A nanny is employed by a family in either a live-in or live-out basis. The function of a nanny is to essentially be responsible for all care of the children in the home in a largely unsupervised setting. Duties are typically focused on childcare and any household chores or tasks related to the children. A nanny may or may not have any formal training; however, many have significant actual experience. A nanny typically works full-time of at least 40 hours a week.

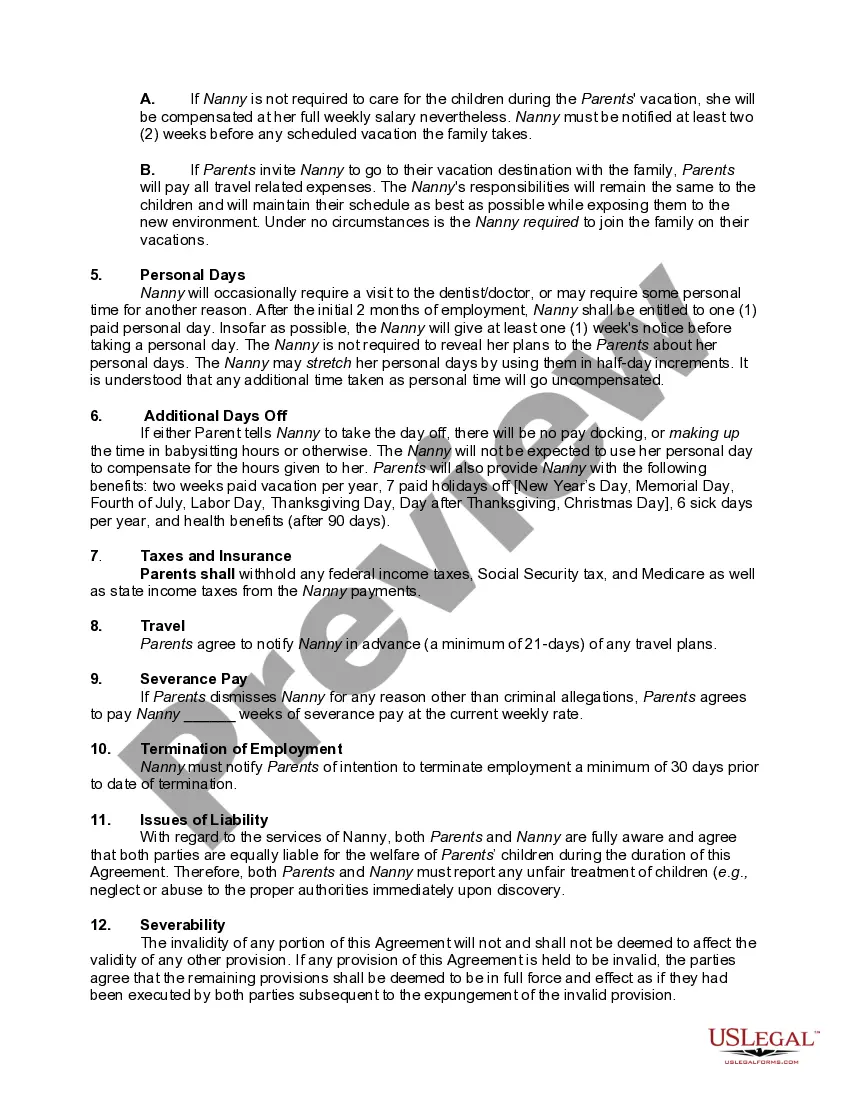

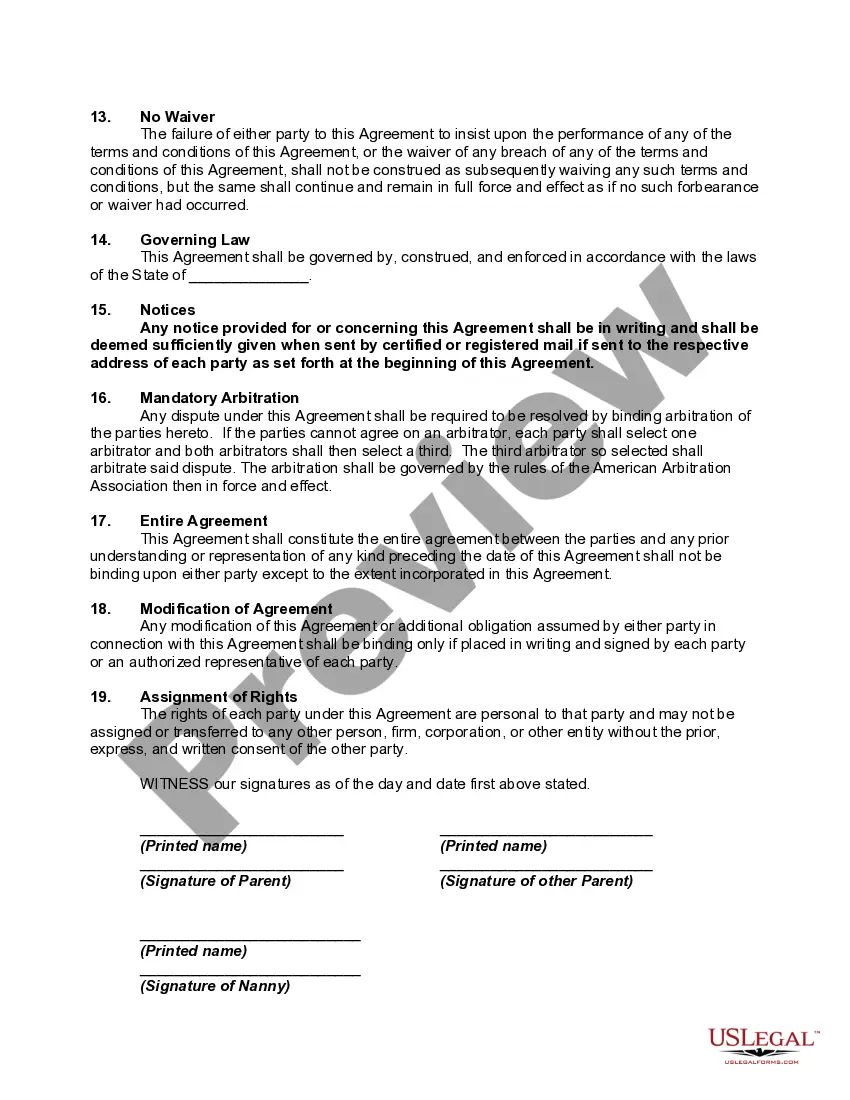

The employing parents are generally responsible for withholding and paying federal income taxes, Social Security tax, and Medicare as well as state income taxes (in most states).