Letter to Small Businessman in Advance Collection

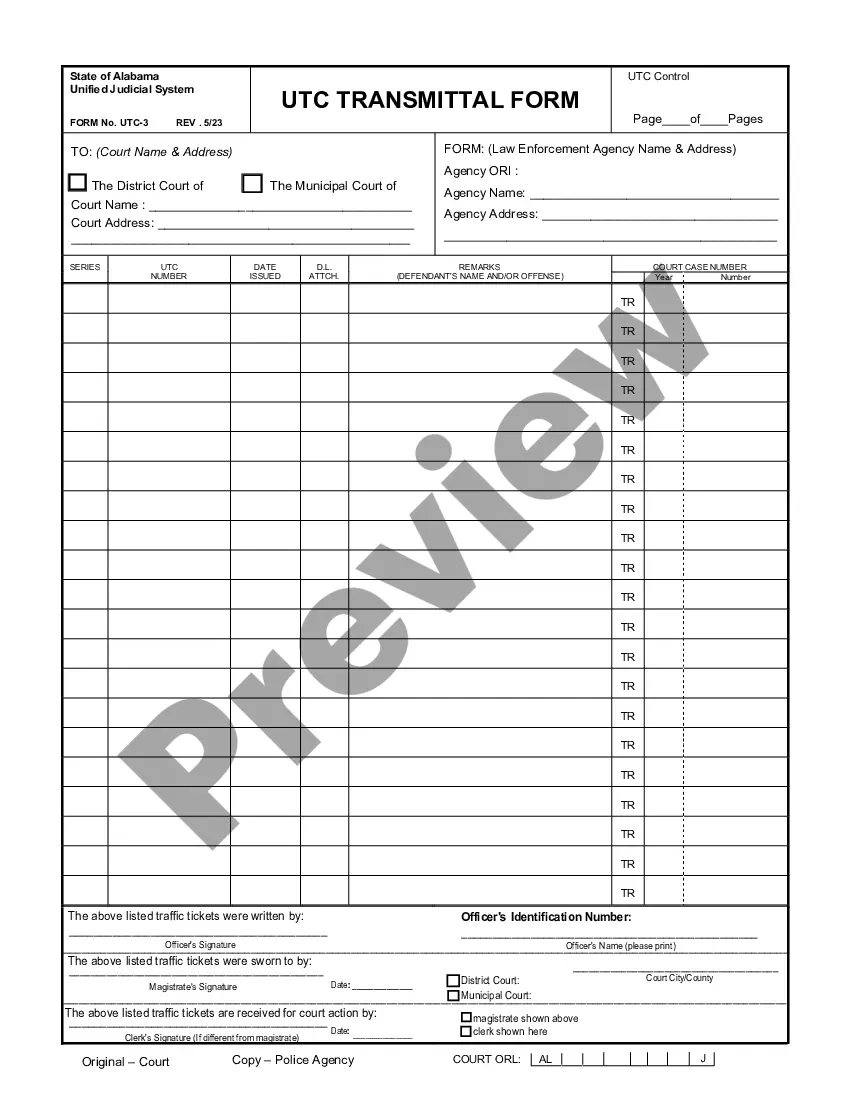

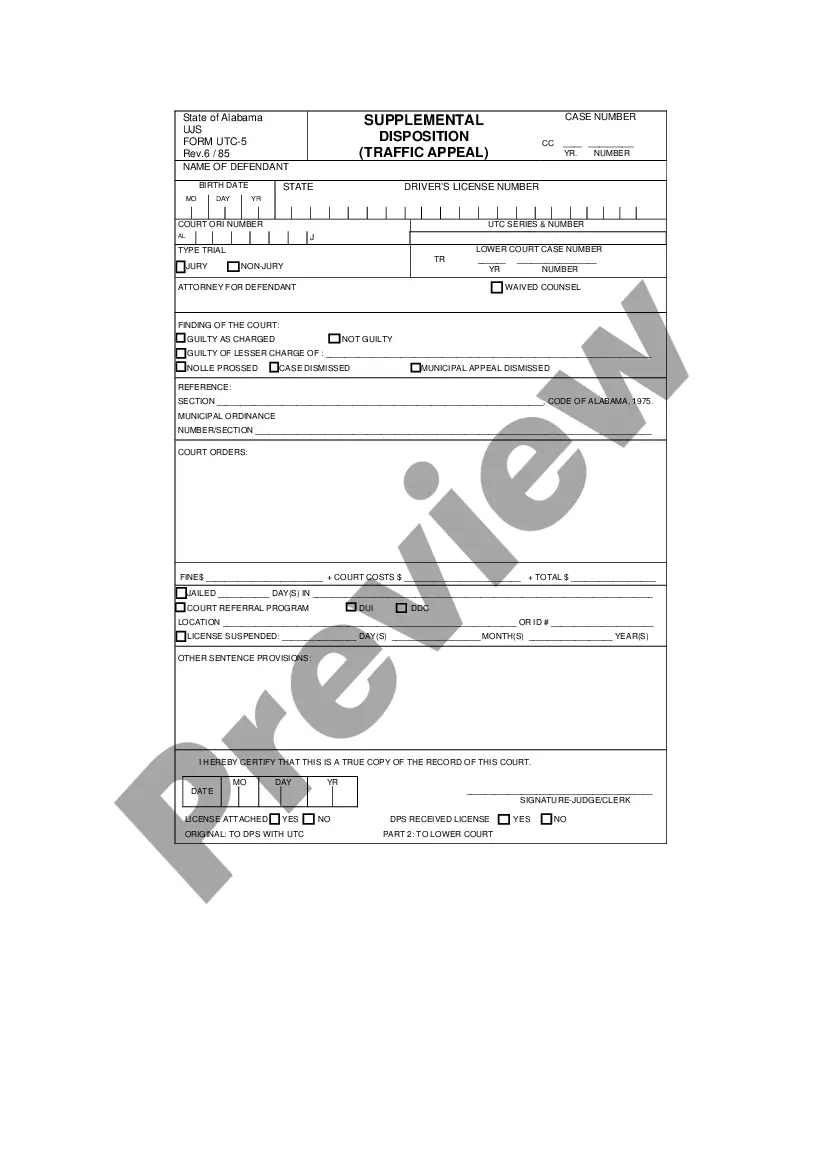

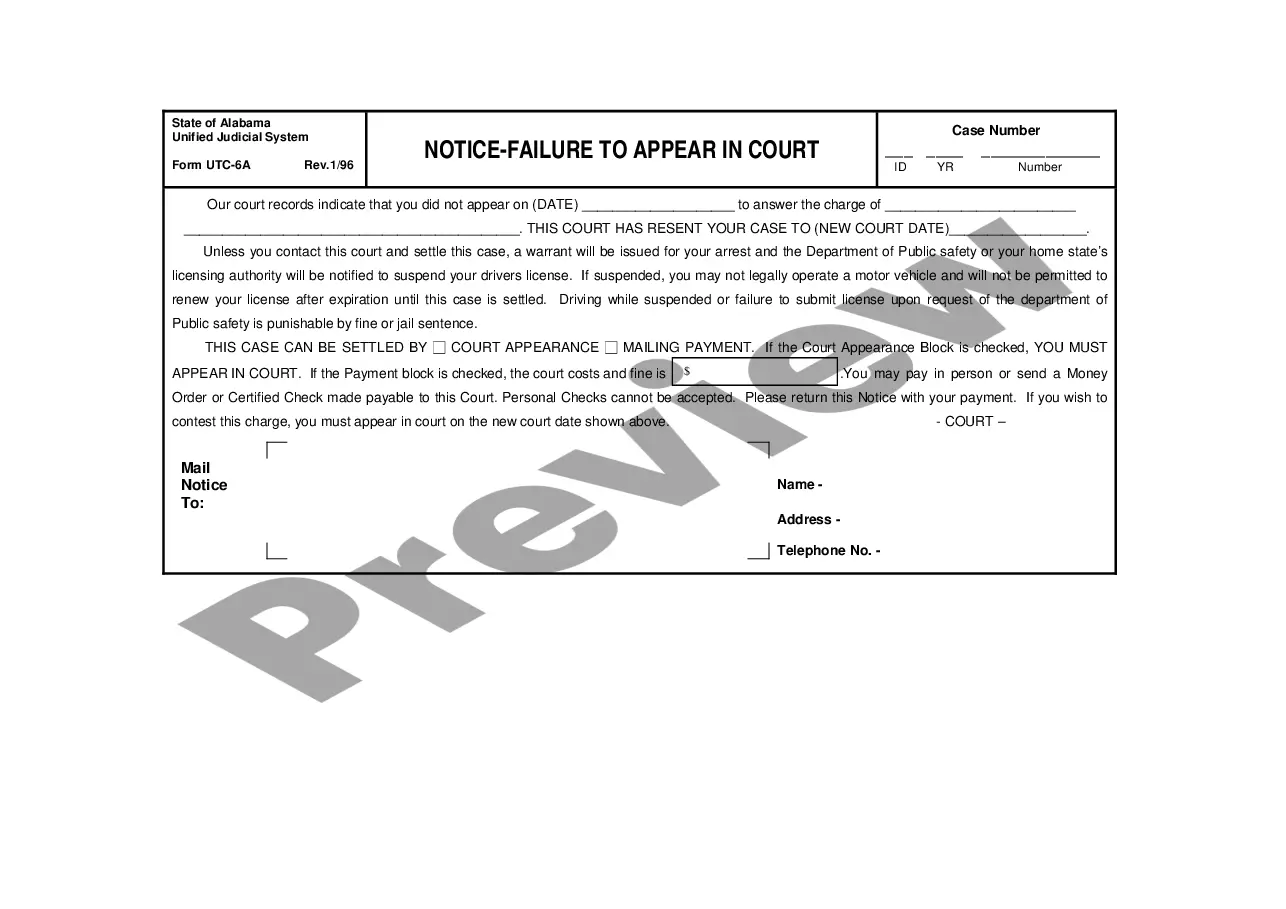

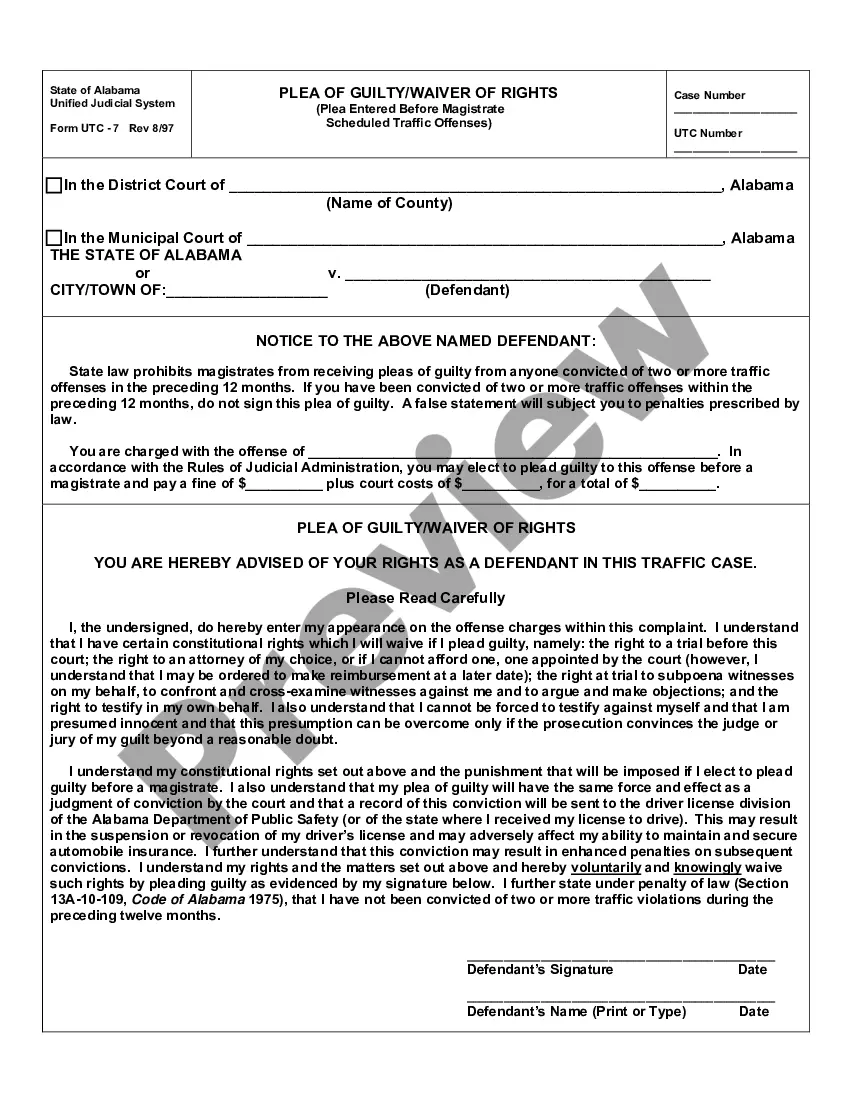

Description

How to fill out Letter To Small Businessman In Advance Collection?

Dealing with legal documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Letter to Small Businessman in Advance Collection template from our library, you can be certain it meets federal and state laws.

Dealing with our service is easy and quick. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Letter to Small Businessman in Advance Collection within minutes:

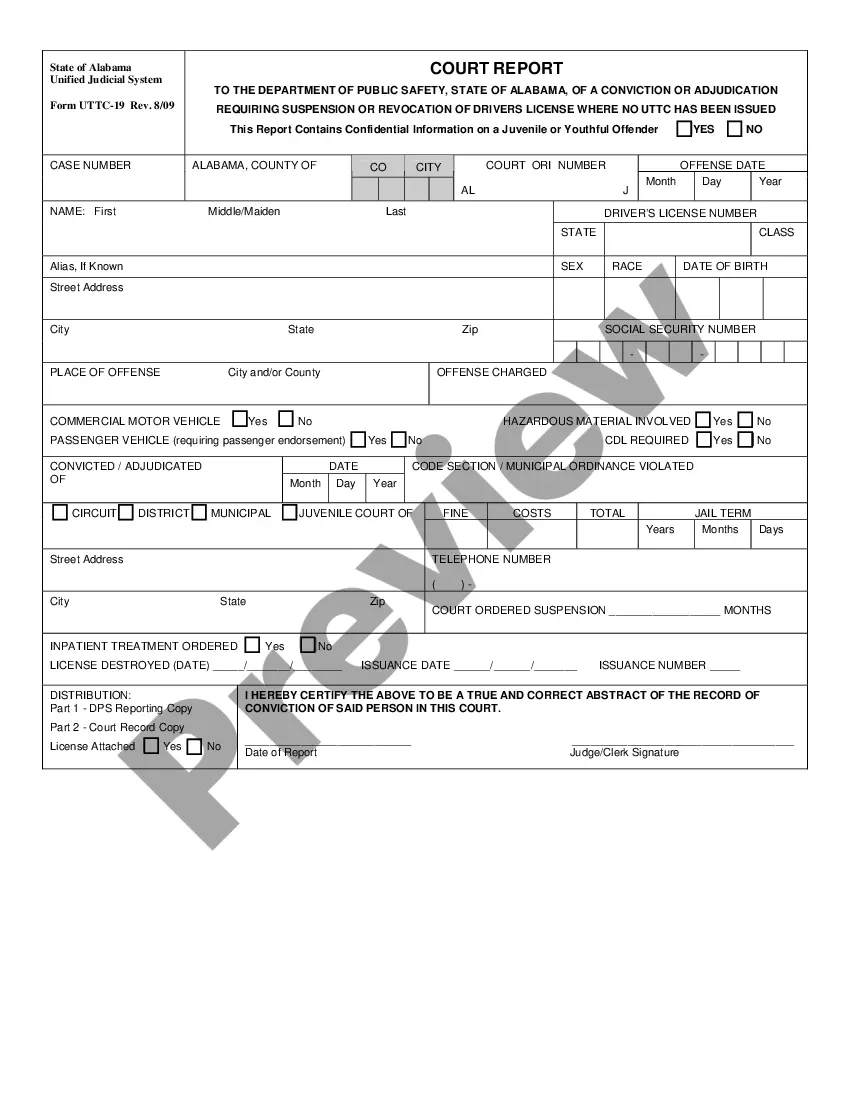

- Make sure to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Letter to Small Businessman in Advance Collection in the format you prefer. If it’s your first experience with our service, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the Letter to Small Businessman in Advance Collection you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or in the future. Instructions on how to pay the debt.

Call the debtor. A professional, to-the-point phone call can remind the client of their debt and show them that you intend to collect your debt. During the call, use a friendly but firm tone, refrain from scolding the client and explain to them how they can pay their debt.

Dear (name), This is a reminder for you that your account balance of $100 has become overdue on the date 23rd March 2020. Please pay this amount and clear your dues as soon as possible. I have included an address and stamped payment envelope with this letter for your convenience.

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or in the future. Instructions on how to pay the debt.

Be polite: Use a friendly and professional tone throughout the email. Avoid using aggressive language. Offer payment options: Provide details on how the recipient can pay, including the due date, acceptable forms of payment, and how to access online payment portals.

A few things to include in your final collection letter: Mention of previous attempts to collect? including any statements, emails, and letters you have sent.Invoice number and amount. Original invoice due date. Current days past due. Instructions- what they need to do next.

This first collection letter should include important points, such as: Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not ?in the next 7 business days? as this can be vauge.

A collection letter may include reminders, inquiries, warnings or notification of possible legal actions. Although a collection letter is a firm notice to a borrower, it must be written in a polite way. One should not use slang, offensive, and abusive words.