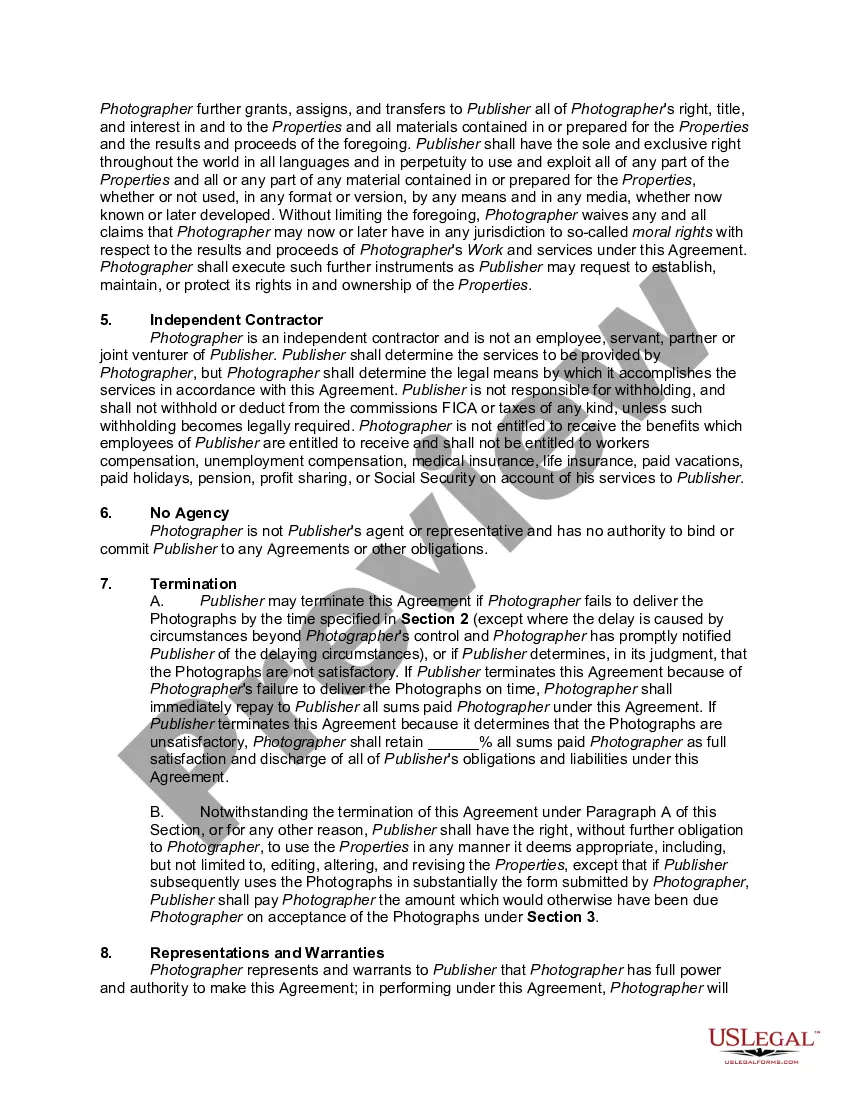

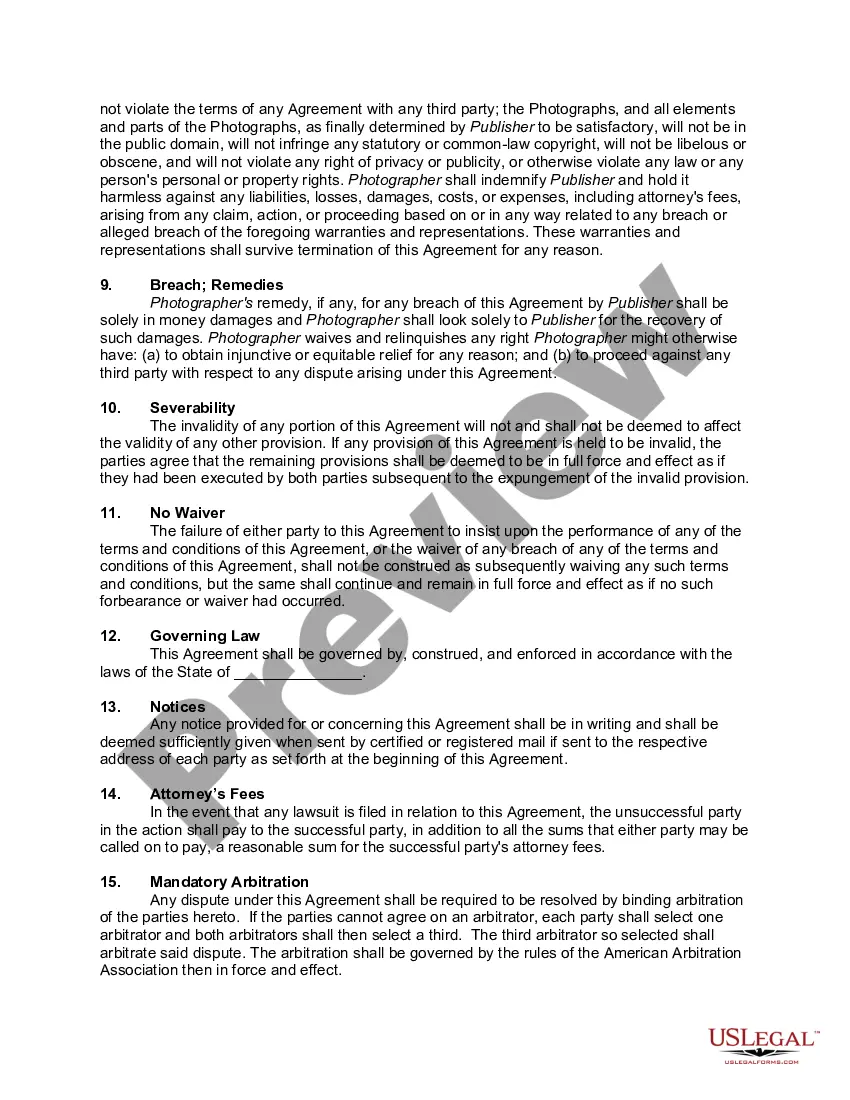

Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed

Description

How to fill out Contract With Independent Contractor To Photograph Works Of Art For Book - Self-Employed?

Aren't you tired of choosing from hundreds of samples each time you need to create a Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed? US Legal Forms eliminates the wasted time countless American people spend exploring the internet for appropriate tax and legal forms. Our professional group of attorneys is constantly upgrading the state-specific Samples library, so that it always provides the appropriate files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have an active subscription should complete a few simple steps before being able to get access to their Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed:

- Make use of the Preview function and look at the form description (if available) to make sure that it is the correct document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate template for your state and situation.

- Utilize the Search field at the top of the page if you want to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your sample in a required format to complete, print, and sign the document.

Once you have followed the step-by-step recommendations above, you'll always have the capacity to sign in and download whatever file you will need for whatever state you need it in. With US Legal Forms, finishing Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed samples or other legal paperwork is not difficult. Begin now, and don't forget to look at the samples with accredited lawyers!

Form popularity

FAQ

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.

Writing Your Construction Contract. Write the title and a little preamble. Your title should describe the purpose of the contract. The preamble should simply state basics like: the date the agreement was entered into, the parties' names, the project, the work site location, and work commencement and end dates.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Timeframe or key milestones of the project; hours of work; deliverables of the project; and. way the business will pay the contractor for their services.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

1040 This form is like a cover sheet for your tax return. You'll input your gross income from photography, deductions, and tax credits here. Schedule C This is one of the most crucial forms for photographers. It lets you detail the business expenses that you plan on deducting.