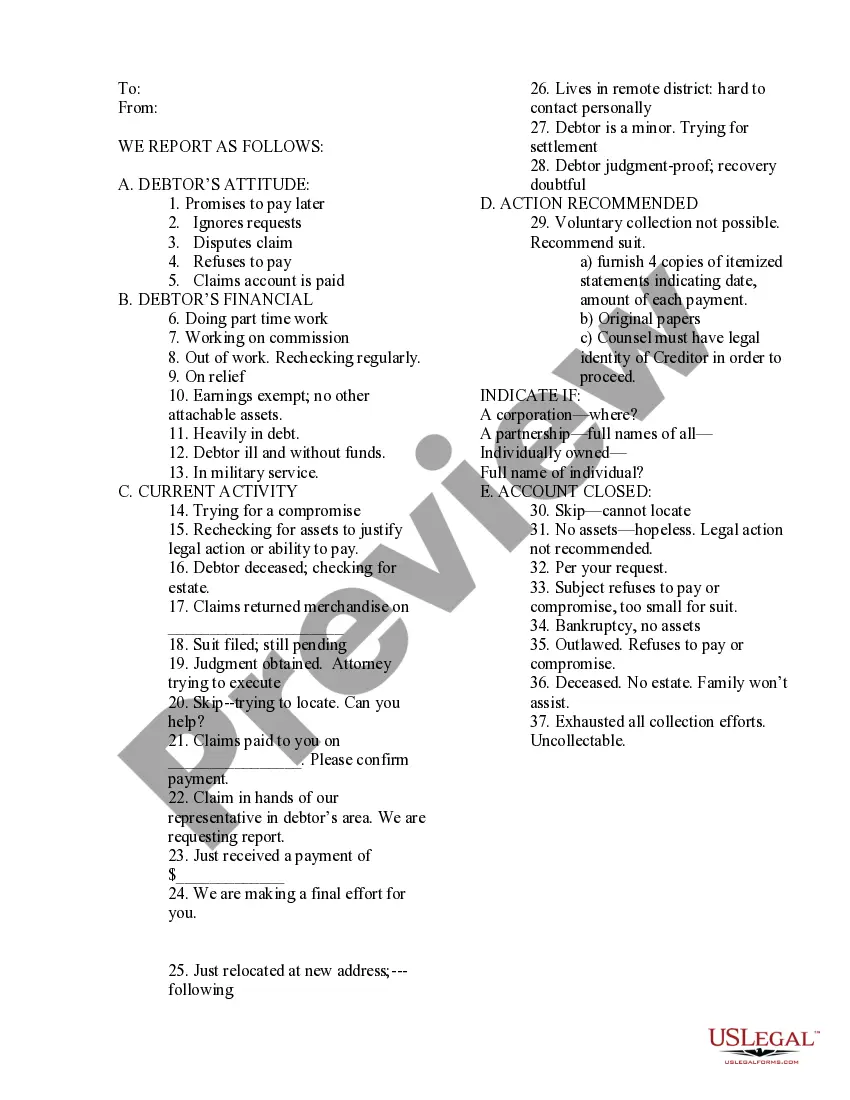

Collection Reports on Current Status of Debt

Description

How to fill out Collection Reports On Current Status Of Debt?

US Legal Forms is the most straightforward and cost-effective way to locate appropriate formal templates. It’s the most extensive online library of business and personal legal documentation drafted and verified by legal professionals. Here, you can find printable and fillable blanks that comply with national and local laws - just like your Collection Reports on Current Status of Debt.

Obtaining your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Collection Reports on Current Status of Debt if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make sure you’ve found the one meeting your requirements, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your Collection Reports on Current Status of Debt and download it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more efficiently.

Take full advantage of US Legal Forms, your reliable assistant in obtaining the required official paperwork. Try it out!

Form popularity

FAQ

Once an account is sold to a collection agency, the collection account can then be reported as a separate account on your credit report. Collection accounts have a significant negative impact on your credit scores. Collections can appear from unsecured accounts, such as credit cards and personal loans.

A collection account may be reported to one, two or all three of the nationwide credit bureaus (Equifax, Experian and TransUnion) and reflected on your credit reports. It can also have a negative impact on credit scores, depending on the credit scoring model (different ways credit scores are calculated).

A collection on a debt of less than $100 shouldn't affect your score at all, but anything over $100 could cause a big drop. In many cases, it doesn't even matter how much it is if it's over $100. Whether you owe $500 or $150,000, you may see a credit score drop of 100 points or more, depending on where you started.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

The Debt Collector Hasn't Reported the Debt Yet Some accounts go to ?pre-collections? when they're only one or two months past due. During this period, you may get calls or letters about the debt even though it's not on your credit report yet.

The multistage debt collection process varies depending on the creditor, but it usually includes phone and mail notices, stoppage of services (if applicable), notifications to credit reporting bureaus, assignment to third-party collection agencies, and potential court proceedings.

Collection agencies begin reporting to the credit bureaus once they have taken the required steps to confirm the debt with the borrower, then continue to report monthly. Confirming the debt with the borrower can occur instantly or take up to several weeks.

Step 1: Get notice. By law, a collector must send you a ?Notice of Debt? letter within 30 days of their first contact with you.Step 2: Check your credit report. Once you receive the Notice of Debt you can compare it to your own records?namely, your credit report.Step 3: Ask for validation.Step 4: Cease and desist.