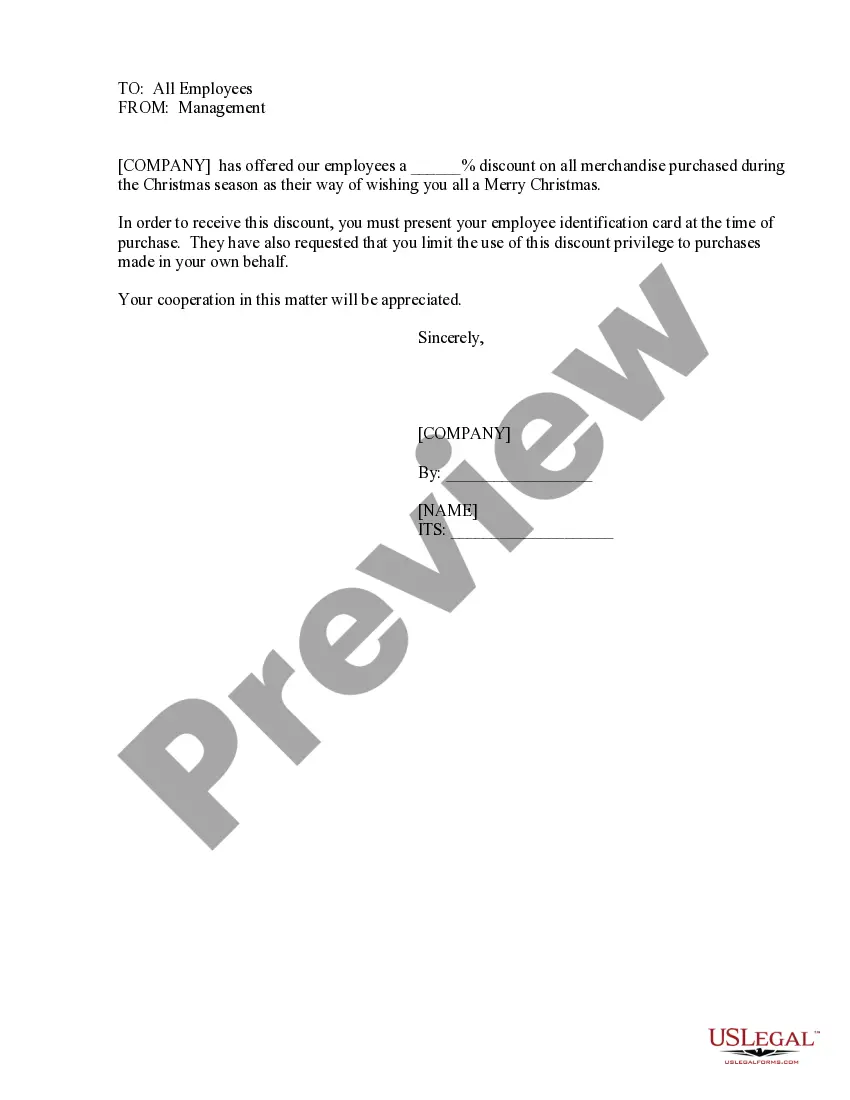

Employee Discount Offer

Description

How to fill out Employee Discount Offer?

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state laws and are checked by our specialists. So if you need to complete Employee Discount Offer, our service is the perfect place to download it.

Getting your Employee Discount Offer from our catalog is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the correct template. Afterwards, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a brief instruction for you:

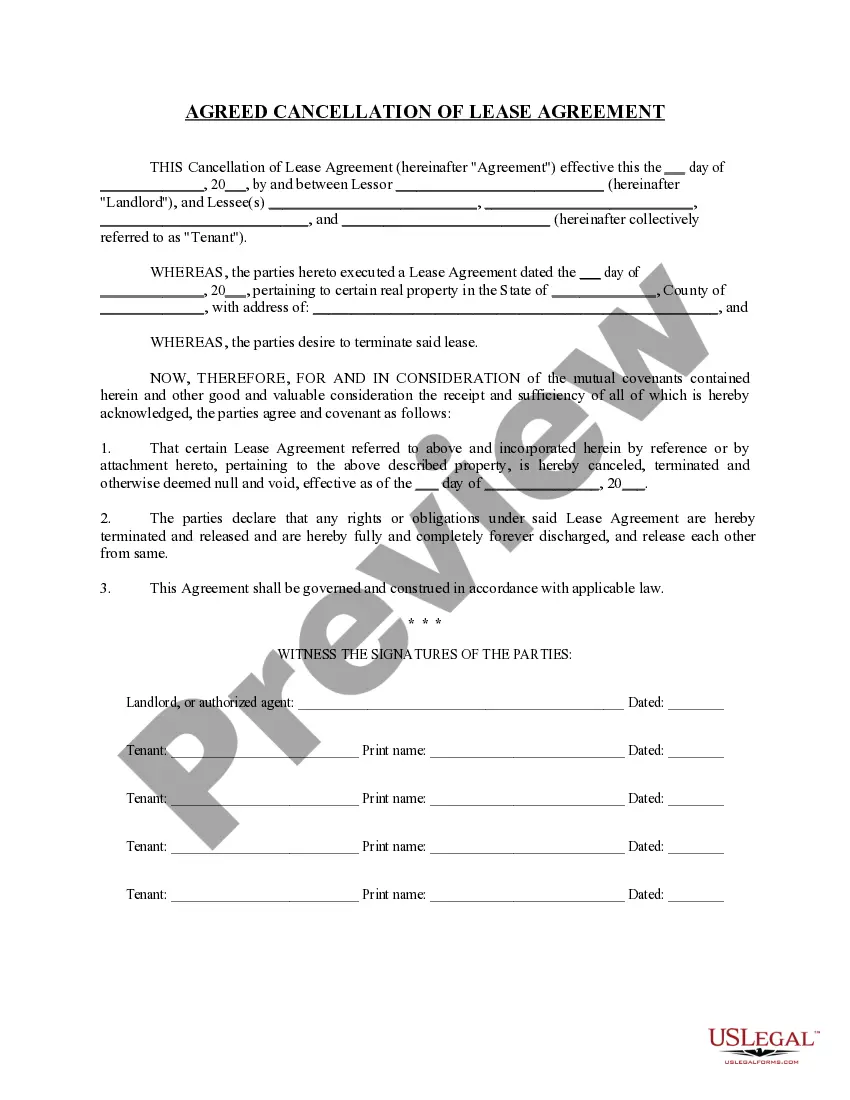

- Document compliance check. You should carefully review the content of the form you want and ensure whether it suits your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable blank, and click Buy Now when you see the one you need.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Employee Discount Offer and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

For a lot of companies, you can only use your employee discount for somebody that you can claim on your taxes or somebody that can claim you on their taxes. If caught using it for somebody other than those people, you can get in trouble and if you continue to do it afterwards, you can even get fired.

What is discount abuse? Discount abuse can be narrowly defined as employees using different discounts to reduce the price of any item in a way that the company would consider unacceptable. It is one of the most common types of employee theft.

An employee discount program allows employees to go for an exclusive discount while shopping for products or services. The products may range from grocery items to movie tickets. Since these are exclusive discounts, the best part is that only the employees are eligible for these discounts.

Employee discounts refer to the discount given on the original price of the goods or services by the company to their employees. Generally an employee discount is given as one of the fringe benefits.

Reporting employee discounts as taxable income Again, employee discounts are taxable if they exceed the IRS limits. Discount amounts in excess of the IRS limits are subject to income, Social Security, Medicare, and FUTA taxes.

How to Implement an Employee Discount Program Review the Related Products and Services. Most businesses start these initiatives by looking for products and services.Choose Local Options.Offer Exclusive Discounts.Consider the Discount's Relevance.Consider Contract Duration.

Offering employee discounts can help you: Attract and retain employees. Boost sales. Increase brand loyalty.

How to Implement an Employee Discount Program Review the Related Products and Services. Most businesses start these initiatives by looking for products and services.Choose Local Options.Offer Exclusive Discounts.Consider the Discount's Relevance.Consider Contract Duration.