Voting Trust Agreement

Description

How to fill out Voting Trust Agreement?

Aren't you tired of choosing from countless templates each time you require to create a Voting Trust Agreement? US Legal Forms eliminates the wasted time countless American citizens spend surfing around the internet for suitable tax and legal forms. Our expert group of lawyers is constantly updating the state-specific Forms library, so it always offers the appropriate files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have a subscription should complete a few simple steps before having the ability to get access to their Voting Trust Agreement:

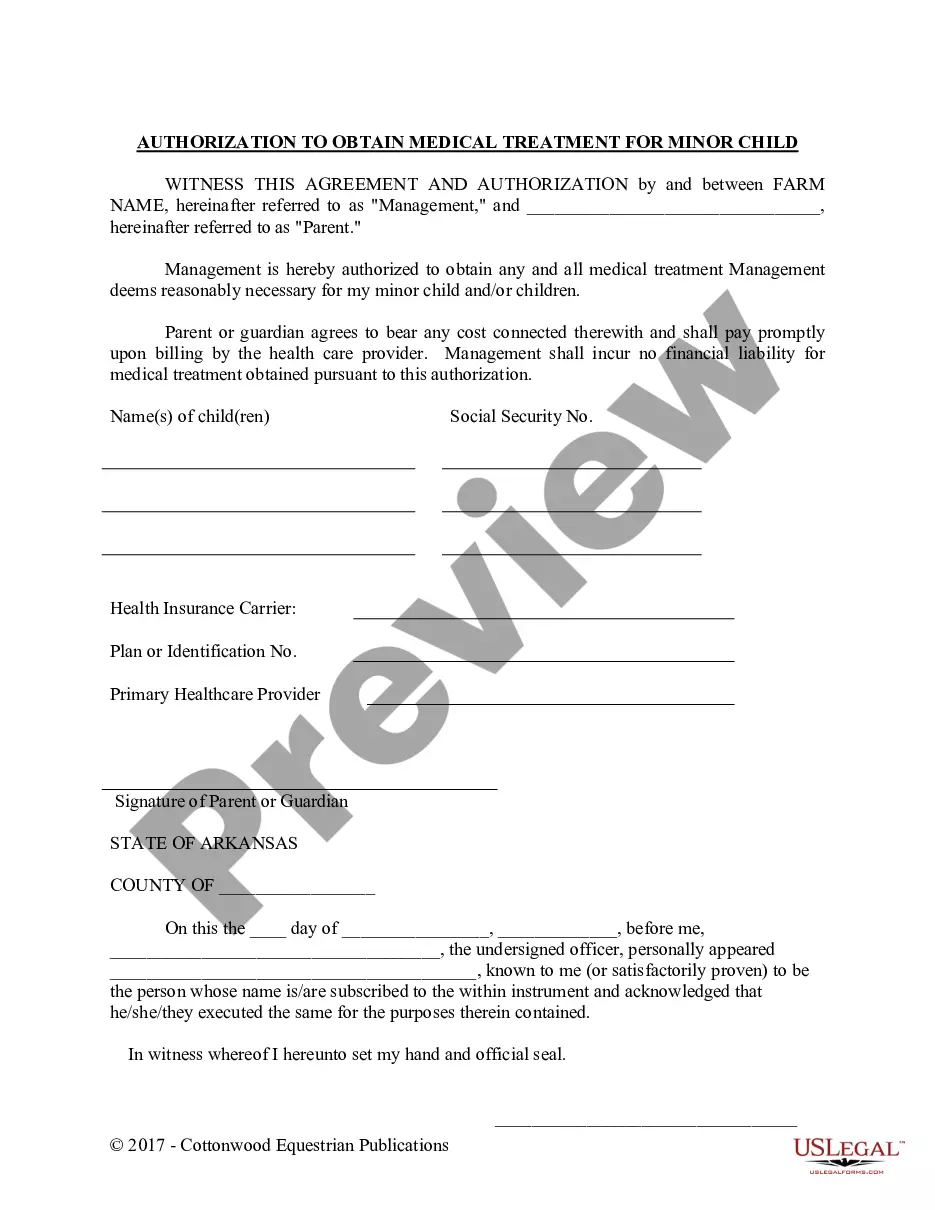

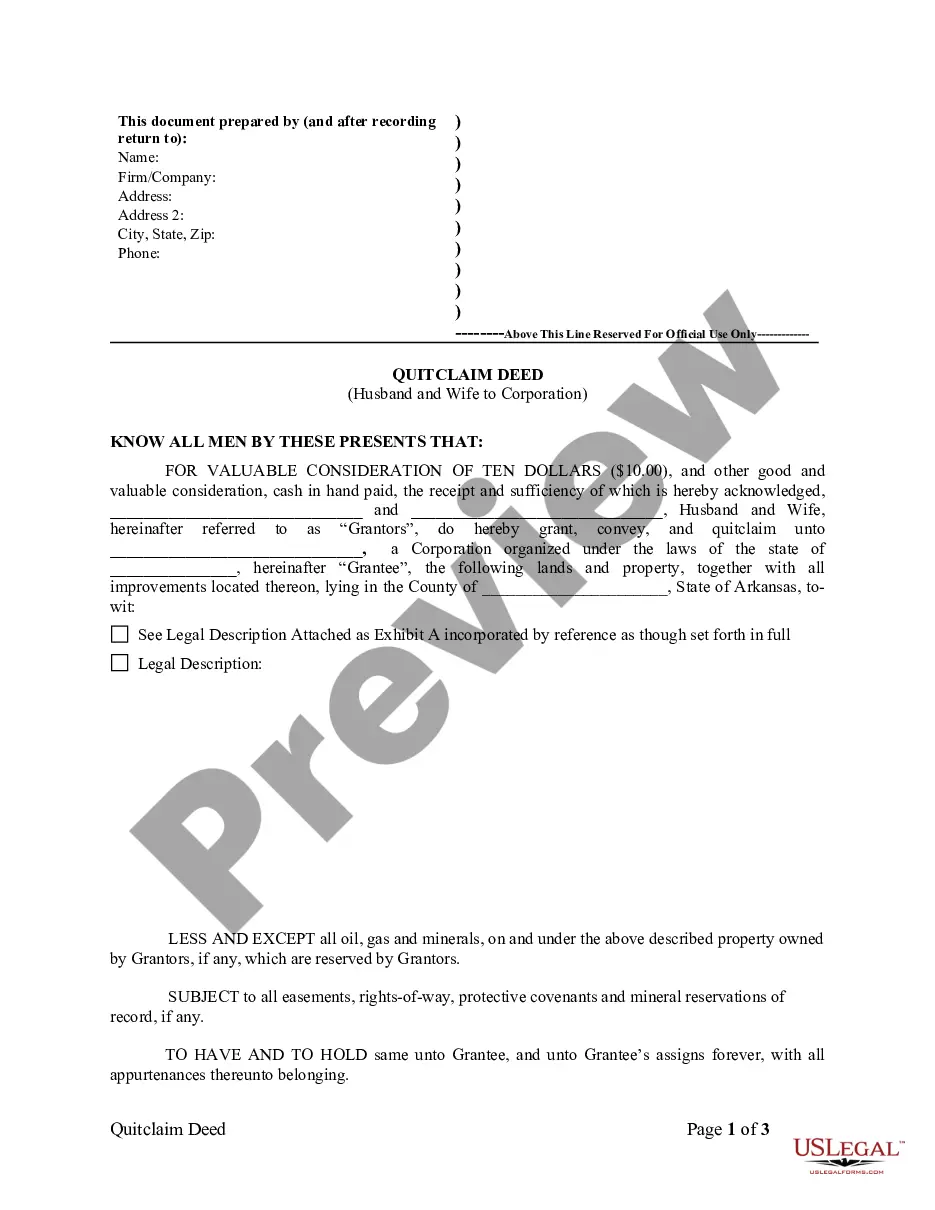

- Make use of the Preview function and read the form description (if available) to be sure that it’s the appropriate document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate template to your state and situation.

- Use the Search field at the top of the web page if you need to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your document in a needed format to complete, print, and sign the document.

When you’ve followed the step-by-step recommendations above, you'll always be able to sign in and download whatever file you require for whatever state you require it in. With US Legal Forms, completing Voting Trust Agreement templates or any other legal documents is not difficult. Begin now, and don't forget to double-check your samples with certified lawyers!

Form popularity

FAQ

A trust agreement is a document that allows you (the trustor) to legally transfer the ownership of specific assets to another person (trustee) to be held for the trustor's beneficiaries.

By Practical Law Corporate & Securities. Maintained 2022 USA (National/Federal) A voting agreement to be used in connection with the acquisition of a public company. This agreement sets out the terms and conditions by which a target company's stockholder agrees to vote in favor of a merger transaction.

A voting trust is a contract between shareholders in which their shares and voting rights are temporarily transferred to a trustee. A voting agreement is a contract in which shareholders agree to vote a certain way on specific issues without giving up their shares or voting rights.

A "shareholder trust" is a trust which holds shares in a corporation.Any fiduciary duties that might otherwise exist between those in control of the entity and other interest holders such as the shareholder trust may run only to the trust.

A voting trust certificate is issued to a stockholder in exchange for his or her common stock, and represents all of the normal rights of a shareholder (e.g., receiving dividends) except the right to vote.

A trust is a legal agreement that allows you (the trustor) to transfer property and assets for the benefit of someone else (the beneficiaries).You place your assets under control of a trustee, an individual or organization that manages and distributes the assets as set out in a trust document specifying your wishes.

A trust agreement is a document that spells out the rules that you want followed for property held in trust for your beneficiaries. Common objectives for trusts are to reduce the estate tax liability, to protect property in your estate, and to avoid probate.

Personal trusts are further divided into either 1) Under Declaration of Trust (U/D/T) meaning the grantor and the trustee are the same person and the grantor controls the trust assets, and 2) Trust Under Agreement (U/A) meaning the grantor and the trustee are different persons and the trustee controls the trust assets.