A Real Estate Investment Trust or REIT is a tax designation for a corporation investing in real estate that reduces or eliminates corporate income taxes. In return, REITs are required to distribute 90% of their income, which may be taxable, into the hands of the investors. REITs invest in different kinds of real estate or real estate related assets. The REIT structure was designed to provide a similar structure for investment in real estate as mutual funds provide for investment in stocks. Like other corporations, REITs can be publicly or privately held. Public REITs may be listed on public stock exchanges like shares of common stock in other firms.

Real Estate Investment Trust - REIT

Description

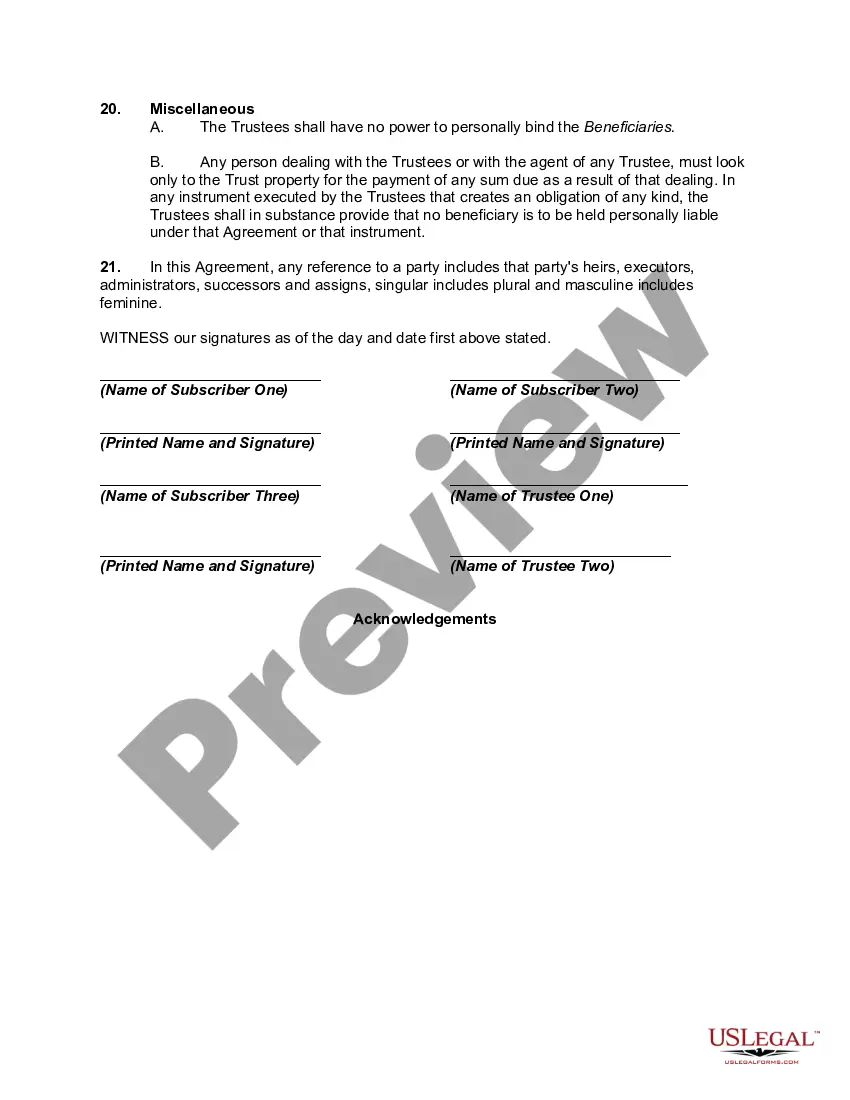

How to fill out Real Estate Investment Trust - REIT?

Aren't you tired of choosing from countless samples every time you require to create a Real Estate Investment Trust - REIT? US Legal Forms eliminates the wasted time numerous American people spend surfing around the internet for appropriate tax and legal forms. Our professional group of attorneys is constantly modernizing the state-specific Forms library, so that it always provides the right documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription should complete simple steps before having the capability to get access to their Real Estate Investment Trust - REIT:

- Make use of the Preview function and read the form description (if available) to be sure that it is the correct document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the right sample to your state and situation.

- Use the Search field at the top of the web page if you have to look for another document.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your sample in a needed format to finish, print, and sign the document.

As soon as you’ve followed the step-by-step recommendations above, you'll always be capable of sign in and download whatever file you will need for whatever state you want it in. With US Legal Forms, completing Real Estate Investment Trust - REIT templates or any other official documents is not hard. Begin now, and don't forget to examine your examples with certified attorneys!

Form popularity

FAQ

Draw up a partnership agreement that designates the percent ownership, financial contributions and responsibilities of each partner in the REIT. Incorporate your management company with the secretary of state in the state in which your REIT will operate. Draft an offering prospectus.

To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37% (returning to 39.6% in 2026), plus a separate 3.8% surtax on investment income. Taxpayers may also generally deduct 20% of the combined qualified business income amount which includes Qualified REIT Dividends through Dec.

Any entity that would be treated as a domestic corporation for federal income tax purposes but for the ReIT election may qualify for treatment as a ReIT.The net effect of these rules is that an entity formed as a trust, partnership, limited liability company or corporation can be a ReIT.

Find investors Your company will need at least 100 investors to be classified as a REIT. You don't necessarily need to get all 100 up front, since the IRS only requires you to meet that threshold by the beginning of the REIT's second tax year.

Invest at least 75% of total assets in real estate, cash, or U.S. Treasuries. Derive at least 75% of gross income from rents, interest on mortgages that finance real property, or real estate sales. Pay a minimum of 90% of taxable income in the form of shareholder dividends each year.

Most REITs have a straightforward business model: The REIT leases space and collects rents on the properties, then distributes that income as dividends to shareholders. Mortgage REITs don't own real estate, but finance real estate, instead. These REITs earn income from the interest on their investments.

If you own shares in a REIT, you should receive a copy of IRS Form 1099-DIV each year. This tells you how much you received in dividends and what kind of dividends they were: Ordinary income dividends are reported in Box 1. Capital gains distributions are generally reported in Box 2a.

Earning money from a publicly owned real estate investment trust (REIT) is like earning money from stocks. You receive dividends from the profits of the company and can sell your shares at a profit when their value in the marketplace increases.