Miller Trust Forms for Medicaid

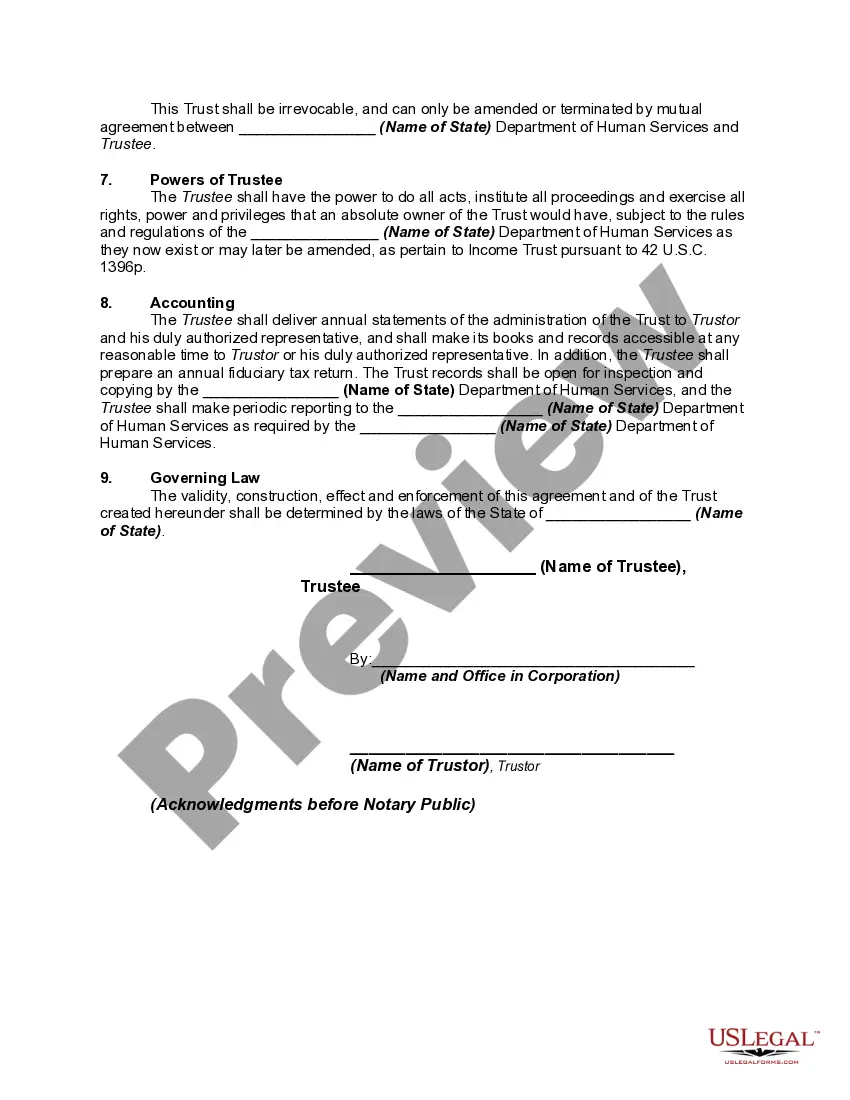

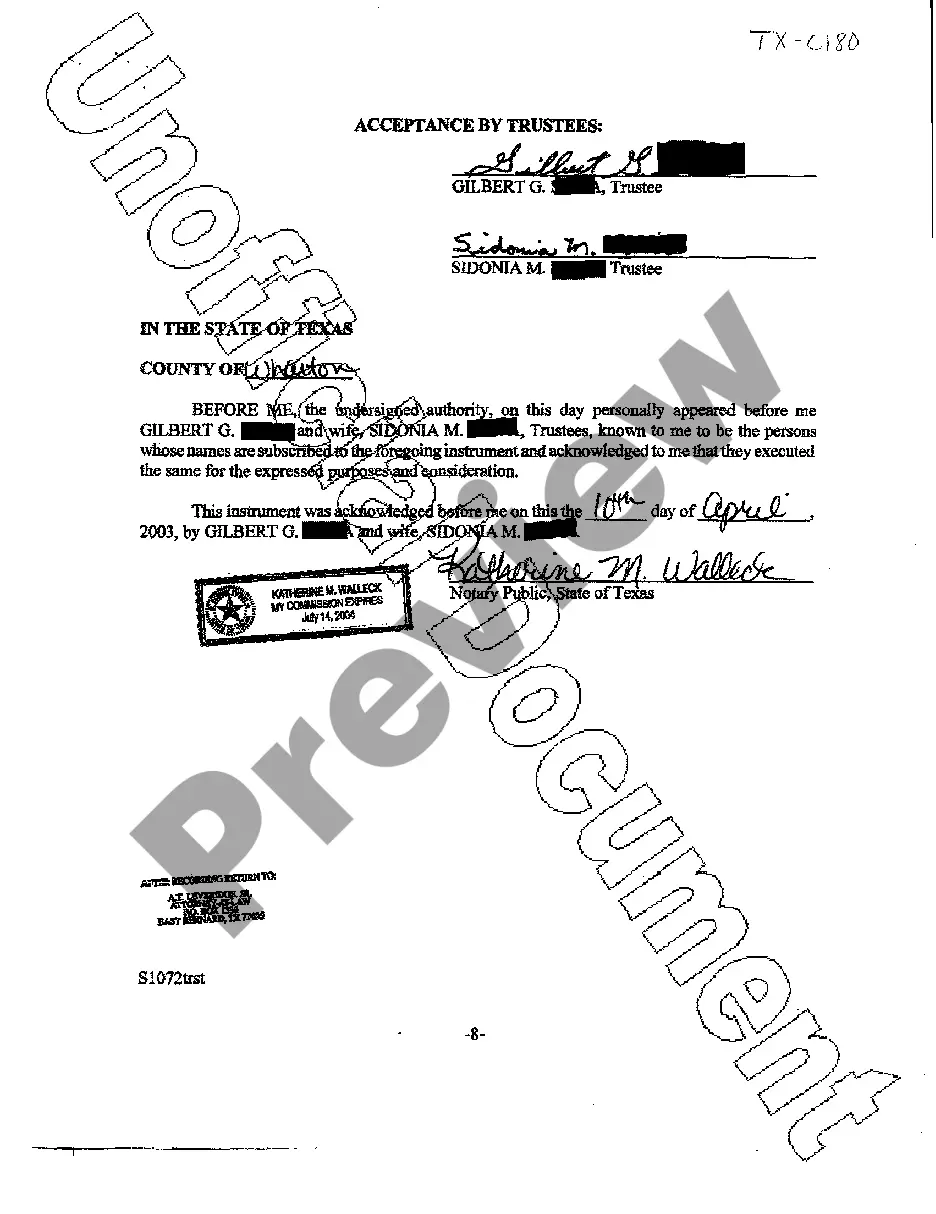

Description Miller Trust Form

How to fill out Miller Trust Forms For Medicaid?

Use US Legal Forms to obtain a printable Miller Trust Forms for Medicaid. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most extensive Forms catalogue on the internet and offers reasonably priced and accurate samples for customers and legal professionals, and SMBs. The documents are categorized into state-based categories and a few of them can be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to quickly find and download Miller Trust Forms for Medicaid:

- Check to ensure that you get the proper template in relation to the state it’s needed in.

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it is the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Make use of the Search engine if you need to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Miller Trust Forms for Medicaid. Above three million users have already used our service successfully. Select your subscription plan and have high-quality forms within a few clicks.

Missouri Miller Trust Form Form popularity

FAQ

Miller trusts can be used to pay for a small monthly allowance, Medicare premiums and medical expenses that are not covered by Medicaid or Medicare.If there are any remaining funds after the state takes its allowed portion, these funds can go to the beneficiaries that are named in the trust.

In order to establish a Miller Trust, a bank account must be set up and a trust document drawn up. The person setting up the Income Diversion Trust (the grantor, also called a settlor) can be the Medicaid applicant, his/her guardian or power of attorney.

Some Medicaid professionals include the cost of establishing this type of trust as a package deal with other Medicaid planning services. However, on average, solely setting up a QIT runs approximately $400 to $500, but may run as high as $1,000 or $2,000.

Establishing the Miller Trust Bank Account National Bank of Arizona is exceptionally cooperative in establishing these trusts. Once the bank account is opened in the name of the trust, the next step is to write social security and the pension payers and ask them to direct deposit future checks into the bank account.

The Miller trust can pay the Medicaid recipient a small personal needs allowance, and the trust can also be used to pay the recipient's spouse a monthly allowance.If there is any money left in the trust when the recipient dies, Medicaid has a right to the money to recover the cost of care.

Sometimes referred to as Qualifying Income Trusts, Qualified Income Trusts, or Miller Trusts (based upon a court case with the same name), they are used when a Medicaid applicant has too much income to qualify for Medicaid but not enough to pay for nursing home care or other long-term care costs.

Payments. Miller trusts can be used to pay for a small monthly allowance, Medicare premiums and medical expenses that are not covered by Medicaid or Medicare.If there are any remaining funds after the state takes its allowed portion, these funds can go to the beneficiaries that are named in the trust.

A Miller trust does not use an EIN.)Note: Miller Trusts are treated as grantor trusts under IRC § 671. Page 2. 4) The individual establishing the trust must have a Power of Attorney or legal guardianship to act on behalf of the member.