Miller Trust Forms for Assisted Living

Description

How to fill out Miller Trust Forms For Assisted Living?

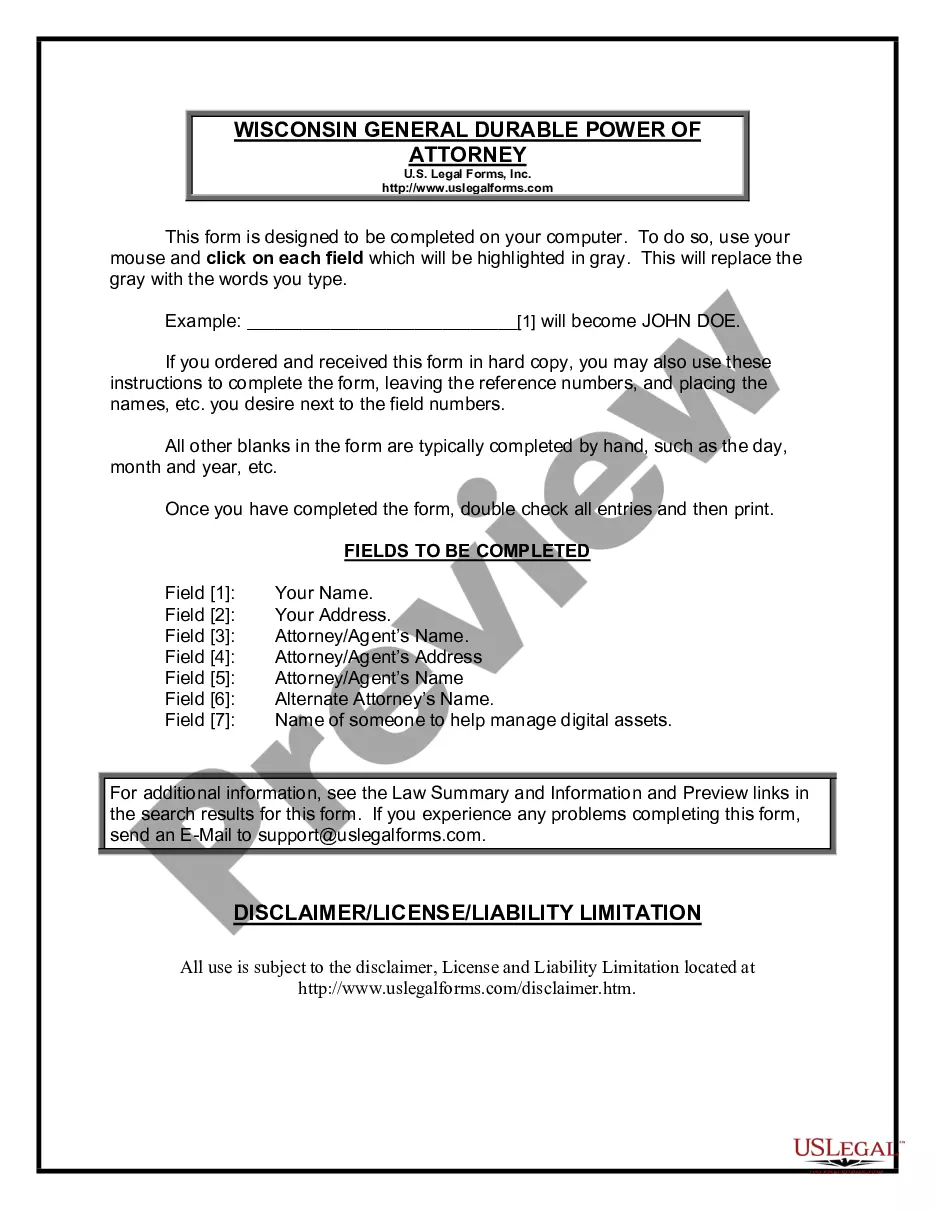

Use US Legal Forms to get a printable Miller Trust Forms for Assisted Living. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms catalogue on the internet and provides affordable and accurate samples for customers and lawyers, and SMBs. The documents are grouped into state-based categories and many of them can be previewed prior to being downloaded.

To download samples, users need to have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For people who do not have a subscription, follow the following guidelines to easily find and download Miller Trust Forms for Assisted Living:

- Check out to ensure that you have the right form with regards to the state it is needed in.

- Review the document by reading the description and using the Preview feature.

- Press Buy Now if it’s the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Make use of the Search field if you want to find another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Miller Trust Forms for Assisted Living. Over three million users have already used our service successfully. Choose your subscription plan and obtain high-quality documents in a few clicks.

Form popularity

FAQ

Some Medicaid professionals include the cost of establishing this type of trust as a package deal with other Medicaid planning services. However, on average, solely setting up a QIT runs approximately $400 to $500, but may run as high as $1,000 or $2,000.

What Is A Qualified Income Trust (QIT)? If an individual's income is over the limit to qualify for Medicaid long-term care services (including nursing home care), a Qualified Income Trust (QIT) allows an individual to become eligible by placing income into an account each month that the individual needs Medicaid.

Some Medicaid professionals include the cost of establishing this type of trust as a package deal with other Medicaid planning services. However, on average, solely setting up a QIT runs approximately $400 to $500, but may run as high as $1,000 or $2,000.

Sometimes referred to as Qualifying Income Trusts, Qualified Income Trusts, or Miller Trusts (based upon a court case with the same name), they are used when a Medicaid applicant has too much income to qualify for Medicaid but not enough to pay for nursing home care or other long-term care costs.

Payments. Miller trusts can be used to pay for a small monthly allowance, Medicare premiums and medical expenses that are not covered by Medicaid or Medicare.If there are any remaining funds after the state takes its allowed portion, these funds can go to the beneficiaries that are named in the trust.

The Miller trust can pay the Medicaid recipient a small personal needs allowance, and the trust can also be used to pay the recipient's spouse a monthly allowance.If there is any money left in the trust when the recipient dies, Medicaid has a right to the money to recover the cost of care.

Miller trusts can be used to pay for a small monthly allowance, Medicare premiums and medical expenses that are not covered by Medicaid or Medicare.If there are any remaining funds after the state takes its allowed portion, these funds can go to the beneficiaries that are named in the trust.