional team of lawyers is constantly changing the state-specific Samples collection, to ensure that it always provides the appropriate files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription need to complete easy actions before being able to download their Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse:

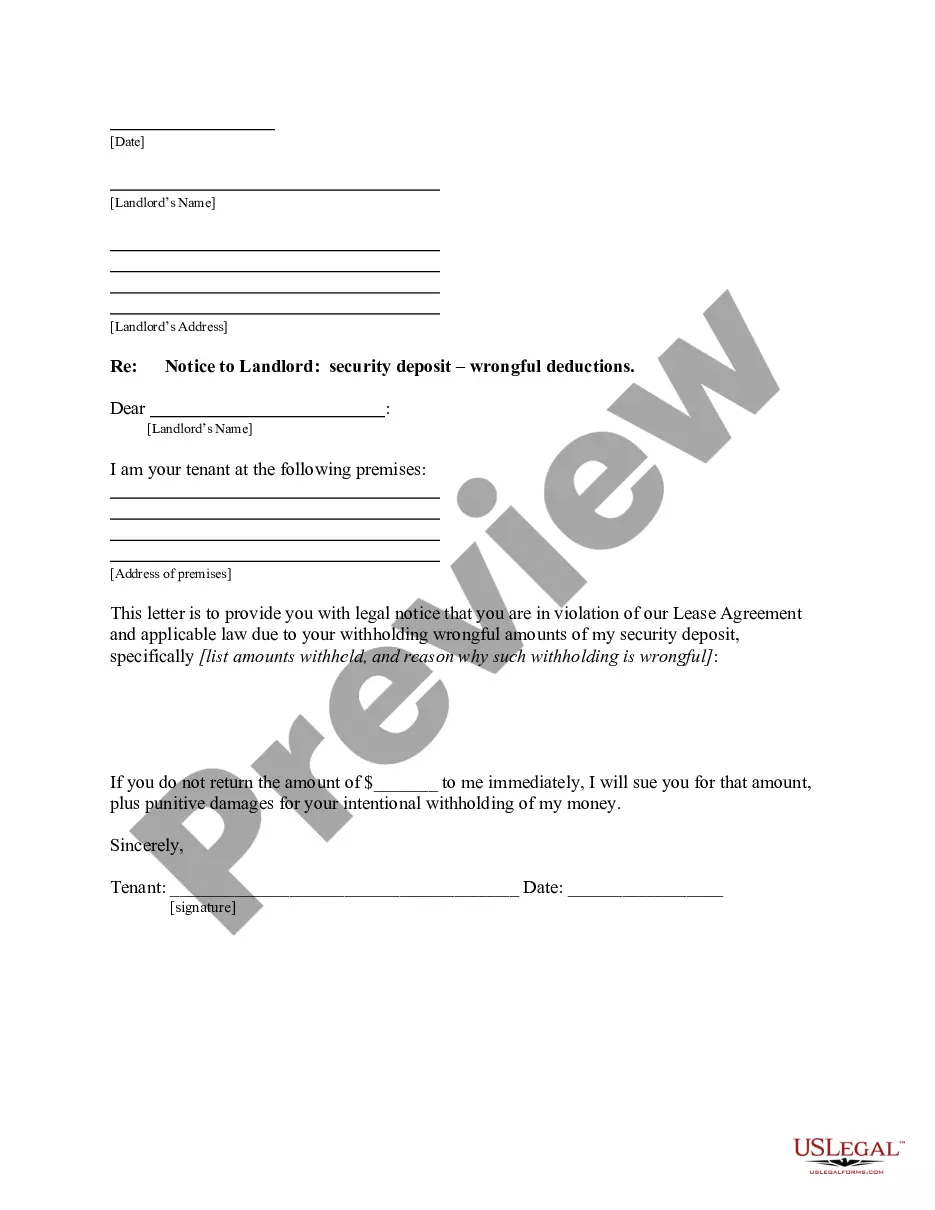

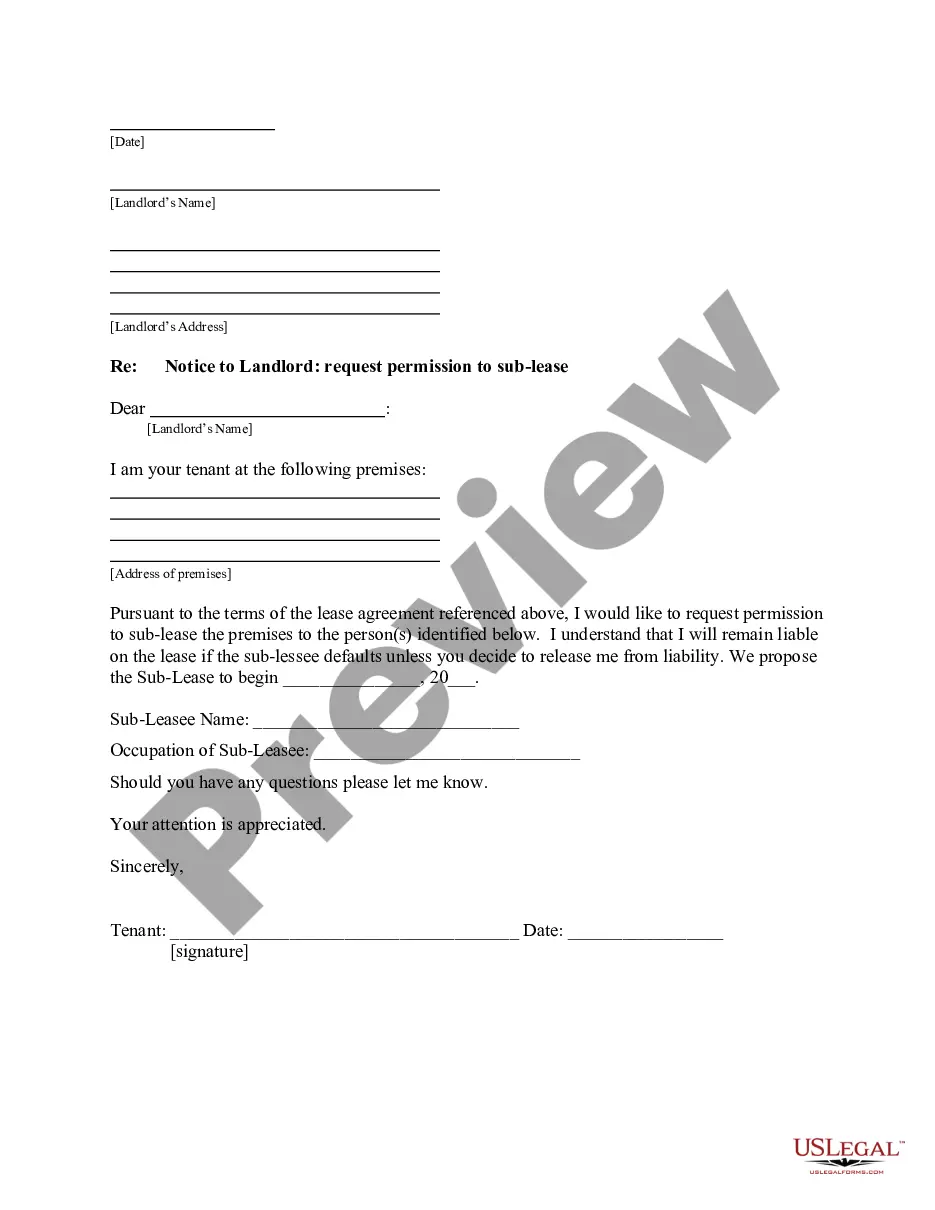

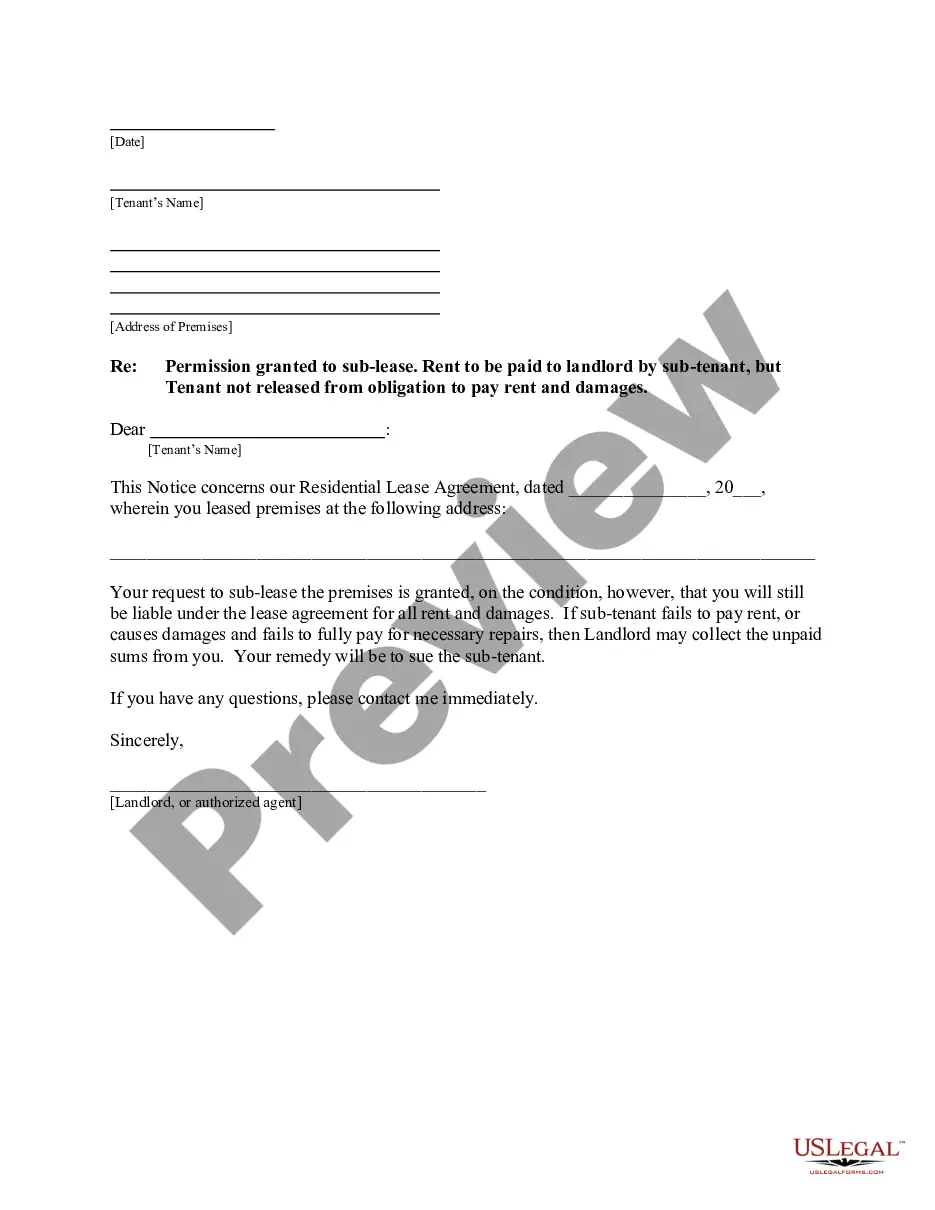

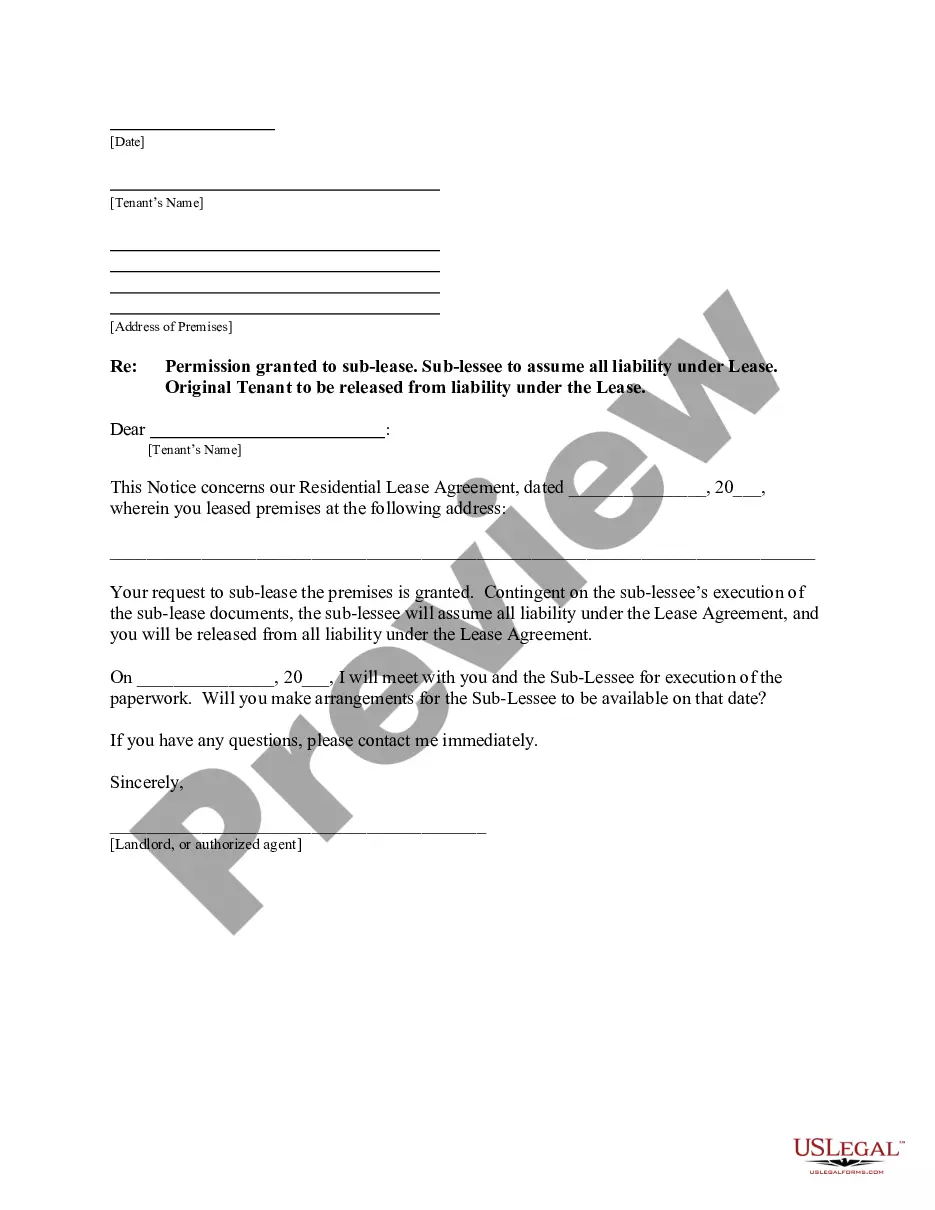

- Make use of the Preview function and read the form description (if available) to make certain that it’s the appropriate document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the proper template to your state and situation.

- Use the Search field at the top of the site if you have to look for another file.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your file in a required format to complete, create a hard copy, and sign the document.

As soon as you have followed the step-by-step guidelines above, you'll always be able to log in and download whatever file you will need for whatever state you want it in. With US Legal Forms, completing Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse templates or other legal documents is not difficult. Begin now, and don't forget to examine your samples with certified lawyers!

Disclaimer Each Property Form Form popularity

Spouses Residence Other Form Names

Disclaimer Interest Provision FAQ

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

Make sure you have all of the basic information and divorce forms you need according to the divorce laws in your state. Make sure you have all of the personal information you need. Include a statement that you and the other party are in agreement with the contents of the document.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

The surviving spouse can serve as the sole trustee, but cannot have any power to direct the beneficial enjoyment of the disclaimed property unless the power is limited by an "ascertainable standard." This is necessary both to qualify the disclaimer and to avoid any taxable general power of appointment.

#1. Start with the Basics. #2. Include the Details. #3. Confirm Your Agreement. #4. Identify and Divide Assets and Debts. #5. Create a Parenting Plan for Custody and Visitation. #6. Agree on Child Support and Spousal Support (Alimony) #7. Polishing Your Agreement. Conclusion.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

Danger #1: Only delays probate. Danger #2: Probate when both owners die together. Danger #3: Unintentional disinheriting. Danger #4: Gift taxes. Danger #5: Loss of income tax benefits. Danger #6: Right to sell or encumber. Danger #7: Financial problems.