A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

Notice of Default and Election to Sell - Intent To Foreclose

Description Deed Of Trust Colorado

How to fill out Name Trust Mortgage?

Aren't you sick and tired of choosing from numerous samples each time you want to create a Notice of Default and Election to Sell - Intent To Foreclose? US Legal Forms eliminates the lost time numerous American people spend exploring the internet for appropriate tax and legal forms. Our skilled team of lawyers is constantly modernizing the state-specific Forms collection, to ensure that it always provides the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription need to complete simple actions before having the ability to download their Notice of Default and Election to Sell - Intent To Foreclose:

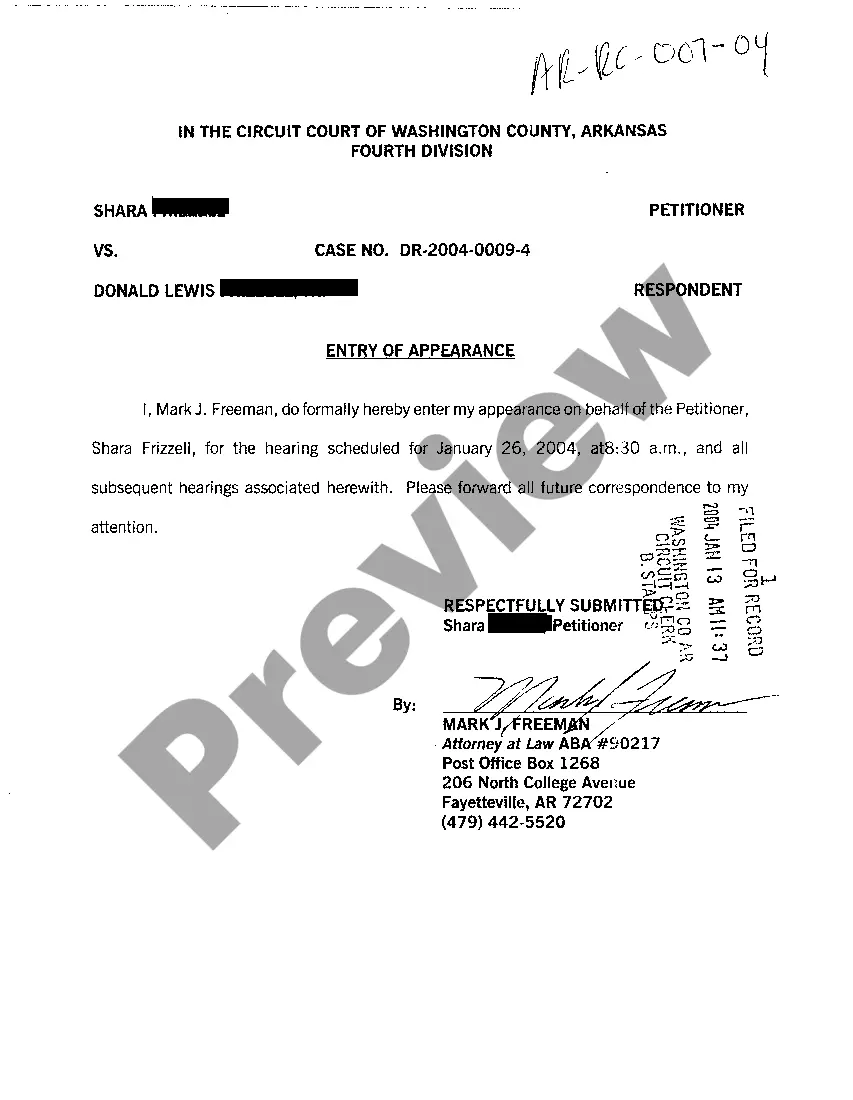

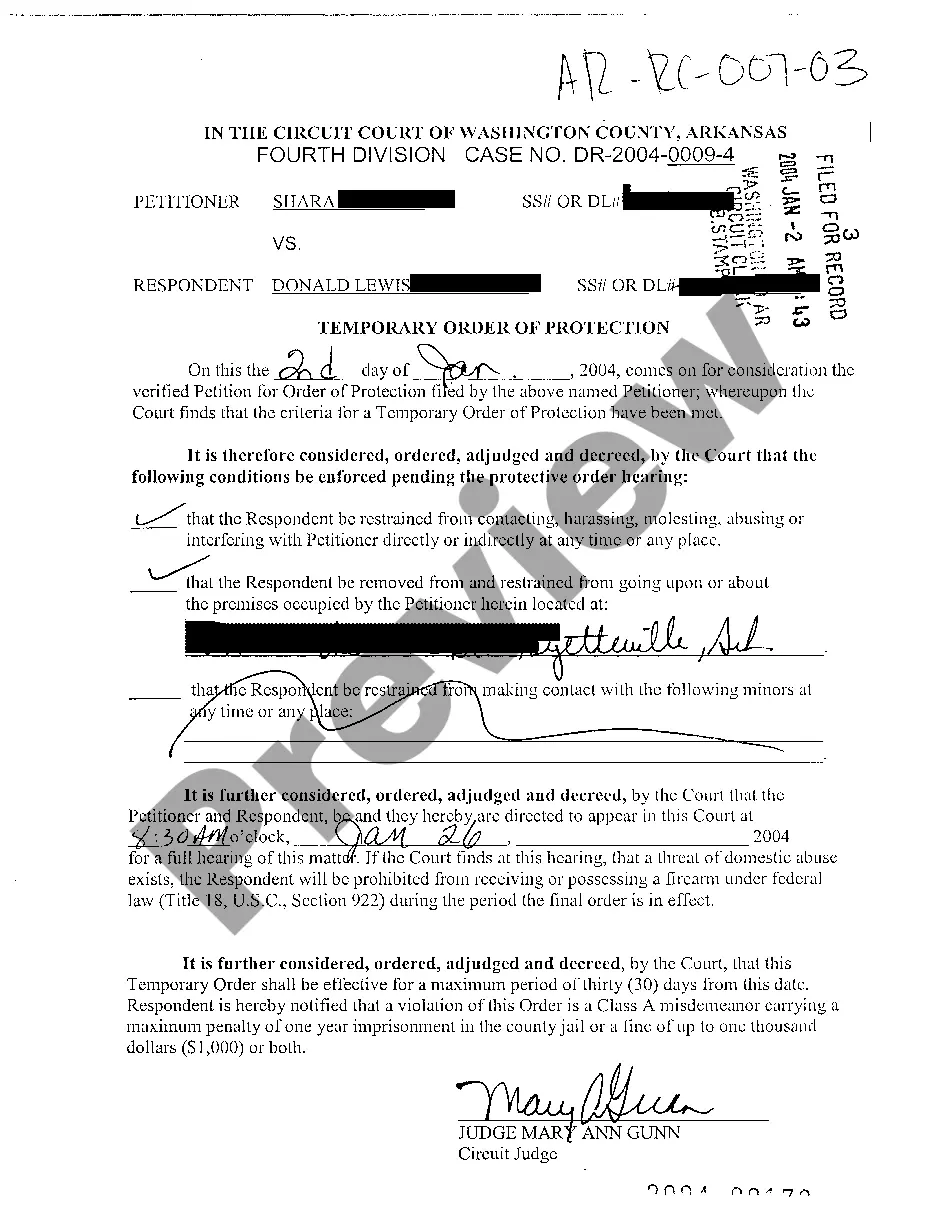

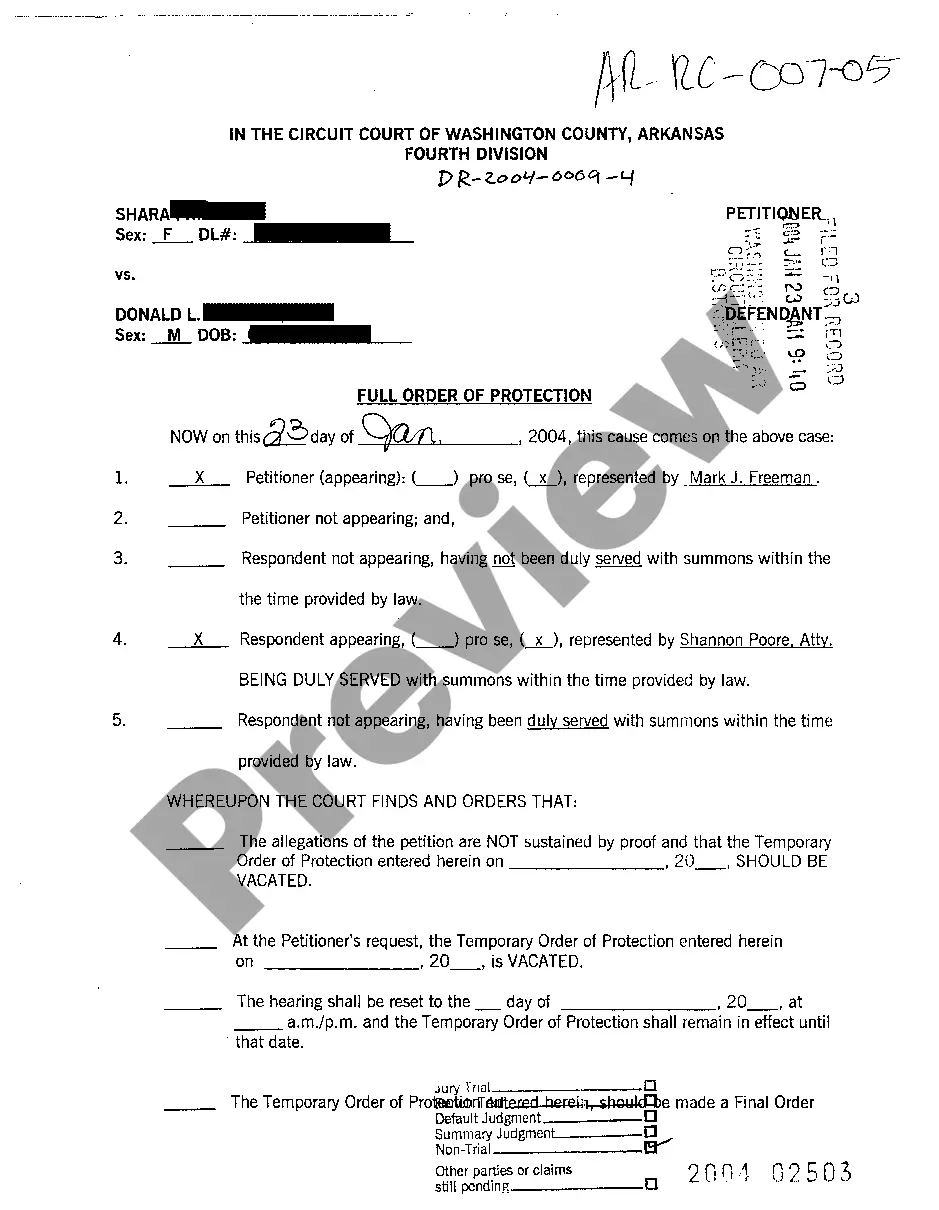

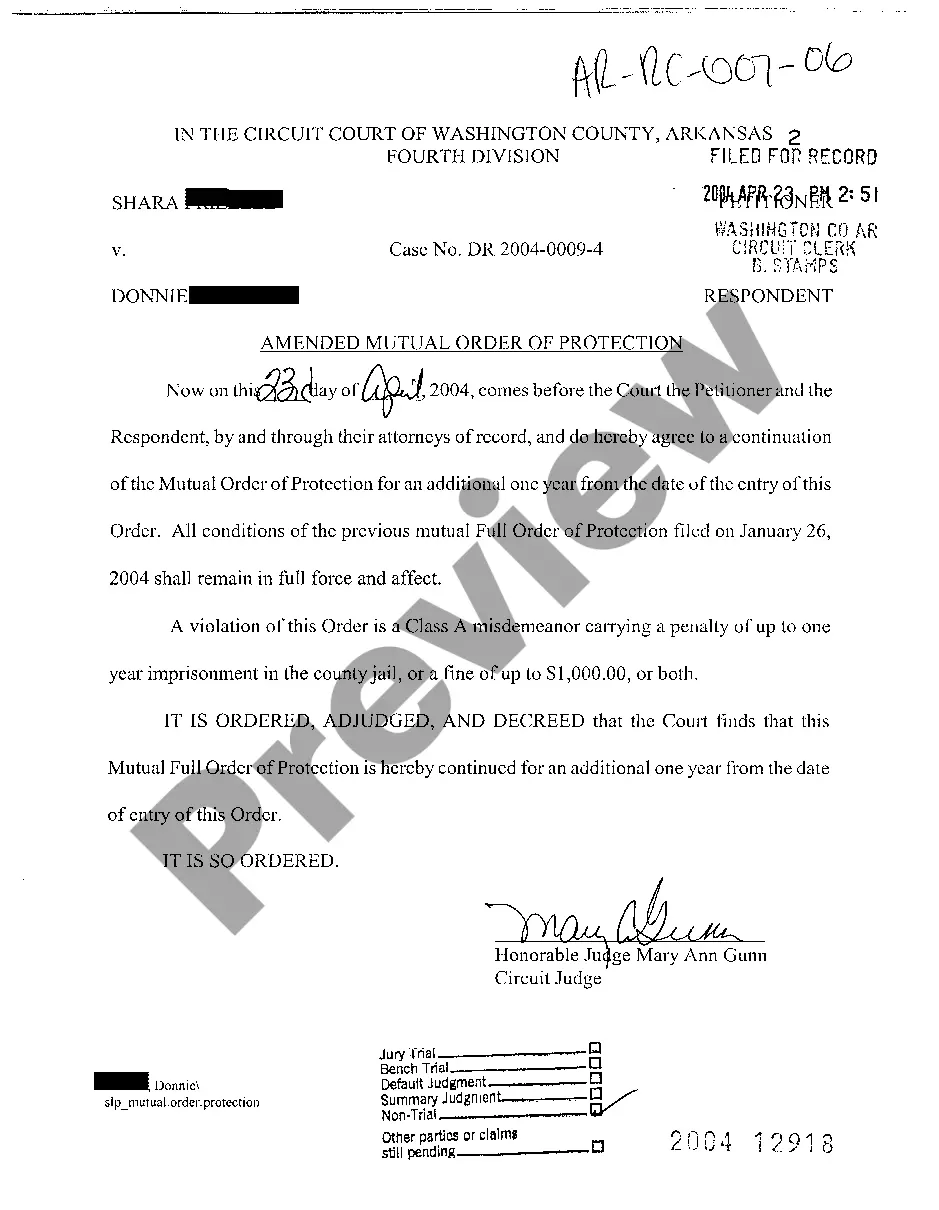

- Make use of the Preview function and look at the form description (if available) to be sure that it’s the proper document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper example for the state and situation.

- Utilize the Search field on top of the site if you want to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your sample in a required format to complete, create a hard copy, and sign the document.

When you have followed the step-by-step instructions above, you'll always have the capacity to sign in and download whatever document you need for whatever state you need it in. With US Legal Forms, completing Notice of Default and Election to Sell - Intent To Foreclose samples or any other legal documents is not hard. Get started now, and don't forget to look at your examples with accredited lawyers!

Default Sell Download Form popularity

Notice Default Intent Other Form Names

Sell Intent Form FAQ

The borrower defaults on the loan. The lender issues a notice of default (NOD). A notice of trustee's sale is recorded in the county office. The lender tries to sell the property at a public auction.

If a borrower falls behind on his mortgage payments, the mortgage lender might file a notice of default, which is an official public notice that the borrower is in arrears. It is one of the initial steps in the foreclosure process.

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.

The term notice of default refers to a public notice filed with a court that states that the borrower of a mortgage is in default on a loan. The lender may file a notice of default when a mortgagor falls behind on their mortgage payments.

"Commencement of Foreclosure" for HUD's purposes is the first public action required by law such as filing a complaint or petition, recording a notice of default, or publication of a notice of sale.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.