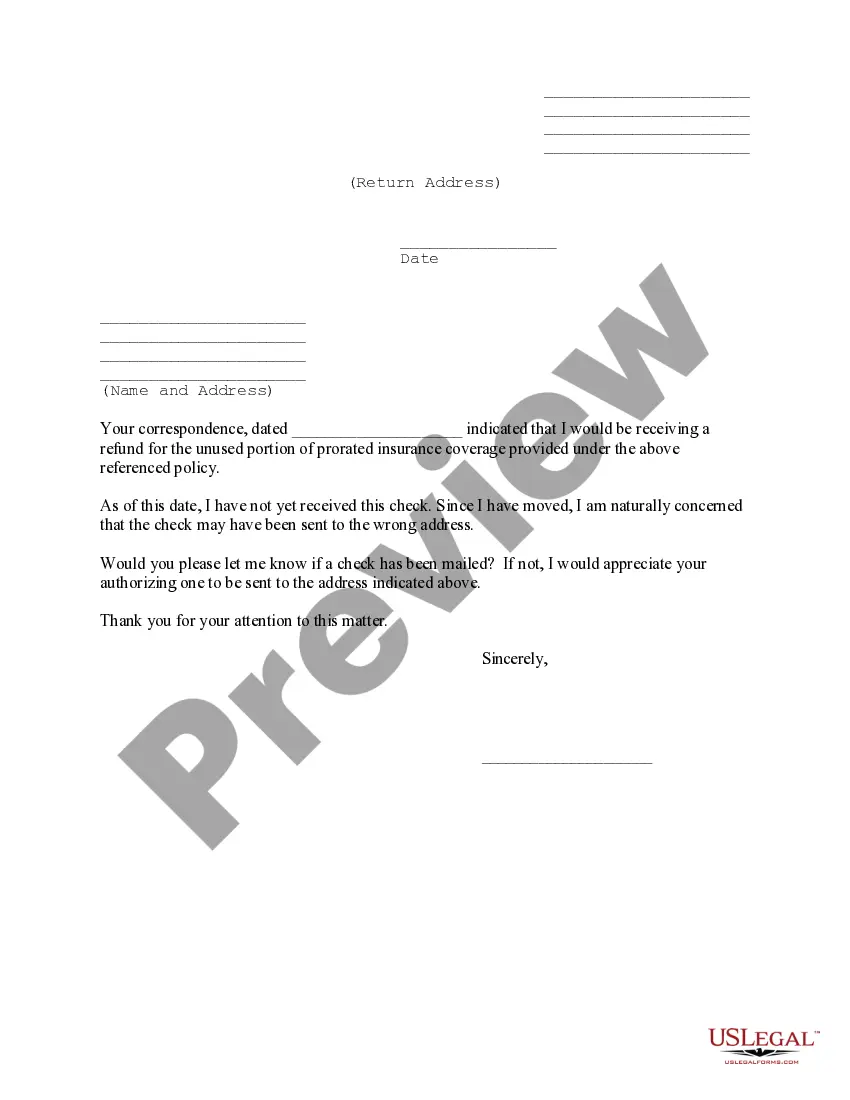

Change of Address Awaiting Refund

Description

How to fill out Change Of Address Awaiting Refund?

Dealing with official documentation requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Change of Address Awaiting Refund template from our service, you can be certain it meets federal and state regulations.

Dealing with our service is simple and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Change of Address Awaiting Refund within minutes:

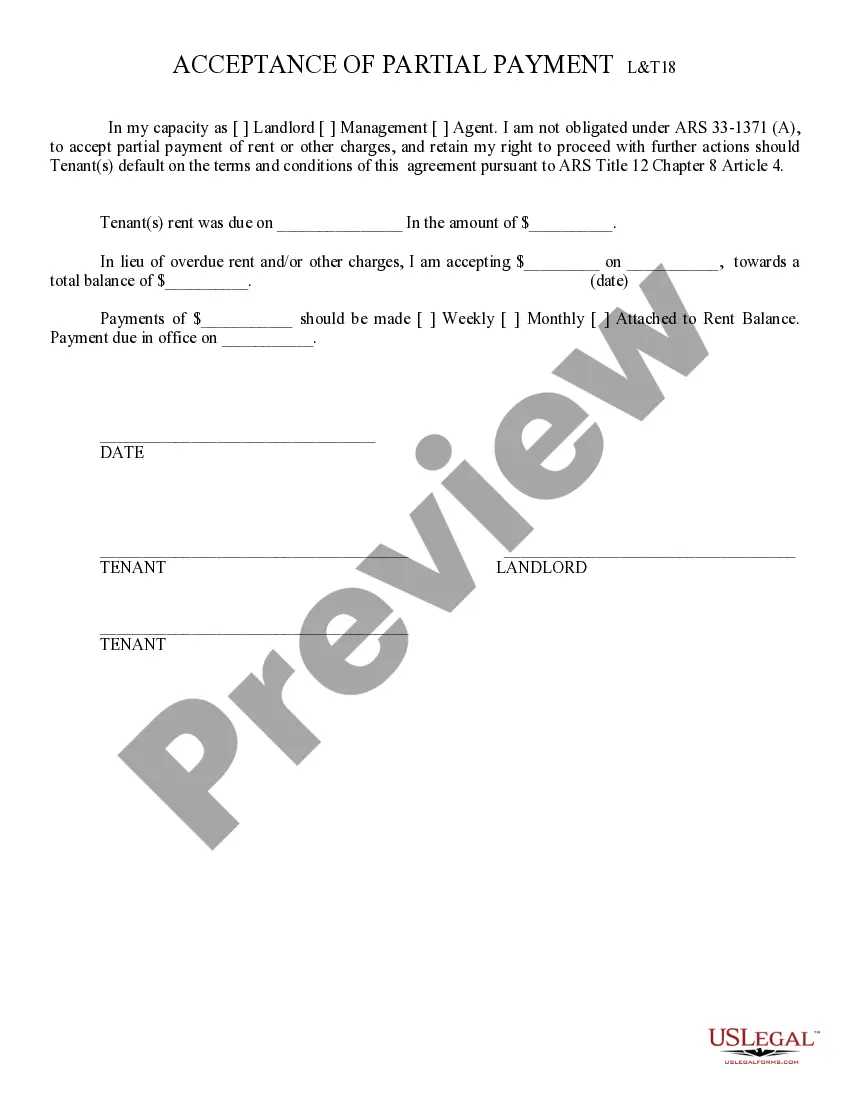

- Remember to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Change of Address Awaiting Refund in the format you need. If it’s your first time with our website, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Change of Address Awaiting Refund you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

How to Verify the IRS Has My Correct Address? - YouTube YouTube Start of suggested clip End of suggested clip So the irs is an online tool a get transcript. Tool here's the the website. And what you could do isMoreSo the irs is an online tool a get transcript. Tool here's the the website. And what you could do is an individual taxpayers you go there you request a transcript of your most recently filed.

If your address has changed, you need to notify the IRS to ensure you receive any IRS refunds or correspondence.

Use IRS Change of Address Form 8822 or 8822-B You can change your address with the IRS directly by completing IRS form 8822 b. This IRS change of address form is used for individual tax returns as well as gift, estate, or generation-skipping transfer tax returns.

If you are a representative signing for the taxpayer, attach to Form 8822 a copy of your power of attorney. Generally, it takes 4 to 6 weeks to process a change of address.

Because not all post offices forward government checks, notifying the post office that services your old address ensures that your mail will be forwarded, but not necessarily your refund check. To change your address with the IRS, you may complete a Form 8822. pdf, Change of Address.

Processing. It can take four to six weeks for a change of address request to be fully processed. Get up-to-date status on IRS operations and services affected by COVID-19.

If you don't change your address and the IRS sends you notices to your previous address, you are considered notified and the clock starts to run on any taxes, penalties or interest you may owe. Make sure you notify IRS of your change of address.